Press release

Specialty Insurance Market Size, Segments And Growth Forecast Report 2024 To 2033

The specialty insurance market size has grown rapidly in recent years. It will grow from $89.87 billion in 2023 to $99.26 billion in 2024 at a compound annual growth rate (CAGR) of 10.5%. The growth in the historic period can be attributed to risk mitigation needs, regulatory changes, globalization impact, emerging industries, litigation trends.The specialty insurance market size is expected to see rapid growth in the next few years. It will grow to $147.67 billion in 2028 at a compound annual growth rate (CAGR) of 10.4%. The growth in the forecast period can be attributed to cybersecurity threats, climate change impacts, pandemic preparedness, technological innovations, healthcare industry evolution, evolving legal landscape. Major trends in the forecast period include customized insurance solutions for the demand for space insurance in the aerospace sector, specialized coverage for fine art and collectibles, growth of insurance for renewable energy projects, increased focus on employee benefits liability coverage.

Market Overview -

Specialty insurances are a kind of insurance that is created especially for companies that require particular coverage. These commercial accounts can contain high-risk holdings or contain assets that aren't typically protected by common commercial insurance policies.

Download Free Sample of Report -

https://www.thebusinessresearchcompany.com/sample.aspx?id=9198&type=smp

Specialty Insurance Market Thrives Amidst Escalating Natural Disasters

The rising natural disasters are expected to propel the growth of the specialty insurance market going forward. Natural disasters are catastrophic events with atmospheric, geological, and hydrological origins that can cause fatalities, property damage, and social environmental disruption. Specialty insurance provides tailored insurance to cover a wide range of damages caused by catastrophic events that include earthquakes, hurricanes, and others, and insurance covers covering real and personal property for captives, including business income and minimizes the financial risk. For instance, the National Centers For Environmental Information, a US-based agency for providing coastal, geophysical, and oceanic data, approximately 18 weather/climate crisis incidents that occurred in 2022 caused the United States to sustain losses of more than $1 billion apiece that claims the lives of 474 people and significantly damaged the local economy. Therefore, the rising natural disasters driving the growth of the specialty insurance market.

Competitive Landscape -

Major companies operating in the specialty insurance market report are Berkshire Hathaway Specialty Insurance, Allianz Group, AXA SA, Assicurazioni Generali SpA, Zurich Insurance Group Ltd., Nationwide Mutual Insurance Company, American International Group Inc., Chubb Corp, QBE Insurance Group Limited, The People's Insurance Company of China Limited, Manulife Reinsurance Limited, Everest Group Ltd., Markel Group Inc., Fidelity National Financial Inc., W.R. Berkley Corporation, Arch Capital Group Ltd., The Hanover Insurance Group Inc., AXIS Capital Holdings Limited, RenaissanceRe Holdings Ltd., Hiscox Ltd., Munich Reinsurance America Inc., Selective Insurance Group Inc., Tokio Marine HCC, Alleghany Corporation, Endurance Specialty Holdings Ltd., Argo Group International Holdings Ltd., Lancashire Holdings Limited, Validus Holdings Ltd., Cincinnati Financial Corporation, Aspen Insurance Holdings Limited, Fairfax Financial Holdings Limited, Catlin Group Limited, CNA Financial Corporation, Sompo International Holdings Ltd., AmTrust Financial Services Inc., Sirius International Insurance Group Ltd., RLI Corp

Digital Transformation And Technological Innovations Propel Specialty Insurance Market Growth

Technological advancements are a key trend gaining popularity in the specialty insurance market. Insurance businesses are leveraging innovative digital solutions to extend their operation and establish product lines based on niche client demand because of shifting business models, which contributes considerably to specialty insurance growth. For instance, in November 2022, Kingstone Insurance, a US-based insurance company, introduced Sure AI Assistant, an artificial intelligence-powered product to modernize the claims process. Sure AI Assistant uses a natural language model to optimize the insurance domain using data from real claims calls to guide policyholders through the claims process with ease. Additionally, Sure AI Assistant can be used in the case of a natural disaster when customers need to file their claims quickly and call volumes are the highest.

