Press release

Cloud Adoption in Banking Market Research Explores Revenue Share Study Analysis Report

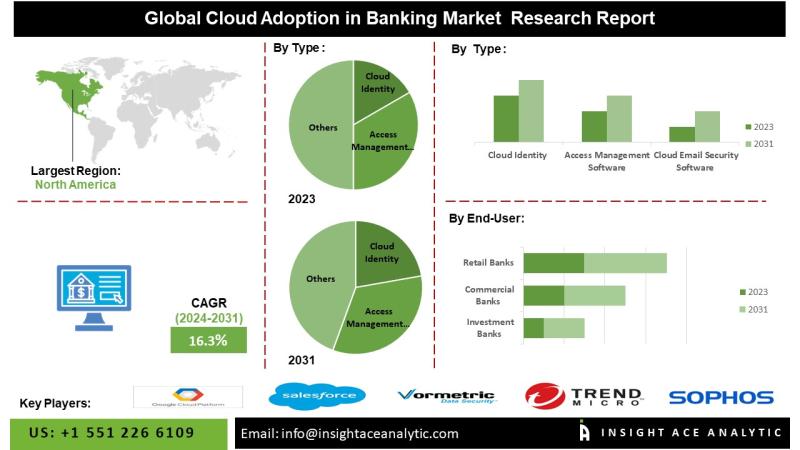

Cloud Adoption in Banking Market is expected to develop with a CAGR of 16.3% during the forecast period of 2024-2031.InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Cloud Adoption in Banking Market - (By End User (Retail Banks, Commercial Banks, Investment Banks, Credit Unions, and Regulatory Bodies), By Type (Cloud Identity and Access Management Software, Cloud Email Security Software, Cloud Intrusion Detection and Prevention System, Cloud Encryption Software, and Cloud Network Security Software)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to the latest research by InsightAce Analytic, the Global Cloud Adoption in Banking Market is expected to develop with a CAGR of 16.3% during the forecast period of 2024-2031.

Cloud adoption in banking describes the current trend in the banking business toward using cloud computing services and technology to advance innovation, scalability, and operational efficiency. The rising demand for cloud computing in banking is driven by various factors such as rapid and easy resource scaling, enhanced confidence in cloud security, more effective regulatory requirements, less data loss, better analytics and artificial intelligence, and an increasingly digital society. Furthermore, banks are being pushed to move to cloud solutions due to the necessity for increased security measures and regulatory compliance. These solutions provide strong data protection and disaster recovery capabilities. Cloud computing allows for the quick rollout of new services and apps to suit the changing demands of customers, which is another way the competitive environment forces banks to innovate. Implementing cloud computing enables banks to adapt to evolving business needs while swiftly preserving operational efficiency. This integration is a key factor for organizations aiming to complete digital transformations, which boosts competitiveness and customer satisfaction. However, security is a top priority for cloud providers due to the prevalence of data breaches. Some financial institutions are hesitant to embrace cloud solutions completely due to the sensitive nature of financial data, which requires strict security measures.

Request for Sample Pages: [https://www.insightaceanalytic.com/request-sample/2393]

List of Prominent Players in the Cloud Adoption in Banking Market:

* Google Cloud Platform

* Salesforce

* Vormetric Inc.

* Boxcryptor

* Trend Micro

* Sophos

* Wave Systems

* Microsoft Azure

* Temenos

* nCino

* Oracle Corporation

* Dell Technologies

* Amazon Web Services

* SAP SE

* IBM Corporation

* VMware

* Other Prominent Players

Market Dynamics:

Drivers-

In the ever-changing digital landscape, the banking industry is seeking more agility, scalability, and better service delivery, fueling the need for cloud adoption in banking. Banks are turning to cloud computing in banking to improve efficiency, cut costs, and provide customers with new and exciting services. Better decision-making and individualized customer service are two outcomes of banks' increased use of cloud computing to store as well as analyze enormous amounts of data. In addition, the pandemic has hastened the transition to digital banking, increasing the demand for the reliable and extensible IT systems offered by cloud providers. Banking finds it easier to comply with stringent data security and privacy regulations, which is helping to facilitate cloud adoption in banking.

