Press release

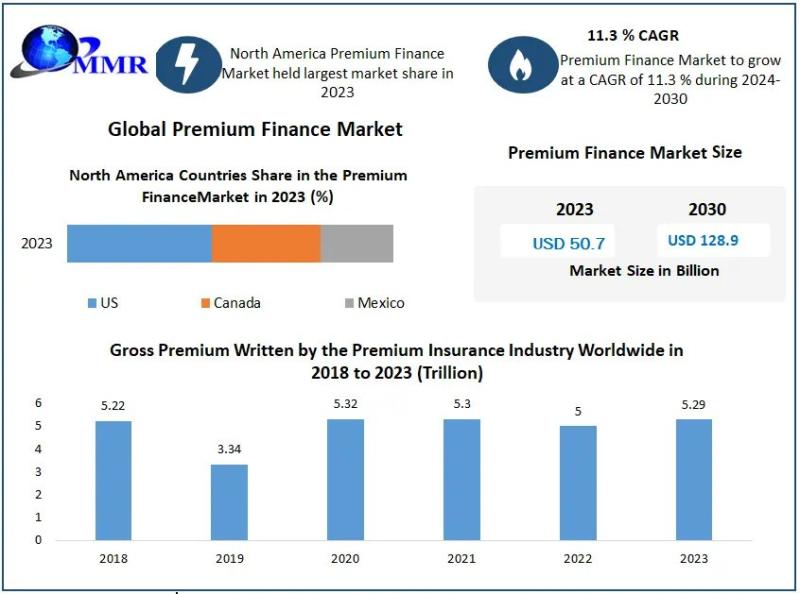

Premium Finance Market is expected to reach USD 128.9 Bn by 2030, at a CAGR of 11.3 %

Premium Finance Market Report Scope and Research MethodologyThe Premium Finance Market Report delves into the intricate dynamics of the premium financing industry, offering a comprehensive analysis of key trends, challenges, opportunities, and market drivers shaping its trajectory. Through meticulous research methodology, this report employs a multi-faceted approach to gather and analyze data, incorporating both primary and secondary research techniques. Primary research involves direct engagement with industry stakeholders, including interviews with executives, surveys, and interactions with key market players. Secondary research encompasses the thorough examination of existing literature, company reports, industry databases, and reliable sources to validate and augment primary findings. This rigorous methodology ensures the accuracy, reliability, and depth of insights provided in the Premium Finance Market Report, empowering stakeholders to make informed decisions and capitalize on emerging opportunities in the premium financing landscape.

Furthermore, the scope of the Premium Finance Market Report extends across various segments of the premium financing market, including insurance types, financing models, end-user industries, and geographical regions. By analyzing market trends, competitive landscape, regulatory frameworks, and technological advancements, this report offers a holistic view of the premium finance ecosystem. Additionally, it explores the impact of macroeconomic factors, such as interest rates, economic growth, and regulatory changes, on the market dynamics. Through a blend of qualitative analysis and quantitative data interpretation, the Premium Finance Market Report provides actionable insights to market participants, enabling them to devise effective strategies, mitigate risks, and capitalize on growth opportunities in the evolving premium finance landscape.

Immediate Delivery Available, Buy Now :https://www.maximizemarketresearch.com/request-sample/213507

Premium Finance Market Dynamics:

The Premium Finance Market is driven by a confluence of factors that shape its dynamics and growth trajectory. One of the primary drivers is the increasing demand for premium financing solutions from individuals and businesses seeking flexible payment options for insurance premiums. As insurance costs rise and coverage needs expand, consumers and businesses are turning to premium financing to spread out the financial burden over time, rather than paying large lump sums upfront. This trend is particularly pronounced in sectors such as property and casualty insurance, life insurance, and commercial insurance, where premiums can be substantial and budgetary constraints may necessitate alternative payment arrangements.

