Press release

Usage-Based Insurance Market Share, Size, Growth, Trends And Forecast 2024-2032

IMARC Group's report titled "Usage-Based Insurance Market Report by Type (Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Manage-How-You-Drive (MHYD), and Others), Technology (OBD II, Black Box, Smartphones, and Others), Vehicle Type (Light-Duty Vehicle (LDV), Heavy-Duty Vehicle (HDV)), Vehicle Age (New Vehicles, Used Vehicles), and Region 2024-2032". The global usage-based insurance market size reached US$ 51.4 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 307.6 Billion by 2032, exhibiting a growth rate (CAGR) of 21.3% during 2024-2032.For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/usage-based-insurance-market/requestsample

Factors Affecting the Growth of the Usage-Based Insurance Industry:

●Advancements in Telematics Technology:

Telematics involves the collection and transmission of real-time data from vehicles to insurers, enabling a deeper understanding of driver behavior. In addition, a global positioning system (GPS), accelerometers, and other sensors in vehicles provide vast information, such as speed, acceleration, braking, and the time of day of a vehicle. This data allows insurers to personalize insurance premiums based on individual driving habits. Apart from this, technological advancements benefit in improving the accuracy of risk assessment, reducing the chances of fraudulent claims, and enabling insurers to better tailor their offerings.

●Rising Need for Cost-Effective Solutions:

The increasing adoption of usage-based insurance (UBI), as it is cost-effective for both insurers and policyholders, is propelling the growth of the market. In line with this, insurers can benefit from UBI programs by gaining access to real-time data on driver behavior. This data allows them to accurately assess risk, identify safe drivers, and reduce fraudulent claims. Furthermore, insurers can offer lower premiums to safe drivers by having a clearer understanding of individual risk profiles. Besides this, safe driving behaviors, such as obeying speed limits, avoiding hard braking, and driving during less congested times, can lead to savings on insurance premiums.

●Increasing Adoption of Connected Vehicles:

The rising adoption of connected vehicles that are equipped with telematics systems is bolstering the growth of the market. In addition, telematic systems can collect and transmit a wide range of data related to driving behavior. Apart from this, connected vehicles simplify the enrollment process for UBI, as policyholders do not need to install additional hardware or devices in their cars. This convenience encourages more drivers to participate in UBI programs. Furthermore, key insurers are refining their pricing models and offering even more personalized premiums.

Leading Companies Operating in the Global Usage-Based Insurance Industry:

●Aioi Nissay Dowa Insurance UK Ltd

●Allianz SE

●Allstate Insurance Company

●American International Group Inc.

●Assicurazioni Generali S.p.A.

AXA

●Liberty Mutual Insurance Company

Mapfre S.A.

●Progressive Casualty Insurance Company

●State Farm Automobile Mutual Insurance Company

●TomTom International BV.

●UnipolSai Assicurazioni S.p.A. (Unipol Gruppo S.p.A)

Explore the full report with table of contents: https://www.imarcgroup.com/usage-based-insurance-market

Usage-Based Insurance Market Report Segmentation:

By Type:

●Pay-As-You-Drive (PAYD)

●Pay-How-You-Drive (PHYD)

●Manage-How-You-Drive (MHYD)

●Others

Pay-as-you-drive (PAYD) represents the largest segment as it allows policyholders to pay premiums based on the distance driven.

By Technology:

●OBD II

●Black Box

●Smartphones

●Others

Black box holds the biggest market share, which can be attributed to the rising demand for enhanced transparency.

By Vehicle Type:

●Light-duty Vehicle (LDV)

●Heavy-duty Vehicle (HDV)

Light-duty vehicle (LDV) accounts for the largest market share on account of the escalating demand for cost-effective and reliable insurance solutions.

By Vehicle Age:

●New Vehicles

●Used Vehicles

New vehicles exhibit a clear dominance in the market due to increasing preferences for personalized insurance solutions.

Regional Insights:

●North America: (United States, Canada)

●Asia Pacific: (China, Japan, India, South Korea, Australia, Indonesia, Others)

●Europe: (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

●Latin America: (Brazil, Mexico, Others)

●Middle East and Africa

North America enjoys the leading position in the usage-based insurance market, which can be accredited to the rising adoption of advanced technologies for accurate data collection and seamless user experiences.

