Press release

Investments Market Competitor Analysis, Growth, Insights, Trends 2024-2033: Strategic Perspectives

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2033The Business Research Company offers in-depth market insights through Investments Global Market Report 2024, providing businesses with a competitive advantage by thoroughly analyzing the market structure, including estimates for numerous segments and sub-segments.

Market Size And Growth Forecast:

The investments market size has grown strongly in recent years. It will grow from $3964.52 billion in 2023 to $4254.18 billion in 2024 at a compound annual growth rate (CAGR) of 7.3%. The growth in the historic period can be attributed to high inflation rates, economic growth, global events, corporate earnings, government policies, commodity prices.

The investments market size is expected to see strong growth in the next few years. It will grow to $5680.1 billion in 2028 at a compound annual growth rate (CAGR) of 7.5%. The growth in the forecast period can be attributed to growing sustainable investing, digital currencies, global trade dynamics, regulatory changes, cybersecurity concerns. Major trends in the forecast period include adoption of robo-advisors, private equity and venture capital investments, real assets and infrastructure investments, artificial intelligence in investment strategies, diversified investment portfolios.

Get Free Sample Of This Report-

https://www.thebusinessresearchcompany.com/sample.aspx?id=1888&type=smp

Market Segmentation:

The investments market covered in this report is segmented -

1) By Type: Wealth Management, Securities Brokerage And Stock Exchange Services, Investment Banking

2) By Mode: Online, Offline

3) By End User: B2B, B2C

Subsegments Covered: Asset Management, Funds, Trusts, And Other Financial Vehicles, Portfolio Management and Investment Advice, Equities Brokerage, Stock Exchanges, Bonds Brokerage, Derivatives & Commodities Brokerage, Other Stock Brokerage, Mergers & Acquisitions Advisory, Debt Capital Markets Underwriting, Equity Capital Markets Underwriting, Financial Sponsor/Syndicated Loans

Major Driver - Transformative Impact Of Big Data Analytics In Wealth Management Enhancing Services And Driving Revenue Growth

Many wealth management companies are investing in big data analytics capabilities to generate insights to enhance and refine service offerings and thus increase revenues. Big data solutions are being implemented to deliver insights around client segments, product penetration, and analyze training program effectiveness. These technologies are being implemented to assess existing and prospective clients' inclination to purchase various products and services being offered by a wealth management company, their lifetime value, investment pattern, and the ability of the client to take risks. They are also aiding wealth management companies to track business performance, increase client acquisition and retention rates, increase sales and offer real-time investment advice. For instance, CargoMetrics, an investment firm based in Boston, used the Automatic Identification System (AIS), to collect data on commodity movement such as cargo location and cargo size to develop an analytics platform for trading commodities, currencies, and equity index funds. This tool was also sold to other hedge funds and wealth managers.

Competitive Landscape:

Major companies operating in the investments market report are Berkshire Hathaway Inc., Industrial and Commercial Bank of China (ICBC), JPMorgan Chase & Co., Bank of America Corporation, Legal & General Group plc, Citigroup Inc., INTL FCStone Inc., MORGAN STANLEY & Co. Inc., Goldman Sachs Group Inc., UBS Group AG, Fidelity Investments, Charles Schwab Corporation, Bank of New York Mellon Corporation, BlackRock Inc., Ameriprise Financial Inc., State Street Corporation, Raymond James Financial Inc., Vanguard Group Inc., Franklin Resources Inc., Jefferies Financial Group Inc., Northern Trust Corporation, T. Rowe Price Group Inc., Invesco Ltd., Evercore Inc., Lazard Ltd., Affiliated Managers Group Inc., E*TRADE Financial Corporation, Houlihan Lokey Inc., PJT Partners Inc., Moelis & Company, CNP Assurances

Get Access To The Full Market Report -

https://www.thebusinessresearchcompany.com/report/investments-global-market-report

