Press release

Online Banking Market Trends, Industry Growth Demand and Statistics Report 2023-2028 | Aci Worldwide Inc., Backbase, Capital Banking Solutions, CGI Inc., ebankIT, EdgeVerve Systems Limited (Infosys Limited), Fiserv Inc., Halcom d.d.

IMARC Group's report titled "Online Banking Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028", Offers a comprehensive analysis of the industry, which comprises insights on the market.Is Online Banking Growing?

The global online banking market size reached US$ 4.0 Billion in 2022. Looking forward, IMARC Group expects the market to reach US$ 5.2 Billion by 2028, exhibiting a growth rate (CAGR) of 4.3% during 2023-2028.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/online-banking-market/requestsample

Factors Affecting the Growth of the Online Banking Industry:

• Continuous Technological Advancements:

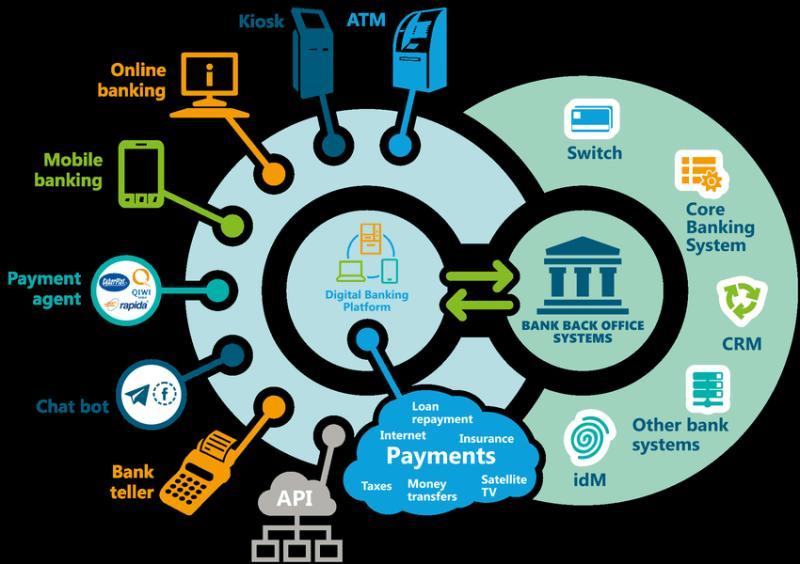

The global online banking market is witnessing significant growth, largely propelled by technological advancements. Innovations in digital banking technology, such as blockchain, artificial intelligence, and machine learning, have greatly enhanced the security and efficiency of online transactions. These advancements facilitate a smoother user experience, contributing to an expanding market size. As financial institutions increasingly adopt these technologies, the market share of online banking services continues to rise. This trend is anticipated to persist, driving market growth and shaping future market trends.

• Changing Consumer Preferences:

Shifts in consumer preferences towards digital banking solutions have been a key driver of the Online Banking market. The convenience, speed, and 24/7 availability of online banking services align with the modern consumer's demand for quick and accessible financial transactions. This shift has encouraged banks to invest in online platforms, significantly affecting market share and contributing to the overall growth of the sector. Market analysis indicates that these preferences will continue to influence market trends and drive innovation, further expanding the market size and enhancing its outlook.

• Regulatory Support and Financial Inclusion:

Governments and regulatory bodies worldwide have been supporting digital banking initiatives to promote financial inclusion. Policies encouraging the development of secure online banking infrastructures have played a crucial role in market growth. This regulatory support has enabled a broader segment of the population to access financial services, thereby increasing the market size and share of online banking. Market analysis suggests that ongoing regulatory backing will continue to provide a favorable market outlook, ensuring sustained growth and adoption of online banking services across different regions.

Leading Companies Operating in the Global Online Banking Industry:

• Aci Worldwide Inc.

• Backbase

• Capital Banking Solutions

• CGI Inc.

• EbankIT

• EdgeVerve Systems Limited (Infosys Limited)

• Fiserv Inc.

• Halcom d.d. (Constellation Software Inc.)

• Oracle Corporation

• Tata Consultancy Services Limited

• Technisys

• Temenos AG.

Ask Analyst for Customization and Explore Full Report with TOC & List of Figure: https://www.imarcgroup.com/online-banking-market

Online Banking Market Report Segmentation:

Breakup by Banking Type:

• Retail Banking

• Corporate Banking

• Investment Banking

Retail banking represents the largest segment by banking type due to its widespread accessibility and comprehensive range of services catering to the daily financial needs of the general public.