Browse Full Report @

https://www.thebusinessresearchcompany.com/report/specialty-insurance-global-market-report

Key Segments -

The specialty insurance market covered in this report is segmented -

1) By Type: Marine, Aviation And Transport (MAT), Political Risk And Credit Insurance, Entertainment Insurance, Art Insurance, Livestock And Aquaculture Insurance, Other Types

2) By Distribution Channel: Brokers, Non-Brokers

3) By End User: Business, Individuals

Key highlights covered in the report -

1. Detailed market size forecast and historical data analysis

2. Key drivers influencing market growth

3. Identification of upcoming trends and potential opportunities in the market

4. Analysis of major players strategies, to understand competitive dynamics and market positioning

5. Evaluation of regional dynamics

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Want To Know More About The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Specialty Insurance Market Size, Segments And Growth Forecast Report 2024 To 2033 here

News-ID: 3459511 • Views: …

More Releases from The Business Research Company

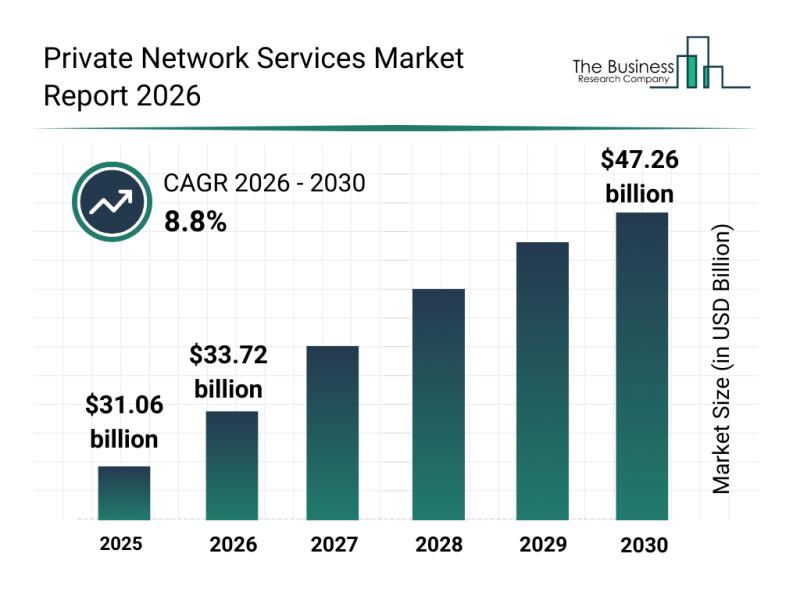

Leading Companies Fueling Innovation and Growth in the Private Network Services …

The private network services sector is set to experience remarkable growth as demand for secure, high-performance connectivity continues to rise across various industries. With advancements in wireless technology and evolving network needs, this market is positioning itself for widespread adoption and innovation over the coming years. Let's explore the market size, key players, driving trends, and segmentation to better understand what lies ahead.

Private Network Services Market Size and Growth Outlook…

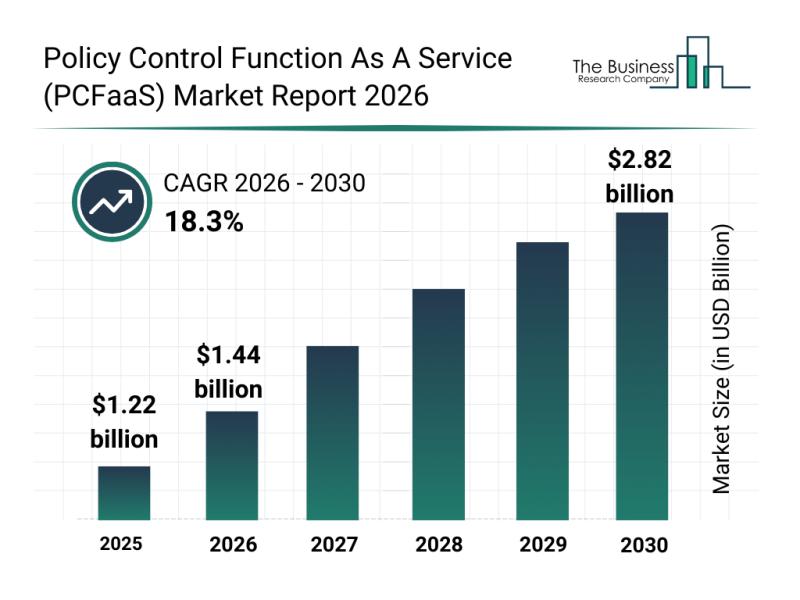

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Po …

The policy control function as a service (PCFaaS) market is on track for substantial expansion over the coming years, driven by technological advancements and increasing demand in telecommunications. This sector is transforming rapidly as operators adapt to next-generation network requirements and cloud-native approaches. Let's delve into the market's expected valuation, key players, emerging trends, and notable segmentations shaping its future.

