Press release

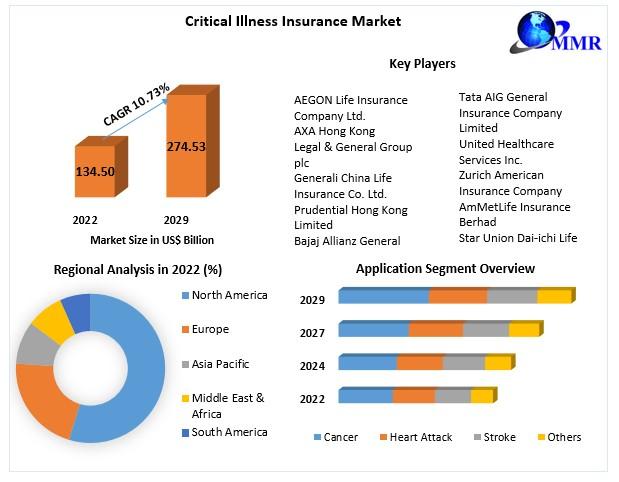

Critical Illness Insurance Market to reach USD 273.53 Bn by 2029, emerging at a CAGR of 10.73 percent and forecast (2023-2029)

Critical Illness Insurance Market Report Scope and Research MethodologyThe research methodology involves a thorough analysis of historical data from 2017 to 2020, utilizing facts, figures, illustrations, and presentations. The report examines drivers, limitations, prospects, and barriers within the Critical Illness Insurance Market, offering investor recommendations based on a comprehensive competitive scenario assessment.

Critical illness insurance serves as a crucial financial safeguard against major medical emergencies such as cancer, heart attacks, and strokes, which often incur expenses beyond conventional health insurance coverage.

Request a Free Sample Copy or View Report Summary: https://www.maximizemarketresearch.com/request-sample/126758

What are Critical Illness Insurance Market Dynamics:

For major medical emergencies like cancer, a heart attack, critical illness insurance may be the only thing separating you from financial ruin. The high expenses of treating life-threatening illnesses are typically greater than any plan will pay for, despite the common misconception that having a conventional health insurance plan provides complete protection. Continue reading to find out more about critical illness insurance and to determine if you and your family should give it any thought. Critical illness insurance policies are subject to a variety of restrictions, just like any other insurance policies. They not only cover the conditions specified in the policy, but they also only do so under the particular criteria mentioned in the policy. A cancer diagnosis, for instance, could not be sufficient to start the policy's payment process if the disease has not progressed past the point of discovery or is not life-threatening. Payment may not be made following a stroke diagnosis unless neurological impairment lasts longer than 30 days. The policyholder must be sick or survive following a diagnosis for a certain number of days, among other requirements.

Critical Illness Insurance Market Regional Insights:

North America dominated the market in 2022, with a share. It is anticipated to witness significant growth at a CAGR of xx% throughout the forecast period. Factors driving this growth include rising medical expenses and an increase in chronic diseases like cancer, heart attacks, and strokes.

Europe is poised for substantial growth due to a rising guaranteed population and increased prevalence of diseases.

The Asia Pacific region is expected to experience considerable expansion, fueled by its growing elderly population and large populations in countries like China and India.

The Middle East and Africa are forecasted to exhibit slower growth rates due to a lack of awareness about the benefits of critical illness insurance.

Request For Customization Report: https://www.maximizemarketresearch.com/market-report/critical-illness-insurance-market/126758/

What is Critical Illness Insurance Market Segmentation:

by Type

Disease Insurance

Medical insurance

Income protection insurance.

by Application

Cancer

Heart Attack

Stroke

Others

Who are Critical Illness Insurance Market Key Players:

1. AEGON Life Insurance Company Ltd.

2. AXA Hong Kong

3. Legal & General Group plc

4. Generali China Life Insurance Co. Ltd.

5. Prudential Hong Kong Limited

6. Bajaj Allianz General Insurance Co. Ltd.

7. Tata AIG General Insurance Company Limited

8. United Healthcare Services Inc.

9. Zurich American Insurance Company

10.AmMetLife Insurance Berhad

11.Star Union Dai-ichi Life Insurance Company Limited

12.Sun Life Assurance Company of Canada.

