Press release

U.S. Insurance Brokerage for Employee Benefits Market Predicted to Hit USD 70.11 billion by 2032, with a 7.5% CAGR

The U.S. insurance brokerage for employee benefits market encompasses a sector within the broader insurance industry that specializes in assisting employers in the design, procurement, and management of employee benefits programs. These programs typically include health insurance, retirement plans, life insurance, disability coverage, and an array of supplementary benefits such as wellness initiatives and financial planning services. Insurance brokers in this market act as intermediaries between employers seeking to provide competitive and tailored benefits packages and insurance providers offering a range of products and services.According to a new report published by Allied Market Research, titled, "U.S. Insurance Brokerage for Employee Benefits Market by brokerage type, product type, and organization size: country opportunity analysis and industry forecast, 2023-2032," The U.S. insurance brokerage for employee benefits market size was valued at $34.74 billion in 2022, and is projected to reach $70.11 billion by 2032, registering a CAGR of 7.5%.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A278701

The U.S. insurance brokerage for employee benefits market is poised for growth and adaptation as organizations recognize the strategic importance of employee benefits in talent management. Technology will continue to play a pivotal role in improving efficiency and enhancing customer experiences. Regulatory changes, though challenging, will also spur innovation and new service offerings. Success in this market will depend on a commitment to expertise, client-centricity, and adaptability to meet the ever-evolving needs of employers and their workforce.

The U.S. insurance brokerage for employee benefits is expected to witness significant growth during the forecast period, owing to the increase in complexity of employee benefits programs, including health insurance, retirement plans, and wellness initiatives, and the need for competitive advantages in talent acquisition. However, the frequent changes in healthcare, tax, and retirement regulations, and the massive availability of alternative platforms for purchasing insurance policies are the major factors limiting the market growth. On the contrary, the rising importance of employee well-being and mental health and the implementation of technologies in existing products and service lines are expected to offer remunerative opportunities for the expansion of the U.S. insurance brokerage for employee benefits market.

Procure Complete Report (465 Pages PDF with Insights, Charts, Tables, and Figures) @ https://bit.ly/3pni64T

By product type, the group health segment led the U.S. insurance brokerage for employee benefits market in 2022 and is projected to maintain its dominance in the future, due to the rise in the cost of healthcare, increase in the number of employees with chronic health conditions, and the expanding regulatory landscape, which is driving market growth in the direct sales segment. However, the stop-loss insurance segment is expected to witness the highest growth, owing to the rapid development of new and innovative stop-loss insurance plans, along with the expansion of telemedicine services and the integration of stop-loss insurance with other employee benefits, which further propelling the growth of the U.S. insurance brokerage for employee benefits market.

The COVID-19 pandemic had a notable impact on the size of the U.S. insurance brokerage for employee benefits market. Initially, the market experienced a contraction as businesses grappled with economic uncertainty and postponed benefit-related decisions. However, as the situation stabilized, employers recognized the crucial role of comprehensive employee benefits in retaining and attracting talent, leading to a gradual recovery. The market saw a notable increase in demand for health insurance brokerage services, reflecting the heightened importance of health coverage during the pandemic. Thus, numerous factors are expected to contribute to overcoming the growth of the market during the period.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/A278701

Key Findings of The Study

By brokerage type, the retail segment accounted for the largest U.S. insurance brokerage for employee benefits market share in 2022.

Based on product type, the group health segment generated the highest revenue in 2022.

Based on organization size, the large enterprises segment generated the highest revenue in 2022.

The major players operating in the U.S. Acrisure, LLC, Alliant Insurance Services, Inc., Aon Plc, Arthur J. Gallagher & Co., Assured Partners, Brown & Brown Insurance, Lockton Companies, Mercer LLC, USI Insurance Services, Willis Towers Watson, AmWins Group, HUB International Ltd., CRC Group/Truist Insurance Holding, RT Specialty (Ryan Specialty), Risk Strategies, Jencap, Accretive Insurance Solutions, Bridge Specialty Group, Brown&Riding, ARC Excess & Surplus, LLC, U.S. Risk Insurance Group, and Program Brokerage Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

𝐀𝐜𝐜𝐞𝐬𝐬 𝐀𝐕𝐄𝐍𝐔𝐄 - 𝐀 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧-𝐁𝐚𝐬𝐞𝐝 𝐋𝐢𝐛𝐫𝐚𝐫𝐲 (𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐎𝐧-𝐃𝐞𝐦𝐚𝐧𝐝, 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧-𝐁𝐚𝐬𝐞𝐝 𝐏𝐫𝐢𝐜𝐢𝐧𝐠 𝐌𝐨𝐝𝐞𝐥) @ https://shorturl.at/tDEF4

Avenue is a subscription-based repository containing an extensive database of global market reports, offering comprehensive insights into the world's largest emerging markets. With quick and easy e-access to a wide range of industry reports, Avenue provides registered members with a convenient single gateway to fulfill all their business needs. From detailed insights on various industries and economies to analysis of end user trends worldwide, Avenue ensures that its members have access to all-inclusive business intelligence.

Key Market Players:

Acrisure, LLC

Alliant Insurance Services, Inc.

