Press release

Insurance Analytics Market to Showcase Impressive 14.2% CAGR from 2022 to 2031: Analysis of Current and Future Trends

According to the report published by Allied Market Research, the global insurance analytics market was pegged at $7.91 billion in 2019 and is anticipated to garner $22.45 billion by 2027 manifesting a CAGR of 14.2% from 2020 to 2027. The report offers an in-depth analysis of the key investment pockets, market player positioning, drivers & opportunities, and business performances of major players.The growth in adoption of advanced technologies and surge in competition among the insurance sector drive the growth of the global insurance analytics market. However, the stringent government regulations and privacy & security concerns restrain the growth to a certain extent. Nevertheless, the rise in fraudulent activities and untapped potential of emerging economies are expected to create innumerable opportunities in the near future.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 :

https://www.alliedmarketresearch.com/request-sample/7967

Covid-19 Scenarios-

The outbreak of covid-19 has positively impacted the growth of the global insurance analytics market, owing to increase in utilization and adoption of advanced technologies to provide digitalized services globally.

In addition, the insurers have largely adopted & implemented insurance analytics solutions globally, due to the potential impacts of insurance analytics & need for advanced analytical solutions

➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐨𝐟𝐟𝐞𝐫 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 :

https://www.alliedmarketresearch.com/request-for-customization/7967?reqfor=covid

The global insurance analytics market is segmented based on component, deployment type, enterprise size, application, end user, and region.

Based on component, the solution segment held the highest market share with around two-thirds of the market share in 2019 and is expected to maintain its dominant share throughout 2027. However, the service segment is expected to portray the fastest CAGR of 15.5% during the forecast period.

Based on application, the risk management segment held the major share in 2019, with nearly two-fifths of the total market share. However, the sales and marketing segment is expected to register the fastest CAGR of 17.3% during the forecast period.

By region, the market is report analyzed across North America, Europe, Asia-Pacific, and LAMEA. The North American region has dominated the market in 2019, with more than two-fifths of the total market revenue share, and is expected to rule the roost throughout the forecast period. On the other hand, the market across Asia-Pacific is anticipated to portray the fastest CAGR of 15.9% from 2020 to 2027.

➡️𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠:

https://www.alliedmarketresearch.com/purchase-enquiry/7967

The key market players in the report include SAP SE, IBM Corp., Microsoft, Open Text Corporation, Oracle, Pegasystems Inc., salesforce.com inc., Vertafore, Inc., SAS Institute Inc., and Applied Systems.Top of Form

𝑫𝒆𝒎𝒂𝒏𝒅 𝒇𝒐𝒓 𝒊𝒏𝒔𝒖𝒓𝒂𝒏𝒄𝒆 𝒂𝒏𝒂𝒍𝒚𝒕𝒊𝒄𝒔 𝒊𝒔 𝒆𝒙𝒑𝒆𝒄𝒕𝒆𝒅 𝒕𝒐 𝒂𝒕𝒕𝒂𝒊𝒏 𝒔𝒊𝒈𝒏𝒊𝒇𝒊𝒄𝒂𝒏𝒕 𝒈𝒓𝒐𝒘𝒕𝒉 𝒊𝒏 𝒕𝒉𝒆 𝒄𝒐𝒎𝒊𝒏𝒈 𝒚𝒆𝒂𝒓𝒔 𝒕𝒐 𝒃𝒆𝒕𝒕𝒆𝒓 𝒖𝒏𝒅𝒆𝒓𝒔𝒕𝒂𝒏𝒅 & 𝒑𝒓𝒆𝒅𝒊𝒄𝒕 𝒃𝒆𝒉𝒂𝒗𝒊𝒐𝒓 𝒐𝒇 𝒊𝒏𝒔𝒖𝒓𝒆𝒅𝒔. 𝑰𝒏 𝒂𝒅𝒅𝒊𝒕𝒊𝒐𝒏, 𝒊𝒏𝒔𝒖𝒓𝒂𝒏𝒄𝒆 𝒄𝒐𝒎𝒑𝒂𝒏𝒊𝒆𝒔 𝒂𝒓𝒆 𝒄𝒐𝒍𝒍𝒆𝒄𝒕𝒊𝒏𝒈 𝒅𝒂𝒕𝒂 𝒇𝒓𝒐𝒎 𝒄𝒖𝒔𝒕𝒐𝒎𝒆𝒓 𝒊𝒏𝒕𝒆𝒓𝒂𝒄𝒕𝒊𝒐𝒏𝒔, 𝒕𝒆𝒍𝒆𝒎𝒂𝒕𝒊𝒄𝒔, 𝒂𝒏𝒅 𝒔𝒐𝒄𝒊𝒂𝒍 𝒎𝒆𝒅𝒊𝒂 𝒕𝒐 𝒃𝒆𝒕𝒕𝒆𝒓 𝒖𝒏𝒅𝒆𝒓𝒔𝒕𝒂𝒏𝒅 & 𝒎𝒂𝒏𝒂𝒈𝒆 𝒕𝒉𝒆𝒊𝒓 𝒓𝒆𝒍𝒂𝒕𝒊𝒐𝒏𝒔𝒉𝒊𝒑𝒔, 𝒄𝒍𝒂𝒊𝒎𝒔, 𝒂𝒏𝒅 𝒖𝒏𝒅𝒆𝒓𝒘𝒓𝒊𝒕𝒊𝒏𝒈 𝒗𝒊𝒂 𝒊𝒏𝒔𝒖𝒓𝒂𝒏𝒄𝒆 𝒂𝒏𝒂𝒍𝒚𝒕𝒊𝒄𝒔 𝒔𝒐𝒍𝒖𝒕𝒊𝒐𝒏𝒔

