Press release

Payment Security Market Set to Soar, Projected to Reach $54.1 Billion by 2028

[Redding, California] - The global Payment Security Market is poised for remarkable expansion, projected to attain a valuation of $54.1 billion by 2028, showcasing a robust Compound Annual Growth Rate (CAGR) of 16.5% throughout the forecast period spanning from 2021 to 2028. This profound growth trajectory is underpinned by several pivotal factors, notably the escalating adoption of digital payment modes, the imperative adherence to PCI DSS guidelines, and the surge in cyber-attacks targeting digital payment platforms.In today's digital landscape, online payment security stands as the cornerstone for preserving customer privacy, safeguarding sensitive data, and fortifying financial transactions. With the proliferation of digital transactions, ensuring a secure payment ecosystem has transcended from a preference to an imperative, guarding against fraud and mitigating security vulnerabilities.

Download Sample Copy: https://www.meticulousresearch.com/download-sample-report/cp_id=5237

The escalating incidents of data breaches loom large as a significant driver propelling the ascent of the payment security market. These breaches not only inflict substantial financial losses but also catalyze the demand for robust payment security solutions to fortify digital infrastructures.

Moreover, the burgeoning utilization of payment applications across diverse industry verticals presents lucrative growth prospects for the digital payment market. However, challenges persist, including the low awareness levels regarding online payments in rural areas and the formidable cost barriers associated with advanced payment security solutions.

The Impact of COVID-19 on Payment Security

The advent of the COVID-19 pandemic has ushered in a seismic shift in consumer behavior, notably towards heightened reliance on digital payment modes. This transformative shift has notably accelerated the growth trajectory of the payment security market. According to ACI Worldwide Inc., real-time payments are poised to witness exponential growth, propelled by the pandemic-induced surge, with transactions projected to surpass half a trillion and a staggering Compound Annual Growth Rate (CAGR) of nearly 23% between 2019 and 2024.

Leading digital payment entities such as PhonePe, Paytm, and Amazon Pay have reported a substantial uptick in transactions via digital wallets since the onset of the pandemic, underscoring the accelerated digital adoption. The pandemic-induced paradigm shift has galvanized banking institutions worldwide to embrace digital transformation initiatives, recognizing online banking services as pivotal for enhancing customer retention and augmenting revenue streams through personalized offerings.

The COVID-19 pandemic has not only accelerated the adoption of a diverse array of digital banking services but has also precipitated a seismic surge in cyber-crime activities targeting digital transactions. With a notable rise in payment-related frauds, bolstering payment security measures emerges as a critical imperative to safeguard digital ecosystems against nefarious cyber threats.

For further insights into the transformative trends reshaping the payment security landscape and to navigate the post-pandemic paradigm, please speak to our esteemed analysts: https://www.meticulousresearch.com/speak-to-analyst/cp_id=5237

Payment Security Market Overview

The payment security market landscape is delineated across various parameters, encompassing offerings, platforms, payment modes, industry verticals, organization sizes, and geographical regions. The market's evolution is propelled by the escalating adoption of advanced payment security solutions, burgeoning digital wallet penetration, and the imperatives of regulatory security compliance, particularly within the Banking, Financial Services, and Insurance (BFSI) sector.

Notably, the digital wallet segment emerges as a key driver, commanding the largest share of the payment security market and poised to exhibit a robust CAGR during the forecast period. The proliferation of smartphones has catalyzed the ascendancy of digital wallets, empowering consumers and amplifying their preference for digital payment modalities.

Geographically, while North America presently dominates the global payment security landscape, the Asia-Pacific region is poised to emerge as the epicenter of growth, buoyed by widespread smartphone penetration and burgeoning internet usage. Nations such as China and India, with their universal adoption of digital wallets and a burgeoning smartphone populace, are at the forefront of the payments revolution.

Strategic Insights and Market Dynamics

The global payment security market is characterized by consolidation, with a handful of major players dictating the industry's trajectory. Key market participants such as Bluefin Payment Systems LLC, Braintree, Cybersource, and MasterCard among others, have been at the vanguard of pioneering innovative solutions to fortify payment ecosystems and mitigate cyber risks.

