Press release

Liability Insurance Market Rapid Revenue Expansion Forecast by Acumen Research

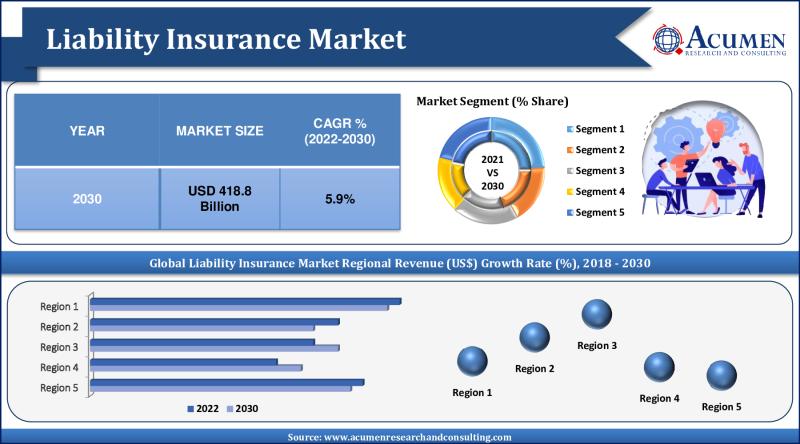

Key Points and Statistics on the Liability Insurance Market:● The global liability insurance market is anticipated to grow to USD 418.8 billion by 2030, with a CAGR of 5.9% from 2022 to 2030.

● North America held a commanding market value of over USD 90 billion in 2021, with Asia-Pacific expected to register a CAGR of over 6% from 2022 to 2030.

● General liability insurance made up about 41% of the market share in 2021, with the commercial application segment achieving over 50% share.

● The market is driven by the increasing awareness of liability insurance, the burgeoning small-business sector, and the rising cost of litigation.

Liability Insurance is a safeguard for individuals and businesses, offering financial protection against legal responsibilities that could arise from causing harm to a third party. With a market size of USD 251.7 billion in 2021, the global liability insurance market is projected to reach USD 418.8 billion by 2030. This market is integral to the stability of businesses and individuals alike, covering a wide spectrum of claims from bodily injury to professional negligence.

Download Sample Report Copy of This Report from Here: https://www.acumenresearchandconsulting.com/request-sample/3134

Liability Insurance Market Overview and Analysis:

Liability insurance may not be the most glamorous of topics, but its role in the modern economy is undeniable. It acts as a financial bulwark against the myriad of risks that businesses and individuals face daily. The market is on an upward trajectory, fueled by the growth of small businesses and stringent government regulations mandating insurance in specific industries. However, challenges such as economic downturns and intense market competition could pose threats to this growth.

Latest Liability Insurance Market Trends and Innovations:

New products catering to emerging liabilities: As new technologies and business practices emerge, so do new risks. Liability insurers are developing new products to cover these risks, such as cyber liability insurance and product liability insurance.

Technological advancements: Technology is also changing the way liability insurance is sold and administered. For example, some insurers are using artificial intelligence to automate claims processing.

Expansion of the healthcare sector: The healthcare sector is growing rapidly, especially in emerging economies. This is driving demand for professional liability insurance, which protects healthcare providers from lawsuits.

Increased awareness of risk: People are becoming more aware of the risks they face, and they are taking steps to protect themselves. This is leading to increased demand for liability insurance.

Regulatory changes: Changes in regulations can also impact the liability insurance market. For example, the introduction of new regulations can create new risks that businesses need to cover.

Major Growth Drivers of the Liability Insurance Market:

The liability insurance market is expanding due to the increasing demand for protection against potential legal liabilities, especially from the small business sector. The rising costs of legal disputes further accentuate the need for comprehensive liability insurance coverage. Liability insurance can protect businesses from a wide range of claims, including product liability, professional liability, and premises liability. It can also help to cover the costs of legal defense and settlements. The small business sector is particularly vulnerable to liability claims, as they often have fewer resources to protect themselves. As a result, small businesses are increasingly turning to liability insurance to protect themselves from financial ruin. The rising costs of legal disputes are also driving the demand for liability insurance. As the cost of litigation continues to increase, businesses are more likely to be sued. Liability insurance can help to offset these costs, making it a valuable investment for businesses of all sizes.

Key Challenges Facing the Liability Insurance Industry:

Despite robust growth, the liability insurance market faces challenges such as stringent regulations and a general lack of understanding about the importance of liability insurance, particularly among small businesses and individuals.

