Press release

Cards & Payments Market Analysis 2024 -2033: Forecasted Market Size, Top Segments, And Largest Region

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2033The Business Research Company offers in-depth market insights through Cards & Payments Global Market Report 2024, providing businesses with a competitive advantage by thoroughly analyzing the market structure, including estimates for numerous segments and sub-segments.

Market Size And Growth Forecast:

The cards & payments market size has grown strongly in recent years. It will grow from $989.8 billion in 2023 to $1085.55 billion in 2024 at a compound annual growth rate (CAGR) of 9.7%. The growth in the historic period can be attributed to emergence of electronic payment systems, introduction of credit and debit cards, globalization and cross-border transactions, consumer shift towards online shopping, enhanced security measures.

The cards & payments market size is expected to see strong growth in the next few years. It will grow to $1544.86 billion in 2028 at a compound annual growth rate (CAGR) of 9.2%. The growth in the forecast period can be attributed to rise of mobile payments, expansion of open banking initiatives, continued growth of e-commerce, regulatory developments, sustainability in payments. Major trends in the forecast period include contactless payments surge, digital wallet adoption, cryptocurrency integration, biometric authentication, subscription and recurring payments.

Get Free Sample Of This Report-

https://www.thebusinessresearchcompany.com/sample.aspx?id=3576&type=smp

Market Segmentation:

The cards & payments market covered in this report is segmented -

1) By Type: Cards, Payments

2) By Institution Type: Banking Institutions, Non-Banking Institutions

3) By Application: Food And Groceries, Health And Pharmacy, Restaurants And Bars, Consumer Electronics, Media And Entertainment, Travel And Tourism, Other Applications

Subsegments Covered: Credit Card, Debit Card, Charge Card, Prepaid Card

Major Driver - E-Commerce Boom Fuels Accelerated Growth In The Cards And Payments Market

The rise in the e-commerce industry is expected to propel the cards and payments market going forward. E-commerce refers to the buying and selling of goods and services over the Internet. Cards and payments are the backbone of e-commerce, providing the necessary infrastructure for businesses to conduct transactions online. For instance, in August 2023, according to the United States Census Bureau, a US-based government agency, compared to the second quarter of 2022, the estimate for e-commerce in the second quarter of 2023 climbed by 7.5% (or 1.4%), while overall retail sales rose by 0.6% (or 0.4%). 15.4% of all sales in the second quarter of 2023 were made through online stores. Therefore, the rise in the e-commerce industry is driving the cards and payments market.

Competitive Landscape:

Major companies operating in the cards & payments market report are Apple Inc., China Construction Bank Corporation (CCB), Industrial and Commercial Bank of China Limited (ICBC), Nippon Telegraph and Telephone Corporation, Banco Santander S.A., American Express Company, Honeywell International Inc., Visa Inc., PayPal Holdings Inc., Johnson Controls International plc, Mastercard Incorporated, Intesa Sanpaolo S.p.A., Fiserv Inc, Franchise Payments Network Inc., Global Payments Inc, Gentex Corporation, Concardis AG, Fike Corporation, Total Pay Solutions Inc., AffiniPay Corp., BlueSnap Inc, BillGO Inc., Hochiki America Corporation, nCourt Inc., Versapay Corp., PayProTec Inc., Spreedly Inc., New West Technologies Inc., International Payout Systems Inc, Pivot Payables Corporation

Get Access To The Full Market Report -

https://www.thebusinessresearchcompany.com/report/cards-and-payments-global-market-report

Top Trend - Advancements In Card And Payment Security Strategies Employed By Industry Players

Cards and payment companies are investing in technologies and formulating guidelines to prevent card and payment fraud. In this regard, payment service providers and merchants have implemented various solutions, including the Payment Card Industry Data Security Standard (PCI DSS) compliance, EMV technology, 3-D Secure services, tokenization, biometrics, and end-to-end encryption. To combat the constantly evolving card fraud methods, the National Retail Federation (NRF) also updates its security guidelines continuously.

The Table Of Content For The Market Report Include:

1. Executive Summary

2. Cards & Payments Market Characteristics

3. Cards & Payments Market Trends And Strategies

4. Cards & Payments Market - Macro Economic Scenario

5. Cards & Payments Market Size And Growth

…..

