Press release

Can You Get Skattefradrag for Gjeldsrenter & How to Do It?

You may have thought already a lot about the debt you have accumulated and the methods of repaying it. Not wanting to struggle with it anymore, you have probably decided that refinancing could be the right move for you. And, chances are that you are quite right. When you refinance your debt and, say, consolidate your unsecured loans, your credit card debt and anything else you may have into just one loan, you are bound to lift a huge financial burden off your shoulders. So, refinancing can get you out of the difficult situation that you have found yourself into.If you have done some research on the refinancing option already, then you may have already realized a few important things. This solution comes with quite some saving potential, meaning that you will get to save money in the long run by using the option and thus doing the responsible thing for your debt. Then, it can also serve to help you get out of the debt sooner, as well as relieve your budget of the strain that you have put on it by getting in debt left and right. All in all, it appears to be quite a beneficial solution for borrowers that have found themselves struggling financially due to various unsecured loans or credit cards.

So, you have taken the time to check the benefits of refinancing, and you've become familiar with quite a lot of those. Did you, however, even think of the tax implications that may come with this option? Has it ever crossed your mind that your savings could actually be higher if you included all of those tax deductions you may be eligible for into your tax return? And, do you have at least some idea as to what the debt refinancing process has to do with tax deductibles in the first place?

Quite a lot of important questions. Paying a visit to https://besterefinansiering.no/skattefradrag-og-refinansiering will get you familiar with the concept of tax deductions for debt interest, that you can definitely take advantage of when refinancing. Furthermore, below I will explain that concept in more details too, as well as explain if you can get those deductions when refinancing your debt. Then, of course, we will talk about the process of doing this as well, getting you prepared for making the right moves when you decide to refinance.

What Is Skattefradrag for Gjeldsrenter?

Let us begin with the most obvious question here. What exactly is skattefradrag for gjeldsrenter, i.e. tax deduction for debt interest? This is the concept that you need to learn about if you really want to do the best thing when refinancing your debt, and I am sure you do. In other words, it is a concept you need to be aware of if you want to maximize your savings.

So, tax deduction for debt interest is, as the name says it, is the deduction you can get on taxes for the interest paid on refinanced debt. When refinancing your loan, you can use this to your advantage, aiming at reducing your taxable income and ultimately lowering the overall tax liability. It is a clearly beneficial solution that you should use to your advantage in order to increase your savings as much as possible. The best part is that it refers to various kinds of debt, including credit cards, mortgages, and personal loans as well.

Can You Get Tax Deductions for the Debt Interest When Refinancing?

The above should have made it clear that getting those deductions is a realistic possibility. So, the answer to this question is, of course, yes. But, there are certain criteria that individuals have to make so as to take advantage of the option. Meaning, therefore, that you should check the criteria before going any further, aiming at figuring out if this is a possibility for you.

In order to qualify for this solution, you will need to have used the refinanced loan for eligible purposes. Those eligible purposes include financing your education, buying a home, or simply covering your living expenses. Apart from that, you should check if the interest paid on the refi loan meets the requirements that are set by the tax authorities. If you meet such criteria, you can count on the deductions when filing your taxes. And, of course, you will also need to have kept detailed records of the interest paid on the refi loan, and provide the necessary documentation when filing your taxes.

Should You Do It?

If you are wondering whether this is something you should do or not, let me cut right to the chase and answer that question. Yes! After all, why not? When you have the opportunity to save money on taxes, why not use it to your advantage? By lowering your tax liability, you can wind up saving quite a significant amount of money, and there is no doubt that saving money is something we all strive towards. In case you're thinking about getting the tax deductions on your mortgage interest, go here to learn some more about the actual idea of it, as well as to check what qualifies and what doesn't.

How to Do It?

The only question you have left is how to actually do all of this the right way. That is, how to get the tax deductions on the debt interest when refinancing it? There are, naturally, a few important steps that you will have to take in this process, aiming at actually maximizing the benefits you can get. So, let me now tell you what you should do, after which you will be prepared to make the necessary moves and get the tax benefits from refinancing your debt.

First off, you will have to check out the actual refinancing options you will have, as well as the offers you can get from the various lenders. Whether going for refi with or without security, you will need to take time to choose an offer that is fair and favorable. It is through getting the best option that you will ultimately be able to save the most amount of money on the actual refinancing process. So, the saving begins with selecting the perfect refi solution.

But, the saving doesn't end there, which should be completely clear to you, given that I have been talking about that in this entire article. The time has come for you to claim those tax deductibles as well, and thus save even more money in the process. In order to maximize the actual benefits, you should understand all the rules, so that you can understand what is eligible for the deductions and what isn't, and to ensure that you meet all the criteria. Next, you will need to keep thorough records of the interest paid on your refinanced loans, in order to support your tax deduction claim.

In the end, if you are not sure how to do all of this correctly, the best thing to do is consult tax professionals and let them use their expertise to help you. These qualified experts will assess your specific financial situation and provide you with the guidance you need when planning the taxes. And, they will undeniably help you maximize your savings.

Besterefinansiering.no drives og eies av Leading Web Solutions A/S

Organisasjonsnummer: 996 532 925MVA

Adresse: Øvre Strandgate 116 0301, 4005 Stavanger

Dersom du har spørsmål vil vi gjerne høre fra deg. Bruk kontaktskjemaet i denne linken for å kontakte oss.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Can You Get Skattefradrag for Gjeldsrenter & How to Do It? here

News-ID: 3440490 • Views: …

More Releases from Stech Web Solution

Choosing the right mousepad for precision gaming and professional performance

Spending extended hours at your computer-whether for gaming or work-means that the details of your setup can significantly impact your experience. While often overlooked, the mousepad plays an important part in ensuring accuracy and comfort. The quality and style of mousepad chosen influence how your mouse glides, assisting with effortless control. The right surface can help with control, support quick reactions, and protect your desk over time.

