Press release

Microfinance Market Size, Share,Trend,Industry, Forecast and outlook (2024-2031)

The microfinance market is expected to be driven by technology innovations, catalyzing financial inclusion and efficiency in microfinance markets globally. Mobile banking solutions have gained traction in developing countries, leveraging the rise in mobile phone penetration to offer credit, savings, payments and e-wallet options. Such innovations, forged through partnerships like the one with Mastercard Foundation, are pivotal in advancing financial inclusion and efficiency in microfinance.Furthermore, to leverage IT interventions effectively, the microfinance industry is educating and empowering rural populations through regular sessions, awareness campaigns and workshops. The integration of telecom services into microfinance operations is revolutionizing customer experiences, operational efficiency and access to financial services. The adoption of mobile money platforms is a prime example, as it empowers individuals to engage in secure and user-friendly financial transactions through their mobile devices.Download Free PDF Sample -https://www.datamintelligence.com/download-sample/microfinance-market

Market Dynamics

The Microfinance market is expected to be driven by increased integration of new technologies and advanmicrofinances in the services, inspired by digital transformation and technology evolvement to bridge gaps between financial service providers and the underserved population. Collaborations between tech companies and financial institutions further reshape the financial services industry. Moreover, technology fosters consumer protection, reduces costs and extends services to previously excluded clients. Bankly, a prominent fintech firm specializing in payment processing, has unveiled its latest venture, Bankly Microfinance Bank, heralding a significant milestone in their quest to offer accessible financial solutions in Nigeria. Its digital approach has modernized the conventional thrift collection system, introducing transparency and enhanced accessibility. Bankly's agency banking network has grown substantially, providing services to more than 12 million individuals through a network of 50,000 agents by 2020.

To Know More Insights - https://www.datamintelligence.com/research-report/microfinance-market

Segment Analysis

Micro-credit holds the largest market share in the microfinance market driven by low-income individuals and groups, particularly in semi-urban and rural areas, who lack a stable source of income and collateral for traditional loans. Microcredit addresses the unique financial challenges faced by lower socio-economic backgrounds by offering tailored financial products like savings accounts and loans. The microcredit loans empower low-income individuals to generate income and achieve sustainable livelihoods.Furthermore, government incentives of microcredits in different nations significantly expanding its market growth. For instance, the government of India, as highlighted by Union IT and Telecom Minister Ashwini Vaishnaw, is planning to emphasize the provision of micro-credit facilities for street vendors in the year 2023. The initiative will be supported by digital technologies. The aim is to offer credit facilities in the range of Rs 3,000-5,000 (USD 30 to USD 60) to street vendors, addressing their small credit requirements. The move is intended to simplify the process of accessing credit and empower street vendors economically.

Competitive Landscape

The major global players in the market include Grameen Bank, SKS Microfinance, BRAC, Compartamos Banco, Bandhan Bank, FINCA International, ASA International, Opportunity International, BancoSol and Equitas Small Finance Bank.

Related Reports :-

Open Banking Market :- https://www.datamintelligence.com/research-report/open-banking-market

Neobanking Market :- https://www.datamintelligence.com/research-report/neobanking-market

Software Market :- https://www.datamintelligence.com/research-report/software-market

Software as a Service (SaaS) Market :- https://www.datamintelligence.com/research-report/software-as-a-service-market

Supply Chain Security Market :- https://www.datamintelligence.com/research-report/supply-chain-security-market

Trade Finance Market :- https://www.datamintelligence.com/research-report/trade-finance-market

Company Name: DataM Intelligence

Contact Person: Sai.K

Email: info@datamintelligence.com

Phone: +1 877 441 4866

Website:https://www.datamintelligence.com/

About DataM Intelligence

DataM Intelligence 4Market Research is a Market Research firm that provides end-to-end business solutions to organizations from Research to Consulting. We at DataM Intelligence leverage our top trademark trends, insights, and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of Syndicate Reports & and; Customized Reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries, catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Microfinance Market Size, Share,Trend,Industry, Forecast and outlook (2024-2031) here

News-ID: 3461086 • Views: …

More Releases from DataM Intelligence

U.S. Radiopharmaceuticals Market to Reach USD 2.36 Billion by 2033, Growing at 6 …

The United States radiopharmaceuticals market was valued at USD 2.21 billion in 2024 and is projected to reach USD 2.36 billion by 2033, exhibiting a CAGR of 6.3% during the forecast period, according to DataM Intelligence. The market expansion is primarily fueled by the growing prevalence of chronic diseases such as cancer and cardiovascular disorders, advancements in diagnostic imaging, and regulatory support for nuclear medicine infrastructure. Radiopharmaceuticals play a pivotal…

