Press release

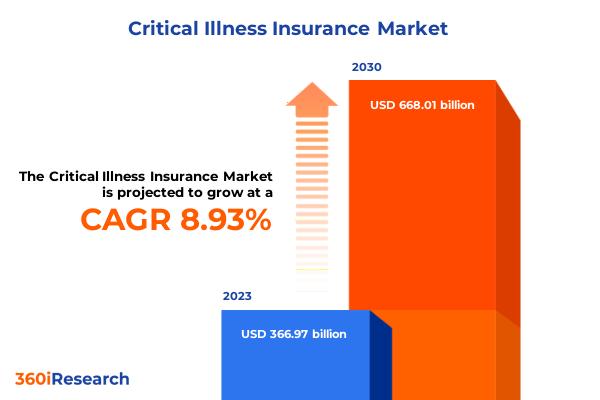

Critical Illness Insurance Market worth $668.01 billion by 2030, growing at a CAGR of 8.93% - Exclusive Report by 360iResearch

The "Critical Illness Insurance Market by Policy Type (Group Policies, Individual Policies), Premium Structure (Half Yearly, Monthly, Quarterly), Policy Coverage - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.The Global Critical Illness Insurance Market to grow from USD 366.97 billion in 2023 to USD 668.01 billion by 2030, at a CAGR of 8.93%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/critical-illness-insurance?utm_source=openpr&utm_medium=referral&utm_campaign=sample

Critical illness insurance is designed to offer policyholders a lump-sum payment if they are diagnosed with a distinct critical illness covered by the policy. This insurance product is intended to offer financial protection by covering costs not typically catered for by traditional health insurance, including treatment expenses, day-to-day bills, loss of income, and the care necessary during recovery from serious diseases such as cancer, heart attack, stroke, and other conditions deemed as critical by the policy. Critical illness insurance finds its application predominantly among individuals seeking financial security against the risk of high medical costs due to serious illnesses. It caters to a broad end-user base, including working professionals, elderly populations, and those with hereditary health risks, making its utility extensive across various demographics. Several factors influence the growth of the critical illness insurance market, including rising awareness about critical illness insurance and its benefits, expanding costs of healthcare services and treatments globally, and the growing prevalence of chronic illnesses and the increasing geriatric population. However, the market faces certain limitations, such as the high cost of premiums of critical illness insurance, concerns associated with complex terms and conditions, and limited awareness in emerging economies. On the other hand, expanding into underpenetrated markets with customized insurance products, incorporating advanced technologies, including AI, to personalize insurance packages and streamline claims processing, and collaborating with healthcare providers to offer bundled insurance and healthcare packages opens new avenues for the critical illness insurance market.

The Americas, particularly the United States and Canada, are pivotal markets for critical illness insurance owing to the increasing healthcare costs and a growing awareness of critical illness insurance. The U.S. market is characterized by a high prevalence of lifestyle diseases and a robust insurance industry, facilitating the adoption of critical illness policies. Latin America is catching up, with countries such as Brazil and Mexico witnessing growth due to improving economic conditions and insurance penetration. Regulatory environments across the Americas significantly influence product offerings and market development. Europe's critical illness insurance market is developed, with high penetration rates in the UK, Germany, and France. The market is driven by a high level of awareness about critical illness insurance, a strong healthcare infrastructure, and supportive government policies. The critical illness insurance market in the Middle East and Africa is nascent but is expected to grow significantly due to economic development, an increasing expatriate population, and rising healthcare expenditure. However, the market faces challenges such as low awareness levels, cultural barriers to insurance, and underdeveloped healthcare infrastructure in certain parts. In APAC, China's critical illness insurance market is expanding rapidly, driven by governmental support and a growing middle class. There's a strong focus on innovation in product offerings, including digital health services. Japan's aging population has increased demand for critical illness insurance, and Japanese consumers prioritize products with transparent terms and lifetime coverage. India's critical illness insurance sector is growing due to rising healthcare costs and increased awareness.

Market Segmentation & Coverage:

This research report categorizes the Critical Illness Insurance Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Policy Type, market is studied across Group Policies and Individual Policies. The Group Policies is projected to witness significant market share during forecast period.

Based on Premium Structure, market is studied across Half Yearly, Monthly, Quarterly, and Yearly. The Quarterly is projected to witness significant market share during forecast period.