13.AFLAC INCORPORATED

14.Liberty General Insurance Ltd.

15.HCF

16.Future Generali India Insurance Company Ltd.

17.Religare Health Insurance Company Limited

18.Cigna.

19.The Guardian Life Insurance Company of America

20.Mutual of Omaha Insurance Company

Table of content for the Critical Illness Insurance Market includes:

1.Global Critical Illness Insurance Market : Research Methodology

2.Global Critical Illness Insurance Market : Executive Summary

Market Overview and Definitions

● Introduction to the Global Market

● Summary

● Key Findings

● Recommendations for Investors

● Recommendations for Market Leaders

● Recommendations for New Market Entry

3.Global Critical Illness Insurance Market : Competitive Analysis

MMR Competition Matrix

● Market Structure by region

● Competitive Benchmarking of Key Players

● Consolidation in the Market

● M&A by region

● Key Developments by Companies

● Market Drivers

● Market Restraints

● Market Opportunities

● Market Challenges

● Market Dynamics

● PORTERS Five Forces Analysis

● PESTLE

● Regulatory Landscape by region

● North America

● Europe

● Asia Pacific

● Middle East and Africa

● South America

● COVID-19 Impact

4.Company Profile: Key players

Company Overview

● Financial Overview

● Global Presence

● Capacity Portfolio

● Business Strategy

● Recent Developments

Key Offerings:

Past Market Size and Competitive Landscape (2022 to 2029)

● Past Pricing and price curve by region (2022 to 2029)

● Market Size, Share, Size and Forecast by different segment | 2022-2029

● Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

● Market Segmentation - A detailed analysis by growth and trend

● Competitive Landscape - Profiles of selected key players by region from a strategic perspective

● Competitive landscape - Market Leaders, Market Followers, Regional player

● Competitive benchmarking of key players by region

● PESTLE Analysis

● PORTER's analysis

● Value chain and supply chain analysis

● Legal Aspects of business by region

● Lucrative business opportunities with SWOT analysis

● Recommendations

Related Reports Published by Maximize Market Research :

Squalene Market https://www.maximizemarketresearch.com/market-report/global-squalene-market/34211/

Cold Insulation Market https://www.maximizemarketresearch.com/market-report/global-cold-insulation-market/70470/

global Health Information Exchange Market https://www.maximizemarketresearch.com/market-report/global-health-information-exchange-market/23810/

HVDC Converter Station Market https://www.maximizemarketresearch.com/market-report/hvdc-converter-station-market/729/

Xylitol Market https://www.maximizemarketresearch.com/market-report/xylitol-market/13398/

High Throughput Screening Market https://www.maximizemarketresearch.com/market-report/global-high-throughput-screening-market/54828/

global Hospital Bed Market https://www.maximizemarketresearch.com/market-report/global-hospital-bed-market/65073/

Commercial Security Market https://www.maximizemarketresearch.com/market-report/global-commercial-security-market/55236/

Medical Holography Market https://www.maximizemarketresearch.com/market-report/global-medical-holography-market/8430/

Polymer Emulsion Market https://www.maximizemarketresearch.com/market-report/global-polymer-emulsion-market/26334/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

Email: sales@maximizemarketresearch.com

Phone: +91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is a multidisciplinary market research and consulting company staffed by professionals from various industries. Its coverage spans medical devices, pharmaceutical manufacturing, science and engineering, electronic components, industrial equipment, technology and communication, automotive, chemical products, general merchandise, beverages, personal care, and automation systems. The company provides industry-verified market estimations, technical trend analysis, essential market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Critical Illness Insurance Market to reach USD 273.53 Bn by 2029, emerging at a CAGR of 10.73 percent and forecast (2023-2029) here