Significant Growth Forecast for the Policy Control Function As A Service…

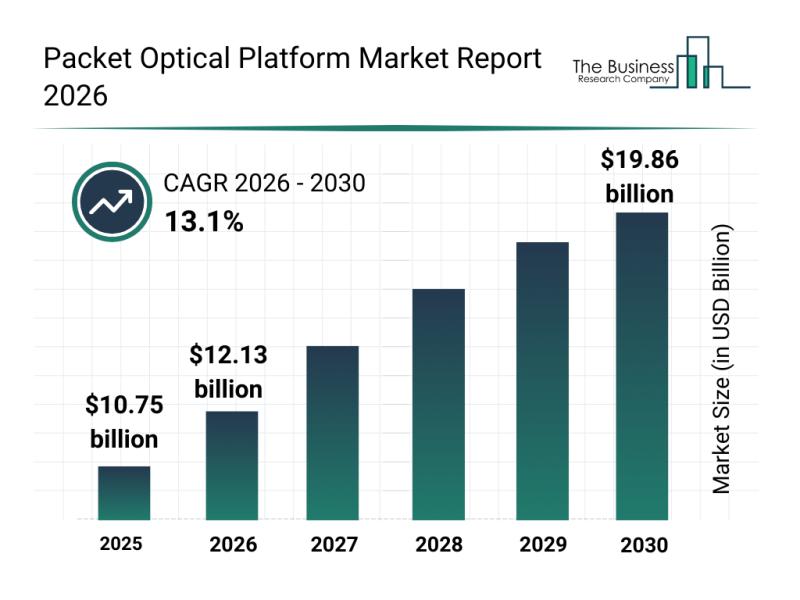

Top Players and Competitive Dynamics in the Packet Optical Platform Market

The packet optical platform market is positioned for significant expansion in the coming years, driven by advances in network technology and increasing demand for high-capacity data transmission. As digital infrastructure evolves, this sector is set to play a crucial role in supporting the growing needs of data centers, telecom providers, and cloud services. Let's explore the market's projected size, key players, emerging trends, and the segments contributing to its growth.

Forecasted…

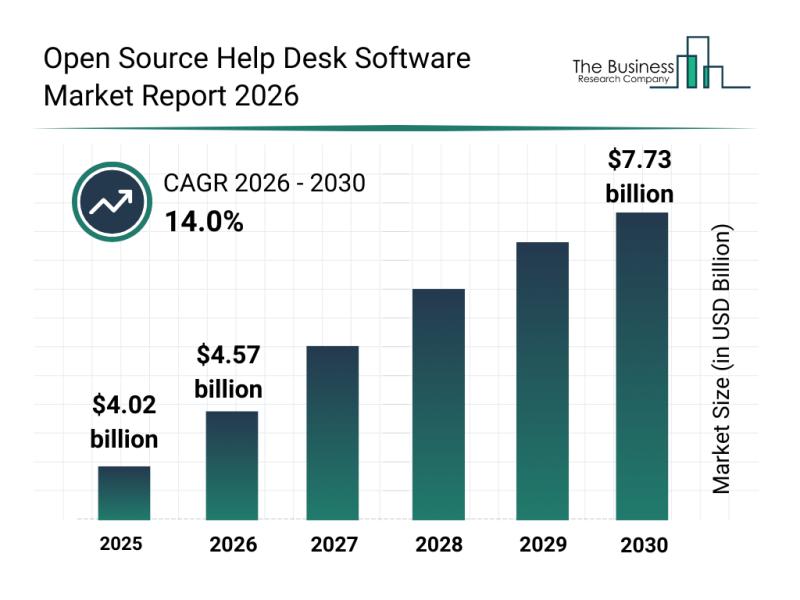

Analysis of Segmentation, Market Trends, and Competitive Landscape in the Open S …

The open source help desk software market is set to experience significant expansion in the coming years, driven by technological advancements and evolving business needs. As organizations increasingly embrace digital customer support, this market is positioned for notable growth through 2030. Below is an in-depth exploration of the market size, leading players, key trends, and segmentation insights.

Projected Market Size and Growth Rate of the Open Source Help Desk Software Market…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…