Press release

Auto Insurance Market: Growing at a CAGR of 8.5%, Top Players, Size, Share, Market Worth, Trends by 2027

The global auto insurance market is experiencing significant growth, and is anticipated to grow considerably in next few years. Auto insurance is an insurance provided for cars, trucks, motorcycles, and other vehicles. The demand for auto insurance is increasing among consumers, as it ensures financial protection in the event of vehicle damage or theft. Along with financial protection of vehicle, it provides third-party liability coverage to insured person for causing injury, death, or property damage to other drivers, passengers, or pedestrians. Hence, having car insurance is a legal requirement and necessity with the right level of cover in many states.As per the report published by Allied Market Research, the global auto insurance market generated $739.30 billion in 2019, and is anticipated to hit $1.06 trillion by 2027, registering a CAGR of 8.5% from 2020 to 2027.

Rise in number of accidents, implementation of stringent government regulation for adoption of auto insurance, and surge in automobile sales across the globe drive the growth of the global auto insurance market. However, adoption of autonomous vehicles hampers the market growth. On the contrary, increase in demand for third-party liability coverage in emerging economies would open new opportunities for market players in the future.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞: https://www.alliedmarketresearch.com/request-sample/2450

Covid-19 scenario:

Insurers have provided new developments in existing policies such as pay-as-you-drive, usage-based insurance, or telematics insurance to improve the claim processes and deal with unprecedented circumstances.

Prolonged lockdown has stopped the travel business across the world and decreased the demand for auto insurance.

However, relaxation regarding traveling is anticipated to rise the demand for auto insurance post-pandemic.

The global auto insurance market is divided on the basis of coverage, distribution channel, vehicle age, application, and region. Based on product, the market is classified into third party liability coverage, and collision/comprehensive/other optional coverages. It is projected to manifest the highest CAGR of 10.1% from 2020 to 2027. However, the third-party liability coverage segment dominated in 2019, contributing to nearly three-fifths of the market.

𝐆𝐞𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐰𝐢𝐭𝐡 𝐲𝐨𝐮'𝐫𝐞 𝐑𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭𝐬:: https://www.alliedmarketresearch.com/request-for-customization/2450?reqfor=covid

On the basis of distribution channel, the market is divided into insurance agents/brokers, direct response, banks, and others. Based on application, the market is segmented into personal and commercial. The personal segment held the largest share in 2019, accounting for nearly three-fourths of the market. However, the commercial segment is projected to manifest the highest CAGR of 9.6% during the forecast period.

Based on vehicle age, the market is segmented into new vehicles and used vehicles. The global auto insurance market is analyzed across various regions such as North America, LAMEA, Asia-Pacific, and Europe. The market across Asia-Pacific is anticipated to register the highest CAGR of 10.2% during the forecast period. However, the market across North America held the lion's share in 2019, contributing to nearly two-fifths of the market.

Enquire For Discount: https://www.alliedmarketresearch.com/purchase-enquiry/2450

The global auto insurance market report includes an in-depth analysis of the market players such as People's Insurance Company of China, CHINA PACIFIC INSURANCE CO., State Farm Mutual Automobile Insurance, Admiral Group Plc, Allstate Insurance Company, Ping An Insurance (Group) Company of China, Ltd., Berkshire Hathaway Inc., GEICO, Allianz, and Tokio Marine Group.

Key Benefits For Stakeholders

The study provides an in-depth analysis of the global auto insurance market share along with the current trends and future estimations to elucidate the imminent investment pockets.

Information about key drivers, restraints, and opportunities and their impact analysis on the global auto insurance market size is provided in the report.

Porter's five forces analysis illustrates the potency of the buyers and suppliers operating in the auto insurance industry.

The quantitative analysis of the market from 2019 to 2027 is provided to determine the market potential.

