Press release

Low Code Technology in Insurance Market Latest Updated Report 2024-2031

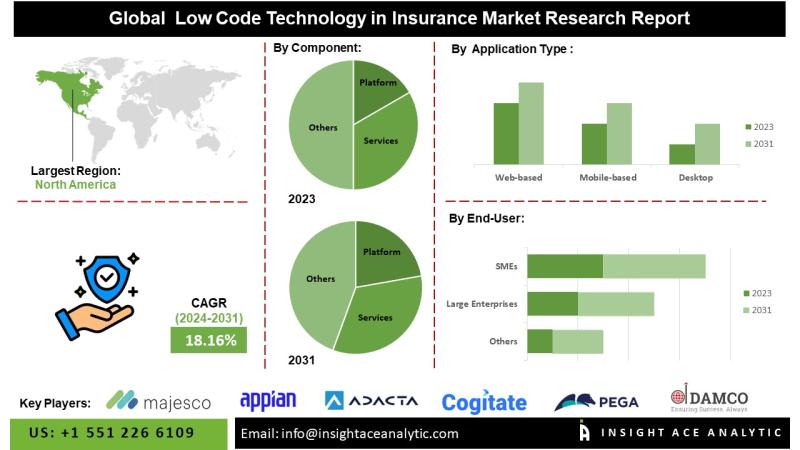

Low Code Technology in Insurance Market to Record an Exponential CAGR by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Low Code Technology in Insurance Market - (By Component (Platform and Services), By Application Type (Web-based, Mobile-based, and Desktop and Server-based), By Organization Size (SMEs and Large Enterprises)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to the latest research by InsightAce Analytic, the Global Low Code Technology in Insurance Market is expected to expand with a CAGR of 18.16% during the forecast period of 2024-2031.

Low-code technology in insurance is a coding environment that lets developers of different skill levels create apps using model-driven logic, a dynamic graphical user interface, and configuration. It lessens reliance on traditional methods of computer programming that rely on hand-coding. By utilizing low-code computing, insurance businesses can simplify the development and release of digital solutions such as chatbots, self-service portals, and mobile applications. Apps can be built by non-technical people, such as business analysts and citizen developers, on platforms that do not require extensive coding knowledge. The insurance business needs more skilled professionals, but low-code solutions can help by streamlining development processes and reducing reliance on IT departments. Insurance companies may quickly prototype and test new products, services, and business models using low-code platforms. Using low-code technologies, insurance companies may create customer-focused products such as self-service portals, mobile apps, and chatbots. At every stage of the client lifecycle, this helps provide tailored services, improve communication, and increase levels of engagement. However, security is a big worry with low-code platforms, even while they make application development faster and more flexible. Security protocol and vulnerability management oversights are more likely to occur when non-technical users are involved and development cycles are rapid.

Get a free sample copy of the report: https://www.insightaceanalytic.com/request-sample/2384

List of Prominent Players in the Low Code Technology in Insurance Market:

• Whatfix

• WalkMe

• Stonly

• Oracle

• AppLearn

• SAP

• Userlane

• Pendo

• Knowmore

• Appcues

• Other Market Players

Market Dynamics:

Drivers-

The growing demand for low-code technology in the insurance market is fueled by the increasing use of the solution to facilitate high-usage, functional software that can satisfy enterprises' data needs and unique processes. The low-code technology market is further impacted by software developers making specialized systems for companies' demands due to the dispersed gadgets that companies need for their employees. The increasing digital transformation in the telecom and IT industries is a key driver propelling the low-code development platform market forward.

Challenges:

The prime challenge is insufficient technological knowledge, a shortage of competent individuals, and a lack of norms and protocol because of lockdowns and isolation in emerging countries, which is predicted to slow the growth of the low code technology in the insurance market. The low-code development platform business could be hindered by variables such as the necessity to replace legacy software and reliance on vendor-supplied modifications. One anticipated obstacle for the low-code technology sector is determining the optimal time and method for process automation.

Regional Trends:

The North American low-code technology in the insurance market is anticipated to record a large market share in terms of revenue. It is projected to grow at a high CAGR in the near future because more and more insurance companies in North America are using low-code technology to modernize their operations, increase productivity, and elevate the customer experience. Besides, Asia Pacific had a considerable revenue share in the market due to more widespread use as insurance companies updated their systems to serve their customers better. Market growth is fueled by regulatory measures that encourage digital innovation and increasing investments in technological infrastructure.

