Press release

Private 5G-as-a-Service Market Size to Surpass USD 34.1 Billion by 2031 | Demand, Industry Insight

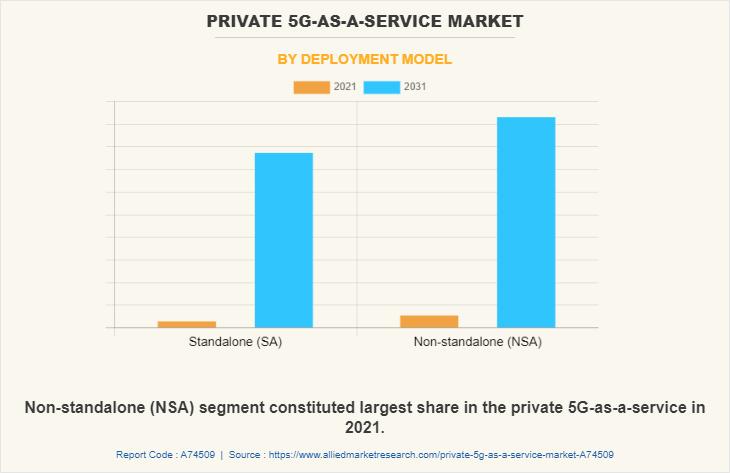

The private 5g-as-a-service market was valued at $1.6 billion in 2021, and is estimated to reach $34.1 billion by 2031, growing at a CAGR of 36.2% from 2022 to 2031.The demand for private 5G-as-a-service has increased tremendously, especially by those needing the high speed, low latency, and network capacity. In addition, there is much faster rollout and adoption of 5G as compared to 4G which is expected to provide lucrative opportunities during the private 5G-as-a-service market forecast.

Request Sample Report: https://www.alliedmarketresearch.com/request-sample/74984

The integration of private 5G-as-a-service with public 5G networks offers organizations the flexibility to leverage both private and public infrastructure as per their requirements. This hybrid approach ensures seamless connectivity and can cater to diverse use cases efficiently.

As the adoption of private 5G-as-a-service grows, there will likely be a push towards establishing open standards. These standards will facilitate interoperability among different vendors' solutions, mitigating vendor lock-in issues. Consequently, organizations will have the freedom to choose solutions that best suit their needs without being tied to a specific vendor.

For Purchase Enquiry: https://www.alliedmarketresearch.com/purchase-enquiry/74984

The low latency and high bandwidth capabilities of private 5G networks make them well-suited for edge computing applications. By processing data closer to the source, organizations can significantly reduce latency and enhance the performance of real-time applications. This shift towards edge computing will likely drive further investment and innovation in this space, bolstering the growth of the private 5G-as-a-service market.

Overall, these emerging factors underscore the increasing importance and potential of private 5G-as-a-service in enabling organizations to achieve enhanced connectivity, flexibility, and performance across a wide range of applications and use cases.

Buy Now and Get Discount: https://www.alliedmarketresearch.com/private-5g-as-a-service-market/purchase-options

Region wise, North America dominated the private 5G-as-a-service market size in 2021. This is attributed to the fact that many businesses in North America are undergoing digital transformation, which is driving the demand for advanced connectivity solutions such as private 5G networks. Furthermore, increase in adoption of Internet of Things (IoT) is driving the demand for private 5G networks, as businesses look for ways to connect and manage large numbers of IoT devices securely and efficiently.

The key players profiled in the private 5G-as-a-service market analysis are Amazon Web Services, Inc., Mavenir, Ericsson, Cisco Systems, Inc., Anterix, Infosys Limited, Verizon, AT&T Intellectual Property, Nokia, and Kyndryl Inc.