Key Findings Of The Study

By deployment type, the on-premise segment led the insurance analytics market size, in terms of revenue in 2019.

By application, the risk management segment accounted for the highest insurance analytics market share in 2019.

By region, North America generated the highest revenue in 2019.

➡️𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Crowdfunding Market https://www.alliedmarketresearch.com/crowdfunding-market-A47387

Disability Insurance Market https://www.alliedmarketresearch.com/disability-insurance-market-A07393

Internet of Things (IoT) in Banking Market https://www.alliedmarketresearch.com/internet-of-things-in-banking-market-A12751

Revenue Assurance Market https://www.alliedmarketresearch.com/revenue-assurance-market-in-the-telecom-sector-market-A126366

Logistics Insurance Market https://www.alliedmarketresearch.com/logistics-insurance-market-A15353

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://steemit.com/@poojabfsi

https://medium.com/@psaraf568

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Analytics Market to Showcase Impressive 14.2% CAGR from 2022 to 2031: Analysis of Current and Future Trends here

News-ID: 3459875 • Views: …

More Releases from Allied Market Research

Combat Self-Defense Management Systems Market Rapidly Growing Dynamics with Indu …

Combat management system is a computer system which integrates the ship sensors, radars, weapons, data links, and other equipment into a single system. The combat management system provides situational awareness & intelligence to the crew and enables them to perform combat missions effectively. A combat management system comprises the central command & decision-making element of vessel combat system. The combat management system is used in combat missions for several purposes…

Ice Cream Coating Market Research Overview, Share, Size, Analysis, and Forecast …

Ice cream is a sweetened frozen product with either an artificial sweetener or natural sugar. Ice cream is eaten as a desert or snack. Increase in consumption of ice cream is highest in summer. Ice cream coating is made from coconut, cashew, almond milk, dairy milk or cream, soy, and is flavored with sugar. Ice cream coating contains thin layers that are manufactured from inexpensive fats such as hydrogenated palm…

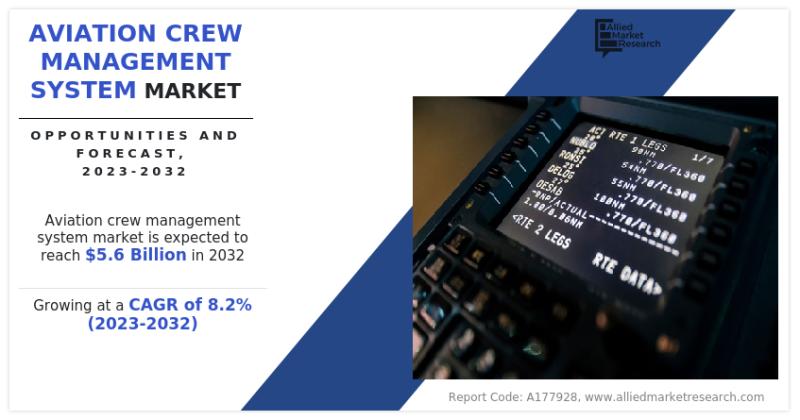

Aviation Crew Management System Market Size Worth $5.61 Billion by 2032 With CAG …

According to the report, the global aviation crew management system market size was valued at $2.61 billion in 2022 and is projected to reach $5.61 billion by 2032, registering a CAGR of 8.16% from 2023 to 2032.

The growing demand for sophisticated software designed to improve crew operations across a range of aviation industries will experience significant growth.

Download Sample Report: https://www.alliedmarketresearch.com/request-sample/A177928

The global aviation crew management system market is driven by factors…

Metal Polishing Compound Market Value To Hit USD 12.1 Billion by 2032

Allied Market Research has recently published a report, titled, "Metal Polishing Compound Market Size, Share, Competitive Landscape and Trend Analysis Report by Type, by End-use : Global Opportunity Analysis and Industry Forecast, 2023-2032." According to the report, the global metal polishing compound market generated $7.4 billion in 2022, and is anticipated to generate $12.1 billion by 2032, rising at a CAGR of 5.1% from 2023 to 2032.

Download Sample…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…