Global Usage-Based Insurance Market Trends:

The increasing utilization of advanced data analytics and artificial intelligence (AI) algorithms is propelling the growth of the market. Moreover, insurers are leveraging these technologies to analyze telematics data more effectively. This allows for enhanced risk assessment, the identification of emerging trends, and the development of more precise pricing models. The rising awareness among individuals about UBI programs is impelling the market growth. Besides this, people are becoming more informed about the cost-saving opportunities associated with UBI and are willing to share their driving data, which is bolstering the market growth.

Explore full report with table of contents:

Positive Airway Pressure Devices: https://www.imarcgroup.com/positive-airway-pressure-devices-market

Polyols Market: https://www.imarcgroup.com/polyols-market

Specialty Spirits Market: https://www.imarcgroup.com/specialty-spirits-market

Still Images Market: https://www.imarcgroup.com/still-images-market

Kids Trolley Bags Market: https://www.imarcgroup.com/kids-trolley-bags-market

Screw Pumps Market: https://www.imarcgroup.com/screw-pumps-market

Cattle Healthcare Market: https://www.imarcgroup.com/cattle-healthcare-market

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARCs information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the companys expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Usage-Based Insurance Market Share, Size, Growth, Trends And Forecast 2024-2032 here

News-ID: 3412654 • Views: …

More Releases from IMARC Group

Cost of Setting Up a Dicalcium Phosphate Production Plant & DPR 2026

Setting up a dicalcium phosphate production plant positions investors within a strategically important segment of the global animal nutrition and food additives industry, driven by increasing demand for feed-grade phosphates, mineral supplements, and pharmaceutical excipients. As modern livestock farming practices advance, animal nutrition requirements become more sophisticated, and the need for high-quality calcium and phosphorus supplementation grows, dicalcium phosphate continues to gain traction across animal feed manufacturing, pharmaceutical formulations, and…

India Online Insurance Market Report 2026-2034: Size, Share, Growth, Trends, Ins …

According to IMARC Group's report titled "India Online Insurance Market Size, Share, Trends and Forecast by Insurance Type, Enterprise Size, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Online Insurance Market Overview

The India online insurance market size reached USD 10.4 Billion in 2025 and is expected to grow to USD 20.8 Billion by 2034, exhibiting a CAGR of…

India Bed Linen Industry Report: Market Size, Demand Surge & Future Forecast 202 …

Introduction:

According to IMARC Group's report titled "India Bed Linen Market Size, Share, Trends and Forecast by Type, Application, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

How Big is the India Bed Linen Market?

The India bed linen market size was valued at USD 18.50 Billion in 2025 and is projected to reach USD 34.81 Billion by 2034,…

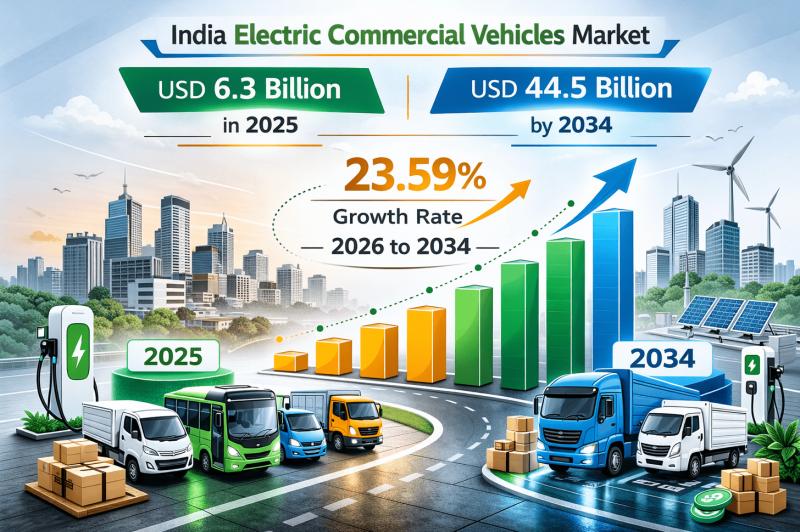

India Electric Commercial Vehicles Market Report 2026-2034: Size, Growth, Trends …

According to IMARC Group's report titled "India Electric Commercial Vehicles Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion Type, Battery Capacity, End User, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Electric Commercial Vehicles Market Analysis

The India electric commercial vehicles market size reached USD 6.3 Billion in 2025 and is expected to grow to USD 44.5…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…