𝐀𝐜𝐜𝐞𝐬𝐬 𝐀𝐕𝐄𝐍𝐔𝐄 - 𝐀 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧-𝐁𝐚𝐬𝐞𝐝 𝐋𝐢𝐛𝐫𝐚𝐫𝐲 (𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐎𝐧-𝐃𝐞𝐦𝐚𝐧𝐝, 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧-𝐁𝐚𝐬𝐞𝐝 𝐏𝐫𝐢𝐜𝐢𝐧𝐠 𝐌𝐨𝐝𝐞𝐥) @ https://shorturl.at/tDEF4

Auto Insurance Market Report Highlights

By Coverage

THIRD PARTY LIABILITY COVERAGE

COLLISION/COMPREHENSIVE/ OTHER OPTIONAL COVERAGES

By Distribution Channel

Insurance Agents/Brokers

Direct Response

Banks

Others

By Vehicle Age

New Vehicles

Used Vehicles

By Application

Personal

Commercial

By Region

North America (U.S., Canada)

Europe (Germany, UK, France, Italy, Spain, Belgium, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Top Trending Reports:

Neobanking Market https://www.alliedmarketresearch.com/neobanking-market

Digital Remittance Market https://www.alliedmarketresearch.com/digital-remittance-market

Banking Wearable Market https://www.alliedmarketresearch.com/banking-wearable-market-A06966

Commodity Contracts Brokerage Market https://www.alliedmarketresearch.com/commodity-contracts-brokerage-market-A15387

Credit Default Swaps Market https://www.alliedmarketresearch.com/credit-default-swap-market-A15388

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://steemit.com/@poojabfsi

https://www.quora.com/profile/Pooja-BFSI

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Auto Insurance Market: Growing at a CAGR of 8.5%, Top Players, Size, Share, Market Worth, Trends by 2027 here

News-ID: 3406991 • Views: …

More Releases from Allied Market Research

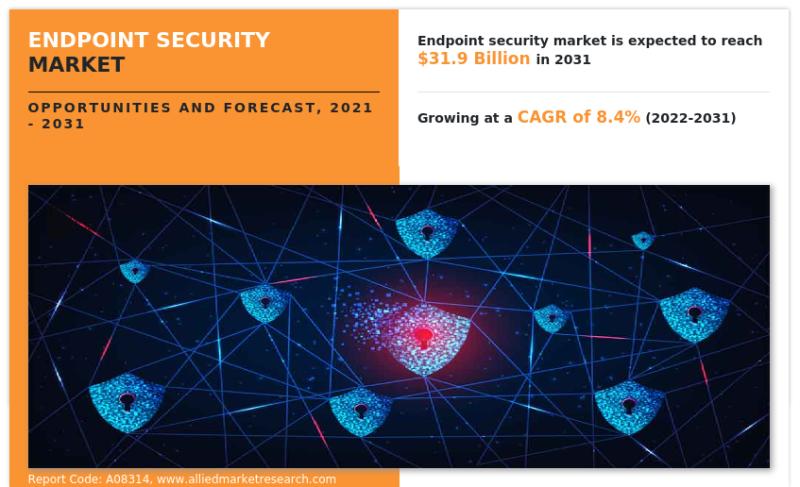

Endpoint Security Market Size Growing at 8.4% CAGR Reach USD 31.9 Billion by 203 …

Allied Market Research published a new report, titled, "Endpoint Security Market Size Growing at 8.4% CAGR Reach USD 31.9 Billion by 2031." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

Smart Manufacturing Market Size Growing at 13.7% CAGR Reach USD 860 Billion by 2 …

Allied Market Research published a new report, titled, "Smart Manufacturing Market Size Growing at 13.7% CAGR Reach USD 860 Billion by 2031." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

Data Virtualization Market Sizze Growing at 21.7% CAGR Reach USD 22.2 Billion by …

According to the report published by Allied Market Research, Data Virtualization Market Sizze Growing at 21.7% CAGR Reach USD 22.2 Billion by 2031. The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers valuable able guidance to leading players, investors, shareholders, and startups in devising strategies for sustainable growth and gaining a competitive edge in the market.

Driving Factors…

Europe IoT Market Growing at 19.0% CAGR Reach USD 12.30 Billion by 2031

According to the report published by Allied Market Research, Europe IoT Market Growing at 19.0% CAGR Reach USD 12.30 Billion by 2031. The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers valuable able guidance to leading players, investors, shareholders, and startups in devising strategies for sustainable growth and gaining a competitive edge in the market.

The Europe IoT…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…