Press release

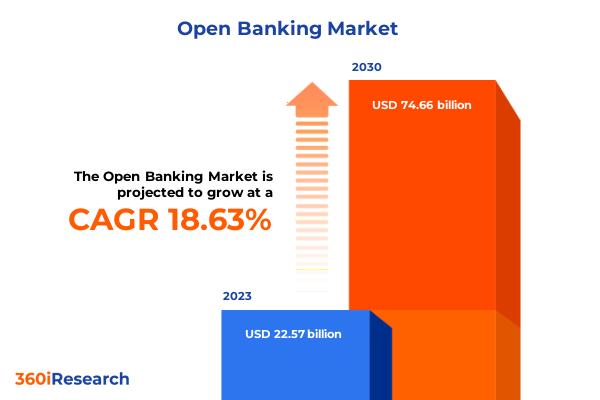

Open Banking Market worth $74.66 billion by 2030, growing at a CAGR of 18.63% - Exclusive Report by 360iResearch

The "Open Banking Market by Services (Banking & Capital Markets, Digital Currencies, Payments), Deployment (Cloud, On-Premise), Distribution Channel - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.The Global Open Banking Market to grow from USD 22.57 billion in 2023 to USD 74.66 billion by 2030, at a CAGR of 18.63%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/open-banking?utm_source=openpr&utm_medium=referral&utm_campaign=sample

Open banking is a novel banking practice that involves the provision of open access to consumer banking, transactions, and other important financial data from banks and non-bank financial institutions through the utilization of application programming interfaces (APIs) to third-party financial service providers. The primary aim of open banking is to increase innovation in the realm of the financial services industry, thereby offering consumers more options, enhanced service quality, and better rates. The increasing need for financial transparency and tailored banking services, regulatory mandates promoting financial data sharing, and global efforts to enhance customer experiences have led to significant demand for open banking services and solutions. Additionally, the growing adoption of mobile banking and payment platforms fosters further market expansion. However, the lack of standardization across banking APIs and varying degrees of regulatory support for open banking across diverse geographical locations hampered the growth of the industry. Additionally, concerns and issues related to data privacy and security can also pose significant hurdles to achieving customer trust and satisfaction. However, key players are exploring cybersecurity measures in API integration, developing uniform API standards, and investigating blockchain's role in open banking to improve the security and privacy features of open banking. The advent of A.I. and machine learning can be harnessed for insights into customer behavior, risk management, and personalized product recommendations, thereby creating new revenue streams.

The Americas region, particularly the U.S. and Canada, is characterized by the presence of a robust banking, financial services, and insurance(BFSI) sector, which has driven several advancements in the realm of open banking. Consumer's need for seamless financial experiences has propelled banks and fintech companies to create partnerships voluntarily. Customer purchasing behavior indicates a trend toward mobile banking solutions and personalized financial products. The E.U. is a pioneer in regulating open banking, with Payment Services Directive Two (PSD2) being a significant legislative framework promoting banking data portability and innovation. It has led to the rise of numerous third-party providers (TPPs), creating a competitive environment that caters well to consumer needs for transparency and diversified financial services. E.U. consumers are increasingly adopting digital wallets and peer-to-peer payment systems, pushing the market towards more collaborative banking practices. Additionally, the presence of several established regulations pertaining to digital privacy and financial security has created a highly standardized and robust environment for the growth of open banking. The APAC region supports several government initiatives and supports to improve the BFSI sector, which creates growth opportunities for open banking services or solutions. The Unified Payments Interface (UPI) by the Indian government has advanced the payment space. Investments and research are primarily directed towards scalability to manage the massive volume of transactions while ensuring system stability. Many nations such as Singapore, China, and Japan are publishing guidelines for open banking and outlining plans to make bank data available through APIs, thereby signaling new avenues for the growth of the industry.

Market Segmentation & Coverage:

This research report categorizes the Open Banking Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Services, market is studied across Banking & Capital Markets, Digital Currencies, Payments, and Value Added Services. The Payments is projected to witness significant market share during forecast period.

