Press release

GCC Bancassurance Global Market Report 2024: Key Players, Demand Patterns And Forecasts 2033| Gulf Insurance Group K.S.C.P., MANAFA Capital, Startupbootcamp FinTech.

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2339The Business Research Company offers in-depth market insights through GCC Bancassurance Global Market Report 2024, providing businesses with a competitive advantage by thoroughly analyzing the market structure, including estimates for numerous segments and sub-segments.

Market Size And Growth Forecast:

The gcc bancassurance market size has grown strongly in recent years. It will grow from $21.35 billion in 2023 to $22.59 billion in 2024 at a compound annual growth rate (CAGR) of 5.8%. The growth in the historic period can be attributed to market competition and differentiation, regulatory framework evolution, consumer demand for convenience, rising income levels, digitalization and tech integration..

The gcc bancassurance market size is expected to see strong growth in the next few years. It will grow to $28.53 billion in 2028 at a compound annual growth rate (CAGR) of 6.0%. The growth in the forecast period can be attributed to utilization of advanced analytics and ai, enhanced education and awareness campaigns, market penetration in underinsured segments, wealth management and high net worth segment growth, focus on personalization and customer-centric solutions.. Major trends in the forecast period include adoption of advanced analytics and data-driven insights, regulatory changes and market liberalization, digital transformation and fintech integration, rising customer demand for one-stop services, focus on customer-centric solutions..

Get Free Sample Of This Report-

https://www.thebusinessresearchcompany.com/sample.aspx?id=8971&type=smp

Market Segmentation:

The gcc bancassurance market covered in this report is segmented -

1) By Product Type: Life Bancassurance, Non-Life Bancassurance

2) By Model Type: Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture

Major Driver - The Surge In Health And Life Insurance Needs Fueling Growth In The Gcc Bancassurance Market

The growing need for health and life insurance is expected to propel the growth of the GCC bancassurance market going forward. Life insurance is a policy that primarily serves to financially safeguard the person's family, beneficiaries, or designee in case of injury of insured. Health insurance is a form of personal and family protection that helps to prevent unfavorable outcomes like a fatality brought on by financial hardship. GCC bancassurance is used to enable banks to offer insurance products from insurers with whom they have collaborated and is one of the various alternative distribution strategies used by GCC insurance companies. For instance, in June 2021, according to a report shared by the Organization for Economic Co-operation and Development (OECD), a France-based intergovernmental organization with 38 member countries, claims payments in the life sector climbed 7.3% on average across the 53 reporting countries. Therefore, the growing need for health and life insurance is driving the growth of the GCC bancassurance market.

Competitive Landscape:

Major companies operating in the gcc bancassurance market report are Gulf Insurance Group K.S.C.P., MANAFA Capital, Startupbootcamp FinTech, Bahrain Kuwait Insurance Company B.S.C., AXA Cooperative Insurance Company, Elseco Ltd, Saudi Arabia's Public Investment Fund, Emirates Retakaful Ltd, Qatar Insurance Company Q.P.S.C., Oman Insurance Company P.S.C., Orient Insurance Company, Arab Insurance Group, Union Insurance Company P.S.C., Abu Dhabi Commercial Bank PJSC, Agricultural Bank of China Limited, Allianz SE, Anthem Inc., Assicurazioni Generali S.p.A., Metropolitan Life Insurance Company, National Bank of Abu Dhabi, BNP Paribas S.A., China Life Insurance Company Limited, Centene Corporation, Cooperative Insurance Company, Ping An Insurance Company of China Ltd., HSBC Holdings plc, Industrial and Commercial Bank of China Limited, Japan Post Holdings Co. Ltd., JPMorgan Chase & Co., Lloyds Bank Group .

Get Access To The Full Market Report -

https://www.thebusinessresearchcompany.com/report/gcc-bancassurance-global-market-report

Top Trend - Technology Advancements In The Gcc Bancassurance Market.

Technological advancements have emerged as a key trend gaining popularity in the GCC bancassurance market. Major companies operating in the GCC bancassurance market are focused on incorporating advanced technologies to automate operations and strengthen their position in the market. For instance, in November 2021, Mashreq Bank, a UAE-based privately owned bank, launched the ASSURE Banca Platform to automate bancassurance operations through a partnership with UAE-based software company WayPoint System. The ASSURA Banca platform enables to significantly simplify Bancassurance administration processes, making the user experience more valuable and personalized. Other advantages include the ability to offer a sophisticated but user-friendly client management experience and a decrease in operating and administration expenditures. The platform's API-driven technology also makes it simple to maintain connections with outside insurance companies. Stakeholders also gain from efficient insurance distribution, commission management, and customer service as needed.

