Press release

Retail Banking Market 2024-2031 | Exclusive Study Report

Retail Banking MarketRetail Banking Market to reach over USD 3032.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Retail Banking Market Size, Share & Trends Analysis Report By Type (Public Sector Banks, Private Sector Banks, Foreign Banks), By Service (Saving & Checking Accounts, Credit & Debit Cards), Region, Market Outlook And Industry Analysis 2031"

The global retail banking market is estimated to reach over USD 3032.77 billion by 2031, exhibiting a CAGR of 6.1% during the forecast period.

Get Free Sample Copy of Report : https://www.insightaceanalytic.com/request-sample/1904

Retail banking, usually called consumer banking or personal banking, is a type of banking that caters to private clients rather than corporations. Retail banking gives individual customers a secure way to manage their finances, get credit, and make deposits. The country's high family debt directly results from rising domestic spending, which has become the main driver of the economy's expansion. Additionally, consumers are reorienting their preferences toward digital platforms like online banking and mobile banking, which can be leveraged to deliver services more effectively and are anticipated to support market expansion. For major players and new entrants in the market, the focus is on evolving and transforming the business model to incorporate technology such as artificial intelligence (AI), robotic process automation (RPA), Robo-advisors, and digital identification (ID) into business processes and bring customer-centric models to enhance customer experience and earnings are expected to continue to open up lucrative business opportunities.

Moreover, rising working-age populations, bettering economic conditions, and more government investment in the banking sector are the main drivers influencing market revenue growth. Demand for retail banking is also fueled by rising government mandates that every person in many nations have access to at least one bank account.

List of Prominent Players in the Retail Banking Market:

• BNP Paribas

• Citigroup, Inc

• HSBC Group

• ICBC

• JP Morgan Chase & Co

• Bank of America Corporation; Barclays

• China Construction Bank

• Deutsche Bank AG

Mitsubishi UFJ Financial Group, Inc.

• Wells Fargo

Market Dynamics:

Drivers-

Rising product offerings for retail customers majorly contribute to the global retail banking market's revenue growth. Investment-related services such as wealth management, retirement planning, financial advice with product options, brokerage accounts, and high net-worth individual products or private banking are also becoming more prevalent. Banks can lower operational costs, take advantage of greater product offerings online, and improve client connectedness due to the expansion of digital and increased preference for using channels like Internet banking and mobile banking. Services like rapid approval, high interest over savings, cheap maintenance fees, and digital onboarding with video KYC all support market growth.

Challenges:

Several adverse circumstances significantly constrain the expansion of the global retail banking market. Some challenges have arisen with the expansion of digital platforms in retail banking, including the need to find acceptable partners, manage data, and address concerns about cybersecurity and privacy. Other retail banking risk factors, such as rigorous government regulation and an increase in enormous loan deficits, are anticipated to considerably slow market expansion.

Regional Trends:

The North American retail banking market is expected to register a major market share. The region's strong economic growth, rising population, high disposable income, and government programs to promote having a personal bank account are primarily responsible for the market's revenue growth in Asia Pacific region. Besides, Asia Pacific had a substantial share of the market. Contrary to other nations where governmental mandates are compelling many banks to implement open banking, open banking is anticipated to develop in the United States as an industry-driven movement. Establishing technical and customer experience standards for data-sharing/APIs is one area where US banks could benefit from what was discovered in these locations. The main drivers of the APAC market growth are leveraging advantages offered by various banking institutions, a large increase in economic activity, particularly in developing countries like China, India, Malaysia, and Indonesia, and a growing working population.

Curious about this latest version of the report? @

https://www.insightaceanalytic.com/enquiry-before-buying/1904

Recent Developments:

• In May 2021-According to its plan to refocus on corporate and investment banking in Asia, HSBC stated that it is leaving the retail and small business banking sector in the United States.

• In November 2020-Wells Fargo launched a new method to assist business customers in stopping using paper checks. The method involves utilizing one-time virtual card numbers to pay payments online using the wellsone virtual card payments service.

