Press release

Robo Advisory Market: Unraveling the Best Platforms for Automated Wealth Management | At CAGR 31.8% By 2027

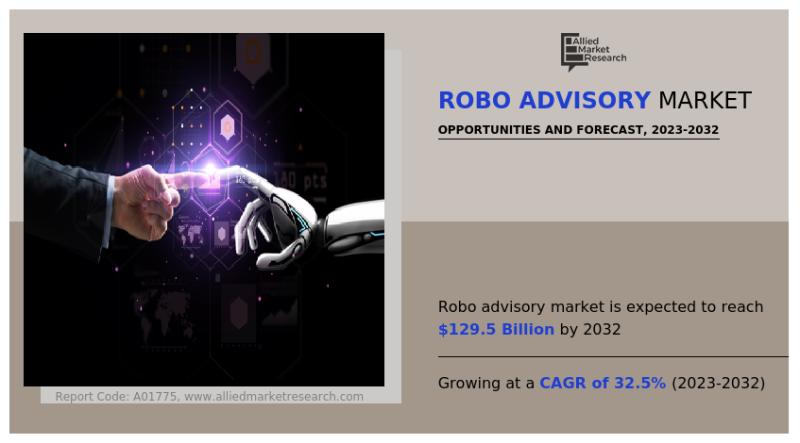

Allied Market Research published a report, titled, "Robo Advisory Market By Business Model (Pure Robo Advisors and Hybrid Robo Advisors), Service Providers (FinTech Robo Advisors, Banks, Traditional Wealth Managers and Others), Service Type (Direct Plan-based/Goal-based and Comprehensive Wealth Advisory), and End User (Retail Investor and High Net Worth Individuals (HNIs)): Global Opportunity Analysis and Industry Forecast, 2020-2027".According to the report, the global robo advisory industry garnered $4.51 billion in 2019, and is projected to generate $41.07 billion by 2027, manifesting a CAGR of 31.8% from 2020 to 2027.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂

https://www.alliedmarketresearch.com/request-sample/2105

Robo advisory platforms simplify wealth management by offering automated services accessible through online or mobile platforms. They provide easy-to-understand guidance and present complex financial information in a simplified manner, making them accessible even to individuals without a financial background.

Prime Determinants of Growth

Surge in adoption of advanced technologies, trend of digitization in financial institutions, and favorable government initiatives drive the growth of the global robo advisory market. However, security & compliance issues restrain the market growth. On the contrary, technological innovations and potential in developing countries are expected to provide new opportunities in the coming years.

Covid-19 Scenario:

Robo-advisors have been adopted extensively for wealth and assets management during the fluctuating conditions of the market taking place during the Covid-19 pandemic. These advisors assist in preventing investors from illogical and impulsive decision-making during times like these.

As robo advisors offers a huge exposure to individuals to gain expertise in diversification & management of the portfolio by investing in stocks, bonds, and certificate of deposit (CD), the need of these services gained traction to survive and sustain during the turbulent economic conditions.

The Hybrid Robo Advisors Segment to Retain Its Dominance By 2027

By business model, the hybrid robo-advisors segment accounted for the largest market share, contributing to nearly four-fifths of the global robo advisory market in 2019, and will continue its lead position during the forecast period. Moreover, this segment is expected to register the largest CAGR of 32.6% from 2020 to 2027. This is attributed to increase in international trades & investments and rise in requirements for customized portfolios for funds. The report also discusses the pure robo-advisors segment.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧:

https://www.alliedmarketresearch.com/request-for-customization/2105

The HNIs Segment to Maintain Its Dominance in Terms of Revenue By 2027

By end user, the HNIs segment contributed to the largest share in 2019, holding around two-thirds of the global robo advisory market, and is projected to maintain its dominance in terms of revenue by 2027. This is due to massive shift toward HNIs from traditional advisory services in developed and developing countries. However, the retail segment is expected to manifest at the fastest CAGR of 33.6% from 2020 to 2027, owing to increase in adoption of automated portfolio management across the globe.

North America to Maintain Its Leadership Status By 2027

By region, North America contributed to the highest market share in 2019, accounting for more than half of the global robo advisory market, and will maintain its leadership status by 2027. This is due to investments in mutual funds or ETFs made through robo advisor software. However, Asia-Pacific is expected to witness the highest CAGR of 34.8% during the forecast period, owing to key market players of the software establishing their presence in the emerging countries including China and India.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐘𝐨𝐮𝐫 𝐄𝐯𝐞𝐫𝐲 𝐃𝐨𝐮𝐛𝐭 𝐇𝐞𝐫𝐞:

https://www.alliedmarketresearch.com/purchase-enquiry/2105

Is robo-advisor a good investment?

Key Insights: Robo-advisors are valuable for investors looking for automated, diversified portfolios. These platforms, with their low costs and minimums, are especially beneficial for novice investors seeking effective portfolio management.

Leading Market Players

Betterment

Charles Schwab Corporation

Blooom

Personal Capital Corporation

FMR LLC

SIGFIG

SoFi

Wealthfront Corporation

The Vanguard Group, Inc.

WiseBanyan, Inc.

𝐀𝐜𝐜𝐞𝐬𝐬 𝐀𝐕𝐄𝐍𝐔𝐄 - 𝐀 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧-𝐁𝐚𝐬𝐞𝐝 𝐋𝐢𝐛𝐫𝐚𝐫𝐲 (𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐎𝐧-𝐃𝐞𝐦𝐚𝐧𝐝, 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧-𝐁𝐚𝐬𝐞𝐝 𝐏𝐫𝐢𝐜𝐢𝐧𝐠 𝐌𝐨𝐝𝐞𝐥) @ https://bit.ly/3ULFjLi

Avenue is a user-based library of global market report database, provides comprehensive reports pertaining to the world's largest emerging markets. It further offers e-access to all the available industry reports just in a jiffy. By offering core business insights on the varied industries, economies, and end users worldwide, Avenue ensures that the registered members get an easy as well as single gateway to their all-inclusive requirements.

𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Foreign Exchange Services Market https://www.alliedmarketresearch.com/foreign-exchange-services-market-A07394

Surety Market https://www.alliedmarketresearch.com/surety-market-A31385

Accounts Payable Automation Market https://www.alliedmarketresearch.com/accounts-payable-automation-market-A53548

LendTech Market https://www.alliedmarketresearch.com/lendtech-market-A47393

Bancassurance Market https://www.alliedmarketresearch.com/bancassurance-market

Insurance Aggregators Market https://www.alliedmarketresearch.com/insurance-aggregators-market-A31712

WealthTech Solutions Market https://www.alliedmarketresearch.com/wealthtech-solutions-market-A31614

Online Insurance Market https://www.alliedmarketresearch.com/online-insurance-market-A31675

Syndicated Loans Market https://www.alliedmarketresearch.com/syndicated-loans-market-A31434

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://steemit.com/@monikak

https://www.quora.com/profile/Monika-Kawade-2

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Robo Advisory Market: Unraveling the Best Platforms for Automated Wealth Management | At CAGR 31.8% By 2027 here

News-ID: 3406278 • Views: …

More Releases from www.alliedmarketresearch.com

Pet Insurance Market Soars: Projected to Hit $38.3 Billion by 2033 as Demand for …

According to a new report published by Allied Market Research, titled, "Pet Insurance Market, By Policy Coverage (Accident Only, Accident and Illness, and Others), By Animal Type (Dogs, Cats, and Others), and By Sales Channel (Agency, Broker, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". The pet insurance market was valued at $10.10 billion in 2023, and is estimated to reach $38.3 billion by 2033, growing at a CAGR…

Manual Spray Guns Market to Hit $2.6 Billion by 2032 | Key Growth Drivers & Oppo …

Prime determinants of growth

The demand for manual spray guns, which are mostly used for painting consumer durables, has increased because of this need, particularly in developing nations like India, China, and Vietnam. Additionally, there is a greater need for manual spray guns from car manufacturers due to the rising demand for automobiles around the world, particularly in industrialized nations like Europe and North America.

Download PDF Sample Report: www.alliedmarketresearch.com/request…ple/111362

Due to…

Hygienic Cladding Market Poised for Growth: Global Trends & Opportunities 2023-2 …

According to the report, the global hygienic cladding market generated $2.8 billion in 2022, and is anticipated to generate $6 billion by 2032, rising at a CAGR of 8.3% from 2023 to 2032.

Prime Determinants of Growth

The increased awareness & demand for health-related products, the increasing need for safe & healthy environments in healthcare facilities, and hygienic wall cladding's affordability & durability than traditional tiling methods are the factors expected to…

AI in Insurance Market Poised to Reach $45.74 Bn Globally by 2031, Soaring at a …

Global Opportunity Analysis and Industry Forecast, 2021-2031". According to the report, the global AI in insurance industry generated $2.74 billion in 2021, and is anticipated to generate $45.74 billion by 2031, witnessing a CAGR of 32.5% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A11615

Higher deployment cost of AI, advanced machine learning, and lack of skilled labor hamper the market growth. On the contrary, surge in government initiatives…

More Releases for Robo

Robo Advisory Market is Rising

According to the latest research report published by Market Data Forecast, the global robo advisory market is expected to grow at a CAGR of 54.2% from 2024 to 2029, and the global market size is anticipated to be worth USD 154.6 billion by 2029 from USD 17.73 billion in 2024.

The robo advising market is expanding rapidly, fueled by technical developments and rising demand for automated financial solutions. These platforms use…

Global Robo-Advisory Market, Global Robo-Advisory Industry, Covid-19 Impact Glob …

The Robo-advisory market is expected to grow from USD X.X million in 2020 to USD X.X million by 2026, at a CAGR of X.X% during the forecast period. The Global Robo-Advisory Market report is a comprehensive research that focuses on the overall consumption structure, development trends, sales models and sales of top countries in the global Robo-advisory market. The report focuses on well-known providers in the global Robo-advisory industry, market…

Global Robo-Advisory Market (2015-2023)

Global robo-advisory market

Robo-advisors are independent financial planning services driven by algorithms and supported by a digital platform with no human intervention. They collect information from their customers at first through an online survey to understand their financial situations and ultimate goals. With this information they make portfolios of investments by calculating their risk and returns along with profits for long-term. The global robo-advisory market is expected to grow at an…

Global Robo-advisory Market (2015-2023)

Market Research Report Store offers a latest published report on Robo-advisory Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report. This report focuses on the key global Robo-advisory players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.To analyze the Robo-advisory with respect to individual growth trends, future…

Robo-Advisors: Mapping The Competitive Landscape

The wealth management industry has long been resilient to the digitization process observed in the wider financial services space. This has started to change, however, with interest in robo-advice platforms increasing in 2015. The automated investment management space is hence becoming ever-more competitive as new entrants launch propositions. Supported by software developers, traditional wealth managers have also started exploring the digital advice market. Competition will thus increase further, although robo-advisors…

Robo-Advisors: Mapping the Competitive Landscape

Summary

The wealth management industry has long been resilient to the digitization process observed in the wider financial services space. This has started to change, however, with interest in robo-advice platforms increasing in 2015. The automated investment management space is hence becoming ever-more competitive as new entrants launch propositions. Supported by software developers, traditional wealth managers have also started exploring the digital advice market. Competition will thus increase further, although robo-advisors…