Challenges:

The prime challenge is data privacy, worries about data residency regulations, and a lack of norms and protocol, which is predicted to slow the growth of Cloud adoption in the banking market. One potential obstacle to cloud adoption is the uncertainty surrounding data residency rules, access controls, and ownership, slowing market growth. Challenges for banks considering cloud adoption include regulatory uncertainty and varied compliance norms across geographies, especially regarding data residency and privacy. Financial institutions depend on long-standing systems that are integral to their daily operations. Integrating these systems with cloud-based alternatives may take a lot of effort and money. Due to the high cost and uncertainty, the banking industry must adopt cloud computing.

Regional Trends:

The North American cloud adoption in the banking market is anticipated to hold a major market share in revenue. It is projected to grow at a high CAGR soon because of the region's banking sector's rising use of cutting-edge networks, including big data analytics, AI, AR, VR, ML, and advanced network technologies (4G and 5G). Additionally, market participants are adding to the region's anticipated domination in the banking industry's cloud adoption. Besides, Asia Pacific is predicted to grow with a remarkable share in the market because of the assertive measures implemented by the administrations of numerous nations in the area and advancements in digital infrastructure, the rising popularity of mobile banking apps, and the ever-expanding cloud adoption in Banking fuel market expansion in the Asia Pacific.

Curious About This Latest Version Of The Report? Enquiry Before Buying: [https://www.insightaceanalytic.com/enquiry-before-buying/2393]

Recent Developments:

* In Dec 2023, Cloud banking company nCino and Salesforce have recently strengthened their partnership. The 12-year-old partnership between nCino and Salesforce was extended. In order to aid financial institutions (FIs) that utilize both nCino and Salesforce in modernizing customer experiences such as onboarding, loan origination, deposit account opening, and portfolio management, the new agreement saw nCino strengthen its integration with Salesforce platform tools, including its financial services cloud.

* In Dec 2023, The Reserve Bank of India (RBI) has implemented a cloud infrastructure specifically designed for the financial industry in order to bolster data security. Banks and financial institutions have consistently accumulated a growing amount of data. A significant number of individuals employed a range of public and private cloud services for this objective.

Segmentation of Cloud Adoption in Banking Market-

By Type-

* Cloud Identity and Access Management Software

* Cloud Email Security Software

* Cloud Intrusion Detection and Prevention System

* Cloud Encryption Software

* Cloud Network Security Software

By End-User-

* Retail Banks

* Commercial Banks

* Investment Banks

* Credit Unions

* Regulatory Bodies

By Region-

North America-

* The US

* Canada

* Mexico

Europe-

* Germany

* The UK

* France

* Italy

* Spain

* Rest of Europe

Asia-Pacific-

* China

* Japan

* India

* South Korea

* Southeast Asia

* Rest of Asia Pacific

Latin America-

* Brazil

* Argentina

* Rest of Latin America

Middle East & Africa-

* GCC Countries

* South Africa

* Rest of the Middle East and Africa

For More Customization @ [https://www.insightaceanalytic.com/customisation/2393]

Media Contact

Company Name: InsightAce Analytic Pvt. Ltd

Contact Person: Diana D'Souza

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=cloud-adoption-in-banking-market-research-explores-revenue-share-study-analysis-report]

Country: United States

Website: https://www.insightaceanalytic.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cloud Adoption in Banking Market Research Explores Revenue Share Study Analysis Report here

News-ID: 3459337 • Views: …

More Releases from ABNewswire

Real Estate Agent in Austin, TX, Adds Mortgage Licensing to Support Buyers Throu …

Austin, TX - In a strategic move to provide more comprehensive service to his clients, Brian C Folsom has recently obtained his mortgage license, positioning himself as a unique resource in the Austin real estate market. This additional credential allows him to guide buyers through both the home search and financing qualification processes, offering an integrated approach that streamlines the journey to homeownership.

The decision to pursue mortgage licensing stems from…

Digital Printing Service Support in Nazareth, PA Expanded by Sign Textile to Cov …

Sign Textile, a full-service digital printing company based in Nazareth, PA, has expanded its production and fulfillment support to businesses across Allentown, Philadelphia, Trenton, and Princeton. The company now offers direct access to custom outdoor signs, banner printing, vehicle wrap services, large format printing, and custom textile products across the broader Pennsylvania and New Jersey region. Orders are available online at signtextile.com.