Segmentation of Retail Banking Market-

By Type

• Public Sector Banks

• Private Sector Banks

• Foreign Banks

• Community Development Banks

• Non-banking Financial Companies (NBFC)

By Service

• Saving and Checking Account

• Transactional Account

• Personal Loan

• Home Loan

• Mortgages

• Debit and Credit Cards

• ATM Cards

• Certificates of Deposits

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

For More Customization @ https://www.insightaceanalytic.com/report/retail-banking-market-/1904

Contact Us:

InsightAce Analytic Pvt. Ltd.

Tel.: +1 718 593 4405

Email: info@insightaceanalytic.com

Site Visit: www.insightaceanalytic.com

Follow Us on LinkedIn @ bit.ly/2tBXsgS

Follow Us On Facebook @ bit.ly/2H9jnDZ

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions.

Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses.

We help clients gain a competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets, and repositioning products.

Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Retail Banking Market 2024-2031 | Exclusive Study Report here

News-ID: 3390226 • Views: …

More Releases from InsightAce Analytic Pvt.Ltd

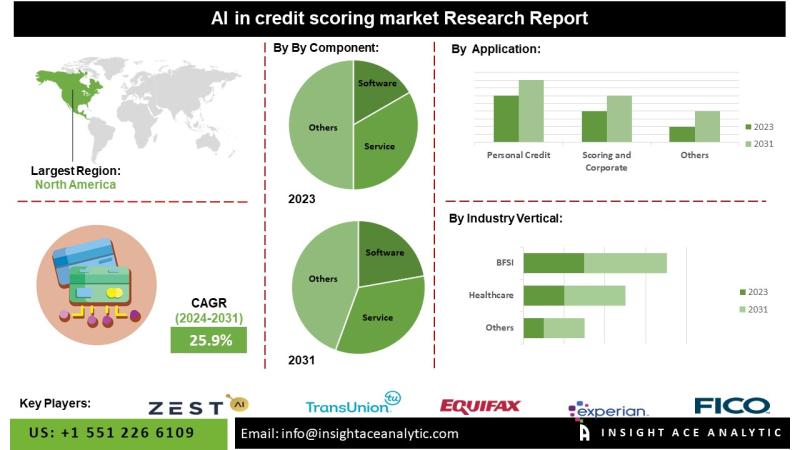

AI In The Credit-Scoring Market Smarter Credit Decisions: How AI is Transforming …

AI In The Credit-Scoring Market to Record an Exponential CAGR by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global AI In The Credit-Scoring Market - (By Component (Software and Service), By Application (Personal Credit Scoring and Corporate Credit Scoring), By Industry Vertical (BFSI (Banking, Financial Services, Insurance), Retail, Healthcare,

Telecommunications, Utilities, and Real Estate)), Trends,…

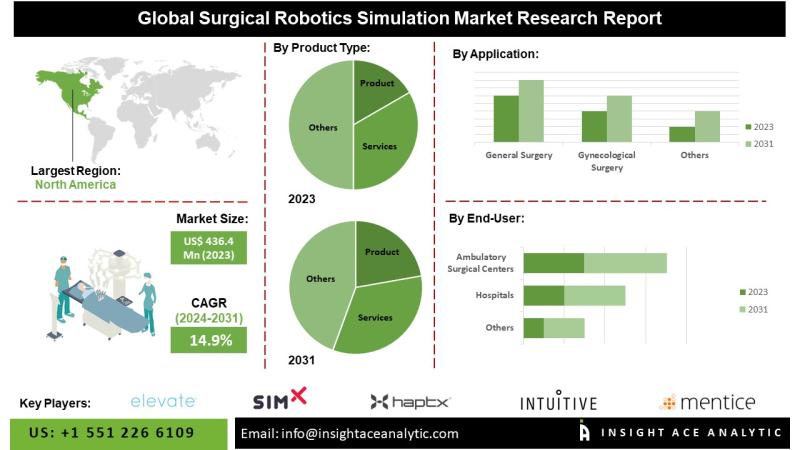

Surgical Robotics Simulation Market Guiding the Next Generation of Surgeons: Gro …

