Press release

The Global Industrial Salt Market to Reach $17 Billion by 2028 - Arizton

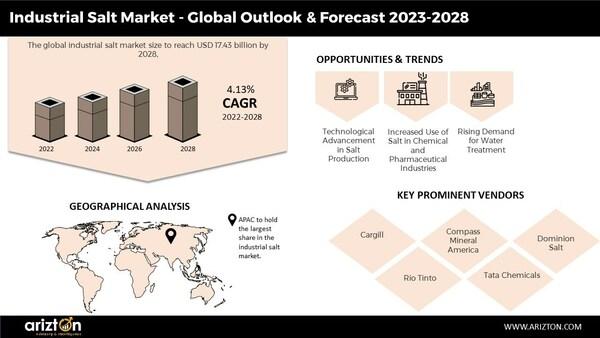

According to Arizton's latest research report, the industrial salt market will grow at A CAGR of 4.13% during 2022-2028.To Know More, Download the Free Sample Report: https://www.arizton.com/market-reports/industrial-salt-market

Global industrial salts market shipments are projected to reach 389.51 million tons by 2028, driven by their extensive non-food applications in chemical manufacturing, water treatment, and de-icing. Industrial salt plays a crucial role in various industries with over 14,000 diverse uses, including dye setting, glass production, and tire manufacturing. Salt production, one of the oldest and most widespread industries, spans more than 100 countries, with approximately 60% of global salt production dedicated to industrial purposes. The industrial salt market is witnessing increasing competition, with Asia poised to exhibit the strongest regional growth. Furthermore, the international trade of industrial salt has experienced significant expansion, as traditional European salt producers face competition from emerging suppliers as distant as Australia, Mexico, and Chile. These dynamics present substantial growth opportunities for industry participants in the salt market.

The chlor-alkali industry is the largest end-user of industrial salts. In 2018, the industry accounted for approximately 36% of the global consumption of industrial salts, equivalent to 127.8 million tons. Around 52% of the global consumption of industrial salts was witnessed in East Asia, followed by North America and Western Europe. The per capita consumption of caustic soda increased by 60% in China during the last 10 years. Japan and South Korea have exceeded Western Europe regarding the per capita consumption of industrial salts. The rise in demand for products such as caustic soda and soda ash will drive the growth of the chlor-alkali market. In 2028, the chlor-alkali production capacity is expected to reach 99 million tons from 90 million tons in 2018. Thus, the growth of the chlor-alkali market is expected to drive the demand for industrial salts, the primary raw materials used in the chlor-alkali manufacturing process.

Key Highlights

Nearly 60% of the global industrial salt output is intended for industrial applications across many areas. Therefore, the demand for industrial salts has increased over the years, making the market more competitive.

The rise in investments by salt producers in new sources for cost-effective production is expected to underpin the growth in the chlor-alkali industry across Asia.

The rise in the consumption of industrial salts has been particularly strong in China, which is a net importer of salt despite its position as the largest salt-producing country in the world.

The US has remained the largest importer of industrial salts in 2022. Chile, Mexico, and Egypt emerged as the main suppliers of industrial salts to the US in 2022.

Hub-Pak of Pakistan has announced plans to develop the world's largest seawater solar salt operation under a private-public partnership with the government.

K+S, a global leader in salt production, continues to move forward with the Ashburton solar salt project located 40 kilometers southwest of Onslow in the Pilbara region of Western Australia.

The leading market for chlor-alkali is a vinyl-chlorinated monomer (VCM), the precursor of polyvinyl chloride (PVC), which accounts for over 50% of the total market.

Complying with stringent government regulations is a key challenge for vendors specializing in salt mining and extraction. Government regulations have a profound impact on the metals and mining sector.

Some of the largest salt mines in the world are in the US, Canada, Germany, Pakistan, Poland, Italy, Germany, Romania, and Russia.

Natural brine springs of commercial importance are found in the Dead Sea, Austria, France, Germany, India, the UK, and the US.

Buy the Report Now: https://www.arizton.com/market-reports/industrial-salt-market

Post-Purchase Benefit

1hr of free analyst discussion

10% of customization

APAC Emerges as Dominant Force in Global Industrial Salts Market, Fueled by Rapid Industrialization and Rising Demand for Processed Food and Chemicals

APAC takes the lead in the global industrial salts market with over 45% consumption share Asia-Pacific region experiences remarkable growth driven by industrialization, population surge, and increased demand for processed food and chemicals. China, India, and Japan emerge as key markets, with China leading as the largest producer and consumer of industrial salt worldwide. East Asian countries witness an urbanization boom, propelling the construction sector with PVC and glass as primary materials. Industrial salt plays a vital role in PVC and glass production, bolstering the market growth in APAC.

