Press release

Banking Wearable Market Expected to Reach US$ 4.5 Billion by 2031, Featuring Growth and Share Analysis

In recent years, the advancement in technology has been penetrating industries at a faster pace. Today, the rise of wearable technology is setting a benchmark across various sectors such as retail, healthcare, telecom, and banking is not excluded. The outbreak of the Covid-19 pandemic has changed customers' priorities and accelerated fintech advancements. Wearable banking allows millennials to perform secure and instantaneous transactions with ease. This blog talks about the key factors shaping the banking wearable market, including new product launches and the involvement of leading companies in the industry.Top banking wearables in the market

Banking wearables are portable devices that allow individuals to make secure and contactless payments conveniently. These devices include apparel, gadgets, and accessories. The most common forms of banking wearables are smartwatches, fitness trackers, jackets, belts, and even rings. Some wearable payment devices are a one-stop-shop for performing several services. For instance, Disney Land provides a magic band to its visitors that acts as a payment device, access key, and personalized tracker.

𝑹𝒆𝒒𝒖𝒆𝒔𝒕 𝑺𝒂𝒎𝒑𝒍𝒆 𝑪𝒐𝒑𝒚 𝒐𝒇 𝑹𝒆𝒑𝒐𝒓𝒕-https://www.alliedmarketresearch.com/request-sample/7331

Apple Watch is one of the innovative wearables featuring NFC (Near Field Communication) technology. This technology allows the wearable to connect with other NFC-enabled devices to make mobile payments, transfer data, and perform other transactions. Similarly, Samsung's Gear G3 is an Android device that permits magnetic secure transmission to make payments through Samsung Pay. Another interesting device is the fitness tracker - UP4, developed by Jawbone, a leading tech-based company. This is a water-resistant fitness tracker that enables contactless payments by partnering with American Express. Such latest top-notch wearables are gaining popularity and skyrocketing the industry's growth.

As per the latest report published by Allied Market Research, the global banking wearables market is expected to rise at a stunning CAGR of 16.8% during the forecast period 2023-2032 and was valued at $13.7 billion in 2022, and is projected to reach $62.7 billion by 2032.

New product launches

To cater to the growing need for making on-the-go payments among individuals several fintech companies have come up with innovative wearable solutions. For instance, the Bank of Baroda, one leading Indian public sector bank, announced the launch of a banking wearable solution that could allow individuals to make small-ticket payments of up to Rs 5,000 without using any PIN. These wearables could be attached to individuals' daily accessories such as watches, rings, and other such items.

Another notable example is the launch of a new range of on-the-go wearables called Zakey Yespay RuPay, in partnership with YES Bank and NCPI (National Payments Corporation of India). These wearables allow individuals to make faster contactless payments at cafeterias.

𝑰𝒇 𝒚𝒐𝒖 𝒉𝒂𝒗𝒆 𝒂𝒏𝒚 𝒔𝒑𝒆𝒄𝒊𝒂𝒍 𝒓𝒆𝒒𝒖𝒊𝒓𝒆𝒎𝒆𝒏𝒕𝒔, 𝒑𝒍𝒆𝒂𝒔𝒆 𝒍𝒆𝒕 𝒖𝒔 𝒌𝒏𝒐𝒘: https://www.alliedmarketresearch.com/request-for-customization/7331

Key Market Players: Visa Inc., Wirecard, Gemalto NV, Fidesmo, Samsung Electronics, Google LLC, Xiaomi Corporation, Nymi Inc., Apple Inc., Thales

Mergers and acquisitions

Along with innovative product launches, many prominent companies have made numerous strategic alliances to foster competitive insights. For example, Fidesmo Pay, a leading Swedish Fintech company launched smart wearable payment services by acquiring a local firm, Cembra. This acquisition would allow Cembra cardholders to make contactless payments by connecting to a wearable supporting Fidesmo Pay.

Moreover, Visa Inc., a world leader in digital payment technology announced its acquisition of Visa Europe to scale up its digital payment services and offer a more seamless experience to European clients.

To wrap up, the banking wearable market is witnessing striking growth due to the increasing use of contactless payments for many day-to-day activities such as fueling vehicles, making payments at tolls, purchasing food items, and other similar purposes. Moreover, as nowadays, individuals are leading a hectic lifestyle, the need for banking wearables to check their accounts' balance, and perform immediate fund transfers saves their valuable time, which may boost the market's growth prominently in the coming years.