Market Segmentation Insights:

Based on Coverage Type:

● Directors and Officers Insurance

● General Liability Insurance

● Professional Liability Insurance

Based on Application:

● Commercial

● Personal

Based on Enterprise Size:

● Small Enterprises

● Large Enterprises

● Medium Enterprises

Overview by Region of the Liability Insurance Market:

The liability insurance market is currently led by North America, but Asia-Pacific is rapidly catching up. This is due to the expanding insurance sector in Asia-Pacific, as well as the rising literacy in insurance matters in the region. The increasing awareness of the importance of liability insurance is driving the growth of the market in Asia-Pacific. Additionally, the increasing number of businesses and individuals in the region is also contributing to the growth of the market.

Liability Insurance Market Table of Content:

CHAPTER 1. Industry Overview of Liability Insurance Market

CHAPTER 2. Research Approach

CHAPTER 3. Market Dynamics And Competition Analysis

CHAPTER 4. Manufacturing Plant Analysis

CHAPTER 5. Liability Insurance Market By Coverage Type

CHAPTER 6. Liability Insurance Market By Application

CHAPTER 7. Liability Insurance Market By Enterprise Size

CHAPTER 8. North America Liability Insurance Market By Country

CHAPTER 9. Europe Liability Insurance Market By Country

CHAPTER 10. Asia-Pacific Liability Insurance Market By Country

CHAPTER 11. Latin America Liability Insurance Market By Country

CHAPTER 12. Middle East & Africa Liability Insurance Market By Country

CHAPTER 13. Player Analysis Of Liability Insurance Market

CHAPTER 14. Company Profile

List of Key Players in the Global Market:

Notable companies in this market include American International Group Inc, Allianz, AXA SA, CNA Financial Corporation, Chubb, IFFCO-Tokio General Insurance Company Limited, Liberty General Insurance Limited, The Hartford, The Travelers Indemnity Company, and Zurich American Insurance Company.

Ask Query Here: Richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/3134

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Liability Insurance Market Rapid Revenue Expansion Forecast by Acumen Research here

News-ID: 3418756 • Views: …

More Releases from Acumen Research and Consulting

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

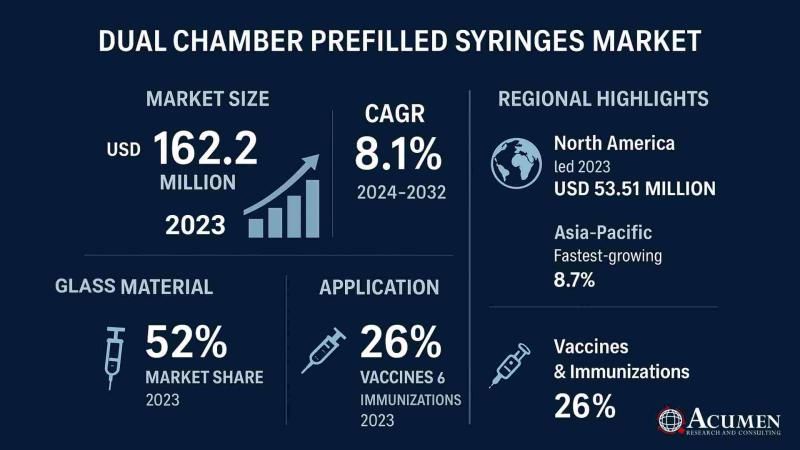

Global Dual Chamber Prefilled Syringes Market to Reach USD 323.7 Million by 2032 …

According to the latest report by Acumen Research and Consulting, the global Dual Chamber Prefilled Syringes Market is witnessing rapid expansion, driven by rising adoption of advanced drug delivery systems, increasing demand for biologics, and the growing emphasis on patient safety and convenience.