North America's Demand for De-icing Salt Soars, especially in Northern U.S. and Canada cold weather conditions in Northern U.S. and Canada lead to substantial consumption of de-icing salt annually. The United States uses approximately 19 million tons of salt yearly for de-icing roads, sidewalks, and walkways.

Europe's industrial salt market thrives, driven by Rock Salt's wide applications Germany, the UK, France, Poland, and Russia dominate Europe's salt production. Rock salt's extensive use in de-icing and the chemical industry contributes significantly to the growth of the industrial salt market in the region.

Brazil Leads Latin America's Industrial Salt consumption, fueled by chemical and mining industries. Brazil emerges as the top consumer of industrial salt in Latin America, driven by the demand from the chemical and mining sectors.

Middle East and Africa witness growing demand for industrial salt United Arab Emirates, Saudi Arabia, and South Africa play crucial roles as major consumers in the industrial salt market. The region's flourishing chemical, oil, and gas sectors fuel the demand for industrial salt.

Global Industrial Salt Market Witnessing Intensified Competition Among Numerous Players

The global industrial salt market is characterized by a fragmented landscape, featuring a multitude of small and large companies. This scenario contributes to a highly competitive market environment that is projected to become even more fiercely contested in the coming years. Companies that specialize in manufacturing superior, popular, and cost-effective products are expected to gain a competitive advantage in this global industry.

One such example is the collaboration between China and North America, which aims to produce marine chemicals at a competitive cost. This initiative will lead to the availability of industrial salt at affordable prices, further intensifying the competition. Companies equipped with robust financial and technological resources, supported by large managerial teams, are better positioned to identify market opportunities. Their flexibility enables them to swiftly embrace changes, drive product innovation, and offer competitive pricing based on economies of scale. These factors are anticipated to stimulate the growth of the global industrial salt market throughout the forecast period.

Consequently, the global industrial salt market has evolved into a highly competitive arena, where numerous players are striving to secure a larger market share. To maintain their competitiveness and ensure sustainable market presence, companies are employing diverse strategies such as product differentiation, competitive pricing, innovation, technological advancements, and brand recognition.

Key Company Profiles

Cargill

Compass Mineral America

Dominion Salt

Rio Tinto

Tata Chemicals

K+S Aktiengesellschaft

China National Salt Industry Group Co. Ltd

INEOS

Wilson Salt

ICL Salt

Irish Salt Mining

Nobian

Donald Brown Group

Delmon

Mitsui & Co.

Morton Salt

Archean Chemical Industries

Zoutman

Swiss Salt Works

Salins Group

Amra Salt Factory

CIECH GROUP

American Rock Salt

Market Segmentation

Process

Extractor

Steamer

Product Type

Solar Salt

Rock Salt

Salt in Brine

Vacuum Salt

End-user

Chemical Industry

De-icing

Water Treatment

Oil & Gas Industry

Others

Geography

APAC

China

India

Australia

Japan

South Korea

North America

The US

Canada

Europe

Germany

The UK

Russia

France

Poland

Middle East & Africa

Iran

Saudi Arabia

The UAE

Turkey

Egypt

Latin America

Brazil

Mexico

Rest of Latin America

Check Out Some of the Top-Selling Research Reports:

Water Treatment Chemicals Market - Global Outlook & Forecast 2021-2026: The global water treatment chemicals market to reach USD 3.8 billion by 2026.

Water Softener Market - Global Outlook & Forecast 2022-2027: The global water softener market to cross $5.7 billion in 2027.