Curious About This Latest Version Of The Report? Enquiry Before Buying: https://www.insightaceanalytic.com/enquiry-before-buying/2384

Recent Developments:

• In October 2023, AppLearn announced the successful completion of its SOC2 Type 1 attestation. Achieving this goal shows how serious the organization is about protecting its customers' privacy, data, and security.

• In Nov 2023, Sagitec formed a partnership with Whatfix, the top-rated Digital Adoption Platform (DAP) for businesses that relies on data. Together, they are developing a distinctive digital adoption solution that will be combined with pension, labor, employment, and other industry solutions. This collaboration enables customers to obtain Whatfix's cutting-edge Digital Adoption Platform directly from Sagitec, simplifying the process of deploying Whatfix to enhance user experience and expedite the adoption of Sagitec's software solutions.

•

Segmentation of Low Code Technology in Insurance Market-

By Component-

• Platform

• Services

By Application Type-

• Web-based

• Mobile-based

• Desktop

• Server-based

By Organization Size-

• SMEs

• Large Enterprises

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of the Middle East and Africa

For More Customization @ https://www.insightaceanalytic.com/customisation/2384

Contact Us:

InsightAce Analytic Pvt. Ltd.

Tel.: +1 718 593 4405

Email: info@insightaceanalytic.com

Site Visit: www.insightaceanalytic.com

Follow Us on LinkedIn @ bit.ly/2tBXsgS

Follow Us On Facebook @ bit.ly/2H9jnDZ

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions.

Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses.

We help clients gain a competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets, and repositioning products.

Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Low Code Technology in Insurance Market Latest Updated Report 2024-2031 here

News-ID: 3434937 • Views: …

More Releases from InsightAce Analytic Pvt.Ltd

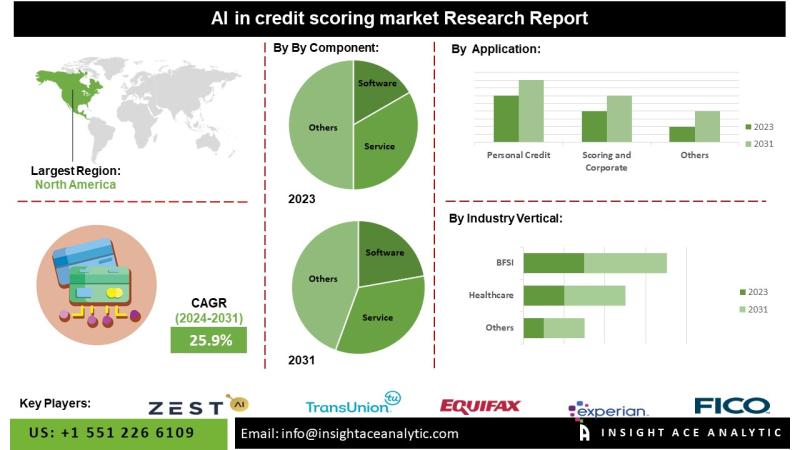

AI In The Credit-Scoring Market Smarter Credit Decisions: How AI is Transforming …

AI In The Credit-Scoring Market to Record an Exponential CAGR by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global AI In The Credit-Scoring Market - (By Component (Software and Service), By Application (Personal Credit Scoring and Corporate Credit Scoring), By Industry Vertical (BFSI (Banking, Financial Services, Insurance), Retail, Healthcare,

Telecommunications, Utilities, and Real Estate)), Trends,…

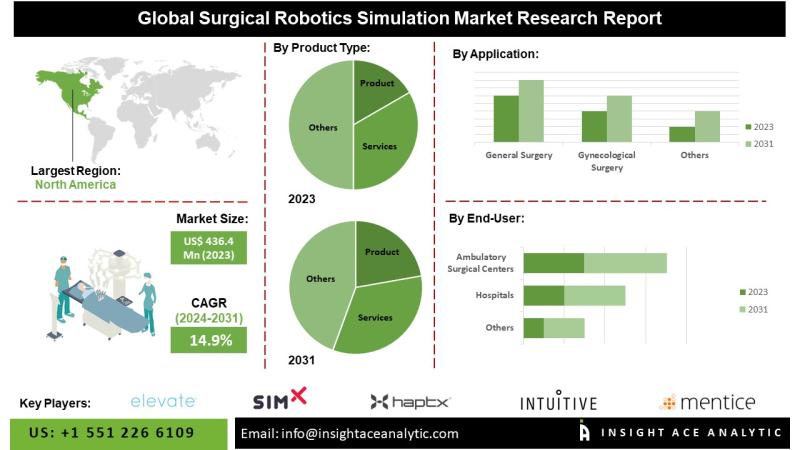

Surgical Robotics Simulation Market Guiding the Next Generation of Surgeons: Gro …