Aon Plc

Arthur J. Gallagher & Co.

Assured Partners

Brown & Brown Insurance

Lockton Companies

Mercer LLC

USI Insurance Services

Willis Towers Watson

AmWins Group

HUB International Ltd.

CRC Group/Truist Insurance Holding

RT Specialty (Ryan Specialty)

Risk Strategies

Jencap

Accretive Insurance Solutions

Bridge Specialty Group

Brown&Riding

ARC Excess & Surplus, LLC

U.S. Risk Insurance Group

Program Brokerage Corporation

𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Event Insurance Market https://www.alliedmarketresearch.com/event-insurance-market-A14929

Blockchain Government Market https://www.alliedmarketresearch.com/blockchain-government-market-A108804

E-brokerage Market https://www.alliedmarketresearch.com/e-brokerage-market-A15390

Augmented Reality in BFSI Market https://www.alliedmarketresearch.com/augmented-reality-in-bfsi-market-A11749

POS Security Market https://www.alliedmarketresearch.com/pos-security-market-A31871

Multi-Cloud Networking in Fintech Market https://www.alliedmarketresearch.com/multi-cloud-networking-in-fintech-market-A31735

Video Banking Service Market https://www.alliedmarketresearch.com/video-banking-service-market-A31651

Public Cloud in BFSI Market https://www.alliedmarketresearch.com/public-cloud-in-bfsi-market-A15481

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://www.quora.com/profile/Pooja-BFSI

https://medium.com/@psaraf568

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. Insurance Brokerage for Employee Benefits Market Predicted to Hit USD 70.11 billion by 2032, with a 7.5% CAGR here

News-ID: 3400532 • Views: …

More Releases from Allied Market Research

Cattle Feed Market Size worth USD 78.3 Billion Globally, by 2027 at a CAGR of 4. …

Cattle feed market size was estimated at $73.5 billion in 2019, and is expected to hit $78.3 billion by 2027, and registering with a CAGR of 4.4% from 2021 to 2027.

Replacement of traditional cattle feed with nutritionally balanced compound feed and livestock industrialization drive the growth of the global cattle feed market. On the other hand, challenges related to the gap between demand and supply of cattle feed act as…

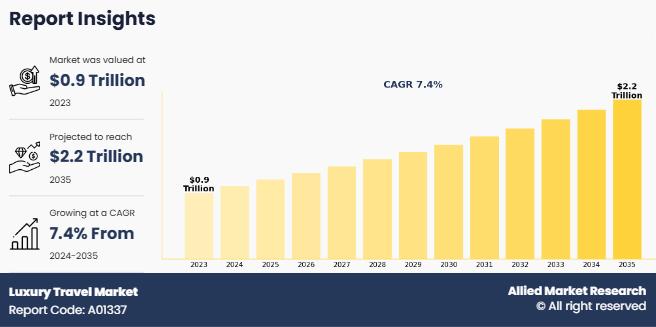

Luxury Travel Market Size to Hit US$ 2149.7 billion by 2035 at 7.4% CAGR

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Hotel Toiletries Market is likely to expand US$ 50.5 billion at 10.8% CAGR by 20 …

The hotel toiletries market was valued at $17.9 billion in 2021, and is estimated to reach $50.5 billion by 2031, growing at a CAGR of 10.8% from 2022 to 2031.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/75060

There is a greater demand for hotel toiletries with the growth of the tourism industry and the rise in international travel. Improved transportation, economic growth, globalization, technology advancements, and other initiatives have…

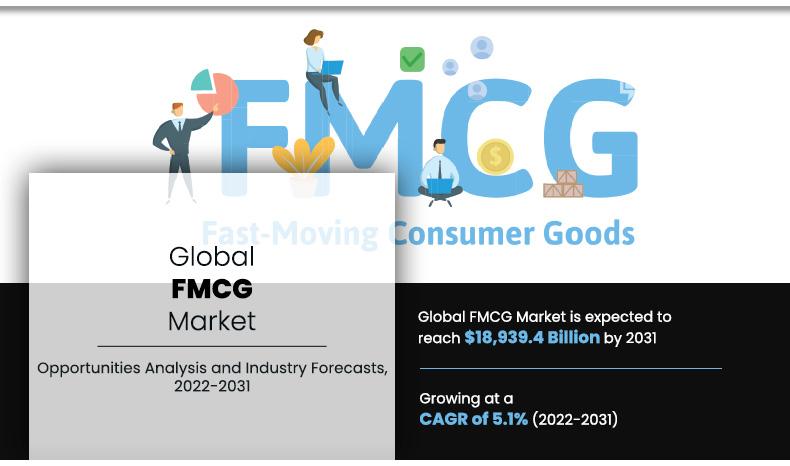

FMCG Industry Set to Achieve a Valuation of US$ 18,939.4 billion, Riding on a 5. …

According to a new report published by Allied Market Research, titled, "FMCG Market by Product Type, Production Type, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2022-2031," the global FMCG market size is expected to reach $18,939.4 billion by 2031 at a CAGR of 5.1% from 2022 to 2031.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/5148

Fast-moving consumer goods (FMCG) is the largest combination of consumer goods…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…