News-ID: 3396212 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

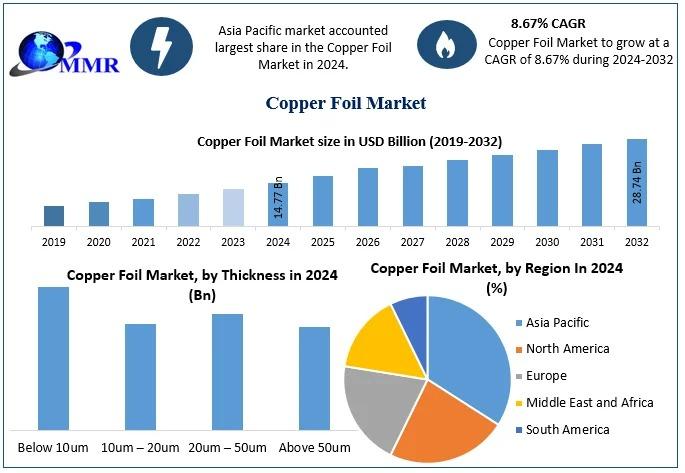

COPPER FOIL MARKET FORECAST TO WITNESS ROBUST GROWTH AMID ELECTRIFICATION AND EL …

Copper Foil Market is expected to witness sustained growth over the forecast period, supported by rising demand from the electronics, electric vehicle (EV), and energy storage sectors, according to industry analysis. The market was valued at USD 14.77 billion in 2024 and is projected to reach approximately USD 28.74 billion by 2032, registering a compound annual growth rate (CAGR) of 8.67% during the forecast period. Growth is primarily attributed to…

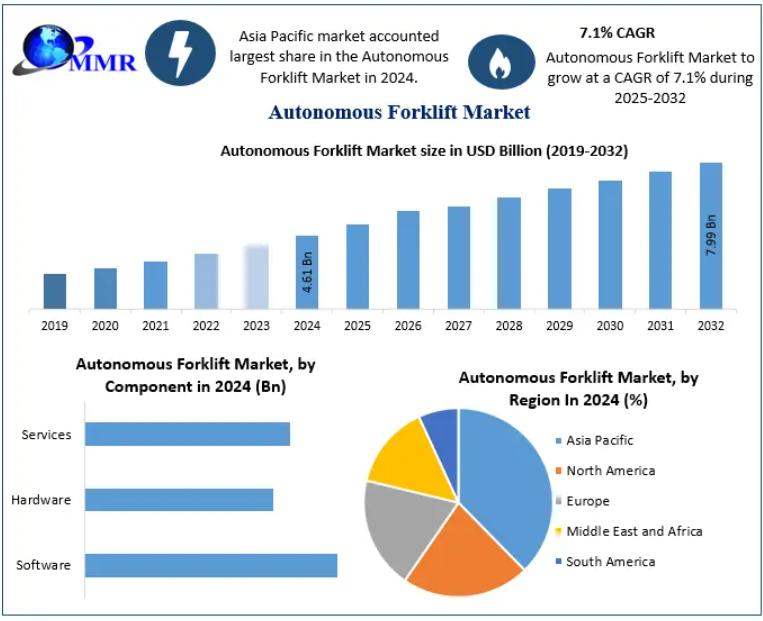

Autonomous Forklift Market: Rising Adoption of Smart Automation for Efficient an …

Autonomous Forklift Market Overview

The global Autonomous Forklift Market is witnessing steady growth as industries increasingly adopt automation to improve productivity, safety, and operational efficiency. Autonomous forklifts are self-driving material handling vehicles capable of lifting, transporting, storing, and retrieving loads without human intervention. These forklifts use advanced technologies such as sensors, cameras, LiDAR, artificial intelligence, and navigation software to operate accurately in complex industrial environments.

