Press release

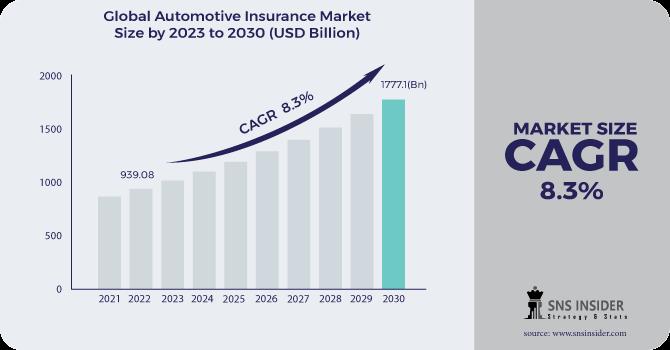

Automotive Insurance Market Estimated to Reach USD 1777.1 Billion by 2030 Owing to Increasing Number of Accidents and Government Regulations Mandating the Purchase of Auto Insurance

Automotive Insurance Market size is projected to reach at USD 1777.1 Bn by 2030, As technology continues to reshape the automotive sector, the insurance market has also witnessed significant transformations.According to SNS Insider, the automotive insurance market is a dynamic and ever-evolving landscape, intricately linked to the global automotive industry.

Market Size:

Automotive Insurance Market size was valued at USD 939.08 billion in 2022 and is expected to reach USD 1777.1 billion by 2030 and grow at a CAGR of 8.3% over the forecast period 2023-2030.

Get Full PDF Sample Copy of Report (Including TOC, List of Tables & Figures, Chart):https://www.snsinsider.com/sample-request/1821

Market Key Players:

Allstate Insurance Company

RAC Motoring Services

Progressive Casualty Insurance Company

Zhongshan Insurance

CPIC

ABIC Inc

Zurich Insurance Group

RSA Insurance Group

Clements Worldwide

Market Scope:

The automotive insurance market encompasses a wide array of insurance products tailored to meet the diverse needs of vehicle owners. These products include coverage for damages, theft, liability, and personal injury. The market scope extends beyond traditional insurance models, with emerging trends such as usage-based insurance (UBI) gaining traction. UBI leverages telematics technology to assess individual driving behaviour, allowing insurers to offer personalized premiums based on actual driving habits.

Industry Analysis:

The automotive insurance industry operates in a highly competitive environment marked by regulatory complexities, technological advancements, and changing consumer preferences. Market players continuously strive to innovate and differentiate their offerings to gain a competitive edge. The industry's growth is closely tied to the overall health of the automotive sector, with economic fluctuations impacting insurance premiums and claim frequencies.

Segmentation Analysis:

The passenger cars segment remains a focal point for insurers due to its sheer volume and diverse customer profiles. The market for passenger car insurance is not only influenced by factors such as vehicle type, model, and age but also by the driver's demographics, driving history, and geographical location. Insurers must navigate these variables to accurately assess risk and set appropriate premium levels.

By Insurance Type:

Third-party

Comprehensive

Third-party theft and Fire

Others

By Vehicle Type:

Passenger cars

LCV

HCV

Regional Analysis

The automotive insurance market exhibits regional variations influenced by economic conditions, regulatory landscapes, and cultural factors. Analyzing regional trends provides insights into market dynamics and helps insurers tailor their products to meet specific demands. The North American automotive insurance market is characterized by a high level of maturity and strong regulatory frameworks. Insurers in this region are increasingly adopting digital technologies, and the prevalence of telematics-based insurance is on the rise.

European countries have diverse insurance landscapes, with some markets favoring traditional models and others embracing innovative solutions. The European Union's focus on data protection and privacy regulations has influenced insurers' approaches to telematics-based offerings.

The Asia-Pacific region, including emerging markets such as China and India, presents significant growth opportunities. Rapid urbanization, increasing vehicle ownership, and a burgeoning middle class contribute to the expansion of the automotive insurance market in this region

Buy Now:@https://www.snsinsider.com/checkout/1821

Key Takeaways

The automotive insurance market's intricate interplay with the automotive industry, coupled with technological advancements and shifting consumer preferences, necessitates a nuanced approach by industry players. The passenger cars segment, being a cornerstone of the market, demands continuous innovation and adaptation to cater to evolving risks.

Recent developments by key players underscore the industry's commitment to embracing change and delivering value to customers. Digital transformation, telematics integration, partnerships, and sustainability initiatives are indicative of a forward-thinking industry poised to meet the challenges of the future.

For More Information, Visit:@https://www.snsinsider.com/reports/automotive-insurance-market-1821

Recent Industry Developments:

Digital Transformation: Leading insurers have invested heavily in digital technologies to enhance customer experience and streamline processes. Online platforms, mobile apps, and digital claims processing have become integral components of modern insurance operations.

Telematics Integration: Many insurers have embraced telematics to offer usage-based insurance, fostering a more personalized approach to pricing. Telematics devices collect real-time data on driving behaviour, enabling insurers to reward safe driving habits with lower premiums.