Breakup by Software Type:

• Customized Software

• Standard Software

On the basis of software type, the market has been divided into customized software and standard software.

Breakup by Service Type:

• Payments

• Processing Services

• Customer and Channel Management

• Wealth Management

• Others

Payments represent the largest segment by service type, as the convenience and efficiency of online transactions have become integral to both personal and business financial activities.

Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

North America is the largest market by region, attributed to its advanced technological infrastructure, high digital literacy rates, and the early adoption of online banking services.

Global Online Banking Market Trends:

The online banking market is currently shaped by several emerging trends that are driving its expansion. Mobile banking, with its considerable growth in adoption, is a dominant trend, as consumers increasingly prefer managing their finances through smartphones and tablets.

Additionally, the integration of fintech solutions into traditional banking services is revolutionizing the market, offering more personalized and efficient financial services.

In addition, the rise of cybersecurity measures is also a significant trend, with banks investing heavily in advanced security protocols to protect user data and build trust. Furthermore, the adoption of cloud computing in banking operations is enhancing service delivery and operational efficiency, contributing to the market's growth trajectory.

Browse Other Research Report:

Smart Agriculture Market Share, Growth Drivers, Report 2023-2028 : https://www.imarcgroup.com/smart-agriculture-market

Global Macadamia Market Share & Growth Report, 2023-2028 : https://www.imarcgroup.com/macadamia-market

Chip Resistor Market Share, Industry Trends | Forecast 2023-2028 : https://www.imarcgroup.com/chip-resistor-market

Biobanking Market Size, Share, Trends and Revenue Report 2023-2028 : https://www.imarcgroup.com/biobanking-market

Genetic Testing Market Share, Growth, Trends Report, 2024-2032 : https://www.imarcgroup.com/genetic-testing-market

Digital Printing Market Share, Revenue Trends and Growth Drivers 2023-2028 : https://www.imarcgroup.com/digital-printing-market

Wireless Gigabit Market Share, Growth and Forecast Report, 2023-2028 : https://www.imarcgroup.com/wireless-gigabit-market

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARCs information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the companys expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Banking Market Trends, Industry Growth Demand and Statistics Report 2023-2028 | Aci Worldwide Inc., Backbase, Capital Banking Solutions, CGI Inc., ebankIT, EdgeVerve Systems Limited (Infosys Limited), Fiserv Inc., Halcom d.d. here

News-ID: 3389196 • Views: …

More Releases from IMARC Group

Charcoal Production Plant DPR & Unit Setup 2026: Demand Analysis and Project Cos …

Setting up a charcoal production plant involves strategic planning, substantial capital investment, and comprehensive understanding of production technologies. This essential biomass fuel serves cooking, heating, metallurgical, and industrial applications. Success requires careful site selection, efficient carbonization processes, proper kiln systems, reliable wood and biomass sourcing, and compliance with environmental and forestry regulations to ensure profitable and sustainable operations.

IMARC Group's report, "Charcoal Production Plant Project Report 2026: Industry Trends, Plant Setup,…

Grease Manufacturing Plant DPR 2026: CapEx/OpEx Analysis with Profitability Fore …

Setting up a grease manufacturing plant involves strategic planning, substantial capital investment, and comprehensive understanding of production technologies. This essential lubricant serves automotive, industrial machinery, and heavy equipment applications. Success requires careful site selection, efficient blending and mixing processes, quality control systems, reliable raw material sourcing from base oil and thickener suppliers, and compliance with environmental and safety regulations to ensure profitable and sustainable operations.

IMARC Group's report, "Grease Production Plant…

Tequila Manufacturing Plant Cost 2026: CapEx, OpEx & ROI Analysis

Setting up a Tequila Manufacturing Plant positions investors in one of the most stable and essential segments of the premium spirits and alcoholic beverages value chain, backed by sustained global growth driven by rising international demand for authentic agave-based spirits, increasing consumer preference for premium and super-premium heritage-driven beverages, expanding consumption across hospitality, retail, and export channels, and the dual-benefit advantages of strong brand loyalty combined with high-margin product differentiation.…

Prefabricated Building and Structural Steel Manufacturing Plant Cost Analysis Re …

Setting up a prefabricated building and structural steel manufacturing plant positions investors within one of the most dynamic and infrastructure-driven segments of the global construction and industrial manufacturing sector, supported by accelerating urbanization, expanding industrial corridors, and rising demand for fast-track, cost-efficient building solutions across residential, commercial, and industrial projects.

Prefabricated structures and structural steel components play a critical role in modern construction by enabling reduced project timelines, improved quality…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…