Table of Content

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4 SCOPE & COVERAGE

4.1 MARKET DEFINITION

4.1.1 INCLUSIONS

4.1.2 EXCLUSIONS

4.1.3 MARKET ESTIMATION CAVEATS

4.2 BASE YEAR

4.3 SCOPE OF THE STUDY

4.3.1 MARKET SEGMENTATION BY GEOGRAPHY

4.3.2 MARKET BY PROCESS TYPE

4.3.3 MARKET BY PRODUCT TYPE

4.3.4 MARKET BY END USER

5 REPORT ASSUMPTIONS & CAVEATS

5.1 KEY CAVEATS

5.2 CURRENCY CONVERSION

5.3 MARKET DERIVATION

6 MARKET AT A GLANCE

7 PREMIUM INSIGHTS

7.1 REPORT OVERVIEW

7.2 ANALYSIS OF OPPORTUNITIES & CHALLENGES

7.3 SEGMENT ANALYSIS

7.4 REGIONAL ANALYSIS

7.5 COMPETITOR ANALYSIS

8 INTRODUCTION

8.1 OVERVIEW

8.1.1 APPLICATION BASED ON ANALYSIS

8.1.2 SALT PRODUCTION PROCESS

8.1.3 GLOBAL SALT PRODUCTION

8.1.4 GOVERNMENT REGULATION AND POLICIES

8.1.5 RISK FACTORS FOR MARKET

8.1.6 COVID-19 IMPACT ANALYSIS

8.1.7 GLOBAL ECONOMIC CONDITION

9 MARKET OPPORTUNITIES & TRENDS

9.1 RAPID PACE OF INDUSTRIALIZATION

9.2 GROWING USE OF SOLAR SALTS

9.3 EXPANSION OF SALT MINES & OTHER PRODUCTION FACILITIES

10 MARKET GROWTH ENABLERS

10.1 TECHNOLOGICAL ADVANCES IN SALT PRODUCTION

10.2 HIGH USE OF SALT IN CHEMICAL & PHARMACEUTICAL INDUSTRIES

10.3 RISE IN DEMAND FOR WATER TREATMENT SYSTEMS

11 MARKET RESTRAINTS

11.1 HEALTH & ENVIRONMENTAL ISSUES

11.2 LIMITED AVAILABILITY & HIGH PRICES OF RAW MATERIALS

11.3 ENDURING ECONOMIC SLOWDOWN

11.4 WINTER WEATHER VARIABILITY AFFECTING SALES OF DE-ICING SALTS

11.5 STRINGENT GOVERNMENT REGULATIONS

12 MARKET LANDSCAPE

12.1 MARKET OVERVIEW

12.2 MARKET SIZE & FORECAST

12.3 MARKET BY PROCESS

12.4 MARKET BY PRODUCT TYPE

12.5 MARKET BY END USER

12.6 FIVE FORCES ANALYSIS

12.6.1 THREAT OF NEW ENTRANTS

12.6.2 BARGAINING POWER OF SUPPLIERS

12.6.3 BARGAINING POWER OF BUYERS

12.6.4 THREAT OF SUBSTITUTES

12.6.5 COMPETITIVE RIVALRY

13 PROCESS

13.1 MARKET SNAPSHOT & GROWTH ENGINE

13.2 MARKET OVERVIEW

13.3 EXTRACTOR

13.3.1 MARKET OVERVIEW

13.3.2 MARKET SIZE & FORECAST

13.3.3 MARKET BY GEOGRAPHY

13.4 STEAMER

13.4.1 MARKET OVERVIEW

13.4.2 MARKET SIZE & FORECAST

13.4.3 MARKET BY GEOGRAPHY

14 PRODUCT TYPE

14.1 MARKET SNAPSHOT & GROWTH ENGINE

14.2 MARKET OVERVIEW

14.3 SOLAR SALT

14.3.1 MARKET SIZE & FORECAST

14.3.2 MARKET BY GEOGRAPHY

14.4 ROCK SALT

14.4.1 MARKET SIZE & FORECAST

14.4.2 MARKET BY GEOGRAPHY

14.5 SALT IN BRINE

14.5.1 MARKET SIZE & FORECAST

14.5.2 MARKET BY GEOGRAPHY

14.6 VACUUM SALT

14.6.1 MARKET SIZE & FORECAST

14.6.2 MARKET BY GEOGRAPHY

15 END USER

15.1 MARKET SNAPSHOT & GROWTH ENGINE

15.2 MARKET OVERVIEW

15.3 CHEMICAL INDUSTRY

15.3.1 MARKET OVERVIEW

15.3.2 MARKET SIZE & FORECAST

15.3.3 MARKET BY GEOGRAPHY

15.4 DE-ICING

15.4.1 MARKET OVERVIEW

15.4.2 MARKET SIZE & FORECAST

15.4.3 MARKET BY GEOGRAPHY

15.5 WATER TREATMENT

15.5.1 MARKET OVERVIEW

15.5.2 MARKET SIZE & FORECAST

15.5.3 MARKET BY GEOGRAPHY

15.6 OIL & GAS INDUSTRY

15.6.1 MARKET OVERVIEW

15.6.2 MARKET SIZE & FORECAST

15.6.3 MARKET BY GEOGRAPHY

15.7 OTHERS

15.7.1 MARKET OVERVIEW

15.7.2 MARKET SIZE & FORECAST

15.7.3 MARKET BY GEOGRAPHY

16 GEOGRAPHY

16.1 MARKET SNAPSHOT & GROWTH ENGINE (REVENUE)

16.2 MARKET SNAPSHOT & GROWTH ENGINE (VOLUME)

16.3 GEOGRAPHIC OVERVIEW

17 APAC

17.1 MARKET SIZE & FORECAST

17.2 PROCESS

17.2.1 MARKET SIZE & FORECAST

