Press release

Algorithmic Trading Market Targets Impressive 12.9% CAGR (2020-2030)

Key Points and Statistics on the Algorithmic Trading Market:● The market size is expected to balloon to USD 41.9 Billion by 2030, with a CAGR of 12.9% from 2022 to 2030.

● North America led the market with over USD 5.1 billion in 2021, while the Asia-Pacific region is anticipated to experience a CAGR of over 13% from 2022 to 2030.

● Platforms dominated the solution segment in 2021, holding a 69% share, thanks to their ability to automate trades and analyze vast market data.

● Cloud deployment is becoming increasingly significant, with USD 8.5 billion in revenue in 2021, offering scalability and cost-effectiveness to businesses of all sizes.

Algorithmic Trading, also known as also trading, harnesses computer programs and complex algorithms to execute trades in financial markets with precision and speed. The market, valued at USD 14.1 billion in 2021, is projected to reach a staggering USD 41.9 billion by 2030. This growth is fueled by the increasing demand for fast, efficient, and error-free trading operations across stocks, bonds, currencies, and commodities.

Download Sample Report Copy of This Report from Here: https://www.acumenresearchandconsulting.com/request-sample/3127

Algorithmic Trading Market Overview and Analysis:

Algorithmic trading is a method of buying and selling financial instruments using computer programs. It is becoming increasingly popular as it can help traders to automate their trading decisions and to take advantage of market opportunities more quickly than they could manually. The algorithmic trading market is driven by the demand for automation, improved market liquidity, and enhanced trading efficiency. Automation can help traders to save time and to avoid making costly mistakes. Improved market liquidity means that traders can buy and sell assets more easily and at a lower cost. Enhanced trading efficiency means that traders can make more informed decisions about when to buy and sell assets. However, the algorithmic trading market also faces challenges such as market volatility, regulatory scrutiny, and the complexity of trading strategies. Market volatility can make it difficult for algorithmic traders to make accurate predictions about future prices. Regulatory scrutiny can make it difficult for algorithmic traders to operate in some jurisdictions. The complexity of trading strategies can make it difficult for algorithmic traders to develop and test their strategies effectively. Despite these challenges, the algorithmic trading market is expected to continue to grow in the future. The demand for automation, improved market liquidity, and enhanced trading efficiency is expected to continue to grow. As algorithmic trading technology becomes more sophisticated, it is expected to become more accessible to a wider range of traders.

Latest Algorithmic Trading Market Trends and Innovations:

The market is witnessing a surge in the adoption of machine learning and artificial intelligence, leading to the development of sophisticated trading bots and the potential integration of quantum computing in trading algorithms.

Major Growth Drivers of the Algorithmic Trading Market:

Automation is the key driver, reducing human error and increasing efficiency.

The rise in market liquidity and the speed of transactions are also significant contributors to the market's growth.

Key Challenges Facing the Algorithmic Trading Industry:

The lack of transparency: Algorithmic trading can be difficult to track and monitor, which can make it difficult to identify and prevent market manipulation.

The potential for increased market volatility: Algorithmic trading can lead to sudden and large price movements, which can increase market volatility.

The complexity of algorithms: Algorithmic trading systems can be complex and difficult to understand, which can make it difficult to identify and prevent errors.

The need for robust regulatory frameworks: Algorithmic trading is a relatively new and rapidly evolving field, which means that regulatory frameworks need to be updated to keep up with the latest developments.

Market Segmentation Insights:

● By Solutions:

○ Platforms

○ Software Tools

● By Services:

○ Professional Services

○ Managed Services

● By Deployment:

○ Cloud

○ On-Premise

● By Trading Types:

○ FOREX

○ Stock Markets

○ ETFs

○ Bonds

○ Cryptocurrencies

○ Others

● By Traders:

○ Institutional Investors

○ Long-term Traders

○ Short-term Traders

○ Retail Investors

Overview by Region of the Algorithmic Trading Market:

North America currently dominates the market, but Asia-Pacific is rapidly growing, with countries like China, Japan, and Australia contributing significantly to the expansion.

Algorithmic Trading Market Table of Content:

CHAPTER 1. Industry Overview of Algorithmic Trading Market

CHAPTER 2. Research Approach

CHAPTER 3. Market Dynamics And Competition Analysis

CHAPTER 4. Algorithmic Trading Market By Solution

CHAPTER 5. Algorithmic Trading Market By Service

CHAPTER 6. Algorithmic Trading Market By Deployment

CHAPTER 7. Algorithmic Trading Market By Trading Types

CHAPTER 8. Algorithmic Trading Market By Type of Traders

CHAPTER 9. North America Algorithmic Trading Market By Country

CHAPTER 10. Europe Algorithmic Trading Market By Country

CHAPTER 11. Asia-Pacific Algorithmic Trading Market By Country

CHAPTER 12. Latin America Algorithmic Trading Market By Country

CHAPTER 13. Middle East & Africa Algorithmic Trading Market By Country

CHAPTER 14. Player Analysis Of Algorithmic Trading Market

CHAPTER 15. Company Profile

List of Key Players in the Global Market:

Notable market players include AlgoTrader, 63 moons technologies limited, Argo Software Tools Engineering, InfoReach, Inc., and others, who are at the forefront of advancing algorithmic trading technologies.

