Press release

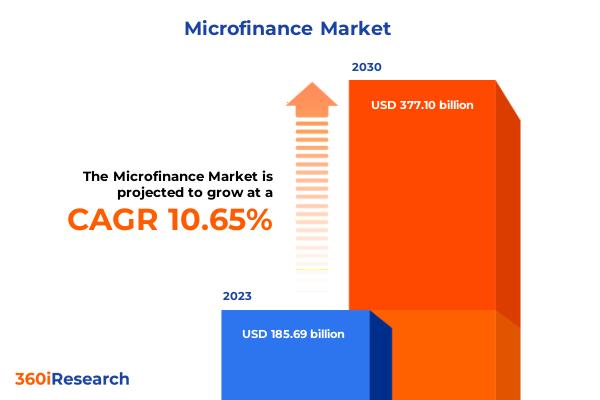

Microfinance Market worth $377.10 billion by 2030, growing at a CAGR of 10.65% - Exclusive Report by 360iResearch

The "Microfinance Market by Services (Group & Individual Micro Credit, Insurance, Leasing), Providers (Banks, Non-Banks) - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.The Global Microfinance Market to grow from USD 185.69 billion in 2023 to USD 377.10 billion by 2030, at a CAGR of 10.65%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/microfinance?utm_source=openpr&utm_medium=referral&utm_campaign=sample

Microfinance or microcredit is a banking service offered to unemployed or low-income individuals without access to other financial services. This service enables people to safely take on reasonable small business loans through ethical and legal banking sources. The World Bank estimates that over 500 million people have benefited from microfinance-related activities. Government initiatives encourage establishing microfinance institutions and services, and the rising availability of microfinance services in digital and mobile-based payment models are driving market development. However, surging cases of fraud in microfinancing services and strict regulations on microfinance concerning reserve requirements, loan loss provisions, and loan documentation impede the expansion of microfinance. With funding accessible to microfinance startups aiming to develop new software based on AI & Big Data and government rules easing with public awareness and set guidelines on the services, the popularity of microfinance is expected to increase. The coming years are also expected to witness a potential amalgamation of blockchain technology and microfinance services.

Microfinance is widely adopted in Asian countries of China, Malaysia, Vietnam, Thailand, the Philippines, Indonesia, India, and Bangladesh, owing to their national strategies to raise investments for small-scale businesses and farmers. Most large and established microfinance companies in Asia have transformed into small finance banks with access to deposits and greater operational leverage. The microfinance sector in Europe is diverse, majorly driven by the increasing number of NGOs, NBFIs, and cooperatives offering various services. In the Middle East & Africa (MEA), microfinance is essential for poverty alleviation and financial inclusion. Many countries in the MEA region lack formal banking systems; hence, there is significant potential for microfinance market growth. Eastern European microfinance institutions are more likely to provide agricultural, personal, and housing loans, while Western institutions offer microenterprise and SME loans and other types of financial services, such as insurance, accounts, and payment services. In the North American context, microfinance entered a phase of institutional strengthening to support the diversification of investments, the increasing and innovative use of new technologies, and the development of several financial and non-financial services.

Market Segmentation & Coverage:

This research report categorizes the Microfinance Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Services, market is studied across Group & Individual Micro Credit, Insurance, Leasing, Micro Investment Funds, and Savings & Checking Accounts. The Group & Individual Micro Credit commanded largest market share of 29.87% in 2023, followed by Savings & Checking Accounts.

Based on Providers, market is studied across Banks and Non-Banks. The Banks commanded largest market share of 65.79% in 2023, followed by Non-Banks.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Asia-Pacific commanded largest market share of 35.58% in 2023, followed by Americas.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/microfinance?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Microfinance Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Microfinance Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Microfinance Market, highlighting leading vendors and their innovative profiles. These include Access Microfinance Holding AG, Accion International, Agricultural Bank of China Limited, Al-Barakah Microfinance Bank, Annapurna Finance (P) Ltd., ASA International India Microfinance Limited, Banco do Nordeste do Brasil SA, BancoSol, Bandhan Bank Limited, Belstar Microfinance Limited, BlueOrchard Finance Ltd., BOPA Pte Ltd., BRAC, BSS Microfinance Ltd., Cashpor Micro Credit, CDC Small Business Finance Corp., Citigroup Inc., CreditAccess Grameen Limited, Emirates Development Bank, Equitas Small Finance Bank Ltd., Fusion Micro Finance Ltd., Gojo & Company, Inc., Grameen America Inc., IndusInd Bank Limited, J.P.Morgan Chase & Co., Khushhali Microfinance Bank Limited, Kiva Microfunds, LiftFund Inc., Manappuram Finance Limited, Microfinance Ireland, Microlend Australia Ltd, NRSP Microfinance Bank Limited, Opportunity International, Pacific Community Ventures Inc., Pro Mujer Inc., PT.Bank Rakyat Indonesia (Persero) Tbk., SATHAPANA Limited, Satin Creditcare Network Limited, SKS India, Terra Motors Corporation, The Enterprise Fund Limited, and Ujjivan Small Finance Bank Ltd..