17.3 PRODUCT TYPE

17.3.1 MARKET SIZE & FORECAST

17.4 END USER

17.4.1 MARKET SIZE & FORECAST

17.5 KEY COUNTRIES (VOLUME)

17.5.1 CHINA: MARKET SIZE & FORECAST

17.5.2 INDIA: MARKET SIZE & FORECAST

17.5.3 AUSTRALIA: MARKET SIZE & FORECAST

17.5.4 JAPAN: MARKET SIZE & FORECAST

17.5.5 SOUTH KOREA: MARKET SIZE & FORECAST

18 NORTH AMERICA

18.1 MARKET SIZE & FORECAST

18.2 PROCESS

18.2.1 MARKET SIZE & FORECAST

18.3 PRODUCT TYPE

18.3.1 MARKET SIZE & FORECAST

18.4 END USER

18.4.1 MARKET SIZE & FORECAST

18.5 KEY COUNTRIES (VOLUME)

18.5.1 US: MARKET SIZE & FORECAST

18.5.2 CANADA: MARKET SIZE & FORECAST

19 EUROPE

19.1 MARKET SIZE & FORECAST

19.2 PROCESS

19.2.1 MARKET SIZE & FORECAST

19.3 PRODUCT TYPE

19.3.1 MARKET SIZE & FORECAST

19.4 END USER

19.4.1 MARKET SIZE & FORECAST

19.5 KEY COUNTRIES (VOLUME)

19.5.1 GERMANY: MARKET SIZE & FORECAST

19.5.2 UK: MARKET SIZE & FORECAST

19.5.3 RUSSIA: MARKET SIZE & FORECAST

19.5.4 FRANCE: MARKET SIZE & FORECAST

19.5.5 POLAND: MARKET SIZE & FORECAST

20 MIDDLE EAST & AFRICA

20.1 MARKET SIZE & FORECAST

20.2 PROCESS

20.2.1 MARKET SIZE & FORECAST

20.3 PRODUCT TYPE

20.3.1 MARKET SIZE & FORECAST

20.4 END USER

20.4.1 MARKET SIZE & FORECAST

20.5 KEY COUNTRIES (VOLUME)

20.5.1 IRAN: MARKET SIZE & FORECAST

20.5.2 SAUDI ARABIA: MARKET SIZE & FORECAST

20.5.3 UAE: MARKET SIZE & FORECAST

20.5.4 TURKEY: MARKET SIZE & FORECAST

20.5.5 EGYPT: MARKET SIZE & FORECAST

21 LATIN AMERICA

21.1 MARKET SIZE & OVERVIEW

21.2 PROCESS

21.2.1 MARKET SIZE & FORECAST

21.3 PRODUCT TYPE

21.3.1 MARKET SIZE & FORECAST

21.4 END USER

21.4.1 MARKET SIZE & FORECAST

21.5 KEY COUNTRIES (VOLUME)

21.5.1 BRAZIL: MARKET SIZE & FORECAST

21.5.2 MEXICO: MARKET SIZE & FORECAST

21.5.3 REST OF LATIN AMERICA: MARKET SIZE & FORECAST

22 COMPETITIVE LANDSCAPE

22.1 COMPETITION OVERVIEW

23 KEY COMPANY PROFILES

23.1 CARGILL

23.2 COMPASS MINERALS AMERICA

23.3 DOMINION SALT

23.4 RIO TINTO

23.5 TATA CHEMICALS

23.6 K+S AKTIENGESELLSCHAFT

23.7 CHINA NATIONAL SALT INDUSTRY GROUP

23.8 INEOS GROUP

24 OTHER PROMINENT VENDORS

24.1 WILSON SALT

24.2 ICL SALT

24.3 IRISH SALT MINES

24.4 NOBIAN

24.5 DONALD BROWN GROUP

24.6 DELMON

24.7 MITSUI & CO.

24.8 MORTON SALT

24.9 ARCHEAN CHEMICAL INDUSTRIES

24.10 ZOUTMAN

24.11 SWISS SALT WORKS

24.12 SALINS GROUP

24.13 AMRA SALT FACTORY

24.14 CIECH GROUP

24.15 AMERICAN ROCK SALT

25 REPORT SUMMARY

25.1 KEY TAKEAWAYS

25.2 STRATEGIC RECOMMENDATIONS

26 QUANTITATIVE SUMMARY

26.1 MARKET BY GEOGRAPHY

26.2 MARKET BY PROCESS

26.3 MARKET BY PRODUCT TYPE

26.4 MARKET BY END USER

26.5 APAC

26.5.1 PROCESS

26.5.2 PRODUCT TYPE

26.5.3 END USER

26.6 NORTH AMERICA

26.6.1 PROCESS

26.6.2 PRODUCT TYPE

26.6.3 END USER

26.7 EUROPE

26.7.1 PROCESS

26.7.2 PRODUCT TYPE

26.7.3 END USER

26.8 MIDDLE EAST & AFRICA

26.8.1 PROCESS

26.8.2 PRODUCT TYPE

26.8.3 END USER

26.9 LATIN AMERICA

26.9.1 PROCESS

26.9.2 PRODUCT TYPE

26.9.3 END USER

27 APPENDIX

27.1 ABBREVIATIONS

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Contact Us:

Call: +1-312-235-2040

+1 302 469 0707

Mail: enquiry@arizton.com

Contact Us: https://www.arizton.com/contact-us

Blog: https://www.arizton.com/blog

Website: https://www.arizton.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Global Industrial Salt Market to Reach $17 Billion by 2028 - Arizton here