Based on Policy Coverage, market is studied across Basic Coverage and Comprehensive Coverage. The Basic Coverage is further studied across Cancer, Heart Attack, and Stroke. The Comprehensive Coverage is further studied across Kidney Failure, Major Burns, and Organ Transplant. The Comprehensive Coverage is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 38.03% in 2023, followed by Europe, Middle East & Africa.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/critical-illness-insurance?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Critical Illness Insurance Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Critical Illness Insurance Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Critical Illness Insurance Market, highlighting leading vendors and their innovative profiles. These include Aegon Life Insurance Company Limited, Aflac Group, AIA Group Limited, American International Group, AmMetLife Insurance Berhad, Aviva Group, AWP Health & Life S.A, Bharti AXA Life Insurance Company Limited, China Life Insurance (Overseas) Company Limited, China Pacific Life Insurance (H.K.) Company Limited, Chubb Group of Insurance Companies, Future Generali India Insurance Company Limited, HDFC ERGO General Insurance Company Limited, ICICI Prudential Life Insurance Co. Ltd., Legal & General Group PLC, Liberty General Insurance Limited, Manulife Financial, Max Life Insurance Company Limited, MetLife, Inc., New York Life Insurance Company, Niva Bupa Health Insurance Company Limited, Ping An Insurance (Group) Company of China, Ltd., Plum Benefits Insurance Brokers Pvt Ltd., Policybazaar Insurance Brokers Private Limited, Prudential Financial, Inc., Royal London Group, Sun Life Inc., The Cigna Group Corporation, The Hospitals Contribution Fund of Australia Ltd., The Manufacturers Life Insurance Company, Tokio Marine Insurance Group, UnitedHealth Group, and Zurich Group.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Critical Illness Insurance Market, by Policy Type

7. Critical Illness Insurance Market, by Premium Structure

8. Critical Illness Insurance Market, by Policy Coverage

9. Americas Critical Illness Insurance Market

10. Asia-Pacific Critical Illness Insurance Market

11. Europe, Middle East & Africa Critical Illness Insurance Market

12. Competitive Landscape

13. Competitive Portfolio

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Critical Illness Insurance Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Critical Illness Insurance Market?

3. What is the competitive strategic window for opportunities in the Critical Illness Insurance Market?

4. What are the technology trends and regulatory frameworks in the Critical Illness Insurance Market?

5. What is the market share of the leading vendors in the Critical Illness Insurance Market?

6. What modes and strategic moves are considered suitable for entering the Critical Illness Insurance Market?

Read More @ https://www.360iresearch.com/library/intelligence/critical-illness-insurance?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Critical Illness Insurance Market worth $668.01 billion by 2030, growing at a CAGR of 8.93% - Exclusive Report by 360iResearch here

News-ID: 3438003 • Views: …

More Releases from 360iResearch

Rising Incidence of Human Metapneumovirus in Vulnerable Populations Boosts Globa …

In recent years, the silent ascent of human metapneumovirus (HMPV) infections has begun to capture significant attention within the realm of infectious diseases. As we advance in medical science, unraveling complexities of age-old pathogens like common influenza or emerging illnesses like COVID-19, a critical discourse has been emerging around HMPV. Particularly, there seems to be a burgeoning acknowledgment of its growing impact on vulnerable global populations, propelling an increased demand…

The Meat Alternatives Market size was estimated at USD 9.39 billion in 2023 and …

From Appetite to Advocacy: The Rising Demand for Meat Alternatives

In recent years, the global food industry has been undergoing a remarkable transformation, driven primarily by an increasing consumer demand for healthier, sustainable, and ethically sourced food products. This seismic shift has brought traditional meat alternatives and high-protein plant-based foods into the spotlight. As the world becomes more conscious of the implications of meat consumption on health and the environment, the…

The Mobility-as-a-Service Market size was estimated at USD 264.80 billion in 202 …

Unpacking the Surge in Investments and Collaborations to Bolster Mobility-as-a-Service

In recent years, as urban landscapes continually evolve, a transformative shift known as Mobility-as-a-Service (MaaS) has reshaped the way we perceive transportation. Marked by the integration of various forms of transport services into a single accessible on-demand mobility solution, MaaS is rapidly gaining traction across global cities. As an emerging paradigm, it's not just shaping the future of travel but also…

The Data Center Services Market size was estimated at USD 56.65 billion in 2023 …

Smart City Revolutions: Why Data Center Colocation is the Future Backbone

In the era of digital transformation, urban landscapes across the globe are undergoing a seismic shift toward becoming "smart cities." The concept of a smart city revolves around using digital technology, IoT (Internet of Things), AI, and data analytics at an unprecedented scale to improve urban infrastructure, manage resources efficiently, and enhance the quality of life for citizens. A vital…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…