Press release

Trends in the Trade Credit Insurance Market: Unveiling New Avenues for Research and Innovation | anticipated to reach $18.14 billion by 2027

As per the report published by Allied Market Research, the global trade credit insurance market generated $9.38 billion 2019, and is anticipated to reach $18.14 billion by 2027, growing at a CAGR of 8.6% from 2020 to 2027.Surge in focus toward mitigating risk regarding non-payment across several types of goods & services and expansion of trade in various regions that demand credit insurance drive the growth of the global trade credit insurance market. However, risk of non-payment by foreign buyers hampers the market growth. On the contrary, benefits such as sales support & account receivable support are expected to create lucrative opportunities for the market players in the future.

Download Sample Report: https://www.alliedmarketresearch.com/request-sample/8670

Covid-19 scenario:

The Covid-19 and following lockdown resulted in uncertainty and protectionism in the global trade. Moreover, several regions imposed lockdown, which hampered business finances.

Thus, trade credit insurance products have gained momentum during the pandemic as it protects businesses from unforeseen circumstances.

Therefore, trade credit insurance products are gaining momentum during the pandemic situation. This, in turn, has become one of the major growth factors for the trade credit insurance industry during the global health crisis.

The global trade credit insurance market is segmented on the basis of component, enterprise size, application, coverage, industry vertical, and region.

Based on component, the products segment held the lion's share in 2019, accounting for more than four-fifths of the total revenue. However, the services segment is estimated to manifest the highest CAGR of 10.6% during the forecast period.

Enquire More: https://www.alliedmarketresearch.com/purchase-enquiry/8670

On the basis of enterprise size, the large enterprise segment dominated the market in 2019, contributing to around three-fourths of the market. However, the small enterprise segment is expected to register the highest CAGR of 12.3% during the forecast period.

The global trade credit insurance market is analyzed across several regions such as North America, Europe, Asia-Pacific, and LAMEA. The market across Europe held the largest share in 2019, accounting for nearly two-fifths of the market. However, the market across Asia-Pacific is estimated to register the fastest CAGR of 10.7% during the forecast period.

𝐀𝐜𝐜𝐞𝐬𝐬 𝐀𝐕𝐄𝐍𝐔𝐄 - 𝐀 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧-𝐁𝐚𝐬𝐞𝐝 𝐋𝐢𝐛𝐫𝐚𝐫𝐲 (𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐎𝐧-𝐃𝐞𝐦𝐚𝐧𝐝, 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧-𝐁𝐚𝐬𝐞𝐝 𝐏𝐫𝐢𝐜𝐢𝐧𝐠 𝐌𝐨𝐝𝐞𝐥) @ bit.ly/3wztqhi

Avenue is a subscription-based repository containing an extensive database of global market reports, offering comprehensive insights into the world's largest emerging markets. With quick and easy e-access to a wide range of industry reports, Avenue provides registered members with a convenient single gateway to fulfill all their business needs. From detailed insights on various industries and economies to analysis of end user trends worldwide, Avenue ensures that its members have access to all-inclusive business intelligence.

Leading Market Players: -American International Group Inc., Aon plc, Atradius N.V., Coface, Credendo, EULER HERMES, Export Development Canada, QBE Insurance (Australia) Ltd., SINOSURE, and Zurich.

Customized Report: https://www.alliedmarketresearch.com/request-for-customization/8670

The global trade credit insurance market report includes an in-depth analysis of the major market players such as American International Group Inc., Aon plc, Atradius N.V., Coface, Credendo, EULER HERMES, Export Development Canada, QBE Insurance (Australia) Ltd., SINOSURE, and Zurich.

Related Reports:

Fire Insurance Market https://www.alliedmarketresearch.com/fire-insurance-market-A11106

Mutual Fund Assets Market https://www.alliedmarketresearch.com/mutual-fund-assets-market-A06932

Auto Finance Market https://www.alliedmarketresearch.com/auto-finance-market-A10390

Student Loan Market https://www.alliedmarketresearch.com/student-loan-market-A17046

Contactless Payments Market https://www.alliedmarketresearch.com/contactless-payments-market

Spain Health Insurance Third-Party Administrator Market https://www.alliedmarketresearch.com/spain-health-insurance-third-party-administrator-market-A264461

South Africa Asset-based Lending Market https://www.alliedmarketresearch.com/south-africa-asset-based-lending-market-A74622

Europe Gadget Insurance Market https://www.alliedmarketresearch.com/europe-gadget-insurance-market-A47276

Singapore Student Loan Market https://www.alliedmarketresearch.com/singapore-student-loan-market-A18746

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://www.quora.com/profile/Pooja-BFSI

https://medium.com/@psaraf568

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trends in the Trade Credit Insurance Market: Unveiling New Avenues for Research and Innovation | anticipated to reach $18.14 billion by 2027 here

News-ID: 3400382 • Views: …

More Releases from Allied Market Research

Activewear Market is likely to expand US$ 771.8 billion at 6.2% CAGR by 2032

The activewear market size was valued at $425.5 billion in 2022, and is estimated to reach $771.8 billion by 2032, growing at a CAGR of 6.2% from 2023 to 2032.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/3249

Market Overview

Activewear is apparel, footwear, and accessories meant for sports and physical activities such as sprinting, yoga, bicycle riding, and other sports. Activewear comprises lightweight, breathable fabrics that allow for…

Sports Apparel Market Size To Exceed USD 410.8 billion By 2032 | CAGR of 6%

The sports apparel market size was valued at $230.60 billion in 2022, and is estimated to reach $410.8 billion by 2032, growing at a CAGR of 6% from 2023 to 2032.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/711

Sports apparel is mainly worn during workout sessions or while playing sports. It is designed to provide comfort and agility while performing physical movements. These apparels are made using breathable…

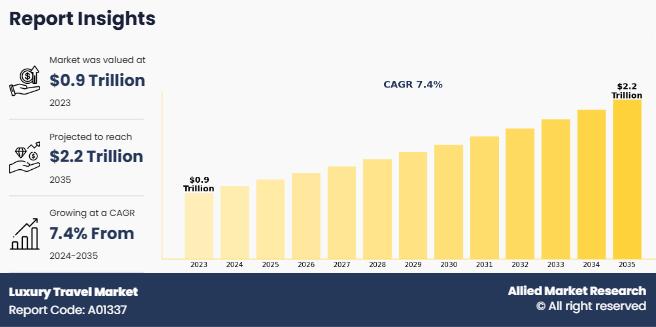

Luxury Travel Market Can Touch Approximately USD 2149.7 billion, Developing at a …

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Cleaning Services Market is poised to reach USD 111,498.8 million, growing at a …

The global cleaning services market size was valued at $55,715.0 million in 2020, and is projected to reach $111,498.8 million by 2030, registering a CAGR of 6.5% from 2021 to 2030. The floor care segment was the highest contributor to the market, with $12,293.8 million in 2020, and is estimated to reach $22,820.2 million by 2030, at a CAGR of 5.7% during the forecast period.

Request The Sample PDF…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…