27. Cards & Payments Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialize in various industries including manufacturing, healthcare, financial services, chemicals, and technology. The firm has offices located in the UK, the US, and India, along with a network of proficient researchers in 28 countries.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cards & Payments Market Analysis 2024 -2033: Forecasted Market Size, Top Segments, And Largest Region here

News-ID: 3412699 • Views: …

More Releases from The Business research company

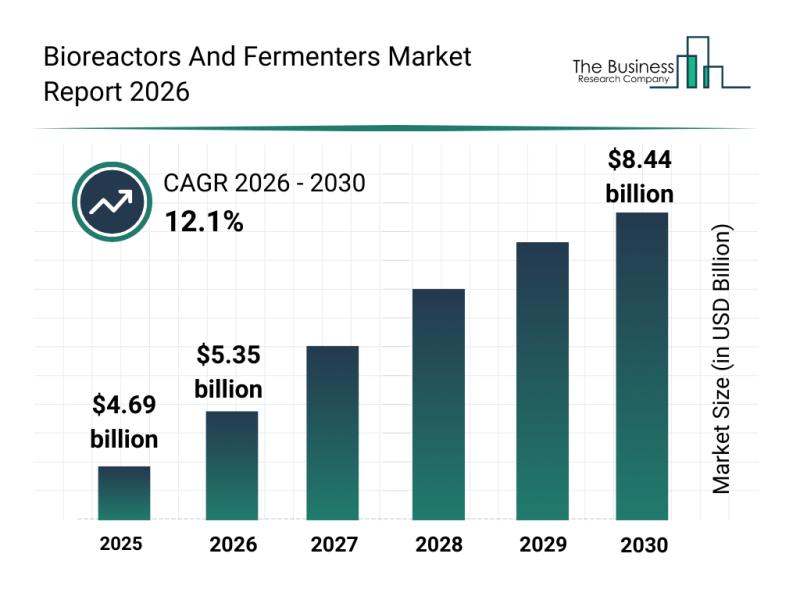

Segmentation, Major Trends, and Competitive Overview of the Bioreactors and Ferm …

The bioreactors and fermenters market is poised for significant expansion over the coming years, driven by advances in biotechnology and increasing demand for efficient bioprocessing technologies. This sector is attracting considerable attention due to its crucial role in the development and production of biologics, biosimilars, and cell and gene therapies. Let's explore the market's forecasted size, major players, emerging trends, and key segments shaping its future.

Projected Growth and Market Size…

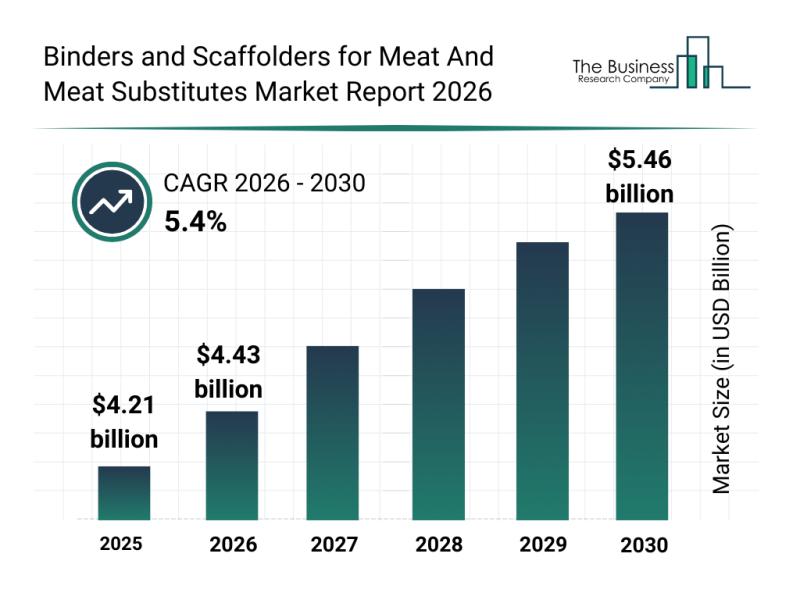

Competitive Landscape: Leading Companies and New Entrants in the Binders and Sca …

The market for binders and scaffolders used in meat and meat substitutes is gaining significant traction as the food industry shifts toward innovative protein sources and sustainable alternatives. This sector is expected to expand notably in the coming years, driven by advancements in technology and evolving consumer preferences. Let's explore the market's projected growth, the major players influencing its development, emerging trends, and the key segments shaping its future.

