Press release

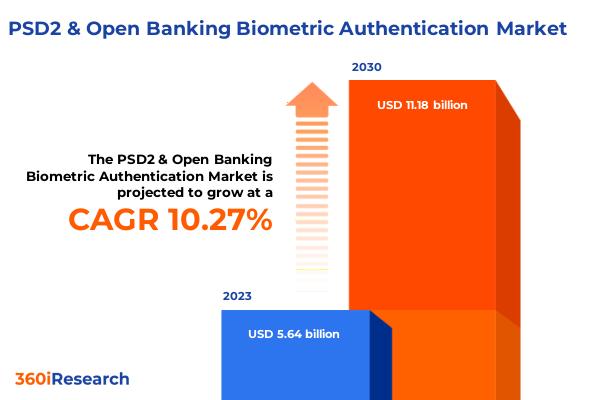

PSD2 & Open Banking Biometric Authentication Market worth $11.18 billion by 2030, growing at a CAGR of 10.27% - Exclusive Report by 360iResearch

The "PSD2 & Open Banking Biometric Authentication Market by Function (Authentication & Authorization, Content Based Attacks Detection, Data Encryption), End Users (Banks, Customers, Marchants) - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.The Global PSD2 & Open Banking Biometric Authentication Market to grow from USD 5.64 billion in 2023 to USD 11.18 billion by 2030, at a CAGR of 10.27%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/psd2-open-banking-biometric-authentication?utm_source=openpr&utm_medium=referral&utm_campaign=sample

The second payment services directive (PSD2) is a regulation in the European Union aimed at reshaping the payment landscape by introducing enhanced consumer protection and fostering innovation among payment services. A foundation of PSD2 is the strong customer authentication (SCA) mandate, ensuring that electronic payments are safeguarded by at least two verification elements categorized as knowledge, possession, and inherence. Within this framework, biometric authentication has emerged as a critical tool in open banking, offering a secure and user-friendly way to authenticate users through unique biological attributes such as fingerprints, facial recognition, or iris scans. Embracing biometrics aligns with PSD2's security directives and also elevates user experience by eliminating dependency on conventional tokens or passwords, thereby mitigating fraud risks and streamlining access to financial services. The advent of mobile banking applications has catalyzed a notable upsurge in the integration of biometric authentication within the financial sphere, driving the adoption of PSD2-compliant and open banking biometric solutions. This is complemented by the escalating significance of application program interfaces (APIs) across financial sectors, optimizing the synergy between various banking services and applications. Further propelling this trend is the imperative need to mitigate high-security risks associated with financial transactions, underpinning the necessity of robust multi-factor authentication mechanisms. However, the substantial costs involved, alongside the potential for inaccuracies and false positives that could undermine system efficiency, hinder the adoption of these solutions. Despite these hurdles, there are profound opportunities on the horizon; financial institutions are increasingly pivoting online, prompted by customer-centric regulatory enhancements, presenting ripe conditions for tech startups to innovate in the biometric authentication domain within the PSD2 and open banking biometric authentication market.

In the Americas, the adaptation to PSD2 and open banking biometric authentication has seen a gradual increase, with the market showing a positive trajectory for digital payment methods. Financial institutions in North America, particularly in the United States and Canada, are investing substantially in biometric technologies to meet the growing demand for secure and convenient authentication methods. Latin America is also witnessing growth in PSD2 and open banking biometric authentication adoption, spurred by regulatory changes and digital transformation initiatives among banks aiming to improve financial inclusivity. In the EMEA region, the market for PSD2 and open banking biometric authentication has shown robust growth, primarily influenced by the European Union's regulatory framework. The PSD2 directive has been a major catalyst in this market, as it emphasizes strong customer authentication (SCA), where biometrics play a pivotal role. European financial institutions are actively incorporating biometric technologies to comply with these regulations and to offer a more personalized banking experience. The Middle East and Africa are also seeing emerging adoption trends, with financial sectors innovating to include biometric systems for identity verification and transaction authentication. Within the APAC region, the adoption of PSD2 and open banking biometric authentication is varied, with advanced economies including Japan, Australia, and Singapore, being at the forefront of implementation. These countries are early adopters of innovative banking technologies, and there is an increasing preference for PSD2 and open banking biometric authentication solutions due to their enhanced security and convenience. Emerging economies in this region have also started embracing biometric authentication systems, aligning with the shift towards digital banking services.

