Press release

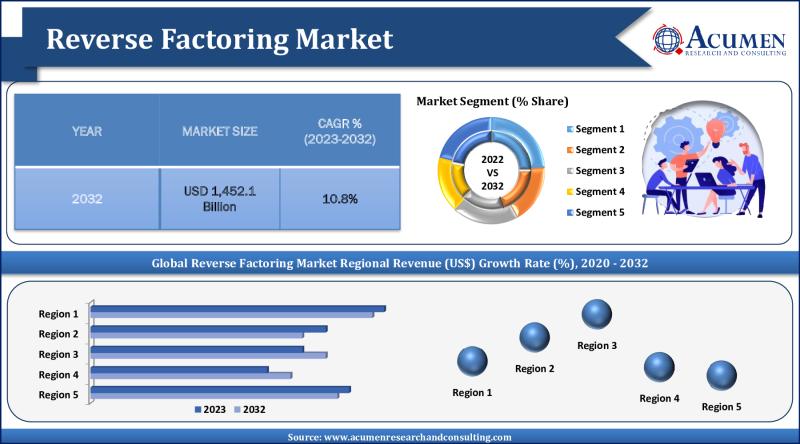

Reverse Factoring Market Dominates Revenue, Aims for USD 1,452.1 Billion by 2032

Key Points and Statistics on the Reverse Factoring Market:● The global reverse factoring market size is projected to expand to USD 1,452.1 Billion by 2032, growing at a CAGR of 10.8% from 2023 to 2032.

● Europe led the market with over 52% share in 2022, while the Asia-Pacific region is expected to record a CAGR of more than 11.5% from 2023 to 2032.

● The domestic segment captured the largest market share of 92% in 2022.

● Banks registered the highest market share of 81% among financial institutions in 2022.

● Key drivers include the growing demand for working capital optimization and the increasing adoption of digital payment solutions.

Download Sample Report Copy of This Report from Here: https://www.acumenresearchandconsulting.com/request-sample/3426

Reverse Factoring Market Overview and Analysis:

Reverse factoring, a cornerstone in modern financial solutions, is transforming the way businesses manage their supply chains and working capital. This market is dedicated to providing financial stability and liquidity to suppliers, thereby ensuring a smooth flow in the supply chain. The market is constantly innovating, with technological advancements in fintech and blockchain enhancing the efficiency and security of reverse factoring solutions. However, challenges such as data security concerns and the complexity of integrating these solutions into existing systems may hinder market growth. Despite these challenges, the reverse factoring market is expected to grow significantly, driven by the increasing complexity of global supply chains and the rise of financial technology.

Latest Reverse Factoring Market Trends and Innovations

● Technological advancements are leading to more efficient and secure reverse factoring solutions.

○ Artificial intelligence (AI) and machine learning (ML) are being used to automate processes, identify risks, and improve decision-making.

○ Blockchain technology is being used to create a secure and transparent platform for transactions.

● The rise in global trade activities is increasing the demand for efficient working capital management solutions.

○ Reverse factoring can help businesses improve their cash flow by providing them with early access to the funds they are owed by their customers.

○ This can give businesses a competitive advantage and help them grow their businesses.

● Educational and promotional campaigns are raising awareness about the benefits of reverse factoring.

○ These campaigns are being conducted by both reverse factoring providers and industry associations.

○ They are helping to educate businesses about the benefits of reverse factoring and how it can help them improve their working capital management.

Major Growth Drivers of the Reverse Factoring Market

● The growing demand for working capital optimization is a major driver of the reverse factoring market.

○ Businesses are under increasing pressure to optimize their working capital and improve their cash flow.

○ Reverse factoring can help businesses achieve these goals by providing them with early access to the funds they are owed by their customers.

● The increasing adoption of digital payment solutions is facilitating the growth of the reverse factoring market.

○ Digital payment solutions are making it easier for businesses to conduct transactions and manage their cash flow.

○ This is creating a more favorable environment for the growth of reverse factoring.

● Favorable government initiatives promoting supply chain financing are contributing to market expansion.

○ Governments are increasingly recognizing the importance of supply chain financing and are taking steps to promote its growth.

○ This is creating a more favorable environment for the growth of reverse factoring.

Key Challenges Facing the Reverse Factoring Industry

● Data security and privacy concerns can impact the adoption of reverse factoring solutions.

○ Reverse factoring involves the sharing of sensitive financial data between businesses.