Top Trend - Binance Introduces Innovative Dual Investment Products With Enhanced Features And User-Friendly Design

Major companies operating in the investment markets are adopting innovative new batches of dual investment products to sustain their position in the market. Dual investment products typically refer to financial instruments or products that combine the features of two different types of investments. For instance, in September 2023, Binance, a Cayman Islands-based company operating in cryptocurrency exchanges, launched a new batch of dual investment products with updated target prices and settlement dates. These investment products provide free access to Buy Low and Sell High products at the chosen price on the chosen future date. It is designed for new Dual Investment users, providing a step-by-step guide to help users understand how to use the product. It also add unique feature where there are no trading fees for dual investment products, and they offer potentially high rewards.

The Table Of Content For The Market Report Include:

1. Executive Summary

2. Investments Market Characteristics

3. Investments Market Trends And Strategies

4. Investments Market - Macro Economic Scenario

5. Investments Market Size And Growth

…..

27. Investments Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

"Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model "

"About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialize in various industries including manufacturing, healthcare, financial services, chemicals, and technology. The firm has offices located in the UK, the US, and India, along with a network of proficient researchers in 28 countries."

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Investments Market Competitor Analysis, Growth, Insights, Trends 2024-2033: Strategic Perspectives here

News-ID: 3417214 • Views: …

More Releases from The Business research company

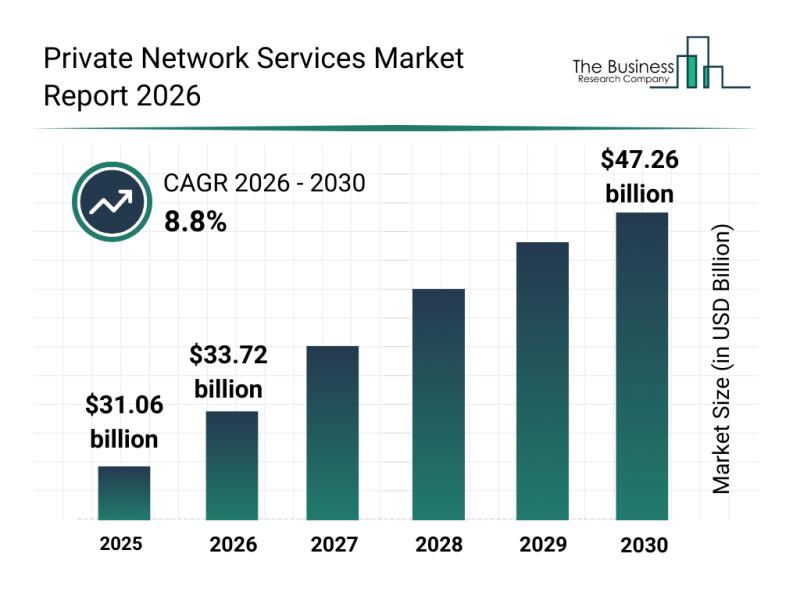

Leading Companies Fueling Innovation and Growth in the Private Network Services …

The private network services sector is set to experience remarkable growth as demand for secure, high-performance connectivity continues to rise across various industries. With advancements in wireless technology and evolving network needs, this market is positioning itself for widespread adoption and innovation over the coming years. Let's explore the market size, key players, driving trends, and segmentation to better understand what lies ahead.

