Press release

Financial Advisory Services Market Surging: Anticipated Demand to Reach US$ 135.6 Billion by 2030, with Growth and Share Analysis

Electric vehicle are the vehicles which are powered by an electric motor that draws electricity from a battery and is capable of being charged from an external source. With such high investment there comes risk. Therefore, most of the EV vehicle owners purchase or take the EV insurance service. EV insurance is a contract under which a person (the insured) receives financial protection from the insurer (the insurance firm) for damages he might incur in certain situations. In this insurance, the policyholder pays a certain amount called 'premium' to the insurance company against which the latter provides insurance cover. Moreover, some upcoming EV insurance market trends include a shift towards usage-based insurance, increased focus on cybersecurity for connected vehicles, and a rise in the number of electric vehicle-specific insurance products. Additionally, there may be changes in liability laws as EVs become more prevalent, and insurance companies may also begin to take into account the unique maintenance needs of electric vehicles.The electric vehicle (EV) insurance market is a rapidly growing and evolving industry. As the number of EVs on the road increases, the demand for electric car insurance is also increasing. This is due to the fact that EVs are more expensive to repair than traditional gasoline-powered vehicles. Furthermore, many insurance companies are beginning to offer specialized coverage options for EVs, such as battery replacement coverage and charging station damage coverage. In addition, some insurance companies are offering usage-based car insurance for electric cars, which means that the premium is based on how much the vehicle is driven. This allows for more personalized and accurate electric car insurance cost. Furthermore, telematics and data analysis: Many insurance companies are using telematics and data analysis to better understand the driving habits and patterns of EV drivers. This allows for more accurate pricing and risk assessment.

The global EV Insurance Market study by Allied Market Research includes an overview of business trends, competitor analysis, and a future market and technical analysis forecast. In addition, the study gave an illustration of the global value and key regional trends in terms of EV Insurance Market size, share and growth opportunities. All information about the global market has been carefully analyzed and verified by industry professionals after being gathered from very reliable sources.

The global ev insurance market was valued at $51.4 billion in 2021, and is projected to reach $210.4 billion by 2031, growing at a CAGR of 15.5% from 2022 to 2031.

Request Sample Report: https://www.alliedmarketresearch.com/request-sample/47858

Research Methodology:

A comprehensive and detailed method that combined primary and secondary research was used to thoroughly investigate the global EV Insurance Market. While secondary research gave a broad overview of the products and services, primary research involved a thorough examination of many factors that influence the market. A process of searching is done using a variety of sources, such as press releases, professional journals, and government websites, to gain insights into the industry. This approach has made it possible to acquire a clear, extensive understanding of the global EV Insurance Market.

Analysis of Key Players:

The market is fragmented, with many large and medium-scale vendors controlling minority shares. Vendors actively engage in product development by making significant investments in R&D initiatives. Through a variety of growth strategies, including alliances, partnerships, mergers, and acquisitions, they are increasing their electric car insurance Market share.

EV Insurance Market Report Highlights

Coverage

First Party Liability Coverage

Third Party Liability Coverage

Others

Distribution Channel

Insurance Companies

Banks

Insurance Agents/ Brokers

Others

Vehicle Age

New Vehicle

Used Vehicle

Application

Personal

Commercial

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Key Market Players: Beinsure Digital Media, Allianz SE, Allstate Insurance Company, AXA, Esure Group plc, HDFC ERGO, Progressive Casualty Insurance Company, ACKO GENERAL INSURANCE LIMITED, Lemonade, Inc., Bajaj Allianz General Insurance Company

Buy this Research at Discounted Price @ https://bit.ly/3k2veJZ

The expert team at Allied Market Research continuously analyzes the market environment by making precise predictions about the necessary driving and restraining factors. On these factors, the stakeholders can base their business plans.

Key Benefits for Stakeholders:

This report offers a quantitative examination of the market segments, estimations, recent trends, and dynamics of the EV Insurance Market analysis from 2023 to 2032 to specify the key competitive advantages.

An in-depth analysis of Market segmentation helps in determining current market opportunities.

Porter's five forces analysis places a strong emphasis on consumers' and vendors' capacity to develop their supplier-buyer networks and come to profitable business decisions.

The report examines regional and global market segmentation, EV Insurance Market trends, leading players, market growth strategies, and application areas.

Market participants' positioning encourages comparative analysis and provides a clear understanding of the player's current position.

The major countries in each region are mapped based on their revenue contribution to the global market.

The report provides in-depth details on the business tactics used by the major market participants in the global EV Insurance Market growth.