Partnerships and Collaborations: Insurers are forming strategic partnerships with automakers, technology companies, and data analytics firms. These collaborations aim to create synergies, enhance risk assessment capabilities, and develop new products tailored to emerging automotive trends.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

5. Value Chain Analysis

6. Porter's 5 forces model

7. PEST Analysis

8. Global Automotive Insurance Market Segmentation, by Insurance Type

9. Global Automotive Insurance Market Segmentation, by Vehicle Type

10. Regional Analysis

11. Company Profiles

12. Competitive Landscape

13. Conclusion

Contact Us:

Akash Anand - Head of Business Development Strategy

Email: mailto:info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Website: https://www.snsinsider.com

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automotive Insurance Market Estimated to Reach USD 1777.1 Billion by 2030 Owing to Increasing Number of Accidents and Government Regulations Mandating the Purchase of Auto Insurance here

News-ID: 3388189 • Views: …

More Releases from SNS Insider Pvt Ltd

Thermal Transfer Tapes Market Heats Up, Projected to Reach USD 1.68 Billion by 2 …

"According to the SNS Insider report, the Thermal Transfer Tapes Market Growth valued at USD 1.145 billion in 2023, is projected to reach a staggering USD 1.678 billion by 2031, exhibiting a compound annual growth rate (CAGR) of 4.9% during the forecast period of 2024-2031"

This notable growth can be attributed to the rising adoption of automation in manufacturing processes, the need for durable and long-lasting labels, and the increasing emphasis…

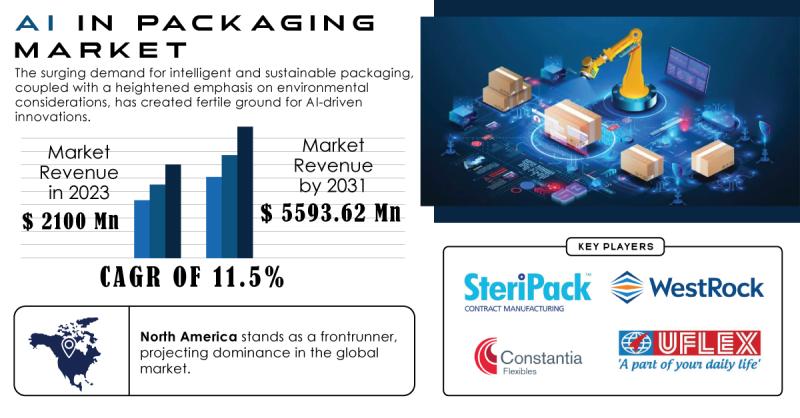

AI in Packaging Market Set to Skyrocket, Projected to Reach USD 5.59 Billion by …

"According to the SNS Insider report, the AI in Packaging Market Growth valued at USD 2.1 billion in 2023, is projected to reach a staggering USD 5.59 billion by 2031, exhibiting a robust compound annual growth rate (CAGR) of 11.5% during the forecast period of 2024-2031"

This substantial growth trajectory is fueled by a convergence of factors, including the need for supply chain optimization, stringent quality control measures, the rising adoption…

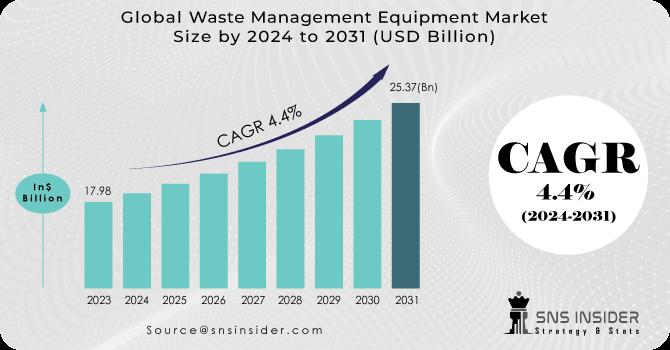

Waste Management Equipment Market is Going to Reach at USD 25.37 billion by 2031

The Waste Management Equipment Market size was estimated at USD 17.98 billion in 2023 and is expected to reach USD 25.37 billion by 2031 at a CAGR of 4.4% during the forecast period of 2024-2031.

The global Waste Management Equipment Market is experiencing substantial growth, driven by increasing environmental concerns, stringent regulations, and the rising volume of waste generated worldwide. Waste management equipment encompasses a wide range of machinery and tools…

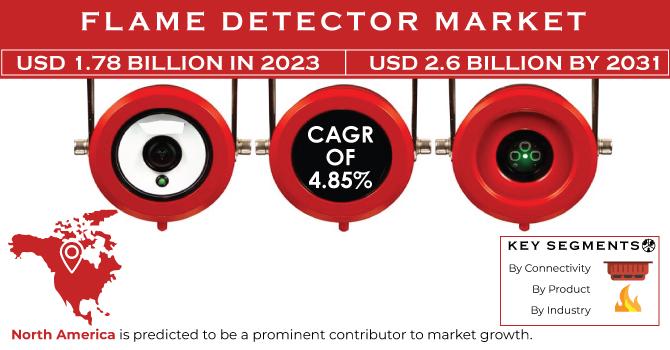

Flame Detector Market Expands as Fire Safety Takes Center Stage

The Flame Detector Market size was estimated at USD 1.78 billion in 2023 and is expected to reach USD 2.6 billion by 2031 at a CAGR of 4.85% during the forecast period of 2024-2031.

The global flame detector market is experiencing significant growth, driven by heightened awareness of fire safety regulations and the increasing need for advanced detection systems across various industries. Flame detectors play a critical role in preventing catastrophic…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…