Read More: https://www.alliedmarketresearch.com/press-release/private-5g-as-a-service-market.html

David Correa

1209 Orange Street

Corporation Trust Center

Wilmington

New Castle

Delaware 19801

USA Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Private 5G-as-a-Service Market Size to Surpass USD 34.1 Billion by 2031 | Demand, Industry Insight here

News-ID: 3398618 • Views: …

More Releases from Allied Market Research

Cotton Pads Market Forecast: Projected CAGR and USD Growth for the 2024 - 2033

The global cotton pads market size was valued at $1.5 billion in 2023, and is projected to reach $2.7 billion by 2033, growing at a CAGR of 6% from 2024 to 2033. Cotton pads are used for skincare, cosmetics, and personal hygiene. They are a popular choice for applying skincare products, removing makeup, and cleansing sensitive parts of the skin since they are soft, absorbent, and disposable. These pads are…

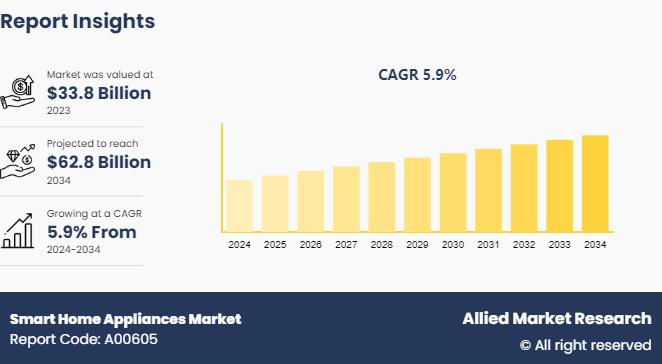

Smart Home Appliances Market 2026 : to Receive Overwhelming Hike In Revenue That …

Allied Market Research published a report, titled, "Smart Home Appliances Market by Product Type (Washing Machine, Refrigerator, Dishwasher, Air Conditioner and Others), and Technology (Wi-Fi, Radio Frequency Identification, Cellular Technology, ZigBee, Bluetooth and Others): Global Opportunity Analysis and Industry Forecast, 2024-2034". According to the report, the smart home appliances market was valued at $33.8 billion in 2023, and is estimated to reach $62.8 billion by 2034, growing at a CAGR…

Collagen Market to Surge USD 14.4 Billion by 2033, Size, Share, Emerging Trends, …

According to the report, the collagen market was valued at $5.9 billion in 2023, and is estimated to reach $14.4 billion by 2033, growing at a CAGR of 9.5% from 2024 to 2033.

The growth of the collagen market is driven by increase in consumer awareness of health and wellness, rise in demand for functional food, and expansion of applications in various industries such as pharmaceuticals, cosmetics, and dietary supplements. Innovations…

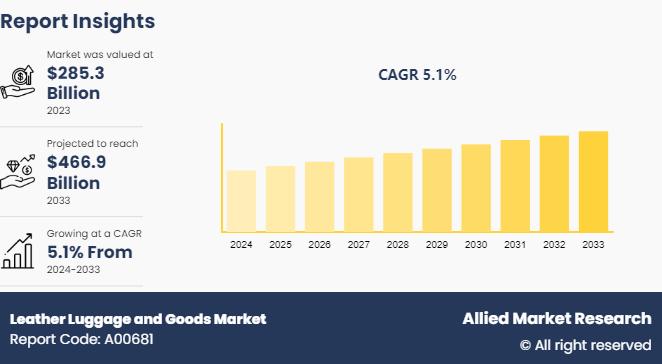

Leather Luggage and Goods Market in 2026 : Competitive Analysis and Industry For …

The global leather luggage and goods market size was valued at $285.3 billion in 2023, and is projected to reach $466.9 billion by 2033, growing at a CAGR of 5.1% from 2024 to 2033. Leather luggage comprises products such as trolley bags and suitcases used for carrying personal belongings, whereas products such as purses, wallets & belts, footwear, handbags, and others are included in the leather goods segment. Factors such…

More Releases for Private

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private asset management,private wealth management firms,middle market private e …

Private asset management is the management of assets on behalf of private individuals, families, or institutions. It involves the creation of a customized investment strategy to achieve specific financial goals, such as wealth preservation, growth, income generation, or a combination of these objectives. The assets managed can include cash and cash equivalents, stocks, bonds, real estate, private equity, and alternative investments.

https://tendawholesale.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private asset management is typically provided by…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Financing Consulting, China Private Equity Investment Corpo …

Pandacu China is a venture capital firm that focuses on early-stage investments in technology companies based in China. The firm was founded in 2015 by a group of experienced venture capitalists and entrepreneurs who have a deep understanding of the Chinese market and a strong network of contacts in the tech industry.

http://pandacuads.com/

China Private Equity Financing Consulting

Email:nolan@pandacuads.com

Pandacu China's mission is to help innovative and ambitious entrepreneurs turn their ideas into successful…