Projected Market…

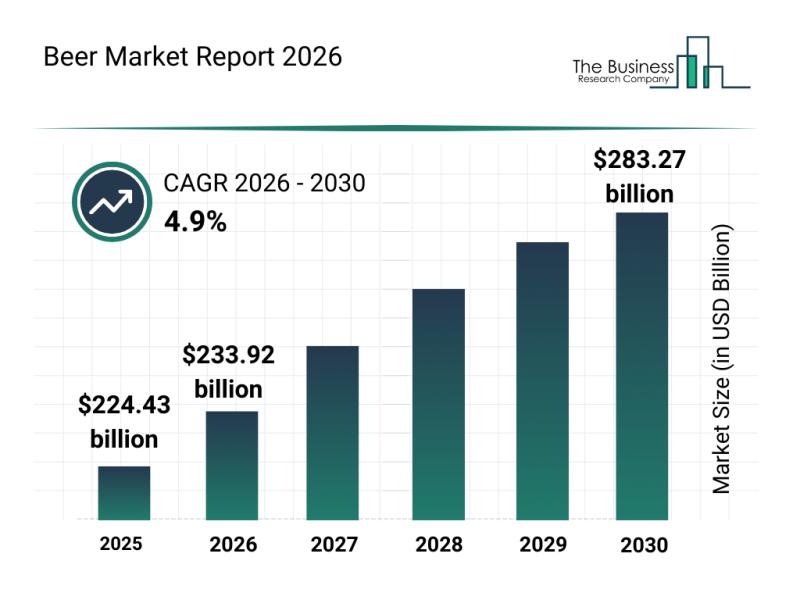

Future Perspectives: Key Trends Shaping the Beer Market Up to 2030

The beer market is poised for steady expansion over the coming years, driven by evolving consumer preferences and innovations in brewing. This sector is witnessing notable shifts that promise to shape its future through 2030. Let's explore the market's size forecast, leading players, influential trends, and segmentation to better understand where the beer industry is heading.

Projected Growth Trajectory of the Beer Market Size Through 2030

The beer market is…

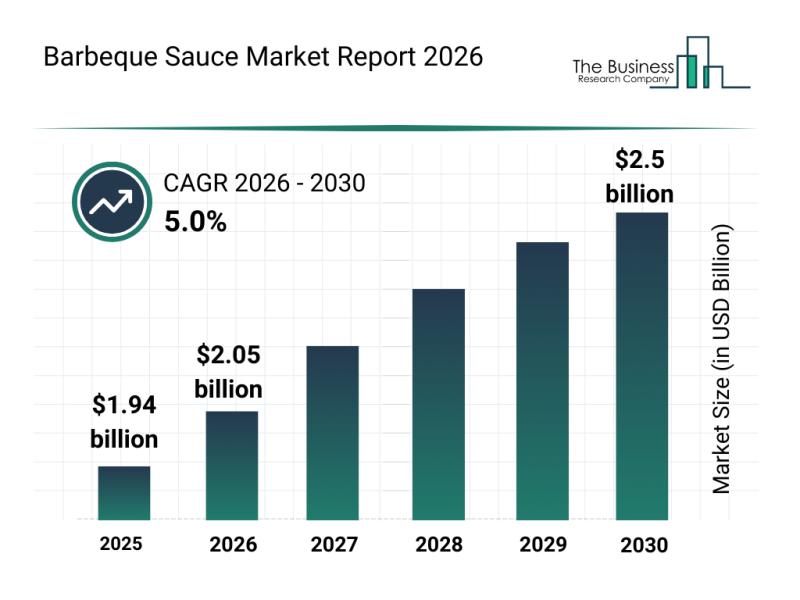

Leading Companies Reinforce Their Presence in the Barbeque Sauce Market

The barbeque sauce market is poised for significant expansion over the coming years, driven by evolving consumer preferences and innovative product offerings. As tastes shift towards healthier and more diverse options, this sector is attracting both established brands and new entrants eager to capture growing demand. Let's explore the market's projected size, key players, emerging trends, and segment breakdown to understand the landscape better.

Projected Growth and Market Size of the…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…