Interested to Procure the Data? Inquire Here: https://www.alliedmarketresearch.com/purchase-enquiry/47858

Key Questions Answered in the Research Report-

What are the market sizes and rates of growth for the various market segments in the global and regional market?

What are the key benefits of the EV Insurance Market report?

What are the driving factors, restraints, and opportunities in the global Market?

Which region has the largest share of the global Market?

Who are the key players in the global Market?

Top Trending Reports:

Virtual Teller Machine (VTM) Market https://www.alliedmarketresearch.com/virtual-teller-machine-vtm-market-A06950

Digital Remittance Market https://www.alliedmarketresearch.com/digital-remittance-market

Banking Wearable Market https://www.alliedmarketresearch.com/banking-wearable-market-A06966

Marine Cargo Insurance Market https://www.alliedmarketresearch.com/marine-cargo-insurance-market-A14731

Dual Interface Payment Card Market https://www.alliedmarketresearch.com/dual-interface-payment-card-market-A108803

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://steemit.com/@poojabfsi

https://www.quora.com/profile/Pooja-BFSI

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Advisory Services Market Surging: Anticipated Demand to Reach US$ 135.6 Billion by 2030, with Growth and Share Analysis here

News-ID: 3461749 • Views: …

More Releases from Allied Market Research

Faucet Market Forecast 2035: Reaching USD 118.4 billion by 2035

According to a new report published by Allied Market Research, titled, "Faucet Market," The faucet market size was valued at $48.9 billion in 2023, and is estimated to reach $118.4 billion by 2035, growing at a CAGR of 7.6% from 2023 to 2035.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/2448

Faucet is a plumbing fixture used to control the flow of water in various settings such as kitchens,…

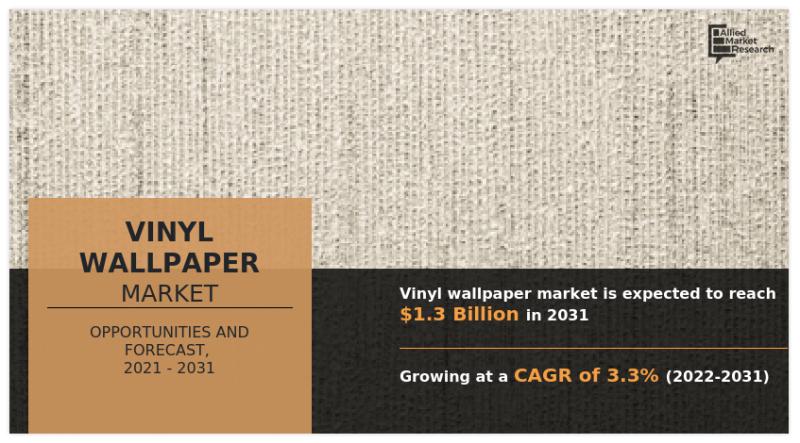

Vinyl Wallpaper Market Size Forecasted to Grow at 3.3% CAGR, Reaching USD 1.3 bi …

The Vinyl Wallpaper Market Size was valued at $943.30 million in 2021, and is estimated to reach $1.3 billion by 2031, growing at a CAGR of 3.3% from 2022 to 2031.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/16970

Vinyl wallpaper consists of a carrier layer (recycled paper or non-woven wallpaper base) and a decorative layer made of polyvinyl chloride. A synthetic foam layer provides three-dimensional structures to…

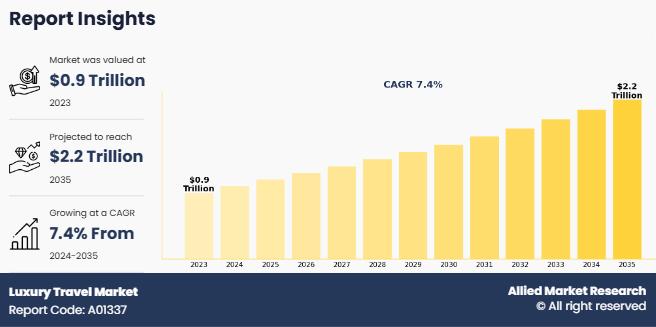

Luxury Travel Market Set to Achieve a Valuation of US$ 2149.7 billion, Riding on …

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Men Personal Care Market to Grow at a CAGR of 8.6% and will Reach USD 276.9 bill …

According to a new report published by Allied Market Research, titled, "Men Personal Care Market by Type, Age Group, Price Point, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2021-2030," the men personal care market size is expected to reach $276.9 billion by 2030 at a CAGR of 8.6% from 2021 to 2030.

Request The Sample PDF of This Report: @ https://www.alliedmarketresearch.com/request-sample/1701

Men personal care products are non-medicinal…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…