Ask Query Here: Richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/3127

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Algorithmic Trading Market Targets Impressive 12.9% CAGR (2020-2030) here

News-ID: 3418612 • Views: …

More Releases from Acumen Research and Consulting

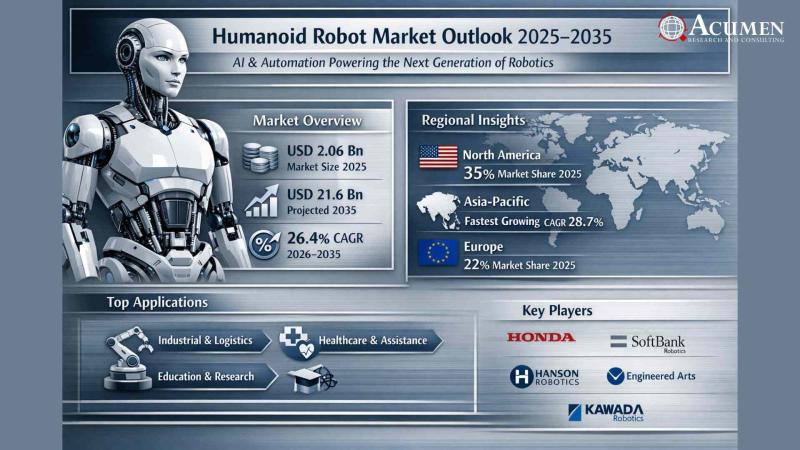

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

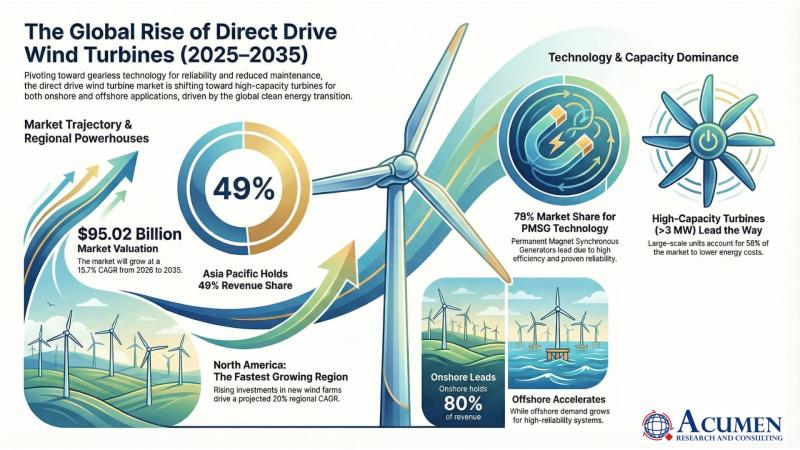

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for Algorithmic

Technical Review: CNCPW's Algorithmic Compliance & Settlement Logic

The CNCPW technical team releases a detailed evaluation report on its next-generation infrastructure, analyzing the execution efficiency of automated AML protocols and the architecture of asset segregation.

As the digital asset industry faces heightened compliance requirements, CNCPW, a U.S.-registered infrastructure provider, today released a Technical Review. Unlike traditional market announcements, this report provides an in-depth, code-level analysis of the companys recently deployed Deterministic Execution architecture.

This review focuses on the two core…

Transforming the Algorithmic Trading Software Market in 2025: The Impact Of Clou …

"What Is the Expected Size and Growth Rate of the Algorithmic Trading Software Market?

In recent times, there has been a swift growth in the algorithmic trading software market size. It is projected to rise from $2.5 billion in 2024 to $2.76 billion in 2025, indicating a compound annual growth rate (CAGR) of 10.2%. Factors like regulatory modifications, escalating complexity in financial markets, cost efficiency and operational scalability, a surge in…

Navigating the Algorithmic Trading Landscape: Insights into the Algorithmic Trad …

The Algorithmic Trading Market at a global level was worth USD 14.1 Billion in 2022 and is anticipated to expand to USD 41.9 Billion by 2032, experiencing a CAGR of 12.9% during the forecast period of 2023-2032.

The Algorithmic Trading Market is at the forefront of revolutionizing the way financial markets operate. Powered by cutting-edge technology and intricate algorithms, this market enables traders to execute large volumes of orders with speed,…

What is the Algorithmic Trading market growth?

Algorithmic Trading Market Perspective 2021

𝗥𝗲𝗽𝗼𝗿𝘁 𝗣𝗮𝗴𝗲𝘀: [166 Pages]

The robotization of the unfamiliar trade market has seen a solid shift from its underlying foundations of phone exchanging, voice work areas and misty value data, to the present mechanical world with internet exchanging and real time of costs. Algorithmic exchanging is another space of the FX market that has considered important to be as customers mean to acquire a superior cost…

Global Algorithmic Trading Market Insights, Forecast to 2025

Algorithmic trading Solutions Industry 2018 Market Research report gives estimation of the factors that are boosting the development of the Healthcare BPO Solutions market and it also gives the analytical data of Market Size, Share, Growth, Application, Opportunity analysis, and forecast on the basis of key principles segments such as end-users, application, product, technology, and region are surveyed comprehensively.

Algorithmic trading is a method of executing a large order (too large…

Algorithmic Trading Market Showing Impressive Growth : Hudson River Trading, Jum …

The competitive landscape which incorporates the Algorithmic Trading Market ranking of the major players, along with new service/product launches, partnerships, business expansions and acquisitions in the past five years of companies profiled are also highlighted in the Algorithmic Trading Market report. Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major Algorithmic Trading Market players.

Top 10 key companies…