Press release

Consumer Credit Market 2024 Size, Key Trends, Growth Opportunities And Forecast 2033

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2033The Business Research Company offers in-depth market insights through Consumer Credit Global Market Report 2024, providing businesses with a competitive advantage by thoroughly analyzing the market structure, including estimates for numerous segments and sub-segments.

Market Size And Growth Forecast:

The consumer credit market size has grown strongly in recent years. It will grow from $11.1 billion in 2023 to $11.79 billion in 2024 at a compound annual growth rate (CAGR) of 6.2%. The growth in the historic period can be attributed to economic growth and prosperity, access to financial services, changing lifestyles and consumption patterns, housing market dynamics, promotion and marketing strategies.

The consumer credit market size is expected to see strong growth in the next few years. It will grow to $14.96 billion in 2028 at a compound annual growth rate (CAGR) of 6.1%. The growth in the forecast period can be attributed to demographic changes and millennial behavior, education and healthcare expenses, innovation in credit products, global economic trends, regulatory environment. Major trends in the forecast period include open banking initiatives, fintech disruption, credit education and financial wellness, pandemic-influenced trends, sustainable finance.

Get Free Sample Of This Report-

https://www.thebusinessresearchcompany.com/sample.aspx?id=9207&type=smp

Market Segmentation:

The consumer credit market covered in this report is segmented -

1) By Service Type: Credit Services, Software And IT Support Services

2) By Credit Type: Revolving Credits, Non-Revolving Credits

3) By Issuer: Banks And Finance Companies, Credit Unions, Other Issuers

4) By Payment Method: Direct Deposit, Debit Card, Other Payment Methods

5) By Application: Individual, Enterprise, Other Applications

Major Driver - Role Of Cashless Transactions In Driving Expansion Of The Consumer Credit Market

The increasing adoption of cashless transactions is expected to propel the growth of the consumer credit market going forward. Cashless transactions are digital methods of transferring financial transactions between two parties that do not require the use of real currency that uses a payment gateway to transmit payments electronically. Fintech lenders are more likely to issue loans to cashless payment adopters than to non-adopters because the borrowers' cashless payment histories provide lenders with reliable information, allowing for more effective screening of loan applications. Additionally, these borrowers may benefit from lower interest rates and lower default risks, and with these benefits, borrowers may choose cashless payments. For instance, in July 2022, according to a report published by the European Central Bank, a Germany-based bank responsible for monetary policy in the European Union (EU), the overall number of non-cash payments in Europe increased by 12.5% to $123.63 billion in 2021 compared to the previous year, while the total value increased by 18.6% to $213.26 trillion. Therefore, the increasing adoption of cashless transactions is driving the consumer credit market.

Competitive Landscape:

Major companies operating in the consumer credit market report are Berkshire Hathaway Inc., Industrial and Commercial Bank of China Limited, JPMorgan Chase & Co., China Construction Bank Corporation, The Bank of America Corporation, WELLS FARGO & CO., HSBC Holdings plc, Citigroup Inc., Prudential Financial Inc., American Express Company, Morgan Stanley, Mitsubishi UFJ Financial Group Inc., BNP Paribas SA, Capital One Financial Corporation, Barclays plc, Deutsche Bank AG, PayPal Holdings Inc., Mastercard Incorporated, Synchrony Financial, Discover Financial Services, Experian plc, Equifax Inc., Navient Corporation, Hilltop Holdings Inc., Affirm Holdings Inc., Afterpay Touch Group Ltd., Zip Co. Limited, Sezzle Inc., Edward D Jones & Co L.P., Klarna Bank AB

Get Access To The Full Market Report -

https://www.thebusinessresearchcompany.com/report/consumer-credit-global-market-report

Top Trend - Consumer Credit Market Forging Partnerships For Enhanced Decision-Making

Major companies operating in the consumer credit market are adopting a strategic partnership approach to make more informed decisions on credit insights and services. A strategic partnership is a collaborative agreement or alliance between two or more entities, such as companies, organizations, or governments, with the aim of achieving mutually beneficial objectives. For instance, in May 2023, CreditWorks Group, a New Zealand-based credit reporting company, partnered with Equifax Inc., a US-based credit bureau company. With this partnership, these companies aim to enhance their risk management and decision-making processes by leveraging Equifax's comprehensive and accurate consumer credit data.

The Table Of Content For The Market Report Include:

1. Executive Summary

2. Consumer Credit Market Characteristics

3. Consumer Credit Market Trends And Strategies

4. Consumer Credit Market - Macro Economic Scenario

5. Consumer Credit Market Size And Growth

…..

27. Consumer Credit Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialize in various industries including manufacturing, healthcare, financial services, chemicals, and technology. The firm has offices located in the UK, the US, and India, along with a network of proficient researchers in 28 countries.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Consumer Credit Market 2024 Size, Key Trends, Growth Opportunities And Forecast 2033 here