Autonomous forklifts are particularly effective in repetitive,…

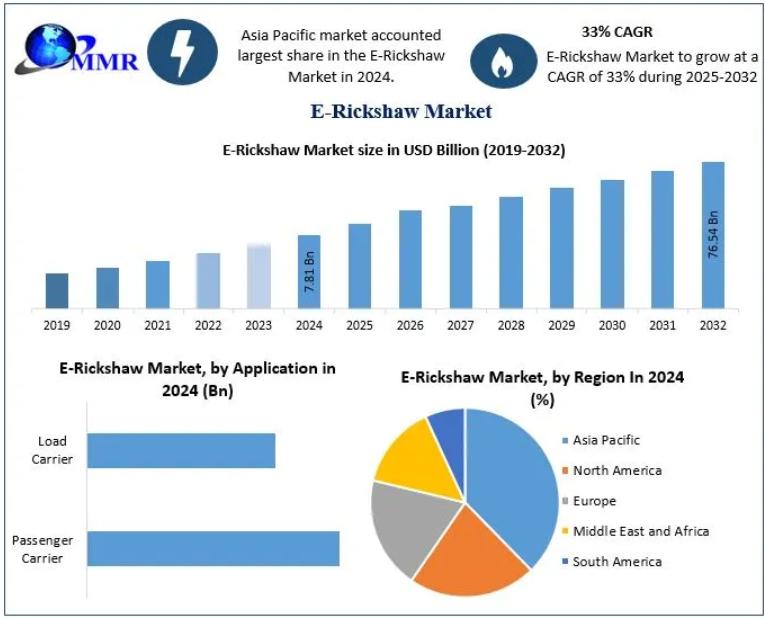

E-Rickshaw Market: Rapid Shift Toward Affordable, Eco-Friendly, and Last-Mile Ur …

E-Rickshaw Market Overview

The global E-Rickshaw Market is experiencing rapid transformation as electric mobility gains traction across urban and semi-urban regions. E-rickshaws, powered by electric drivetrains and traction motors, provide an economical, zero-emission alternative for short-distance passenger and goods transportation. Their compact size, low operating cost, and ability to navigate congested city roads make them a preferred mode of transport, particularly in developing economies.

With increasing concerns over air pollution, rising fuel…

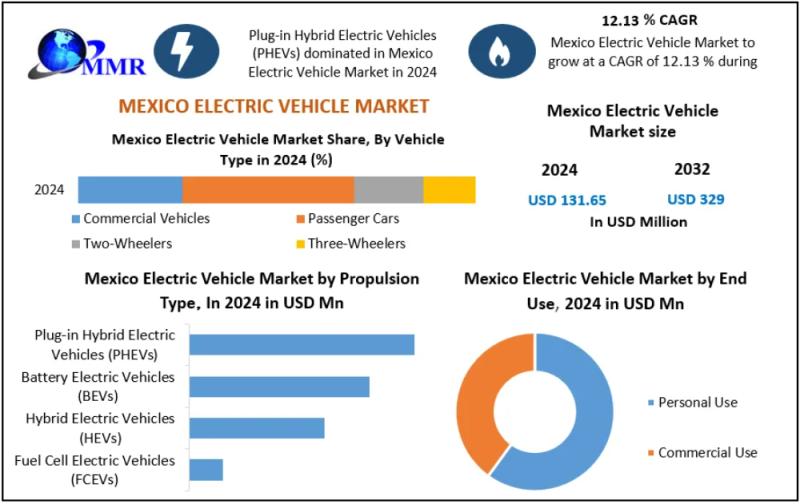

Mexico Electric Vehicle Market: Accelerating Adoption Driven by Sustainability G …

The Mexico electric vehicle (EV) Market is gaining strong momentum as urban congestion, rising pollution levels, and national climate commitments push the country toward cleaner mobility solutions. Major metropolitan areas-particularly Mexico City-are driving adoption due to severe traffic density and air quality concerns. With a growing population and a large vehicle base, Mexico is actively transitioning toward electric and hybrid vehicles to reduce emissions, improve urban mobility, and align with…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…