Moreover, the evolution of financial technology (FinTech) has revolutionized the premium finance landscape, fostering innovation and efficiency in payment processing, risk assessment, and customer engagement. The integration of digital platforms, automated underwriting systems, and data analytics tools has streamlined the premium financing process, making it more accessible, transparent, and convenient for both insurers and policyholders. Furthermore, advancements in artificial intelligence (AI) and machine learning algorithms enable lenders to assess risk more accurately, tailor financing solutions to individual needs, and optimize portfolio management strategies. This technological evolution not only enhances operational efficiency and cost-effectiveness but also opens up new avenues for market expansion and product differentiation in the competitive premium finance market.

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/213507

Premium Finance Market Regional Insights:

Regional insights play a crucial role in understanding the nuances of the Premium Finance Market, as market dynamics can vary significantly across different geographical regions. North America, comprising the United States and Canada, holds a dominant position in the premium finance market, driven by the region's robust insurance industry, high insurance penetration rates, and the presence of established financial institutions offering premium financing services. The region benefits from a mature regulatory framework, favorable interest rate environment, and widespread adoption of premium finance solutions among both individuals and businesses. Additionally, the growing demand for specialty insurance products, such as high-net-worth insurance and commercial insurance, further fuels the growth of the premium finance market in North America.

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/213507

Premium Finance Market Segmentation:

by Type

Life Insurance

Non-life Insurance

by Interest Rate

Fixed Interest Rate

Floating Interest Rate

by Provider

Banks

NBFCs

Others

Browse Full Report & TOC :https://www.maximizemarketresearch.com/market-report/premium-finance-market/213507/

Premium Finance Market Key Players:

1. Colonnade

2. Banking Truths Team

3. Insurance and Estate Strategies LLC

4. AGENTSYNC, INC.

5. The Annuity Expert

6. J.P. Morgan Private Bank

7. Tennessee

8. Capital for Life

9. Generational Strategies Group, LLC.

10. BNY Mellon Wealth Management

11. Byline Bank

12. Succession Capital Alliance

13. Symetra Life Insurance Company

14. Lions Financial

15. Wintrust

16. Evolution, Inc.

17. Parkway Bank & Trust Company

18. Agile Premium Finance

19. AFCO Insurance Premium Finance

20. BankDirect Capital Finance

21. Valley National Bank

22. ARI Financial Group

23. Peoples Premium Finance

24. FMG Suite

25. Schechter

26. US Premium Finance

27. Lincoln National Corporation

Table of content for the Premium Finance Market includes:

1. Global Premium Finance Market: Research Methodology

2. Global Premium Finance Market: Executive Summary

• Market Overview and Definitions

• Introduction to the Global Market

• Summary

• Key Findings

• Recommendations for Investors

• Recommendations for Market Leaders

• Recommendations for New Market Entry

3.Global Premium Finance Market: Competitive Analysis

• MMR Competition Matrix

• Market Structure by region

• Competitive Benchmarking of Key Players

• Consolidation in the Market

• M&A by region

• Key Developments by Companies

• Market Drivers

• Market Restraints

• Market Opportunities

• Market Challenges

• Market Dynamics

• PORTERS Five Forces Analysis

• PESTLE

• Regulatory Landscape by region

• North America

• Europe

• Asia Pacific

• Middle East and Africa

• South America

• COVID-19 Impact

4 . Company Profile: Key players

• Company Overview

• Financial Overview

• Global Presence

• Capacity Portfolio

• Business Strategy

• Recent Developments

Key Offerings:

• Past Market Size and Competitive Landscape (2022 to 2029)

• Past Pricing and price curve by region (2022 to 2029)

• Market Size, Share, Size and Forecast by different segment | 2022-2029

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

• Market Segmentation - A detailed analysis by growth and trend

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

• Competitive landscape - Market Leaders, Market Followers, Regional player

• Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of business by region

• Lucrative business opportunities with SWOT analysis

• Recommendations

Related Reports:

Global Tack Cloth Market : https://www.maximizemarketresearch.com/market-report/global-tack-cloth-market/104300/

Global Hot Drinks Packaging Market : https://www.maximizemarketresearch.com/market-report/global-hot-drinks-packaging-market/106627/

Automotive iBooster Market : https://www.maximizemarketresearch.com/market-report/automotive-ibooster-market/91995/