News-ID: 3434270 • Views: …

More Releases for SALT

Natural Salt Market 2026 Global Outlook- Dominion Salt , Maine Sea Salt Company …

Global Report 2021-2027 on Natural Salt Market Size, Status, Growth and Forecast.

The Natural Salt Market research report is a novel statistical data source. It uses several approaches to analyze data from target markets, such as primary and secondary research methodologies. This includes research based on historical records, current statistics and future developments. The natural salt market is expected to grow at a significant CAGR during the forecast period.

Natural Salt Market…

Gourmet Salts Market, By Product Type (Sel Gris, Smoked Sea Salt, Indian Black S …

Gourmet Salts Market 2017-2027

Gourmet salt is untreated salt that is harvested naturally and has extra taste and flavor as compared to other salts. It is high-quality salt commonly used to cook food as it enhances the taste and texture of food. Gourmet salt has a high level of mineral content and improved solubility property. This salt is also used to preserve canned food items in order to enhance the shelf-life…

Vacuum Salt Market Report ||Key Industry Players- British Salt, Tata Chemicals L …

Looking at the current market trends as well as the promising demand status of the “Vacuum Salt Market”, it can be projected that the future years will bring out positive outcomes. This research report added by MRRSE on its online portal delivers clear insight about the changing tendencies across the global market. Readers can gather prime facets connected to the target market which includes product, end-use and application; assisting them…

Premium Grade Pharmaceutical Salt Market 2019 - Piranske Soline , Khoisan Sea Sa …

The Premium Grade Pharmaceutical Salt Market research report includes status and outlook of Global and major regions, from angles of players, countries, product types and end industries. This report analyses the top players in global market, and splits market by product type and applications/end industries.

The global Premium Grade Pharmaceutical Salt market will reach xxx Million USD in 2018 and with a CAGR if xx% between 2019-2025.

Download Sample PDF Of This…

Flavored Salt Market Share and Forecast 2018 - 2028: AMAGANSETT SEA SALT CO., Hi …

MarketResearchReports.biz announces the availability of a report on the evolving market of "Flavored Salt Market - Global Industry Trend Analysis 2013 to 2017 and Forecast 2018 - 2028.”

Flavored Salt Market Outlook

Flavored salts or specialty salts were re-introduced in the market about a decade ago with the emergence of exotic salts brought in from all over the world. Flavored salts were overlooked in the market for quite some time, but with…

Rock Salt Global Market 2018: Key Players – Mid American Salt LLC, Santader S …

Global Rock Salt market size will increase to Million US$ by 2025, from Million US$ in 2017, at a CAGR of during the forecast period. In this study, 2017 has been considered as the base year and 2018 to 2025 as the forecast period to estimate the market size for Rock Salt.

This report researches the worldwide Rock Salt market size (value, capacity, production and consumption) in key regions like United…