Banking Wearable Market Report Highlights

By Type

Fitness Tracker

Payment Wristbands

Smart Watches

Others

By Technology

Near Field Communication (NFC)

Quick Response (QR) Codes

Radio Frequency Identification (RFID)

Others

By Application

Retail

Entertainment Centers

Restaurants and Bars

Healthcare

Others

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐘𝐨𝐮𝐫 𝐄𝐯𝐞𝐫𝐲 𝐃𝐨𝐮𝐛𝐭 𝐇𝐞𝐫𝐞: https://www.alliedmarketresearch.com/purchase-enquiry/7331

𝐑𝐞𝐚𝐝 𝐌𝐨𝐫𝐞 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 -

Coin Sorter Market https://www.alliedmarketresearch.com/coin-sorter-market

Remittance Market https://www.alliedmarketresearch.com/remittance-market

Commercial Lending Market https://www.alliedmarketresearch.com/commercial-lending-market-A11617

Microfinance Market https://www.alliedmarketresearch.com/microfinance-market-A06004

Banking as a Service Market https://www.alliedmarketresearch.com/banking-as-a-service-market-A14258

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://steemit.com/@poojabfsi

https://www.quora.com/profile/Pooja-BFSI

https://medium.com/@psaraf568

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking Wearable Market Expected to Reach US$ 4.5 Billion by 2031, Featuring Growth and Share Analysis here

News-ID: 3434000 • Views: …

More Releases from Allied Market Research

Cattle Feed Market Size worth USD 78.3 Billion Globally, by 2027 at a CAGR of 4. …

Cattle feed market size was estimated at $73.5 billion in 2019, and is expected to hit $78.3 billion by 2027, and registering with a CAGR of 4.4% from 2021 to 2027.

Replacement of traditional cattle feed with nutritionally balanced compound feed and livestock industrialization drive the growth of the global cattle feed market. On the other hand, challenges related to the gap between demand and supply of cattle feed act as…

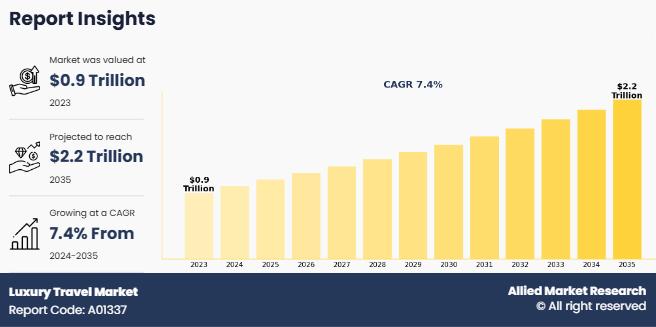

Luxury Travel Market Size to Hit US$ 2149.7 billion by 2035 at 7.4% CAGR

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Hotel Toiletries Market is likely to expand US$ 50.5 billion at 10.8% CAGR by 20 …

The hotel toiletries market was valued at $17.9 billion in 2021, and is estimated to reach $50.5 billion by 2031, growing at a CAGR of 10.8% from 2022 to 2031.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/75060

There is a greater demand for hotel toiletries with the growth of the tourism industry and the rise in international travel. Improved transportation, economic growth, globalization, technology advancements, and other initiatives have…

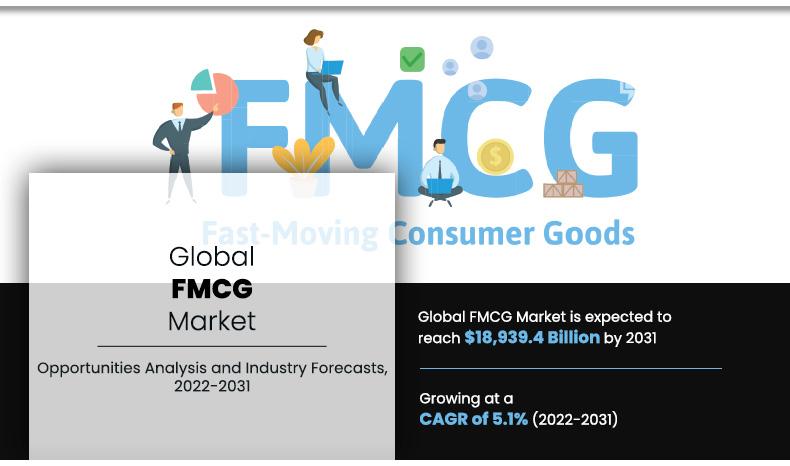

FMCG Industry Set to Achieve a Valuation of US$ 18,939.4 billion, Riding on a 5. …

According to a new report published by Allied Market Research, titled, "FMCG Market by Product Type, Production Type, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2022-2031," the global FMCG market size is expected to reach $18,939.4 billion by 2031 at a CAGR of 5.1% from 2022 to 2031.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/5148

Fast-moving consumer goods (FMCG) is the largest combination of consumer goods…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…