The Dual Chamber Prefilled Syringes Market Size was valued at USD 162.2 million in 2023 and is projected to reach USD 323.7 million by 2032, growing at a…

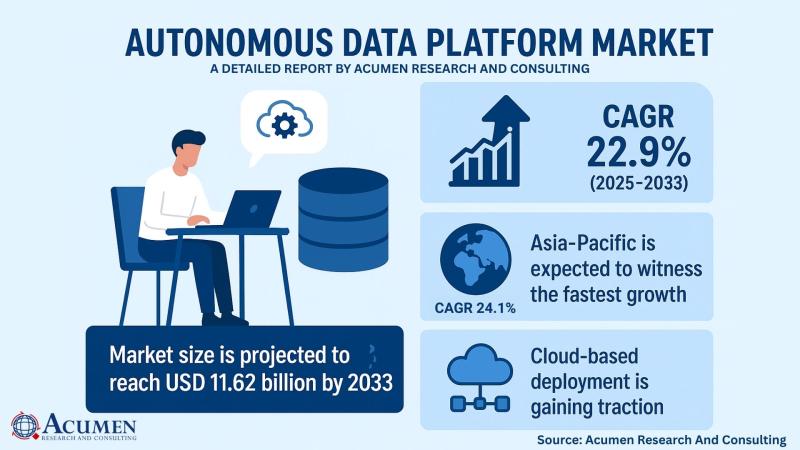

Autonomous Data Platform Market to Reach USD 11.62 Billion by 2033, Growing at a …

The global Autonomous Data Platform Market is experiencing significant growth, driven by the increasing demand for AI-driven data management and real-time analytics across various industries. According to a comprehensive market analysis by Acumen Research and Consulting, the market was valued at USD 1.85 billion in 2024 and is projected to reach USD 11.62 billion by 2033, expanding at a robust compound annual growth rate (CAGR) of 22.9% during the forecast…

More Releases for Liability

Brooklyn Premises Liability Attorney Samantha Kucher Discusses Store Liability f …

Brooklyn premises liability attorney Samantha Kucher (https://www.rrklawgroup.com/is-a-store-liable-for-a-customer-injury-in-new-york/) recently addressed a key concern for shoppers and business owners alike-store liability for customer injuries. Understanding when a store can be held responsible is essential, as these incidents can result in serious harm. Whether caused by a slippery floor, a falling object, or another hazardous condition, the question remains: "Is a store liable for a customer injury?"

Premises liability law establishes that store owners…

Brooklyn Premises Liability Lawyer Samantha Kucher Releases Crucial Article on P …

Brooklyn premises liability lawyer Samantha Kucher (https://www.rrklawgroup.com/premises-liability-and-building-code/) of Kucher Law Group has recently published a comprehensive article titled 'Premises Liability and Building Code'. The article is crucial for property owners, tenants, and legal advisors, providing essential insights into the intricacies of premises liability and the importance of adhering to building codes.

In the insightful piece, the Brooklyn premises liability lawyer explores the complexities of premises liability-a concept that holds property owners…

Brooklyn Premises Liability Lawyer Samantha Kucher Shares Insights on NY Premise …

Samantha Kucher (https://www.rrklawgroup.com/what-are-the-elements-of-a-premises-liability-case-in-ny/), a Brooklyn premises liability lawyer at Kucher Law Group, has recently published an in-depth article titled "What are the Elements of a Premises Liability Case in NY?" The article aims to demystify the various components of premises liability law in New York, providing vital information for those who have suffered injuries on someone else's property due to negligence.

The Brooklyn premises liability lawyer discusses how understanding the legal…

Brooklyn Premises Liability Attorney Samantha Kucher Releases Insightful Article …

Brooklyn premises liability attorney Samantha Kucher (https://www.rrklawgroup.com/is-a-store-liable-for-a-customer-injury-in-new-york/), of Kucher Law Group, has recently published an informative article titled "Is A Store Liable For A Customer Injury?" This comprehensive piece sheds light on the intricate details of premises liability law and the responsibilities of store owners towards maintaining a safe environment for their customers.

In her article, Brooklyn premises liability attorney Samantha Kucher emphasizes the legal obligations that store owners and managers…

Cosmetology Liability Insurance Market Forecast Report on Cosmetology Liability …

The report titled, Global Cosmetology Liability Insurance Market Size, Status and Forecast 2019-2026 has been recently published by Researchmoz.us. The Cosmetology Liability Insurance market has been garnering remarkable momentum in recent years. Demand continues to rise due to increasing purchasing power is projected to bode well for the global market. The insightful research report on the Cosmetology Liability Insurance market includes Porter’s five forces analysis and SWOT analysis to understand the factors…

Liability Insurance Market

Global Liability Insurance Market 2019

Liability insurance is a part of the general insurance system of risk financing to protect the purchaser (the "insured") from the risks of liabilities imposed by lawsuits and similar claims. It protects the insured in the event he or she is sued for claims that come within the coverage of the insurance policy.

Get sample copy of this report: https://bit.ly/2FggjnP

Global Liability Insurance Market…