The Table Of Content For The Market Report Include:

1. Executive Summary

2. GCC Bancassurance Market Characteristics

3. GCC Bancassurance Market Trends And Strategies

4. GCC Bancassurance Market - Macro Economic Scenario

5. GCC Bancassurance Market Size And Growth

…..

27. GCC Bancassurance Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialize in various industries including manufacturing, healthcare, financial services, chemicals, and technology. The firm has offices located in the UK, the US, and India, along with a network of proficient researchers in 28 countries.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release GCC Bancassurance Global Market Report 2024: Key Players, Demand Patterns And Forecasts 2033| Gulf Insurance Group K.S.C.P., MANAFA Capital, Startupbootcamp FinTech. here

News-ID: 3424793 • Views: …

More Releases from The Business research company

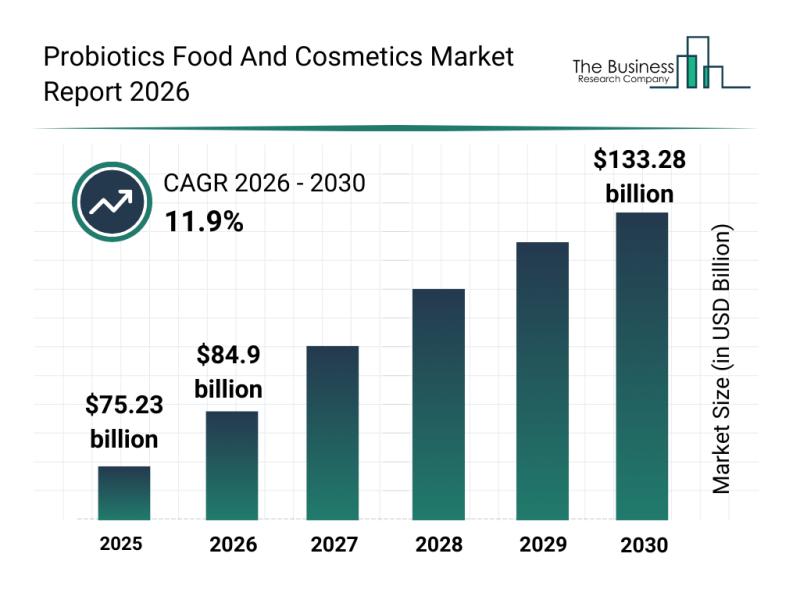

Outlook on the Probiotics Food and Cosmetics Market: Major Segments, Strategic D …

The probiotics food and cosmetics sector is on the brink of significant expansion, driven by increasing consumer awareness and innovative product developments. As wellness trends continue to evolve, this market is set to experience remarkable growth, presenting vast opportunities for manufacturers and retailers alike. Here, we explore the market's expected size, key players, emerging trends, and detailed segmentation.

Projected Market Size and Growth Trends in the Probiotics Food and Cosmetics Market…

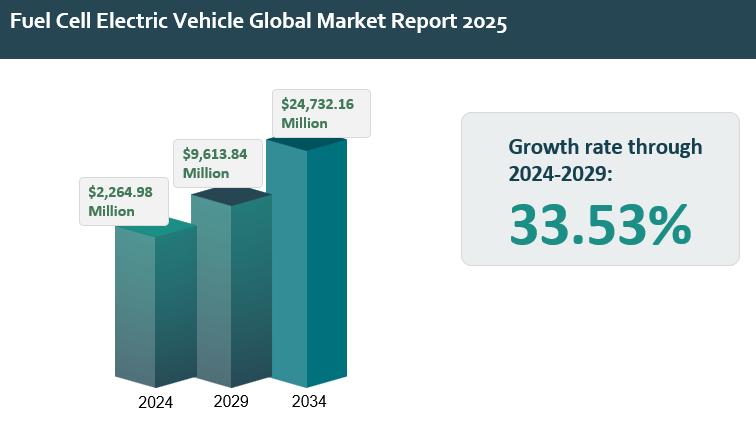

Global Fuel Cell Electric Vehicle Market Outlook 2025-2034: Growth Acceleration, …

The fuel cell electric vehicle report outlines and analyzes the fuel cell electric vehicle market, covering the historic period 2019-2024 and the forecast periods 2024-2029 and 2034F. The report assesses the market across regions and the major economies within each region.

