Press release

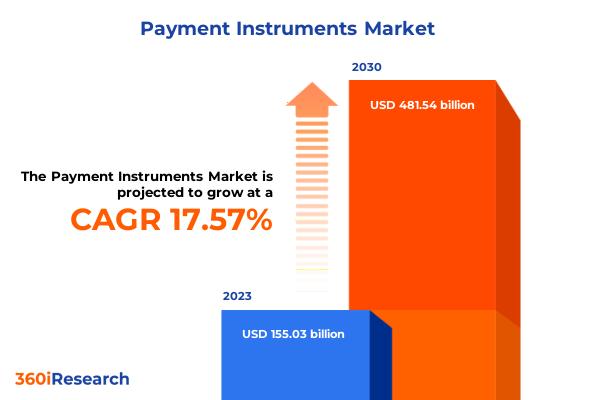

Payment Instruments Market worth $481.54 billion by 2030, growing at a CAGR of 17.57% - Exclusive Report by 360iResearch

The "Payment Instruments Market by Type (Cash Payment Instruments, Non-cash Payment Instruments), End-use (BFSI, Healthcare, IT & Telecom) - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.The Global Payment Instruments Market to grow from USD 155.03 billion in 2023 to USD 481.54 billion by 2030, at a CAGR of 17.57%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/payment-instruments?utm_source=openpr&utm_medium=referral&utm_campaign=sample

A payment instrument is a tool or method that enables the transfer of financial value between individuals, businesses, and institutions in exchange for goods, services, or the settlement of obligations. Payment instruments facilitate transactions by providing a secure and efficient means to transfer funds from one party to another. In recent years, the payment instruments market has observed exponential growth owing to several factors, such as the increasing use of online payments, an upsurge in prepaid payment instruments, and the integration of advanced technologies. The global digital payments landscape is rapidly transforming, significantly shifting towards cashless transactions. The growing number of internet users, higher smartphone penetration, and ever-expanding eCommerce industry fuel the swelling adoption of online payments. As per a report published in March 2023, Apple Pay and Google Wallet had approximately 383 million and 150 million users utilizing non-cash payment instruments for seamless transactions. Prepaid payment instruments (PPIs) have also gained massive popularity for providing convenience and security for users while making transactions. However, the market has witnessed challenges such as cyber-attacks on digital payments. The industry is integrating advanced technologies such as artificial intelligence (AI), machine learning algorithms, blockchain technology, biometric authentication methods, and tokenization to counter these challenges and enhance user experience, which is expected to shape the future of secure financial transactions in the digital age.

The North American region has remained at the forefront of expanding payment systems and gateways, supporting the integration and expansion of payment instruments. In the Americas, the United States leads the charge in adopting digital payment methods due to widespread internet access, smartphone penetration, and a supportive regulatory environment. In addition, the vast presence of payment solution entities across the region bodes well for the industry's regional growth. Further, Latin America is witnessing rapid growth in digital payment adoption, driven by increasing eCommerce activities and government initiatives promoting financial inclusion. In EMEA, government regulations play a critical role in shaping payment instruments. The European Union has introduced several directives, such as the Payment Services Directive (PSD) and PSD2, to foster innovation, competition, and transparency in electronic payments. Additionally, schemes such as the Single Euro Payments Area (SEPA) help standardize euro-denominated bank transfers across Europe. APAC is experiencing rapid growth in prepaid payment instruments due to increasing smartphone penetration and a growing unbanked population. Countries such as India have witnessed significant growth in mobile wallets and digital transactions fueled by government initiatives, especially the Unified Payments Interface (UPI) launch.

Market Segmentation & Coverage:

This research report categorizes the Payment Instruments Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Type, market is studied across Cash Payment Instruments and Non-cash Payment Instruments. The Cash Payment Instruments is further studied across Banknotes and Coins. The Non-cash Payment Instruments is further studied across Card-based, Cryptocurrency, E-wallets, Electronic Funds Transfer (EFT), and Paper-based. The Card-based is further studied across Credit Card and Debit Card. The Paper-based is further studied across Check, Credit Note, Debit Note, and Demand Deposit. The Cash Payment Instruments is projected to witness significant market share during forecast period.

