Press release

Investment Banking Trading Services Market Analysis 2024 -2033: Forecasted Market Size, Top Segments, And Largest Region

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2434The Business Research Company offers in-depth market insights through Investment Banking Trading Services Global Market Report 2024, providing businesses with a competitive advantage by thoroughly analyzing the market structure, including estimates for numerous segments and sub-segments.

Market Size And Growth Forecast:

The investment banking trading services market size has grown strongly in recent years. It will grow from $372.39 billion in 2023 to $404.29 billion in 2024 at a compound annual growth rate (CAGR) of 8.6%. The growth in the historic period can be attributed to rise of derivatives and structured products, regulatory changes post-financial crisis, market globalization and interconnectedness, introduction of algorithmic trading, emergence of electronic trading..

The investment banking trading services market size is expected to see strong growth in the next few years. It will grow to $574.8 billion in 2028 at a compound annual growth rate (CAGR) of 9.2%. The growth in the forecast period can be attributed to expansion of high-frequency trading (hft), market volatility and risk mitigation, augmented reality and virtual trading environments, increasing focus on derivatives trading, global expansion of financial markets.. Major trends in the forecast period include adoption of algorithmic trading, rise of esg investing, integration of artificial intelligence (ai), expansion of cryptocurrency trading, shift towards remote trading environments..

Get Free Sample Of This Report-

https://www.thebusinessresearchcompany.com/sample.aspx?id=9144&type=smp

Market Segmentation:

The investment banking trading services market covered in this report is segmented -

1) By Service Type: Equity Underwriting And Debt Underwriting Services, Trading And Related Services, Financial Advisory, Other Service Types

2) By Industry Vertical: BFSI, Healthcare, Manufacturing, Energy And Utilities, IT And Telecom, Retail And Consumer Goods, Media And Entertainment, Other Industry Vertical

Major Driver - Surging Demand For Advisory And Consultancy Services Fuels Growth In Investment Banking And Trading Services Market

The need for advisory and consultancy services is expected to propel the growth of the investment banking and trading services market going forward. Advisory services are consulting services performed by a CPA to develop findings, conclusions, and recommendations for a client whereas a consulting service is the provision of expertise or strategic advice for consideration and decision-making. Investment banking and trading services provide advisory services including IPOs for companies who wanted to go public, merger and acquisition advisory services, and other services. For instance, in March 2023, according to Statistics Canada, a Canada-based government agency, the management, scientific, and technical consulting services reported $29.2 billion in operating revenue in 2021, an increase of 9.7% from the previous year. Therefore, the need for advisory and consultancy services is driving the growth of the investment banking and trading services

Competitive Landscape:

Major companies operating in the investment banking trading services market report are Bank of America Corporation, Barclays Bank PLC, Citigroup Inc., Credit Suisse Group AG, Deutsche Bank AG, Goldman Sachs, JPMorgan Chase & Co., Morgan Stanley, UBS Group AG, Wells Fargo & Company, HSBC Holdings PLC., BNP Paribas S.A, Societe Generale Group, ABN AMRO Bank N.V., AllianceBernstein Holding L.P., BofA Securities Inc., RBC Capital Markets, Mizuho Financial Group, Nomura Holdings Inc., The Royal Bank of Scotland Group plc, Macquarie Group Limited, Lazard Ltd., Rothschild & Co., Evercore Partners Inc., Jefferies Group LLC, Piper Jaffray Companies, Sumitomo Mitsui Financial Group Inc., SunTrust Robinson Humphrey Inc., Truist Securities Inc., UniCredit SpA, VTB Capital plc .

Get Access To The Full Market Report -

https://www.thebusinessresearchcompany.com/report/investment-banking-trading-services-global-market-report

Top Trend - Technological Advancements In Investment Banking With Financial Cloud For Data

Technological advancements have emerged as a key trend gaining popularity in the investment banking trading services market. Major companies operating in the investment banking trading services market are focused on developing cloud-based solutions. For instance, in November 2021, in partnership with Amazon Web Services, Inc. (AWS), Goldman Sachs, a US-based investment banking company launched Goldman Sachs Financial Cloud for Data. It offers financial institutions cloud-based data and analytics solutions. Investing firms will be able to access advanced quantitative analytics across global markets much more easily due to this solution. Goldman Sachs Financial Cloud for Data will also offer more streamlined and secure access to best-in-class financial data. Goldman Sachs Financial Cloud for Data provides hedge funds, asset managers, and other institutional clients with cloud-native financial data management and analytics.