News-ID: 3413869 • Views: …

More Releases from The Business research company

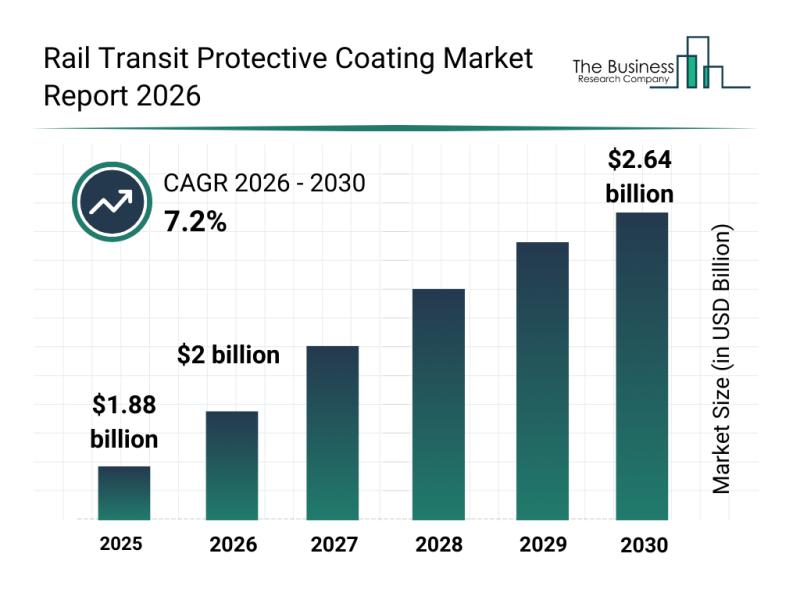

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

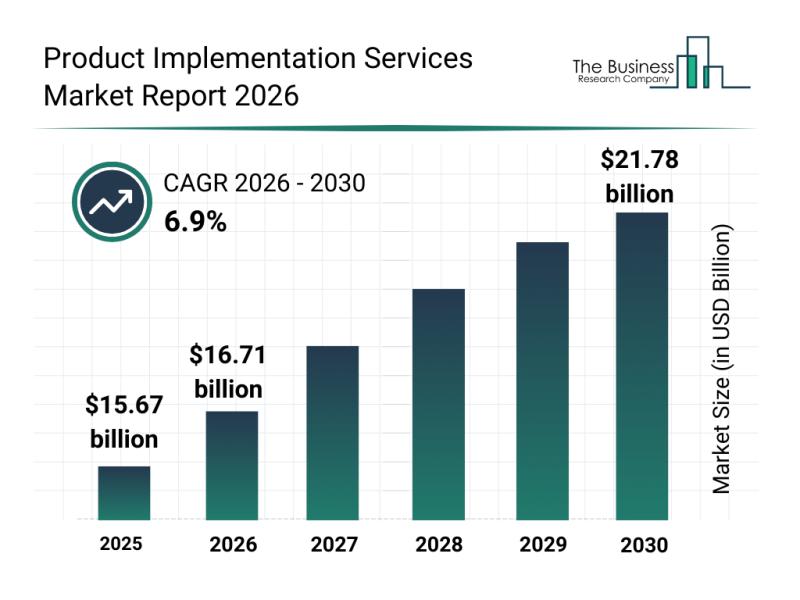

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

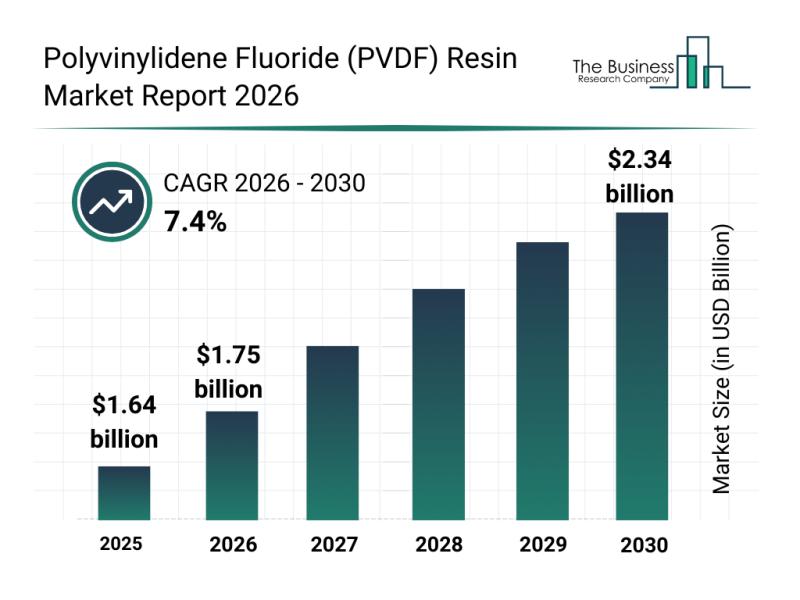

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

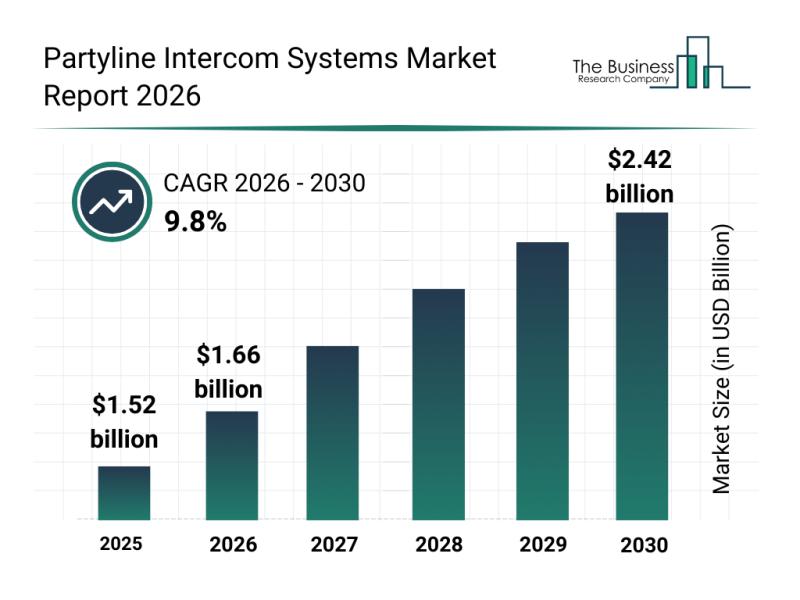

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…