Surgical Robotics Simulation Market Worth $1,283.6 Mn by 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Surgical Robotics Simulation Market Size, Share & Trends Analysis Report By Product Type (Product, Services), By Application (General Surgery, Gynecological Surgery, Urological Surgery, Neurological Surgery (Head and Neck Surgery), Cardiological Surgery, Orthopedic Surgery, Others), By End User (Hospitals, Ambulatory Surgical Centers,…

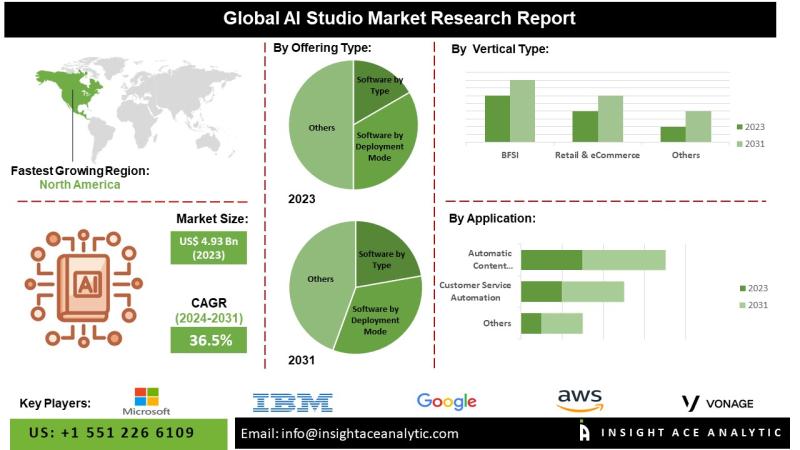

AI Studio Market Accelerating Innovation: The Benefits of AI Studios for Busines …

Global AI Studio Market Worth $57.89 Bn by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global AI Studio Market- (By Application (Sentiment Analysis, Customer Service Automation, Image Classification & Labelling, Synthetic Data Generation, Predictive Modelling & Forecasting, Automatic Content Generation, and Others), By Offering, By Vertical, By Region, Trends, Industry Competition Analysis, Revenue and Forecast…

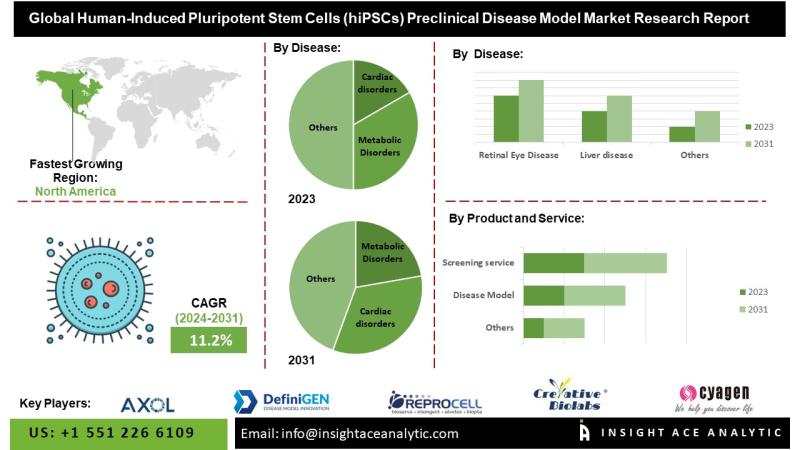

Human-Induced Pluripotent Stem Cells (hiPSCs) Preclinical Disease Model Market G …

Global Human-Induced Pluripotent Stem Cells (hiPSCs) Preclinical Disease Model Market to Record an Exponential CAGR by 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Human-Induced Pluripotent Stem Cells (hiPSCs) Preclinical Disease Model Market- (Disease (Neurological Disorders and Dystrophies, Cardiac disorders, Retinal Eye Disease, Metabolic Disorders, Liver disease, Others), Products and Services (Disease Model,

Reprogramming service, Differentiation…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…