Market Segmentation & Coverage:

This research report categorizes the PSD2 & Open Banking Biometric Authentication Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Function, market is studied across Authentication & Authorization, Content Based Attacks Detection, Data Encryption, Identity Tracking, Message Validation, and Traffic Management. The Authentication & Authorization commanded largest market share of 21.22% in 2023, followed by Identity Tracking.

Based on End Users, market is studied across Banks, Customers, Marchants, and Payment Service Provider. The Banks commanded largest market share of 39.84% in 2023, followed by Payment Service Provider.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 36.74% in 2023, followed by Europe, Middle East & Africa.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/psd2-open-banking-biometric-authentication?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the PSD2 & Open Banking Biometric Authentication Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the PSD2 & Open Banking Biometric Authentication Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the PSD2 & Open Banking Biometric Authentication Market, highlighting leading vendors and their innovative profiles. These include Apple Inc., Avanade Inc., Banfico Ltd, Capgemini SE, CardinalCommerce Corporation, ClearBank Ltd., Enfuce Financial Services Ltd., Fujitsu Limited, Google LLC by Alphabet Inc., Incode Technologies Inc., InfoCert S.p.A., INFOSISTEMA, SISTEMAS DE INFORMAÇÃO, S.A. by JYON Group, iProov Limited, LexisNexis Risk Solutions Inc. by RELX Group PLC, Mastercard International Incorporated, Metro Bank PLC, Mollie B.V., Moneyhub Financial Technology Ltd, National Westminster Bank plc, Nok Nok Labs, Inc., Okta, Inc., Plaid Financial Ltd., Salt Edge Inc., TAS S.p.A., Tata Consultancy Services Limited, Tell Money Limited, Temenos Headquarters SA, and Thales Group.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. PSD2 & Open Banking Biometric Authentication Market, by Function

7. PSD2 & Open Banking Biometric Authentication Market, by End Users

8. Americas PSD2 & Open Banking Biometric Authentication Market

9. Asia-Pacific PSD2 & Open Banking Biometric Authentication Market

10. Europe, Middle East & Africa PSD2 & Open Banking Biometric Authentication Market

11. Competitive Landscape

12. Competitive Portfolio

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the PSD2 & Open Banking Biometric Authentication Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the PSD2 & Open Banking Biometric Authentication Market?

3. What is the competitive strategic window for opportunities in the PSD2 & Open Banking Biometric Authentication Market?

4. What are the technology trends and regulatory frameworks in the PSD2 & Open Banking Biometric Authentication Market?

5. What is the market share of the leading vendors in the PSD2 & Open Banking Biometric Authentication Market?

6. What modes and strategic moves are considered suitable for entering the PSD2 & Open Banking Biometric Authentication Market?

Read More @ https://www.360iresearch.com/library/intelligence/psd2-open-banking-biometric-authentication?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release PSD2 & Open Banking Biometric Authentication Market worth $11.18 billion by 2030, growing at a CAGR of 10.27% - Exclusive Report by 360iResearch here

News-ID: 3412202 • Views: …

More Releases from 360iResearch

Rising Incidence of Human Metapneumovirus in Vulnerable Populations Boosts Globa …

In recent years, the silent ascent of human metapneumovirus (HMPV) infections has begun to capture significant attention within the realm of infectious diseases. As we advance in medical science, unraveling complexities of age-old pathogens like common influenza or emerging illnesses like COVID-19, a critical discourse has been emerging around HMPV. Particularly, there seems to be a burgeoning acknowledgment of its growing impact on vulnerable global populations, propelling an increased demand…

The Meat Alternatives Market size was estimated at USD 9.39 billion in 2023 and …