The global fuel cell electric vehicle market was valued at $2.26498 billion in 2024, increasing at a CAGR of 6.88% since 2019. The market is projected to rise from $2.26498…

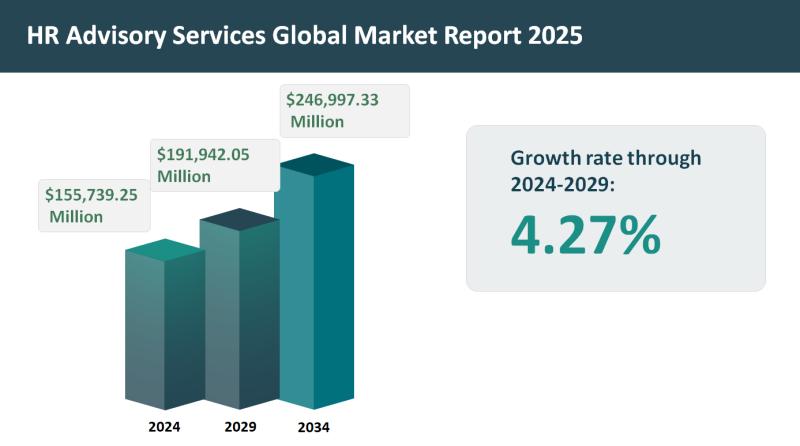

Global HR Advisory Services Market Set for 4.27% Growth, Projected to Reach $191 …

The HR advisory services report outlines and analyzes the HR advisory services market across 2019-2024 (historic period) and 2024-2029, 2034F (forecast period). It examines market performance across global regions and key economies.

The global HR advisory services market was valued at approximately $155.73925 billion in 2024, increasing at a CAGR of 4.22% since 2019. The market is anticipated to rise from $155.73925 billion in 2024 to $191.94205 billion in 2029, reflecting…

Evolving Market Trends In The Integrated Geophysical Services Industry: Enhancin …

The Integrated Geophysical Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Integrated Geophysical Services Market Size During the Forecast Period?

The integrated geophysical services market has experienced consistent growth in recent years, expected to rise from $2.35 billion in 2024 to…

More Releases for Banca

Banca Neo Announces Digital Banking Platform Using Advanced Technology to Serve …

Young French entrepreneur Mickael Mosse is leading a modern organization to serve the underbanked and provide exceptional financial operation services for businesses.

Latvia – There are currently over 2 billion people worldwide who are unbanked for several reasons. Lack of a bank account reduces the economic advantage of the individuals and is one of the causes of poverty. A modern bank, Banca Neo, is confronting the problems using modern and advanced…

Retail Banking Market Is Thriving Worldwide | BNL, UBI Banca, Mediobanca, Banca …

HTF MI added a new research study in its database with title 'Italy Retail Banking: Opportunities and Risks to 2023' that includes detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, Europe, Asia-Pacific, South America, Middle East and Africa and important players/vendors such as Intesa Sanpaolo, UniCredit, Banco BPM etc. The report will help user gain market insights, future trends and…

Alternative Payment Solution: Jiffy By SIA, Paym, Swish, BNL, Banca Nuova, Banca …

Jiffy is an Italy-based mobile payment solution developed by SIA S.p.A. in October 2014. It is one of the leading P2P payment solutions in Europe with 4.2 million users, the second-highest in the region after Swish, ahead of the UK’s Paym. The solution allows users to make P2P transfers in real-time on their smartphones. Jiffy allows money to be transferred simply by selecting the recipient from the mobile's address book.

To…

Credit Suisse Private Banking Market 2019 Financial Performance Analysis by Cred …

Credit Suisse is a global bank headquartered in Zürich, Switzerland. It provides private banking and wealth management, corporate banking, investment banking, and retail banking services to individuals, corporations, and institutions in around 50 countries. It offers private banking services through three regional divisions that collectively employ 3,020 relationship managers as of December 31, 2017.

This profile is a comprehensive analysis of Credit Suisse’s wealth management and private banking operations. It offers insight into…

Payments Landscape in Romania Market Opportunities and Risks by Banca Transilvan …

Payments Landscape in Romania Market report provides detailed analysis of market trends in the Romanian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including cash, payment cards, credit transfers, direct debit, and cheques during the review-period 2013-2017.

Get Sample Copy Of This Report at http://orbisresearch.com/contacts/request-sample/2123756

Key Leading Major Companies Mentioned:

Banca Transilvania, Raiffeisen Bank, Erste Bank, CEC Bank, ING Bank, Eurobank, UniCredit…

Italy Cards And Payments Market Dominated Key Players BancoPosta Poste Italiane …

Italy cards and payments industry is dominated by prepaid cards, which accounted for a share of 35% of the total cards in circulation. Prepaid cards are expected to be the most popular as they allow customers to eliminate wasteful spending and pre-define their spending limits. The debit card category will continue to remain the largest card category both in terms of volume and transaction value. Credit and charge cards are…