○ This can raise concerns about data security and privacy.

● The complexity in implementation and integration with existing systems poses a significant challenge.

○ Reverse factoring is a complex financial product that can be difficult to implement and integrate with existing systems.

● The need for continuous technological upgrades and maintenance can be resource-intensive.

○ Reverse factoring providers need to constantly upgrade their technology and systems to stay ahead of the curve.

○ This can be a resource-intensive process.

Market Segmentation Insights:

Based on Category:

● International

● Domestic

Based on Financial Institution:

● Banks

● Non-banking Financial Institutions

Based on End-Use:

● Manufacturing

● Information Technology

● Transport & Logistics

● Construction

● Healthcare

● Others

Overview by Region of the Reverse Factoring Market:

Europe currently dominates the reverse factoring market, thanks to its strong focus on SMEs and a well-established regulatory framework. However, significant growth potential lies in the Asia-Pacific region, driven by increasing trade activities and digitalization.

Reverse Factoring Market Table of Content:

CHAPTER 1. Industry Overview of Reverse Factoring Market

CHAPTER 2. Research Approach

CHAPTER 3. Market Dynamics And Competition Analysis

CHAPTER 4. Manufacturing Plant Analysis

CHAPTER 5. Reverse Factoring Market By Category

CHAPTER 6. Reverse Factoring Market By Financial Institution

CHAPTER 7. Reverse Factoring Market By End-use

CHAPTER 8. North America Reverse Factoring Market By Country

CHAPTER 9. Europe Reverse Factoring Market By Country

CHAPTER 10. Asia Pacific Reverse Factoring Market By Country

CHAPTER 11. Latin America Reverse Factoring Market By Country

CHAPTER 12. Middle East & Africa Reverse Factoring Market By Country

CHAPTER 13. Player Analysis Of Reverse Factoring Market

CHAPTER 14. Company Profile

List of Key Players in the Global Market:

Prominent players in the market include Accion International, Barclays Plc, PrimeRevenue, Inc., Banco Bilbao Vizcaya Argentaria, S.A., Trade Finance Global, Deutsche Factoring Bank, Credit Suisse Group AG, JP Morgan Chase & Co., Drip Capital Inc., HSBC Group, Viva Capital Funding, LLC, Mitsubishi UFJ Financial Group, Inc., and TRADEWIND GMBH.

Ask Query Here: Richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/3426

Browse for more Related Reports

https://reserchindustries.blogspot.com/2024/03/specialty-lighting-market-industry.html

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Reverse Factoring Market Dominates Revenue, Aims for USD 1,452.1 Billion by 2032 here

News-ID: 3450098 • Views: …

More Releases from Acumen Research and Consulting

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

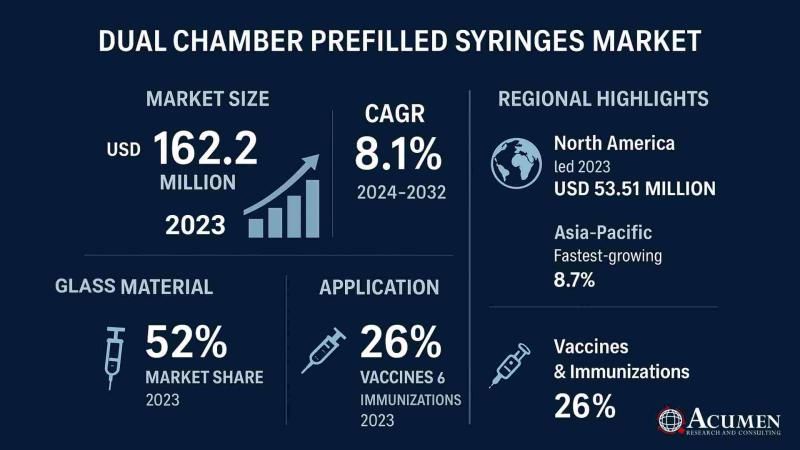

Global Dual Chamber Prefilled Syringes Market to Reach USD 323.7 Million by 2032 …

According to the latest report by Acumen Research and Consulting, the global Dual Chamber Prefilled Syringes Market is witnessing rapid expansion, driven by rising adoption of advanced drug delivery systems, increasing demand for biologics, and the growing emphasis on patient safety and convenience.