The Table Of Content For The Market Report Include:

1. Executive Summary

2. Investment Banking Trading Services Market Characteristics

3. Investment Banking Trading Services Market Trends And Strategies

4. Investment Banking Trading Services Market - Macro Economic Scenario

5. Investment Banking Trading Services Market Size And Growth

…..

27. Investment Banking Trading Services Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialize in various industries including manufacturing, healthcare, financial services, chemicals, and technology. The firm has offices located in the UK, the US, and India, along with a network of proficient researchers in 28 countries.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Investment Banking Trading Services Market Analysis 2024 -2033: Forecasted Market Size, Top Segments, And Largest Region here

News-ID: 3428441 • Views: …

More Releases from The Business Research Company

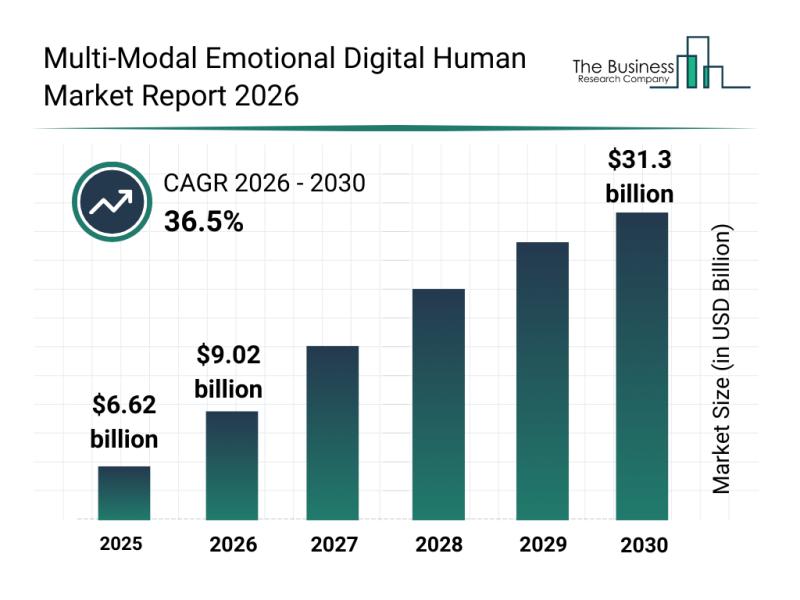

Segmentation, Major Trends, and Competitive Overview of the Multi-Modal Emotiona …

The multi-modal emotional digital human market is poised for remarkable expansion, transforming how digital entities interact with human emotions across various sectors. This emerging field combines advanced AI technologies and emotional intelligence to create digital humans capable of nuanced, empathetic interactions. Let's explore the market's growth outlook, key players, technological trends, and segment classifications shaping this evolving industry.

Projected Growth and Market Value of the Multi-Modal Emotional Digital Human Market …

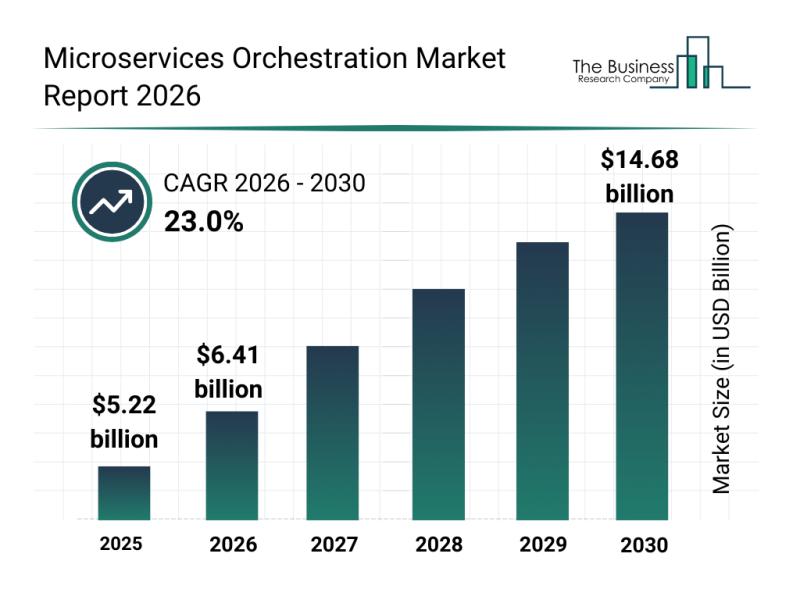

Market Trend Insights: The Impact of Recent Advances on the Microservices Orches …

The microservices orchestration market is rapidly gaining traction as organizations increasingly adopt cloud-native architectures to enhance agility and scalability. With the growing complexity of distributed systems, the need for efficient orchestration solutions that streamline service coordination and management has become critical. Let's explore the market's size, key players, emerging trends, and significant segments shaping its future.

