Press release

Africa Insurance Market Expanding at a CAGR of 6.3% during 2024-2032- IMARC Group

The latest report by IMARC Group, titled "Africa Insurance Market: Industry Trends, Share, Size, Growth, Opportunity, and Forecast 2024-2032," offers a comprehensive analysis of the industry, which comprises insights into the market. The report also includes competitor and regional analysis, and contemporary advancements in the market.The Africa insurance market size reached US$ 87.4 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 153.9 Billion by 2032, exhibiting a growth rate (CAGR) of 6.3% during 2024-2032.

Africa Insurance Market Overview:

Insurance is a financial product that mitigates risk and provides protection against financial loss arising from unforeseen events. It operates on the principle of risk pooling, where insured parties pay premiums to an insurer who, in turn, compensates them in the event of a covered loss. The insurance market encompasses a wide range of product types, including life insurance, health insurance, property and casualty insurance, and liability insurance, each designed to address specific risks and needs. The advantages of insurance extend beyond risk mitigation to include financial stability for individuals and businesses, support for investment and economic growth through the accumulation and allocation of capital, and the promotion of risk management practices.

Request to Get the Free Sample Report: https://www.imarcgroup.com/africa-insurance-market/requestsample

Africa Insurance Market Trends:

The Africa market is majorly driven by increasing economic development, rising awareness of the benefits of insurance, and a growing middle class with higher disposable incomes. Additionally, the expansion of the banking and financial services sectors, coupled with technological advancements such as mobile banking and digital platforms, is facilitating greater access to insurance products across the continent.

Along with this, regulatory reforms aimed at strengthening the insurance sector, improving solvency, and enhancing consumer protection are further contributing to market development. In addition, the increasing prevalence of natural disasters and heightened awareness of health risks, partly accelerated by the COVID-19 pandemic, are emphasizing the importance of insurance coverage. Furthermore, the introduction of innovative products tailored to local needs, coupled with strategic partnerships between insurers and technology companies, is creating a positive market outlook.

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/africa-insurance-market

Competitive Landscape:

• African Life Assurance Limited

• The Liberty Holdings Limited

• Libya Insurance Company

• Misr Insurance Holding Company

• Momentum Metropolitan Holdings Limited

• Old Mutual Limited Group

• Sage Term Life Insurance

• Sanlam Life Insurance Limited

• Santam Limited

• Société Nationale Des Assurances, SPA

Africa Insurance Industry Segmentation:

Breakup by Type:

• Life Insurance

• Non-life Insurance

o Automobile Insurance

o Fire Insurance

o Liability Insurance

o Other Insurances

Breakup by Country:

• South Africa

• Morocco

• Nigeria

• Egypt

• Kenya

• Algeria

• Angola

• Namibia

• Tunisia

• Mauritius

• Others

Key highlights of the Report:

• Market Performance (2018-2023)

• Market Outlook (2024-2032)

• COVID-19 Impact on the Market

• Porter's Five Forces Analysis

• Strategic Recommendations

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Structure of the Market

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Read Also Latest Market Research Reports:

• GCC Oyster Market: https://www.linkedin.com/pulse/gcc-oyster-market-growth-price-trends-report-ravi-dwivedi-kmoyf

• Europe Set-top Box Market: https://www.linkedin.com/pulse/europe-set-top-box-market-size-industry-report-ravi-dwivedi-flqzf

• Europe Power Rental Market: https://www.linkedin.com/pulse/europe-power-rental-market-size-share-forecast-2024-32-ravi-dwivedi-lms7f

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Africa Insurance Market Expanding at a CAGR of 6.3% during 2024-2032- IMARC Group here