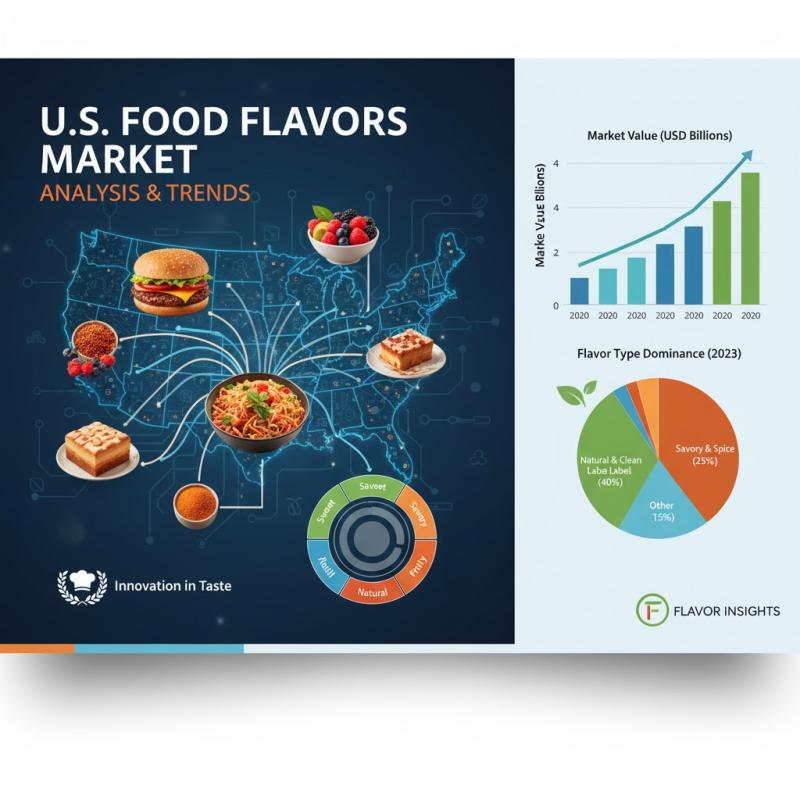

U.S. Food Flavors Market to Reach USD 6.1 Billion by 2033, Registering 5.2% CAGR …

The U.S. flavors market was valued at USD 3,887.7 million in 2024 and is projected to reach USD 6,108.4 million by 2033, growing at a CAGR of 5.2% during 2025-2033, according to DataM Intelligence. The market's growth is driven by surging demand for processed foods, global flavor innovation, and increasing consumer preference for natural, clean-label, and wellness-oriented products. Flavors continue to play a vital role in enhancing the sensory experience…

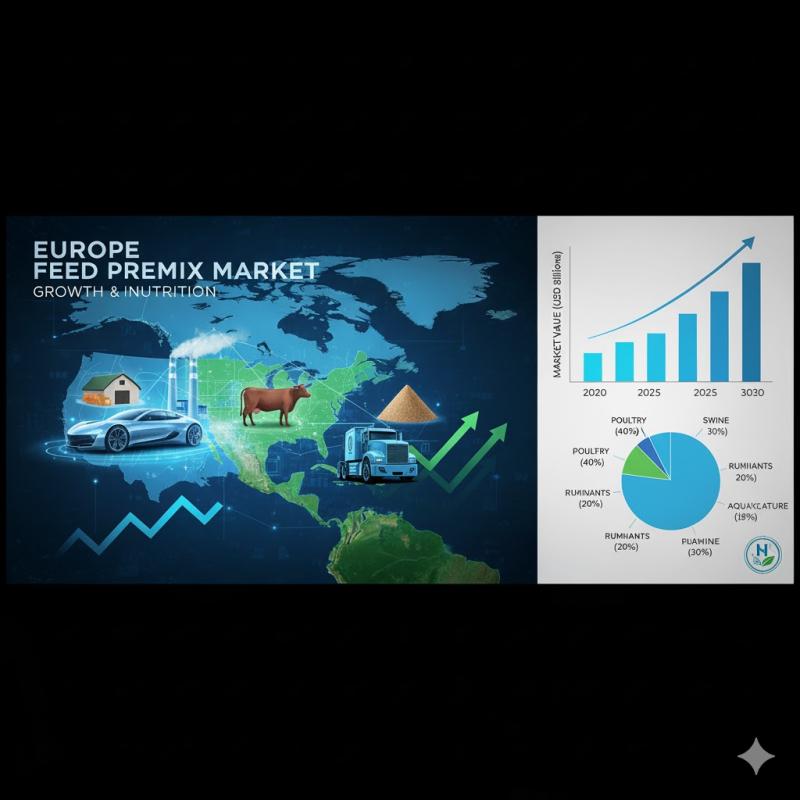

Europe Feed Premix Market to Reach USD 7.31 Billion by 2030, Growing at a 4.32% …

The Europe Feed Premix Market is estimated to grow from USD 5.92 billion in 2025 to USD 7.31 billion by 2030, registering a CAGR of 4.32% during the forecast period, according to DataM Intelligence. The market's growth is driven by increasing demand for nutrient-rich animal feed formulations, expanding livestock production, and a rising preference for high-quality, antibiotic-free animal products. Feed premixes-comprising essential vitamins, minerals, amino acids, and other additives-are vital…

North America Feed Phytogenics Market to Reach USD 500.6 Million by 2030, Growin …

The North America Feed Phytogenics Market is projected to grow from USD 383.10 million in 2025 to USD 500.60 million by 2030, at a CAGR of 5.5% during the forecast period, according to DataM Intelligence. The market is witnessing robust growth due to rising demand for high-quality animal-derived products and increasing regulatory restrictions on antibiotics in livestock production. As a result, plant-based feed solutions have gained widespread adoption for improving…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…