Global F-style Cans Market : https://www.maximizemarketresearch.com/market-report/global-f-style-cans-market/104341/

Global Dual Surface Polyester Film Market : https://www.maximizemarketresearch.com/market-report/global-dual-surface-polyester-film-market/107095/

Global Automotive Rain, Light, Humidity Sensor Market : https://www.maximizemarketresearch.com/market-report/global-automotive-rain-light-humidity-sensor-market/92103/

Global Heat Sealable Packaging Market : https://www.maximizemarketresearch.com/market-report/global-heat-sealable-packaging-market/107142/

Global Current Sense Amplifier Market.docx(electronics)-Ankita : https://www.maximizemarketresearch.com/market-report/global-current-sense-amplifier-market/116358/

Global Drone Inspection and Monitoring Market : https://www.maximizemarketresearch.com/market-report/global-drone-inspection-and-monitoring-market/114195/

Global Overall Environmental Remediation Market : https://www.maximizemarketresearch.com/market-report/global-overall-environmental-remediation-market/113688/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 444 West Lake Street, Floor 17,

Chicago, IL, 60606, USA.

✆ +1 800 507 4489

✆ +91 9607365656

🖂 mailto:sales@maximizemarketresearch.com

🌐 https://www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of the majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Premium Finance Market is expected to reach USD 128.9 Bn by 2030, at a CAGR of 11.3 % here

News-ID: 3419570 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Electric Enclosure Market to Reach USD 115.16 Billion by 2032, Growing at 8.57% …

Electric enclosures are protective cabinets designed to house electrical and electronic components such as switches, circuit boards, and displays. Their primary purpose is to safeguard users from electric shocks while protecting sensitive equipment from environmental hazards. Typically installed within walls, electric enclosures offer both functional and aesthetic benefits by concealing wires and maintaining a clean, organized look.

These enclosures find widespread applications across multiple sectors including power transmission and distribution, energy…

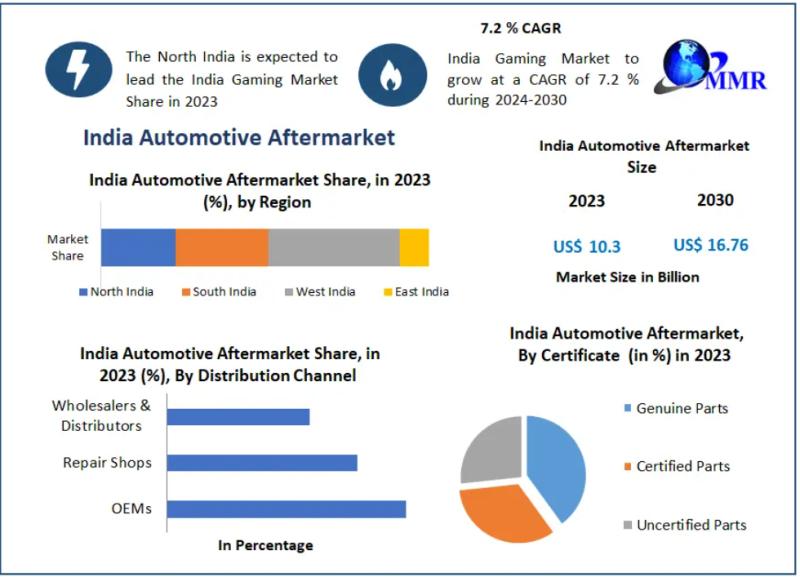

India Automotive Aftermarket: Rising Focus on Vehicle Maintenance, Upgrades, and …

India Automotive Aftermarket - Market Overview

The India Automotive Aftermarket represents a critical pillar of the country's mobility ecosystem, encompassing replacement parts, accessories, diagnostics, maintenance, and repair services for vehicles already in operation. Valued at USD 10.3 billion in 2023, the market is benefiting from India's expanding vehicle parc of over 340 million vehicles, increasing vehicle age, and rising consumer awareness around preventive maintenance. The aftermarket plays a vital role in…

