Press release

Banking-as-a-Service (BaaS) Market to Surpass USD 64.87 Billion by 2030 | Stripe, Plaid, Marqeta

The latest report by Congruence Market Insights, titled 'Global Banking-as-a-Service (BaaS) Market - Size, Trends, Share, Growth, Dynamics, Competition, and Opportunity Forecast, 2023 - 2030,' provides a thorough analysis of the global Banking-as-a-Service (BaaS) market. The report meticulously examines both macro and micro trends, offering insights into the dynamic factors influencing the market. It encompasses a detailed exploration of qualitative and quantitative aspects, delivering a precise depiction of market size, growth rates, annual progression, prevailing trends, key drivers, promising opportunities, and potential challenges. Additionally, the report highlights the impact of crucial events such as technological advancements and regulatory changes on the Banking-as-a-Service (BaaS) market landscape. This exhaustive examination equips businesses and stakeholders with invaluable intelligence for making informed decisions in the evolving Banking-as-a-Service (BaaS) industry.Request full report sample here: https://www.congruencemarketinsights.com/report/banking-as-a-service-(baas)-market?section=Request

What is the anticipated market size in 2030, along with the major drivers, restraints, and opportunities?

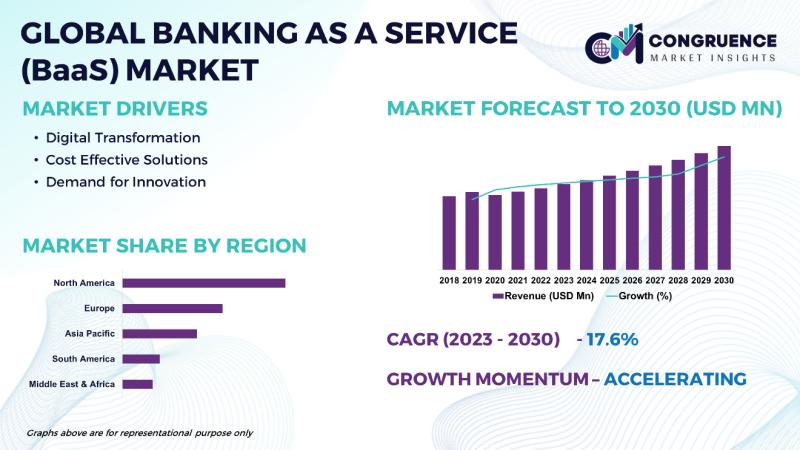

According to the in-depth market study, the global Banking-as-a-Service (BaaS) market is anticipated to reach a value of USD 64.87 Billion by 2030, expanding at a CAGR of 17.6% between 2023 and 2030. The Banking-as-a-Service (BaaS) market is driven by several factors, including the increasing adoption of digital banking solutions, rising demand for personalized financial services, and growing partnerships between traditional banks and fintech companies to offer innovative banking solutions. Opportunities lie in the development of open banking platforms, the integration of artificial intelligence and machine learning in banking services, and the expansion of Banking-as-a-Service (BaaS) offerings to emerging markets. Challenges include data security concerns, regulatory compliance, and interoperability issues between different banking systems.

How does AI impact the global Banking-as-a-Service (BaaS) market?

AI impacts the global Banking-as-a-Service (BaaS) market by enhancing customer experience, improving operational efficiency, and enabling personalized financial services. AI-driven technologies enable banks and fintech companies to analyze vast amounts of customer data to offer personalized recommendations, streamline account opening and loan approval processes, and detect fraudulent activities in real-time. Advanced analytics and machine learning algorithms enable predictive analytics for credit scoring, risk management, and investment recommendations, enhancing financial decision-making for both customers and financial institutions. AI-powered chatbots and virtual assistants provide round-the-clock customer support, improving customer engagement and satisfaction. While AI offers significant opportunities for innovation and efficiency in Banking-as-a-Service (BaaS), challenges include data privacy concerns, algorithm bias, and the need for skilled AI talent.

Buy Now @ https://www.congruencemarketinsights.com/buy-now/351/1

Scope of the Report:

► Executive Summary

► Demand and Supply-side Trends

► Market Drivers, Restraints, Opportunities, and Challenges

► Value Chain Analysis

► Porter's Five Forces Analysis

► Industry SWOT Analysis

► COVID-19 Impact Assessment

► PESTLE Analysis

► Global Market Size and Forecast

► Regional Market Size and Forecast (Cross-country Analysis)

► Competition Landscape

► Company Profiles

Banking-as-a-Service (BaaS) Market Size and Forecast:

The report will comprehensively detail the Banking-as-a-Service (BaaS) market size and forecast (2023-2030), presenting key metrics for strategic insights. We will analyze market revenue, quantifying total income from Banking-as-a-Service (BaaS) solutions and services, and provide volume insights into product circulation. The report will delineate market share, highlighting competitive landscapes. Year-on-Year growth analysis will track annual percentage changes, offering trend insights. Additionally, the Compound Annual Growth Rate (CAGR) will be presented, providing a smoothed growth rate for a more consistent assessment of the market's expansion over the forecast period.

Which region holds the largest market share, and where does the major opportunity lie in the future?

North America holds the largest market share in the global Banking-as-a-Service (BaaS) market, driven by the presence of established fintech companies, increasing investments in digital banking infrastructure, and widespread adoption of mobile banking solutions. The major opportunity in the future lies in Asia-Pacific, fueled by the growing internet penetration, rising smartphone adoption, and supportive government initiatives to promote digital banking services. Europe and Latin America also present significant growth opportunities, driven by regulatory reforms promoting open banking initiatives, increasing collaborations between banks and fintech companies, and growing demand for seamless financial services across various industries.

Competition Landscape

The global Banking-as-a-Service (BaaS) market is highly competitive, characterized by the presence of established fintech companies and traditional banks offering innovative banking solutions. Key competitors focus on technological innovation, product portfolio expansion, and strategic partnerships to gain a competitive edge. Diverse offerings, ranging from core banking platforms to payment solutions, contribute to market dynamism. The competition landscape features leading players such as Stripe, Inc., Plaid Inc., Marqeta, and more, all vying for market share and differentiation in this transformative segment of the financial services industry.

>> Stripe, Inc.

>> Plaid Inc.

>> Marqeta

>> Solaris SE

>> Banco Bilbao Vizcaya Argentaria, S.A.

>> Galileo Financial Technologies, LLC

>> Synapse Financial Technologies, Inc.

>> Railsr

>> Treasury Prime, Inc.

>> ClearBank Ltd.

>> Mambu

>> 10x Banking Technology Limited

>> Thought Machine Group Limited

>> Cross River Bank

>> Alkami Technology, Inc,

>> OpenPayd Services Ltd.

>> Finxact

>> Aezion, Inc.

>> Green Dot

>> Q2 Software, Inc.

Comprehensive Market Segmentation:

∆ By Service type (Core Banking, Payments, Compliance, and Others)

∆ By Deployment Model (Cloud-based, and On-premises)

∆ By End-User (Banks, Fintech companies, and Enterprises)

Market Segmentation by Geography including:

∆ North America: U.S., Canada, and Mexico

∆ Europe: Germany, France, U.K., Italy, Spain, and Rest of Europe

∆ Asia Pacific: China, India, Japan, South Korea, Southeast Asia, and Rest of Asia Pacific

∆ South America: Brazil, Argentina, and Rest of Latin America

∆ Middle East & Africa: GCC Countries, South Africa, and Rest of Middle East & Africa

Frequently Asked Questions (FAQs):

► What is the current market scenario?

► What was the historical demand scenario, and forecast outlook from 2023 to 2030?

► What are the key market dynamics influencing growth in the Global Banking-as-a-Service (BaaS) Market?

► Who are the prominent players in the Global Banking-as-a-Service (BaaS) Market?

► What is the consumer perspective in the Global Banking-as-a-Service (BaaS) Market?

► What are the key demand-side and supply-side trends in the Global Banking-as-a-Service (BaaS) Market?

► What are the largest and the fastest-growing geographies?

► Which segment dominated, and which segment is expected to grow fastest?

► What was the COVID-19 impact on the Global Banking-as-a-Service (BaaS) Market?

Explore in-depth industry research reports across various verticals from Congruence Market Insights @ https://www.congruencemarketinsights.com/reports/all-industries

Related Reports:

► Live Commerce Platform Market: https://www.congruencemarketinsights.com/report/live-commerce-platform-market

► AI In Telecommunication Market: https://www.congruencemarketinsights.com/report/ai-in-telecommunication-market

Contact Us:

Ms. Shalaka Dubey

Senior Sales Manager

Congruence Market Insights

Palo Alto, CA 94301, United States

Phone: +1 650-646-2623

Email: sales@congruencemarketinsights.com

About Us:

Congruence Market Insights is a leading market research firm dedicated to providing in-depth analysis and strategic solutions for businesses across diverse industries. With a focus on delivering actionable insights, we offer comprehensive market intelligence, trend analysis, and forecasting to empower informed decision-making. We have built a reputation for delivering practical insights and genuine reports across diverse sectors such as banking and finance, technology, healthcare, and more, covering an extensive array of both primary and niche sub-domains. Our expertise lies in uncovering market trends, consumer behavior, and competitive landscapes, enabling our clients to stay ahead in an ever-evolving business landscape.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking-as-a-Service (BaaS) Market to Surpass USD 64.87 Billion by 2030 | Stripe, Plaid, Marqeta here

News-ID: 3426079 • Views: …

More Releases from Congruence Market Insights

Edge AI Software Market Brief Exploration to 2031: Growth Analysis, CAGR Status, …

The recently published Edge AI Software Market Report 2024, spanning 169 pages, offers a comprehensive overview of the market's current state, size, volume, and market share. In today's rapidly evolving business landscape, staying informed about the Edge AI Software Market is essential for businesses and marketers alike.

This report is a valuable resource for gaining insights through in-depth research and analysis. It goes beyond mere data and statistics, serving as…

Directed Energy Weapons Market New Update: Latest Trends, Dynamics, Upcoming Opp …

The recently published Directed Energy Weapons Market Report 2024, spanning 185 pages, offers a comprehensive overview of the market's current state, size, volume, and market share. In today's rapidly evolving business landscape, staying informed about the Directed Energy Weapons Market is essential for businesses and marketers alike. This report is a valuable resource for gaining insights through in-depth research and analysis. It goes beyond mere data and statistics, serving as…

Educational Toys Market Brief Exploration to 2031: Growth Analysis, CAGR Status, …

The recently published Educational Toys Market Report 2024, spanning 251 pages, offers a comprehensive overview of the market's current state, size, volume, and market share. In today's rapidly evolving business landscape, staying informed about the Educational Toys Market is essential for businesses and marketers alike. This report is a valuable resource for gaining insights through in-depth research and analysis. It goes beyond mere data and statistics, serving as a strategic…

Cement Board Market New Update: Latest Trends, Dynamics, Upcoming Opportunities …

The recently published Cement Board Market Report 2024, spanning 235 pages, offers a comprehensive overview of the market's current state, size, volume, and market share. In today's rapidly evolving business landscape, staying informed about the Cement Board Market is essential for businesses and marketers alike. This report is a valuable resource for gaining insights through in-depth research and analysis. It goes beyond mere data and statistics, serving as a strategic…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…