Expected Growth and Market Size for Microservices Orchestration

The microservices orchestration market is projected…

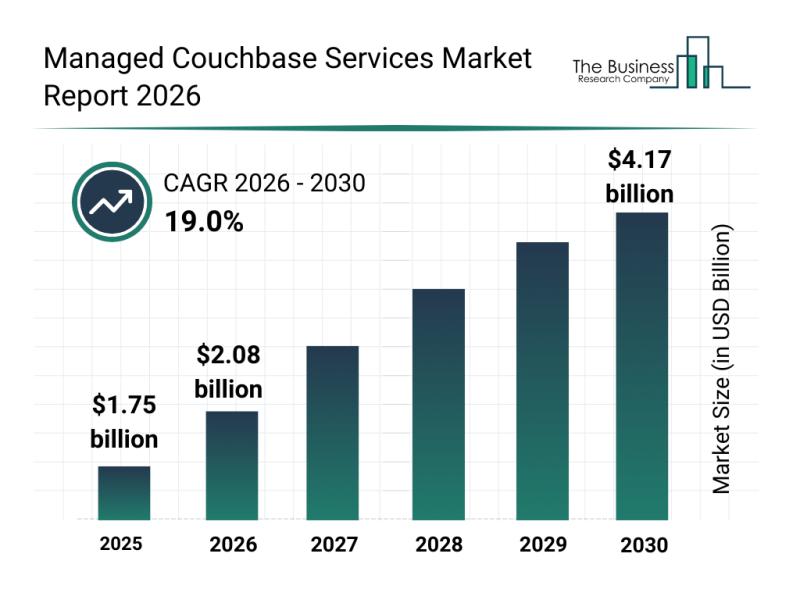

Analysis of Key Market Segments Influencing the Managed Couchbase Services Marke …

The managed couchbase services market is set for substantial expansion in the coming years as businesses increasingly turn to cloud-native solutions for their database needs. With a growing focus on scalability, performance, and security, this sector is becoming a critical component for enterprises managing complex data workloads. Let's explore the market's value projections, key players, emerging trends, and the main segments driving growth.

Anticipated Market Growth and Value of Managed Couchbase…

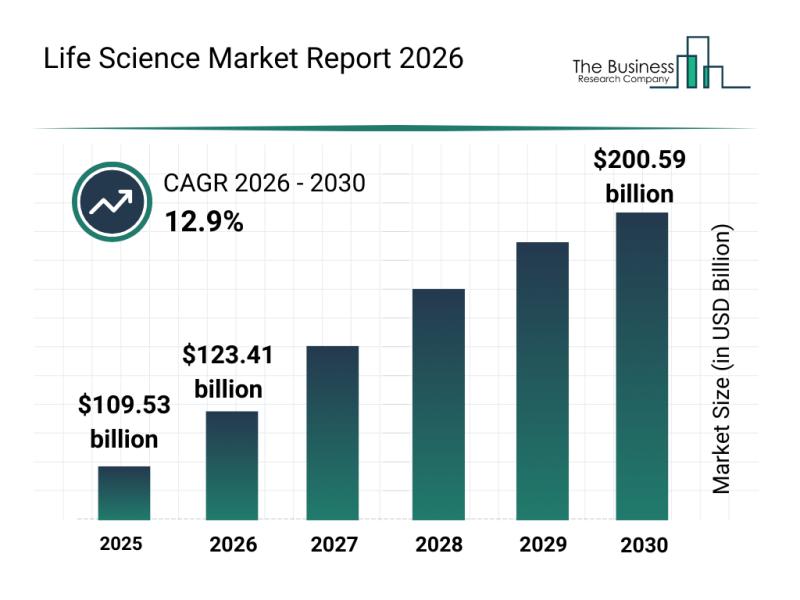

Global Drivers Analysis: The Rapid Evolution of the Life Science Market

The life science sector is on the brink of impressive expansion, driven by technological breakthroughs and evolving healare needs. As innovations continue to reshape research and treatment approaches, the market is set to grow significantly over the coming years. Let's explore the current market size, influential players, key trends, and segmentation that define the life science industry today.

Projected Growth and Future Size of the Life Science Market

The life…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…