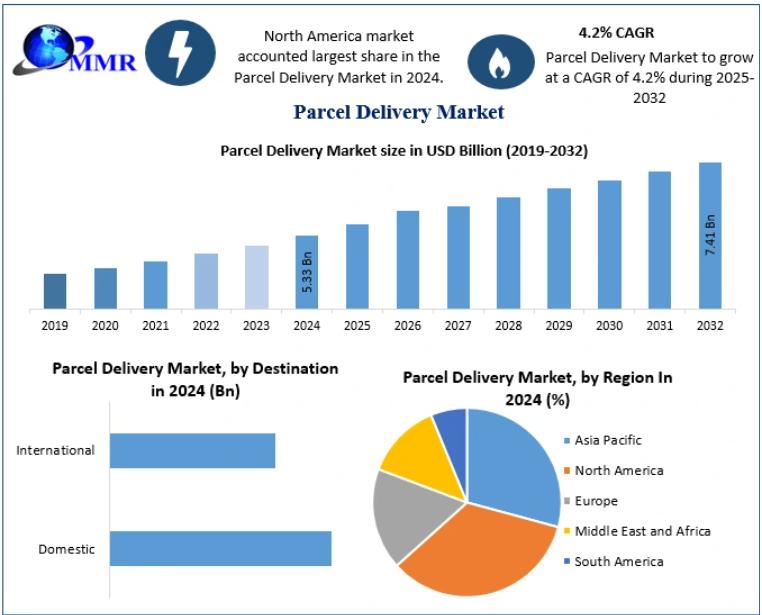

Parcel Delivery Market: Growing Demand for Fast, Reliable, and Technology-Driven …

Parcel Delivery Market Insights

Market Overview

The Global Parcel Delivery Market is experiencing steady growth driven by increasing e-commerce adoption, internet penetration, and cross-border trade. Parcel delivery involves transporting goods via road, rail, air, or sea, with services ranging from express delivery to standard courier options. The sector benefits from technological advancements, such as GPS tracking, RFID, autonomous delivery vehicles (ADVs), and electric vehicles (EVs) for last-mile delivery, improving efficiency and customer…

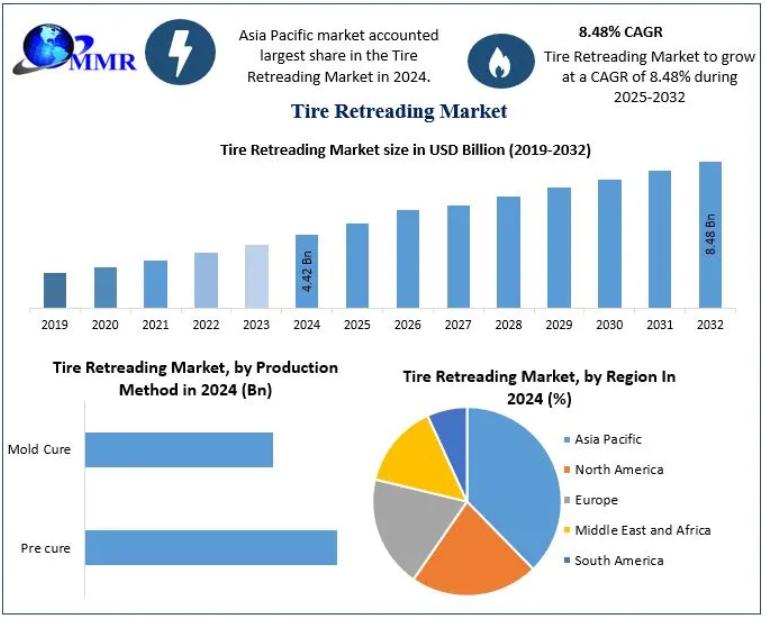

Tire Retreading Market: Rising Focus on Cost-Effective, Sustainable, and High-Pe …

Global Tire Retreading Market - Overview

The Global Tire Retreading Market is an integral part of the circular economy, offering a sustainable alternative to new tires by reducing raw material consumption and energy usage during production. Retreaded tires are widely used in commercial and transport vehicles, providing cost-effective, environmentally friendly solutions without compromising performance or durability. The adoption of retreading technologies is transforming supply chains in the transportation sector, enabling companies…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…