From Appetite to Advocacy: The Rising Demand for Meat Alternatives

In recent years, the global food industry has been undergoing a remarkable transformation, driven primarily by an increasing consumer demand for healthier, sustainable, and ethically sourced food products. This seismic shift has brought traditional meat alternatives and high-protein plant-based foods into the spotlight. As the world becomes more conscious of the implications of meat consumption on health and the environment, the…

The Mobility-as-a-Service Market size was estimated at USD 264.80 billion in 202 …

Unpacking the Surge in Investments and Collaborations to Bolster Mobility-as-a-Service

In recent years, as urban landscapes continually evolve, a transformative shift known as Mobility-as-a-Service (MaaS) has reshaped the way we perceive transportation. Marked by the integration of various forms of transport services into a single accessible on-demand mobility solution, MaaS is rapidly gaining traction across global cities. As an emerging paradigm, it's not just shaping the future of travel but also…

The Data Center Services Market size was estimated at USD 56.65 billion in 2023 …

Smart City Revolutions: Why Data Center Colocation is the Future Backbone

In the era of digital transformation, urban landscapes across the globe are undergoing a seismic shift toward becoming "smart cities." The concept of a smart city revolves around using digital technology, IoT (Internet of Things), AI, and data analytics at an unprecedented scale to improve urban infrastructure, manage resources efficiently, and enhance the quality of life for citizens. A vital…

More Releases for PSD2

PSD2 and Finance Software Solutions Market Review: All Eyes on 2024 Outlook

The Latest published market study on Global PSD2 and Finance Software Solutions Market provides an overview of the current market dynamics in the PSD2 and Finance Software Solutions space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2029. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify…

The Growing Importance of PSD2 and Open Banking Market: Today's World

This comprehensive report thoroughly assesses various regions, estimating the volume of the global PSD2 and Open Banking market within each region during the projected timeframe. The report is meticulously crafted and includes valuable information on the current market status, historical data, and projected outlook. Furthermore, it presents a detailed market analysis, segmenting it based on regions, types, and applications. The report closely monitors key trends that play a crucial role…

EPSM recommends harmonised migration plans on PSD2-SCA

EPSM appreciates the acknowledgement by the European Banking Authority (EBA) that the payments trade needs a flexible approach with the introduction of Regulatory Technical Requirements (RTS) for Strong Customer Authentication (SCA). These will become applicable from 14th September 2019.

EPSM has suggested timeframes for a harmonised migration approach on PSD2-SCA. EPSM is aware that migration plans are currently being negotiated by payment industry participants, together with their respective national authorities,…

Preparing for PSD2 and Open Banking

Summary

The EU’s Directive on Payment Services 2 (PSD2) will accelerate the fragmentation of Europe’s retail banking industry following the global financial crisis. The opportunities brought about by PSD2 will energize banks with strong brand awareness and advanced digital offerings into pushing the boundaries of open banking. Increased competition from card issuers and non-bank third-party providers will prompt steady mid-cap players to fundamentally evaluate their strategies. Banks that are competing on…

2016 PSD2 and Open Banking Market Size, Share, Trends & Analysis Report

The EU’s Directive on Payment Services 2 (PSD2) will accelerate the fragmentation of Europe’s retail banking industry following the global financial crisis. The opportunities brought about by PSD2 will energize banks with strong brand awareness and advanced digital offerings into pushing the boundaries of open banking. Increased competition from card issuers and non-bank third-party providers will prompt steady mid-cap players to fundamentally evaluate their strategies. Banks that are competing on…

PSD2 and Open Banking will energize banks with strong brand awareness

The EUs Directive on Payment Services 2 (PSD2) will accelerate the fragmentation of Europes retail banking industry following the global financial crisis. The opportunities brought about by PSD2 will energize banks with strong brand awareness and advanced digital offerings into pushing the boundaries of open banking. Increased competition from card issuers and non-bank third-party providers will prompt steady mid-cap players to fundamentally evaluate their strategies. Banks that are competing on…