Surgical Robotics Simulation Market Worth $1,283.6 Mn by 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Surgical Robotics Simulation Market Size, Share & Trends Analysis Report By Product Type (Product, Services), By Application (General Surgery, Gynecological Surgery, Urological Surgery, Neurological Surgery (Head and Neck Surgery), Cardiological Surgery, Orthopedic Surgery, Others), By End User (Hospitals, Ambulatory Surgical Centers,…

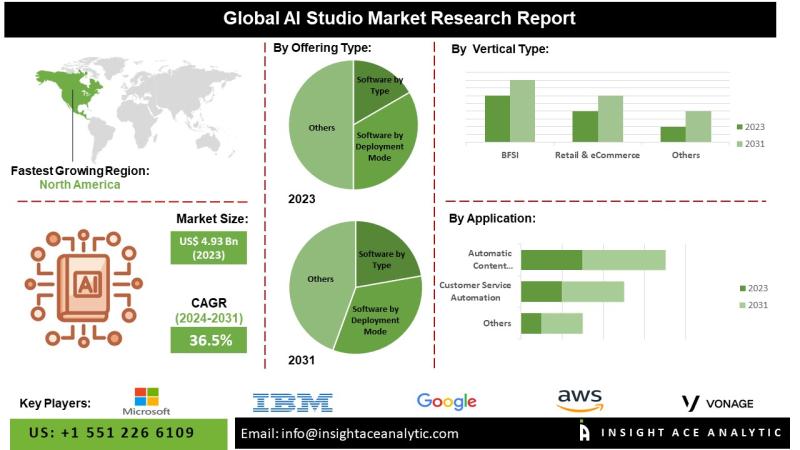

AI Studio Market Accelerating Innovation: The Benefits of AI Studios for Busines …

Global AI Studio Market Worth $57.89 Bn by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global AI Studio Market- (By Application (Sentiment Analysis, Customer Service Automation, Image Classification & Labelling, Synthetic Data Generation, Predictive Modelling & Forecasting, Automatic Content Generation, and Others), By Offering, By Vertical, By Region, Trends, Industry Competition Analysis, Revenue and Forecast…

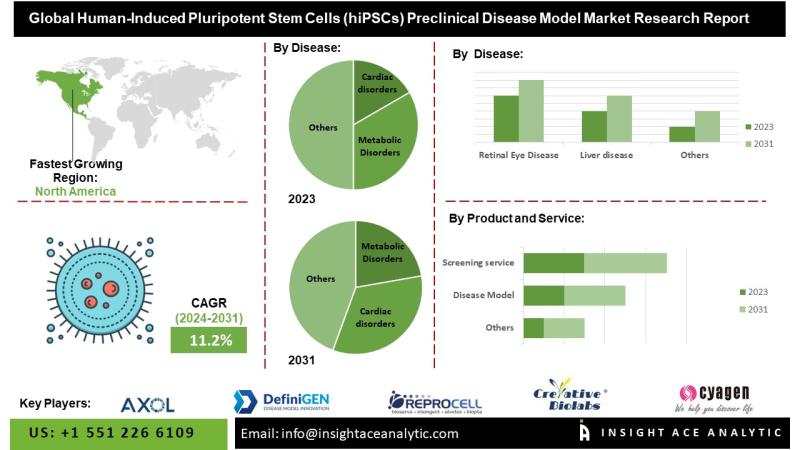

Human-Induced Pluripotent Stem Cells (hiPSCs) Preclinical Disease Model Market G …

Global Human-Induced Pluripotent Stem Cells (hiPSCs) Preclinical Disease Model Market to Record an Exponential CAGR by 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Human-Induced Pluripotent Stem Cells (hiPSCs) Preclinical Disease Model Market- (Disease (Neurological Disorders and Dystrophies, Cardiac disorders, Retinal Eye Disease, Metabolic Disorders, Liver disease, Others), Products and Services (Disease Model,

Reprogramming service, Differentiation…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…