Based on End-use, market is studied across BFSI, Healthcare, IT & Telecom, Media & Entertainment, Retail & eCommerce, and Transportation. The IT & Telecom is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas is projected to witness significant market share during forecast period.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/payment-instruments?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Payment Instruments Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Payment Instruments Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Payment Instruments Market, highlighting leading vendors and their innovative profiles. These include Amazon.com, Inc., American Express Company, Apple Inc., Bharti Airtel Limited, Castles Technology, Coinbase Ascending Markets Kenya Limited, Dspread Technology Inc., Equinox Payments, Fiserv, Inc., FPL Technologies Pvt. Ltd., Freecharge Payment Technologies Private Limited by Axis Bank Limited, Google LLC by Alphabet Inc., Ingenico, Mastercard International Incorporated, NCR Corporation, Newland Payment Technology, One MobiKwik Systems Limited, One97 Communications Limited, Oxigen Services India Pvt. Ltd., PAX Technology, PayPal Holdings, Inc., PayU Payments Private Limited, PhonePe Private Limited, Pine Labs Private Limited, Pismo Soluções Tecnologicas Ltda., Reliance Jio Infocomm Ltd, Samsung Electronics Co., Ltd., VeriFone, Inc., Virtual Privacy AG, Visa Inc., and Xiaomi Corporation.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Payment Instruments Market, by Type

7. Payment Instruments Market, by End-use

8. Americas Payment Instruments Market

9. Asia-Pacific Payment Instruments Market

10. Europe, Middle East & Africa Payment Instruments Market

11. Competitive Landscape

12. Competitive Portfolio

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Payment Instruments Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Payment Instruments Market?

3. What is the competitive strategic window for opportunities in the Payment Instruments Market?

4. What are the technology trends and regulatory frameworks in the Payment Instruments Market?

5. What is the market share of the leading vendors in the Payment Instruments Market?

6. What modes and strategic moves are considered suitable for entering the Payment Instruments Market?

Read More @ https://www.360iresearch.com/library/intelligence/payment-instruments?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Instruments Market worth $481.54 billion by 2030, growing at a CAGR of 17.57% - Exclusive Report by 360iResearch here

News-ID: 3435359 • Views: …

More Releases from 360iResearch

Rising Incidence of Human Metapneumovirus in Vulnerable Populations Boosts Globa …

In recent years, the silent ascent of human metapneumovirus (HMPV) infections has begun to capture significant attention within the realm of infectious diseases. As we advance in medical science, unraveling complexities of age-old pathogens like common influenza or emerging illnesses like COVID-19, a critical discourse has been emerging around HMPV. Particularly, there seems to be a burgeoning acknowledgment of its growing impact on vulnerable global populations, propelling an increased demand…

The Meat Alternatives Market size was estimated at USD 9.39 billion in 2023 and …

From Appetite to Advocacy: The Rising Demand for Meat Alternatives

In recent years, the global food industry has been undergoing a remarkable transformation, driven primarily by an increasing consumer demand for healthier, sustainable, and ethically sourced food products. This seismic shift has brought traditional meat alternatives and high-protein plant-based foods into the spotlight. As the world becomes more conscious of the implications of meat consumption on health and the environment, the…

The Mobility-as-a-Service Market size was estimated at USD 264.80 billion in 202 …

Unpacking the Surge in Investments and Collaborations to Bolster Mobility-as-a-Service

In recent years, as urban landscapes continually evolve, a transformative shift known as Mobility-as-a-Service (MaaS) has reshaped the way we perceive transportation. Marked by the integration of various forms of transport services into a single accessible on-demand mobility solution, MaaS is rapidly gaining traction across global cities. As an emerging paradigm, it's not just shaping the future of travel but also…

The Data Center Services Market size was estimated at USD 56.65 billion in 2023 …

Smart City Revolutions: Why Data Center Colocation is the Future Backbone

In the era of digital transformation, urban landscapes across the globe are undergoing a seismic shift toward becoming "smart cities." The concept of a smart city revolves around using digital technology, IoT (Internet of Things), AI, and data analytics at an unprecedented scale to improve urban infrastructure, manage resources efficiently, and enhance the quality of life for citizens. A vital…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…