Based on Deployment, market is studied across Cloud and On-Premise. The On-Premise is projected to witness significant market share during forecast period.

Based on Distribution Channel, market is studied across Aggregators, App Market, and Bank Channel. The Aggregators is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Europe, Middle East & Africa commanded largest market share of 37.21% in 2023, followed by Americas.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/open-banking?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Open Banking Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Open Banking Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Open Banking Market, highlighting leading vendors and their innovative profiles. These include Alkami Technology Inc., Amplify Platform. by TrillerNet, Banco Bilbao Vizcaya Argentaria, S.A. by PNC Financial Services, Bud Financial, Cashfree Payments India Private Limited, Codat Limited, Cross River Bank, Crédit Agricole CIB, DirectID, Finastra, Fincity by Mastercard, Flinks, GoCardless Ltd., Jack Henry & Associates, Inc., M2P Solutions Private Limited, Minna Technologies AB, Nubank, Plaid Inc. by Visa, Railsbank Technology Ltd., Salt Edge, Stitch, Stripe, Inc., Token.io Ltd., TrueLayer Ltd., and Yodlee by Envestnet.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Open Banking Market, by Services

7. Open Banking Market, by Deployment

8. Open Banking Market, by Distribution Channel

9. Americas Open Banking Market

10. Asia-Pacific Open Banking Market

11. Europe, Middle East & Africa Open Banking Market

12. Competitive Landscape

13. Competitive Portfolio

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Open Banking Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Open Banking Market?

3. What is the competitive strategic window for opportunities in the Open Banking Market?

4. What are the technology trends and regulatory frameworks in the Open Banking Market?

5. What is the market share of the leading vendors in the Open Banking Market?

6. What modes and strategic moves are considered suitable for entering the Open Banking Market?

Read More @ https://www.360iresearch.com/library/intelligence/open-banking?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Open Banking Market worth $74.66 billion by 2030, growing at a CAGR of 18.63% - Exclusive Report by 360iResearch here

News-ID: 3407770 • Views: …

More Releases from 360iResearch

Rising Incidence of Human Metapneumovirus in Vulnerable Populations Boosts Globa …

In recent years, the silent ascent of human metapneumovirus (HMPV) infections has begun to capture significant attention within the realm of infectious diseases. As we advance in medical science, unraveling complexities of age-old pathogens like common influenza or emerging illnesses like COVID-19, a critical discourse has been emerging around HMPV. Particularly, there seems to be a burgeoning acknowledgment of its growing impact on vulnerable global populations, propelling an increased demand…

The Meat Alternatives Market size was estimated at USD 9.39 billion in 2023 and …

From Appetite to Advocacy: The Rising Demand for Meat Alternatives

In recent years, the global food industry has been undergoing a remarkable transformation, driven primarily by an increasing consumer demand for healthier, sustainable, and ethically sourced food products. This seismic shift has brought traditional meat alternatives and high-protein plant-based foods into the spotlight. As the world becomes more conscious of the implications of meat consumption on health and the environment, the…

The Mobility-as-a-Service Market size was estimated at USD 264.80 billion in 202 …

Unpacking the Surge in Investments and Collaborations to Bolster Mobility-as-a-Service

In recent years, as urban landscapes continually evolve, a transformative shift known as Mobility-as-a-Service (MaaS) has reshaped the way we perceive transportation. Marked by the integration of various forms of transport services into a single accessible on-demand mobility solution, MaaS is rapidly gaining traction across global cities. As an emerging paradigm, it's not just shaping the future of travel but also…

The Data Center Services Market size was estimated at USD 56.65 billion in 2023 …

Smart City Revolutions: Why Data Center Colocation is the Future Backbone

In the era of digital transformation, urban landscapes across the globe are undergoing a seismic shift toward becoming "smart cities." The concept of a smart city revolves around using digital technology, IoT (Internet of Things), AI, and data analytics at an unprecedented scale to improve urban infrastructure, manage resources efficiently, and enhance the quality of life for citizens. A vital…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…