Mousepads also help…

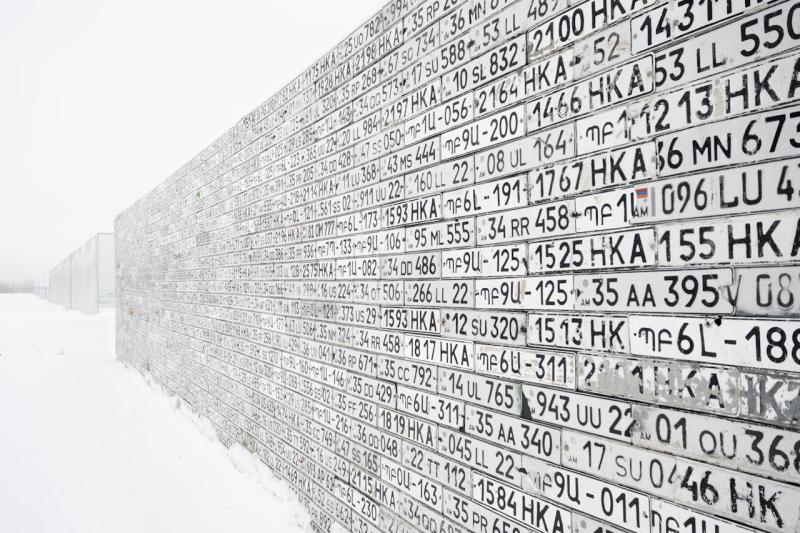

Top States for Collectible License Plates

The hobby of collecting license plates has grown significantly in recent years, driven by enthusiasts seeking unique pieces of automotive history. Certain states in the United States stand out for their diverse, visually striking, and historically significant license plates, making them prime targets for collectors. This article explores the top states for collectible license plates, focusing on their unique designs, historical value, and availability for collectors. For collectors, the appeal…

How to Finance a Swimming Pool Without Breaking the Bank

A backyard swimming pool is a dream addition for many homeowners, offering relaxation, recreation, and an increase in property value. But building a pool can be a significant financial commitment. The good news? You don't have to drain your savings to make it happen. With smart planning and the right financing strategy, you can bring your dream pool to life without overwhelming your budget.

1. Set a Realistic Budget

Before exploring financing…

Seasonal Pest Problems: What to Watch Out for and How to Prevent Them

As the seasons change, so do the types of pests that can invade our homes and businesses. Understanding these seasonal pest patterns is crucial for effective prevention and control. Whether dealing with rodents in the fall or mosquitoes in the summer, having a reliable North Vancouver pest control https://seasidepest.ca/north-vancouver-pest-control/ plan in place can help protect your property year-round. In this comprehensive guide, we'll explore common pests associated with each season…

More Releases for It?

Atlas Search Explained: What It Is, How It Works, and Why It Matters

Atlas Search Explained: What It Is, How It Works, and Why It Matters

Modern applications demand fast, relevant, and intelligent search experiences. Whether it's an e-commerce product search, a SaaS dashboard, or a content-heavy platform, users expect search results that feel instant and accurate.

That's where Atlas Search comes in.

In this guide, we'll break down what Atlas Search is, how it works, key features, use cases, and why it's becoming a preferred…

Sketchgenius review – is it really worth it?

Sketchgenius is a software that creates stunning visuals and graphics for any business. Every businesses online needs graphics and getting a really good graphics might be quite expensive. Paul is about to launch this software called sketch genius to help people solve big problem. Are you looking for ways to get graphics for your client and for your business? Sketchgenius is the tool that you need. Sketchgenius will create…

Get The Best Outsourced IT Support At UK IT Service - IT Support London

UK IT Service - IT Support London (https://www.ukitservice.co.uk/) is one of the best outsourced IT companies across the UK today, offering a wide range of IT support services. They aim to help businesses grow by handling all IT system issues and problems.

The company caters to all businesses of shapes and sizes, providing them with IT support onboarding services. They have a team of experienced IT professionals who will set…

Born From Google … Would it defeat it

Real Value Company has launched its new web site called (Five Of All) under the URL www. 5ofall.com.

This company introduces itself as the latest "competitor of Google" which has the best home page for surfing the internet.

The Company expects that its user friendly new web site that will compete with the major search engines, not by searching but by being the best start page.

The company aims to make 5 OF…

The Water Bottle Perfected: Sip it, Fold it, Snap it and Go!

Elevate Brands Rolls Out Sip N’ Go -the Evolution of Convenient Environmentally Responsible Water Bottles

LOS ANGELES, CA (February 4, 2011) – Elevate Brands is taking environmentally friendly water bottles to the next level with the launch of its fun, sustainable Sip N’ Go. Sip N’ Go is a foldable reusable water bottle with snaps for folding. This lightweight, eco-friendly bottle is the best alternative to bottled water or bulky…

"Scene From Both Sides": Write It, Shoot It, Edit, Screen It

San Antonio-based multimedia marketing firm PrimaDonna Productions, Inc. introduces actors to the process of filmmaking with its newest class, SCENE FROM BOTH SIDES: THE INDEPENDENT FILM EXPERIENCE.

WHEN:

Saturdays, November 1, 8, 15, and 22

10AM – 5PM

WHERE:

PrimaDonna Productions - 8603 Crownhill Blvd. (near the Magic Time Machine)

DETAILS:

SCENE FROM BOTH SIDES: THE INDEPENDENT FILM EXPERIENCE is a four-week class for actors of all ages and levels of skill and experience, from the untrained…