Private Network Services Market Size and Growth Outlook…

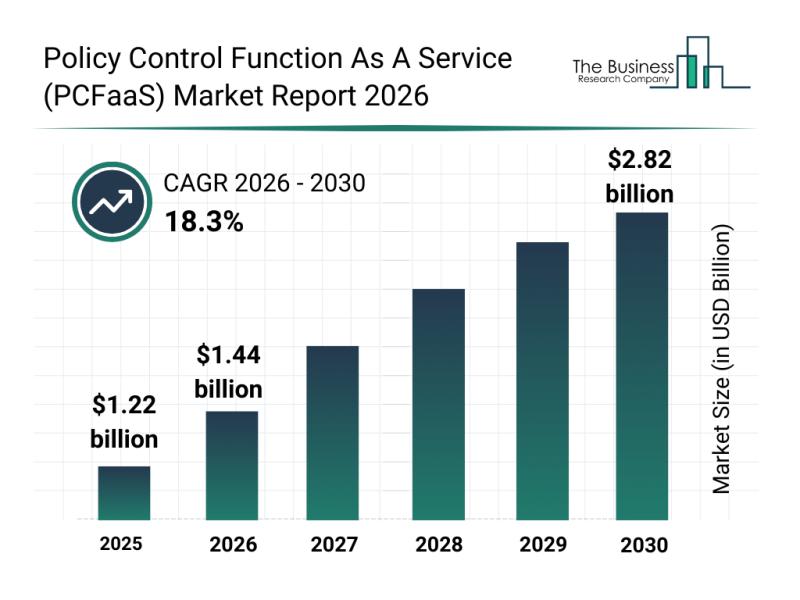

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Po …

The policy control function as a service (PCFaaS) market is on track for substantial expansion over the coming years, driven by technological advancements and increasing demand in telecommunications. This sector is transforming rapidly as operators adapt to next-generation network requirements and cloud-native approaches. Let's delve into the market's expected valuation, key players, emerging trends, and notable segmentations shaping its future.

Significant Growth Forecast for the Policy Control Function As A Service…

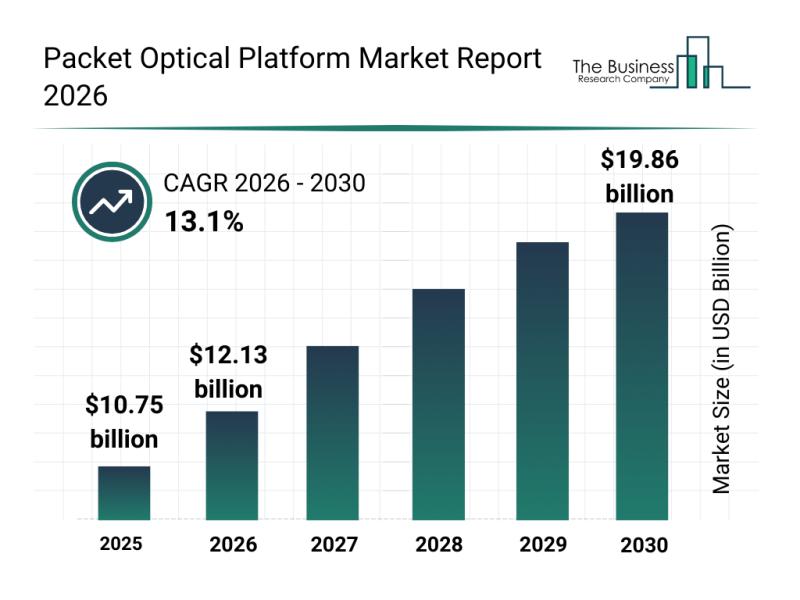

Top Players and Competitive Dynamics in the Packet Optical Platform Market

The packet optical platform market is positioned for significant expansion in the coming years, driven by advances in network technology and increasing demand for high-capacity data transmission. As digital infrastructure evolves, this sector is set to play a crucial role in supporting the growing needs of data centers, telecom providers, and cloud services. Let's explore the market's projected size, key players, emerging trends, and the segments contributing to its growth.