Digital Printing Service in Nazareth, PA

Digital printing service [https://www.google.com/maps/place/Sign+Textile/@40.7385309,-75.3075722,794m/data=!3m2!1e3!4b1!4m6!3m5!1s0x89c4698e5e06db87:0xec2c645ea7b860f8!8m2!3d40.7385309!4d-75.3075722!16s%2Fg%2F11zk5427c5?hl=en-GB&entry=ttu&g_ep=EgoyMDI2MDIyMy4wIKXMDSoASAFQAw%3D%3D#:~:text=digital%20printing%20service]…

CoreAge Rx Raises the Bar on Medication Delivery With Free 2-Day Shipping, Tempe …

As GLP-1 demand continues to grow across the United States, CoreAge Rx delivers compounded Semaglutide and Tirzepatide directly to patients' doors with speed, discretion, and pharmaceutical-grade handling at no extra cost.

Image: https://www.abnewswire.com/upload/2026/02/97f63fd2a72edd923f925e1750cfbd14.jpg

CoreAge Rx, a LegitScript-certified telehealth weight management provider based in Wichita Falls, Texas, has built a medication delivery model that independent reviewers and patients consistently describe as one of the strongest in the GLP-1 telehealth space. Free 2-day shipping…

CoreAge Rx Builds Its GLP-1 Program Around Patient Support That Goes Beyond the …

With 24/7 access, rapid response times, dedicated care coordinators, and physician continuity throughout treatment, CoreAge Rx has set a new standard for what patient support looks like in telehealth weight management.

Image: https://www.abnewswire.com/upload/2026/02/79b953c7d7b86bdc830623292680666e.jpg

CoreAge Rx, a LegitScript-certified telehealth weight management provider based in Wichita Falls, Texas, has built a patient support model that independent reviewers consistently identify as one of the most comprehensive in the GLP-1 telehealth space. From 24/7 access across…

More Releases for Cloud

Cloud Logistics Market to Experience Significant Growth Through 2033 | Google Cl …

Latest Report, titled Cloud Logistics Market Trends, Share, Size, Growth, Opportunity and Forecast 2026-2033, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. The report also includes competitor and regional analysis, and contemporary advancements in the market.

➤ The report features a comprehensive table of contents, figures, tables, and charts, as well as insightful analysis. The Cloud Logistics Market has been…

Government Service Cloud Market SWOT Analysis by Leading Key Players: Google Clo …

HTF MI just released the Global Government Service Cloud Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Government Service Cloud Market are:

Amazon Web…

Cloud Model Hosting Platform Market Size, Status, Global Outlook 2025 To 2033 | …

New Jersey, United States: The latest research study by Infinity Business Insights, titled 'Global Cloud Model Hosting Platform Market,' 118 analysis on business strategies adopted by key and emerging industry players. It provides insights into current market developments, trends, technologies, drivers, opportunities, and overall market outlook. Understanding various segments is crucial for identifying the factors that drive market growth. Some of the major companies featured in this report include Amazon Web…

AI Supercomputing Cloud Market to Witness Huge Growth by 2029 | AWS, Oracle, Mic …

The AI Supercomputing Cloud Market a detailed study added to provide most recent insights about critical reports of the Global AI Supercomputing Cloud market. This report provides a detailed overview of key factors in the AI Supercomputing Cloud Market and factors such as driver, limitation, past and current trends, guiding scenarios, and technology development. In addition, AI Supercomputing Cloud Market attractiveness according to country, end-user, and other measures is also…

Open Cloud Services Market Size in 2023 To 2029 | Google Cloud - T-Systems - IBM …

The Open Cloud Services market report includes market-driving factors, major obstacles, and restraining factors impeding market growth. The report assists existing manufacturers and start-ups in developing strategies to combat challenges and capitalize on lucrative opportunities to gain a foothold in the global market. Moreover, the report provides thorough information about prime end-users and annual forecast during an estimated period.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐫𝐞𝐞 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 + 𝐃𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐓𝐎𝐂 ➡️ https://www.reportsnreports.com/contacts/requestsample.aspx?name=6778415

𝐋𝐞𝐚𝐝𝐢𝐧𝐠 𝐩𝐥𝐚𝐲𝐞𝐫𝐬 𝐩𝐫𝐨𝐟𝐢𝐥𝐞𝐝…

Mini Program Development Services Market Size in 2023 To 2029 | Tencent Cloud, A …

The Mini Program Development Services market report provides valuable insights for new entrants and stakeholders, offering a comprehensive understanding of market dynamics. It analyzes the competitive landscape and future market scenarios using tools like Porter's five forces and parent/peer market analysis. The report evaluates the product portfolios and services of key market players in detail. It also examines the impact of government regulations during the Covid-19 pandemic and provides market…