Buy this Report: https://www.meticulousresearch.com/Checkout/30768240

In conclusion, the payment security market's exponential growth trajectory underscores its pivotal role in fortifying digital ecosystems against evolving cyber threats. As digital transactions continue to proliferate, robust payment security measures stand as an indispensable imperative, safeguarding consumer interests and fostering trust in digital payment modalities.

About Us:

We are the trusted research partners for leading businesses around the world, providing market intelligence focused towards building revenue transformation strategies. Our research is used by Fortune 500 organizations to attain success by scouting next generation revenue opportunities well ahead of their competition.

Contact Us:

Meticulous Research®

Email- sales@meticulousresearch.com

Contact Sales- +1-646-781-8004

Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

Connect with us on Twitter- https://twitter.com/MeticulousR123

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Security Market Set to Soar, Projected to Reach $54.1 Billion by 2028 here

News-ID: 3398059 • Views: …

More Releases from Meticulous Research®

Machines at the Molecular Scale: How Nanorobotics is Opening a New Frontier in M …

The global nanorobotics market is entering one of the most consequential growth phases in the history of medical technology. Valued at USD 7.24 billion in 2025, the market is projected to grow from USD 8.27 billion in 2026 to approximately USD 31.19 billion by 2036, at a compound annual growth rate of 14.2%. That trajectory reflects something genuinely new happening in science - the emergence of machines so small they…

The Science of Sleep: How Digital Platforms Are Turning Rest Into a Health Strat …

The global sleep software market is growing quickly, and the reasons say something meaningful about how people's relationship with their own health is changing. Valued at USD 2.94 billion in 2025, the market is projected to climb from USD 3.41 billion in 2026 to approximately USD 12.76 billion by 2036, at a compound annual growth rate of 14.1%. That's more than a fourfold increase over a decade - driven not…

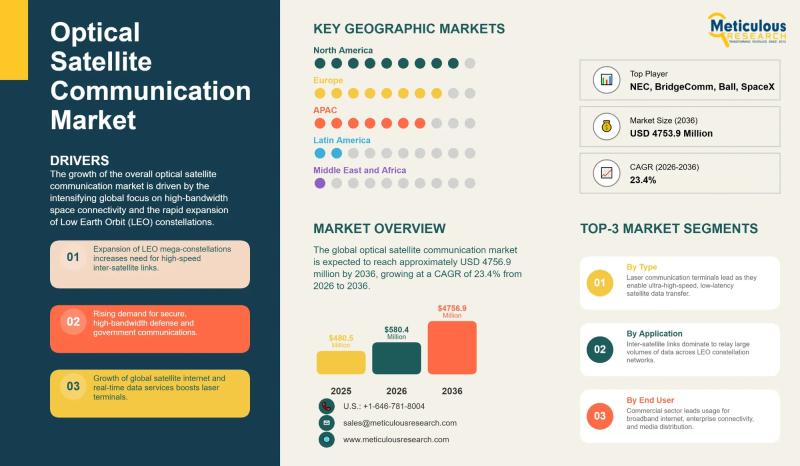

Light Speed in Orbit: How Laser Communication is Revolutionizing the Way Satelli …

The global optical satellite communication market is growing at a pace that reflects just how urgently the space industry needs a better way to move data. Valued at USD 480.5 million in 2025, the market is projected to expand from USD 580.4 million in 2026 to approximately USD 4.76 billion by 2036 - a compound annual growth rate of 23.4%. That's nearly a tenfold increase in a single decade, driven…

Connecting the Unconnected: How VSAT Technology is Redefining Global Communicati …

The global VSAT market was valued at USD 9.32 billion in 2025 and is on track to reach approximately USD 20.1 billion by 2036, growing from USD 9.88 billion in 2026 at a compound annual rate of 7.4%. While that pace is more measured than some of the faster-moving segments of the space industry, the story behind it is one of quiet but fundamental transformation - a technology that has…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…