Forecasted…

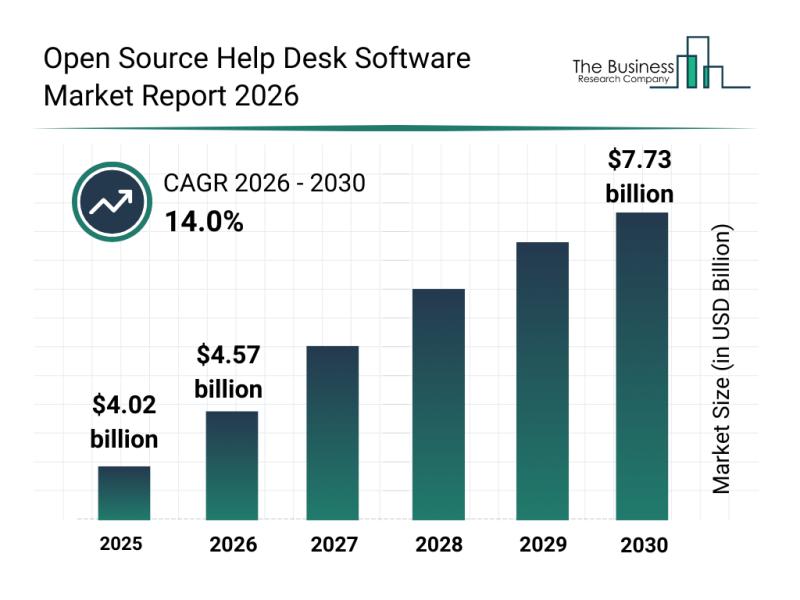

Analysis of Segmentation, Market Trends, and Competitive Landscape in the Open S …

The open source help desk software market is set to experience significant expansion in the coming years, driven by technological advancements and evolving business needs. As organizations increasingly embrace digital customer support, this market is positioned for notable growth through 2030. Below is an in-depth exploration of the market size, leading players, key trends, and segmentation insights.

Projected Market Size and Growth Rate of the Open Source Help Desk Software Market…

More Releases for Investment

ST Investment Co., Ltd: Pioneering the Global Investment Trend

Since its establishment in 2017 in the United Kingdom, ST Investment Co., Ltd has rapidly emerged as a shining star in the global investment sector. Through its diversified business portfolio and exceptional financial services, the company provides a comprehensive wealth growth platform for clients worldwide. Its services span key sectors such as artificial intelligence-based smart contracts, private equity, gold investments, and wealth management, all aimed at delivering stable and diverse…

Lakshmishree Investment: Common Investment Mistakes When Markets Are High

One big mistake many investors make is taking too much risk because they fear missing out.

Stock markets around the world are on fire! From the bustling streets of Wall Street to the vibrant Bombay Stock Exchange (BSE), markets are scaling new highs, leaving many investors excited and bewildered. While this bull run is thrilling, it can also be confusing. Should you jump in and buy more? Hold on tight…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

China Investment Bank, China Investment Consultant, China Investment Corporation …

Pandacu is a company that specializes in cross-border investment in China. The company was founded in china and has since grown to become one of the leading cross-border investment firms in China. Pandacu offers a wide range of services to its clients, including investment advisory, market research, due diligence, and post-investment support.

http://pandacuads.com/

Investment banking consultant

Email:nolan@pandacuads.com

Cross-border investment in China can be a complex and challenging process, as the country has a unique…

Trident Steels - Investment Casting, Stainless Steel Investment Casting, Steel I …

With decades of experience in this industry, we have become the preferred partner for global companies who look for high-end metal casting manufacturing from India. Our investment casting company in India offers best-in-class quality products and services to our customers. We are a customer-centric company and invest in our people, processes, and technology to provide high-quality products every time. This has helped us to become the preferred partner for companies…

Investment Management Market Growth Improvement Highly Witness | NWQ Investment …

Investment management is designed to help investors or owners to recognize, manage, and communicate the performance and risks of assets and related investments. As an alternative to spending time pursuing data and manually creating reports, fund managers, owners, and operators can focus on maximizing performance.

Investment Management market size is expected to grow at a compound annual growth rate of xx% for the forecast period of 2021 to 2028.

Market IntelliX report…