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Microfinance Market, by Services

7. Microfinance Market, by Providers

8. Americas Microfinance Market

9. Asia-Pacific Microfinance Market

10. Europe, Middle East & Africa Microfinance Market

11. Competitive Landscape

12. Competitive Portfolio

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Microfinance Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Microfinance Market?

3. What is the competitive strategic window for opportunities in the Microfinance Market?

4. What are the technology trends and regulatory frameworks in the Microfinance Market?

5. What is the market share of the leading vendors in the Microfinance Market?

6. What modes and strategic moves are considered suitable for entering the Microfinance Market?

Read More @ https://www.360iresearch.com/library/intelligence/microfinance?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Microfinance Market worth $377.10 billion by 2030, growing at a CAGR of 10.65% - Exclusive Report by 360iResearch here

News-ID: 3433105 • Views: …

More Releases from 360iResearch

Rising Incidence of Human Metapneumovirus in Vulnerable Populations Boosts Globa …

In recent years, the silent ascent of human metapneumovirus (HMPV) infections has begun to capture significant attention within the realm of infectious diseases. As we advance in medical science, unraveling complexities of age-old pathogens like common influenza or emerging illnesses like COVID-19, a critical discourse has been emerging around HMPV. Particularly, there seems to be a burgeoning acknowledgment of its growing impact on vulnerable global populations, propelling an increased demand…

The Meat Alternatives Market size was estimated at USD 9.39 billion in 2023 and …

From Appetite to Advocacy: The Rising Demand for Meat Alternatives

In recent years, the global food industry has been undergoing a remarkable transformation, driven primarily by an increasing consumer demand for healthier, sustainable, and ethically sourced food products. This seismic shift has brought traditional meat alternatives and high-protein plant-based foods into the spotlight. As the world becomes more conscious of the implications of meat consumption on health and the environment, the…

The Mobility-as-a-Service Market size was estimated at USD 264.80 billion in 202 …

Unpacking the Surge in Investments and Collaborations to Bolster Mobility-as-a-Service

In recent years, as urban landscapes continually evolve, a transformative shift known as Mobility-as-a-Service (MaaS) has reshaped the way we perceive transportation. Marked by the integration of various forms of transport services into a single accessible on-demand mobility solution, MaaS is rapidly gaining traction across global cities. As an emerging paradigm, it's not just shaping the future of travel but also…

The Data Center Services Market size was estimated at USD 56.65 billion in 2023 …

Smart City Revolutions: Why Data Center Colocation is the Future Backbone

In the era of digital transformation, urban landscapes across the globe are undergoing a seismic shift toward becoming "smart cities." The concept of a smart city revolves around using digital technology, IoT (Internet of Things), AI, and data analytics at an unprecedented scale to improve urban infrastructure, manage resources efficiently, and enhance the quality of life for citizens. A vital…

More Releases for Micro

Micro and Ultra-Micro Balances Market Size Report 2025

"Global Micro and Ultra-Micro Balances Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031" is published by Global Info Research. It covers the key influencing factors of the Micro and Ultra-Micro Balances market, including Micro and Ultra-Micro Balances market share, price analysis, competitive landscape, market dynamics, consumer behavior, and technological impact, etc.At the same time, comprehensive data analysis is conducted by national and regional sales, corporate competition rankings,…

Micro Mobility Revolution: Exploring the Growing Micro Cars Market

The term micro car is used for small-sized and lightweight cars, with an engine small than 700 cc. Bubble cars, cycle cars and quadricycles are defined as micro cars. This is usually three-wheeled and four-wheeled vehicle, available for personal and commercial usage. It is often used as a second or commuter car due to its low cost and fuel efficiency. This car is suitable for urban and suburban environment, as…

Micro Injection Molded Plastic Market worth $1,692 million by 2026 | Key players …

According to recent market research the "Micro Injection Molded Plastic Market by Material Type (Liquid-Crystal Polymer (LCP), Polyether Ether (PEEK), Polycarbonate (PC), Polyethylene (PE), Polyoxymethylene (POM)), Application and Region - Global Forecast to 2026", published by MarketsandMarkets, the micro injection molded plastic market is projected to reach USD 1,692 million by 2026, at a CAGR of 11.2% from USD 995 million in 2021.

Micro injection molded plastics are made of micro…

Micro Combined Heat & Power (Micro CHP) Market 2022 | Detailed Report

The Micro Combined Heat & Power (Micro CHP) research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the Micro Combined Heat & Power (Micro CHP) research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope,…

Micro-Invasive Glaucoma Implants Micro-Invasive Glaucoma Implants

Global Micro-Invasive Glaucoma Implants Market Definition: Micro-invasive glaucoma implants is performed for the treatment of the open- angle glaucoma and is done through an ab- interno approach. It is very safe and provides faster recovery as compared to the traditional methods. They usually lower the intraocular by increasing the flow or reducing the production of the aqueous humor. Increasing cases of the glaucoma worldwide is the major factor fueling the…

Comprehensive Analysis On Micro Welding Equipment Market 2019 : Pro-Fusion, OR L …

Up Market Research added a new Micro Welding Equipment Market research report for the period of 2019 – 2026. Report focuses on the major drivers and restraints providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market.

Get Sample Copy Of This Report @

https://www.upmarketresearch.com/home/requested_sample/108038

The report contains 112 pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing…