Press release

Insurance Brokers Market Explores Size, Share, and Key Growth Strategies in Risk Management || Marsh & McLennan Cos Inc, Aon PLC, Arthur J Gallagher & Co, Willis Towers Watson PLC

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2033The Business Research Company offers in-depth market insights through Insurance Brokers Global Market Report 2024, providing businesses with a competitive advantage by thoroughly analyzing the market structure, including estimates for numerous segments and sub-segments.

Market Size And Growth Forecast:

The insurance brokers market size has grown strongly in recent years. It will grow from $100.7 billion in 2023 to $105.81 billion in 2024 at a compound annual growth rate (CAGR) of 5.1%. The growth in the historic period can be attributed to strong economic growth in emerging markets, government led insurance reforms, increasing healthcare costs, and impact of covid-19.

The insurance brokers market size is expected to see steady growth in the next few years. It will grow to $127.88 billion in 2028 at a compound annual growth rate (CAGR) of 4.8%. The growth in the forecast period can be attributed to an increase in chronic diseases and disabilities, growth of the middle-class in emerging markets, and increasing mergers and acquisitions. Major trends in the forecast period include technologies to aid automation of insurance, adaption of insurance portals and digital distribution channels for efficiency, entry of nontraditional firms in the insurance brokers market, and increasing mergers and acquisitions.

Get Free Sample Of This Report-

https://www.thebusinessresearchcompany.com/sample.aspx?id=3668&type=smp

Market Segmentation:

The insurance brokers market covered in this report is segmented -

1) By Type: Life Insurance, General Insurance, Health Insurance, Other Types

2) By Mode: Offline, Online

3) By End User: Corporate, Individuals

Major Driver - Rising Insurance Demand Fuels Growth In The Insurance Brokers Market

The increasing demand for insurance policies is expected to fuel the growth of the insurance brokers market over the forecast period. The demand for insurance policies has risen due to the availability of security services and customized financial services to clients. According to the Insurance Regulatory and Development Authority (IRDAI) of India, the Life Insurance Corporation of India sold 2.17 crore insurance policies in the fiscal year 2021-2022 which was an 3.54% increase from previous year's 2.10 crore policies. Therefore, the increasing demand for insurance policies drives the growth of the insurance brokerage market.

Competitive Landscape:

Major companies operating in the insurance brokers market report are Marsh & McLennan Cos Inc, Aon PLC, Arthur J Gallagher & Co, Willis Towers Watson PLC, Acrisure LLC, Brown & Brown Inc., Truist Insurance Holdings Inc., USI Insurance Services LLC, Lockton Companies Inc., HUB International Limited, Beacon Insurance Brokers Pvt. Ltd., Urjita Insurance Brokers Pvt. Ltd., Mahindra Insurance Brokers Limited, Efficient Insurance Brokers Pvt. Ltd., Vibhuti Insurance Brokers Pvt.Ltd., Unison Insurance Broking Services Pvt. Ltd., Uib Insurance Brokers (India) Private Limited, Mga Insurance Brokers, Mega Capital, Roderick Insurance Brokers, Unity Insurance Brokers, Insurance Advisernet Australia, Fanhua Inc., Chang'an Insurance Brokers Co., Ltd., Mintaian Insurance Surveyors & Loss Adjusters Group Co., Ltd, Shenzhen Huakang Insurance Agency Co., Ltd., Jiangtai Insurance Broker Co. Ltd., Aon-Cofco Insurance Brokers Co. Ltd., Air Union Insurance Brokers Co. Ltd., Huatai Insurance Agency & Consultant Service Ltd, Axa France Vie, Icare Insurance Brokers, Western Europe, Lloyd's Of London Limited, Aon Holding Deutschland Gmbh, Funk Gruppe Gmbh, Ecclesia Holding Gmbh, Allianz Global, Crédit Agricole Assurances, Cnp Assurance, Société Générale, Bnp Paribas Cardif, Mai Insurance Brokers Poland Sp. Z O.O., Howden Insurance Brokers Nederland B.V, Meijers Assurantiën B.V, Aon Nederland, International Insurance Brokers S.R.O.., Cbiz, Inc., Canadian Insurance Brokers Inc., Aligned Insurance Inc., Novamar Insurance, Jah Insurance Brokers Corp, Thb Mexico, Intermediario De Reaseguro, S.A. De C.V., Alliant Insurance Services, Inc, Nfp Corp, Assured Partners Inc, Aon Risk Services Argentina S.A, Ttms Argentina S.A, 123seguro, Insur Insurance Company S.A., Src Brokers, Uai Brazil Insurance Broker, Alc Corretora De Seguros, Aon Brasil - São Paulo, Ez Towers, Middle East, Bupa Arabia For Cooperative Insurance, Abu Dhabi Insurance Brokers L.L.C, Nexus Insurance Brokers Llc, Wehbe Insurance Services Llc, New Shield Insurance Brokers Llc, Gulf Oasis Insurance Brokers Llc, Earnest Insurance Brokers Llc, Al Noor Insurance Broker, Arab Orient Insurance Brokers, Lusail Insurance Brokers, Aon South Africa (Pty) Ltd, Insurance Brokers of Nigeria (Ibn), Northlink Insurance Brokers, Carrier Insurance Brokers, Glanvills Enthoven, Union Commercial Insurance Brokers

Get Access To The Full Market Report -

https://www.thebusinessresearchcompany.com/report/insurance-brokers-global-market-report

Top Trend - Evolving Trends In The Insurance Brokers Market With Artificial Intelligence

The integration of artificial intelligence (AI) in the insurance sector is a key trend gaining popularity in the insurance brokers market. The combined power of artificial intelligence (AI) and human creativity enables the Intelligent Broker, an automation programme for the insurance industry. Brokers will be able to resolve complicated obstacles, produce innovative products and services, and join or build new markets. In addition to this, AI in the insurance industry will improve customer service and prevent customers from fraud. In 2021, 60% of the insurance companies are targeting AI to be used in decision making and to reduce manual input, which has doubled in the last two years.

The Table Of Content For The Market Report Include:

1. Executive Summary

2. Insurance Brokers Market Characteristics

3. Insurance Brokers Market Trends And Strategies

4. Insurance Brokers Market - Macro Economic Scenario

5. Insurance Brokers Market Size And Growth

…..

27. Insurance Brokers Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialize in various industries including manufacturing, healthcare, financial services, chemicals, and technology. The firm has offices located in the UK, the US, and India, along with a network of proficient researchers in 28 countries.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Brokers Market Explores Size, Share, and Key Growth Strategies in Risk Management || Marsh & McLennan Cos Inc, Aon PLC, Arthur J Gallagher & Co, Willis Towers Watson PLC here

News-ID: 3425690 • Views: …

More Releases from The Business research company

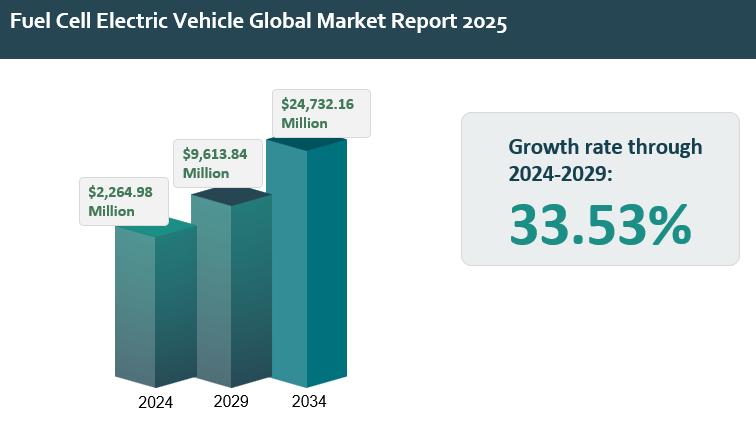

Global Fuel Cell Electric Vehicle Market Outlook 2025-2034: Growth Acceleration, …

The fuel cell electric vehicle report outlines and analyzes the fuel cell electric vehicle market, covering the historic period 2019-2024 and the forecast periods 2024-2029 and 2034F. The report assesses the market across regions and the major economies within each region.

The global fuel cell electric vehicle market was valued at $2.26498 billion in 2024, increasing at a CAGR of 6.88% since 2019. The market is projected to rise from $2.26498…

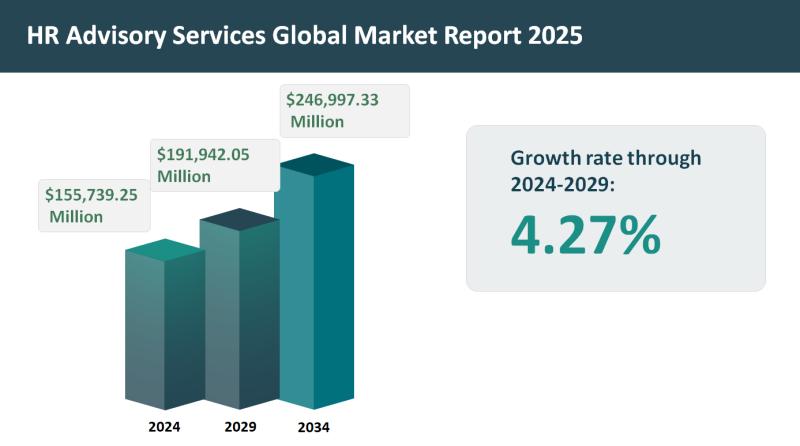

Global HR Advisory Services Market Set for 4.27% Growth, Projected to Reach $191 …

The HR advisory services report outlines and analyzes the HR advisory services market across 2019-2024 (historic period) and 2024-2029, 2034F (forecast period). It examines market performance across global regions and key economies.

The global HR advisory services market was valued at approximately $155.73925 billion in 2024, increasing at a CAGR of 4.22% since 2019. The market is anticipated to rise from $155.73925 billion in 2024 to $191.94205 billion in 2029, reflecting…

Evolving Market Trends In The Integrated Geophysical Services Industry: Enhancin …

The Integrated Geophysical Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Integrated Geophysical Services Market Size During the Forecast Period?

The integrated geophysical services market has experienced consistent growth in recent years, expected to rise from $2.35 billion in 2024 to…

Global HR Advisory Services Market: Key Trends, Market Share, Growth Drivers, An …

The HR advisory services market report describes and explains the HR advisory services market and covers 2019-2024, termed the historic period, and 2024-2029, 2034F termed the forecast period. The report evaluates the market across each region and for the major economies within each region.

The global HR advisory services market reached a value of nearly $155.74 billion in 2024, having grown at a compound annual growth rate (CAGR) of 4.22% since…

More Releases for Insur

Global Crop Reinsurance Market 2024 Technology Scouting, Industry Insights, Busi …

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2033

The Business Research Company offers in-depth market insights through Crop Reinsurance Global Market Report 2024, providing businesses with a competitive advantage by thoroughly analyzing the market structure, including estimates for numerous segments and sub-segments.

Market Size And Growth Forecast:

The crop reinsurance market size has grown strongly in recent years. It…

Global Crop Reinsurance Market 2023 Industry Dynamics, Regional Segments, Share …

The Business Research Company's global market reports are now updated with the latest market sizing information for the year 2023 and forecasted to 2032

The Business Research Company's Crop Reinsurance Global Market Report 2023 identifies An increase in natural disasters as the major driver for the Crop Reinsurance Market's growth in the forecast period. Natural disasters refer to extreme and catastrophic events that occur in the natural environment and cause significant…

Boat Insurance Market 2019: Major Players By Zurich AXA AVIVA State Farm Allianz …

Boat Insurance is hull insurance that covers damage to a boat, its machinery and its equipment. It refers to the main body of the ship and it can be understood like car insurance, with a difference of being for a water faring vehicle instead of land. It covers all types of vessels operating into the oceans, lakes, or rivers like bulk carriers, fishing boats, ships, tankers, cruises, yachts.

Request a Sample…

Global Demand of Child Health Insurance Market will Boom in Forthcoming Year by …

Global Child Health Insurance Market is expected to grow with a CAGR of +14% during forecast period 2019 to 2025. The report is commenced by approximating the size of the current market, giving a basic idea for predicting the future growth of the market. The market subtleties such as market profits, challenges, opportunities, and inclinations have been offered together with their one-to-one impact analysis. The impact analysis helps in collecting…

Cyber Insurance Software Market New Growth By Top Key Players Cryptzone, Splunk, …

Global Cyber Insurance Software market from the in depth perspective of all the ongoing trends that are affecting the market and are important to be understood are studied. These trends are geographical, economic, socioeconomic, political, cultural, political, and many other are studied. Cyber security insurance is an agreement that an individual or substance can buy to help diminish the monetary dangers related with working together on the web. In return…

Health Insurance Market Latest Trends, Business Competitors & Key Companies with …

The health insurance market Report deliver comprehensive analysis of the market structure along with forecast of the various segments and sub-segments of the market. This report is a through synopsis of the Study done on health insurance market’s key vendor revenues, development of the industry by upstream & downstream, industry progress, key companies, along with type segment & market applications. Analysis and discussion of important industry trends, market size, market…