The Dual Chamber Prefilled Syringes Market Size was valued at USD 162.2 million in 2023 and is projected to reach USD 323.7 million by 2032, growing at a…

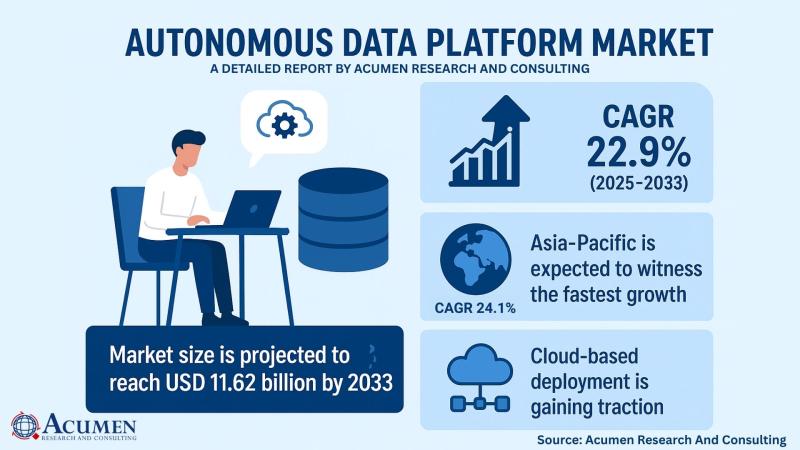

Autonomous Data Platform Market to Reach USD 11.62 Billion by 2033, Growing at a …

The global Autonomous Data Platform Market is experiencing significant growth, driven by the increasing demand for AI-driven data management and real-time analytics across various industries. According to a comprehensive market analysis by Acumen Research and Consulting, the market was valued at USD 1.85 billion in 2024 and is projected to reach USD 11.62 billion by 2033, expanding at a robust compound annual growth rate (CAGR) of 22.9% during the forecast…

More Releases for Reverse

Reverse Mortgage Expert Kevin Guttman Releases Book about the Benefits of Revers …

Reverse mortgages remain one of the most misunderstood financial tools for seniors, often surrounded by confusion and stigma. In his new book, A Reverse Mortgage Changed My Life!!! , Certified Reverse Mortgage Professional (CRMP) and Senior Mortgage Broker Kevin A. Guttman addresses these misconceptions directly. Drawing from real-life stories, Guttman explains how reverse mortgages work, clears up common myths, and highlights how they can provide financial stability and peace of…

Understanding Reverse VAT: Why You Need a Reverse VAT Calculator

If you've ever had to work backwards from a total amount to figure out how much VAT was included, you've already come across the concept of reverse VAT - whether you knew it or not. It's a handy method for calculating the net price and VAT amount when all you have is the final total. This process is essential for business owners, freelancers, and anyone trying to stay financially accurate.

The…

Reverse Factoring Market

The reverse factoring market has been experiencing significant growth, with its market size accounted for USD 530.8 billion in 2022. It is projected to achieve a remarkable market size of USD 1,452.1 billion by 2032, growing at a compound annual growth rate (CAGR) of 10.8% from 2023 to 2032. This substantial growth is driven by various market trends, emerging opportunities, and a competitive landscape that is continuously evolving.

Download Free Reverse…

Reverse Mortgage Providers Market Analysis by 2028, Industry Trends, Size, Share …

Reverse Mortgage Providers market Overview: The report focuses on providing corporate insights and advice to help clients make strategic business moves and to grow over a long time in their respective markets. The report on the Reverse Mortgage Providers market assists readers in obtaining useful information and in promoting their growth. The market report covers a thorough study conducted through an overall analysis of the industry. It provides an overview…

Reverse Mortgage Providers Market 2021 - American Advisors Group (AAG), Finance …

Reverse Mortgage Providers Market research report is very indispensable in many ways for business growth and to thrive in the market. Getting well-versed about the trends and opportunities in the industry is a fairly time-consuming process. Nonetheless, this global Reverse Mortgage Providers Market research report solves this problem very quickly and easily. Clients can unearth the best opportunities to be successful in the market with excellent practice models and methods…

Reverse Engineering Bespoke Parts

We use the data gathered during the inspection to replicate the design, create a 3D model from CAD drawings, and generate a functioning part that meets your performance expectations. When this process is complete, the customer has the exact instructions he needs to replicate the part exactly as it needs to be, saving a lot of time and money in retrospect. Reverse engineering enables the duplication of existing parts by…