News-ID: 3413670 • Views: …

More Releases from IMARC Group

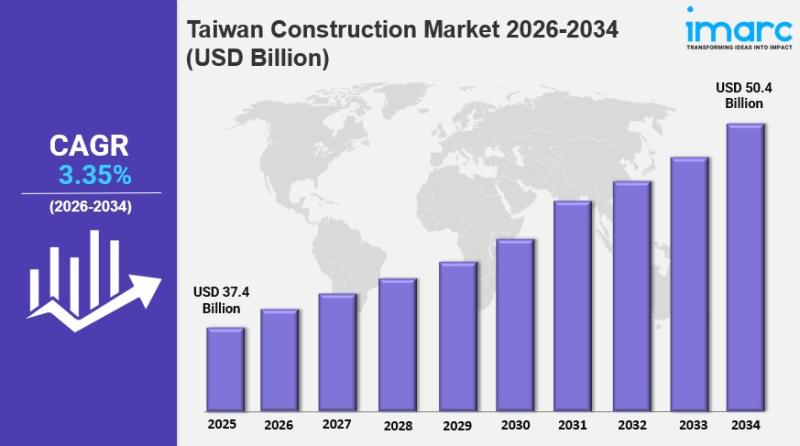

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

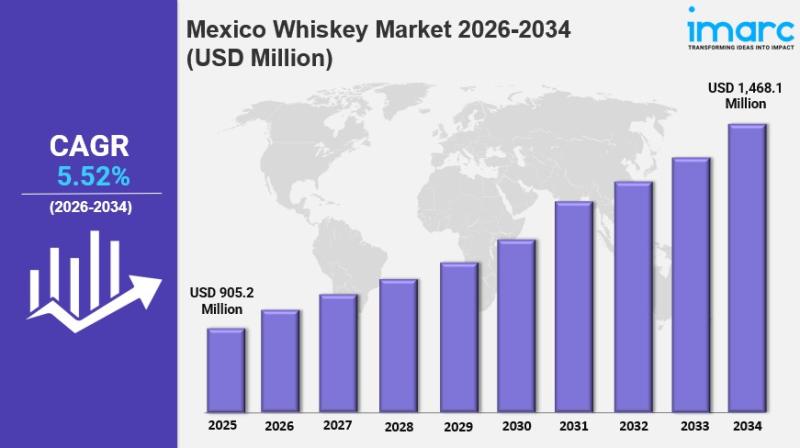

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

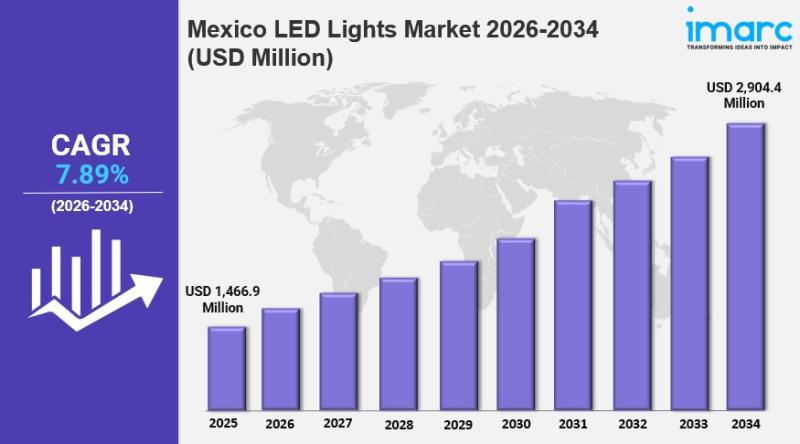

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

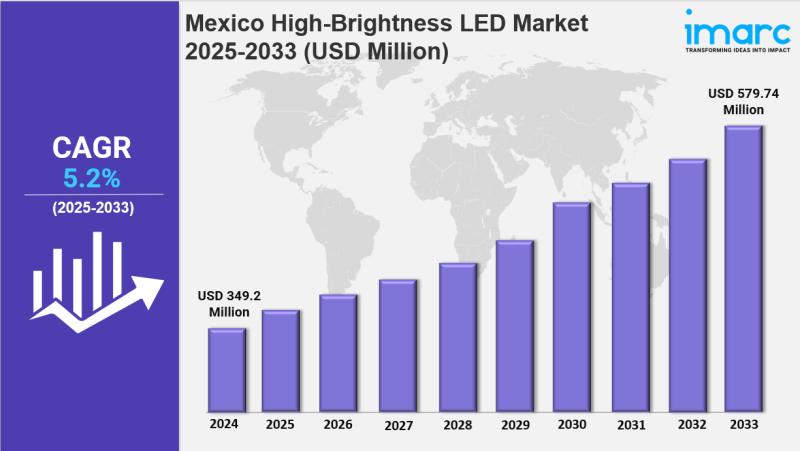

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…