Press release

Digital Insurance Platform Market Poised for Impressive Growth with a Projected CAGR of 13.7% from 2022 to 2029, as per Data Bridge Market Research

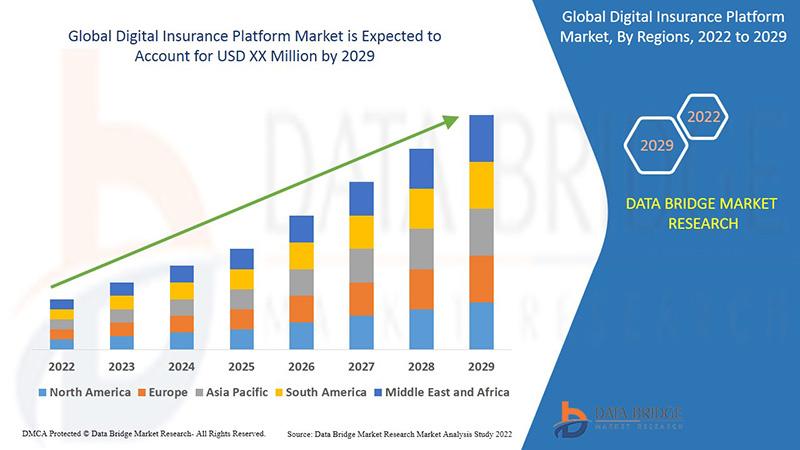

Discover a detailed exploration of the Digital Insurance Platform Market by Data Bridge Market Research, thoughtfully presented with visual finesse to ensure seamless data absorption. Crucial insights are illuminated through vivid graphs, charts, and figures, empowering astute decision-making.Data Bridge Market Research analyses that the global digital insurance platform market will exhibit a CAGR of 13.7% for the forecast period of 2022-2029.

The Digital Insurance Platform market report stands out as an unparalleled resource delivering precise Compound Annual Growth Rate (CAGR) insights a midst the forecast period's fluctuations. Through a comprehensive market analysis, it illuminates the market landscape across types and applications, spotlighting crucial business assets and key players. Presenting statistical and numerical data in graphical formats enhances the clarity of facts and figures. This report dives deep into anticipating prime market challenges, whether in sales, export, import, or revenue, offering an analytical edge. Additionally, it furnishes a roster of leading competitors, accompanied by strategic insights and a thorough analysis of the pivotal factors influencing the ICT industry.

Distinguished by its global scope, this Digital Insurance Platform market research report derives its assessment of market drivers and restraints from a robust SWOT analysis. Moreover, it captures ongoing developmental trends, patterns, distribution channels, and marketing strategies. Noteworthy product advancements, coupled with tracking recent mergers, acquisitions, and research initiatives within the ICT industry, are meticulously documented. Delving into the market potential across various geographical regions, it factors in growth rates, macroeconomic indicators, consumer behaviors, and supply-demand dynamics. Undoubtedly, this Digital Insurance Platform market research report serves as a potent foundation for the ICT industry, empowering it to surpass competition with confidence.

Gain access to your complimentary snippet of Digital Insurance Platform Market research @---> https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-digital-insurance-platform-market

Market Growth Drivers:

The digital insurance platform market is being driven by the rising adoption of IoT products. The upsurge in the adoption rate of underwater acoustic modems in naval defense is a major factor driving the market's growth. The changing insurer's focus from product-based to customer-centric strategies is driving up demand for digital insurance platform equipment market. Other significant factors such as rising awareness amongst insurers towards digital channels, and technological advancement will cushion the growth rate of digital insurance platform market. Furthermore, upsurge in the adoption rate of cloud-based digital solutions by the insurers to obtain the high scalability will accelerate the growth rate of digital insurance platform market for the forecast period mentioned above.

Notably, the report emphasizes the engagement of essential entities, including:

Tata Consultancy Services Limited

DXC Technology Company

Infosys Limited

Pegasystems Inc.

Appian

Mindtree Ltd.

Prima Solutions

FINEOS

Cognizant

Inzura Limited

Cogitate Technology Solutions, Inc.

Duck Creek Technologies

Decoding Market Nuances: Key Takeaways

Holistic Market Share Assessment

Thorough evaluation of market shares globally and regionally.

Parent Market Dynamics & Growth Prospects

Uncover dynamics of the parent market and potential growth areas.

Order Management Software Analysis

Delve into current and future trends of global order management software.

Dynamic Industry Shifts

Navigate through evolving industry dynamics.

Key Players' Strategies & Product Landscape

Understand strategies and product landscapes of key industry players.

Market Size: Past, Present, and Future

Comprehensive examination of historical, current, and projected market sizes.

Strategic Profiling for Informed Decisions

Strategically profile key players, analyzing market positions and competencies.

Key Market Segmentation

By Component (Tools, Services), End-User (Insurance Companies, Third-Party Administrators and Brokers, Aggregators), Insurance Application (Automotive and Transportation, Home and Commercial Buildings, Life and Health, Business and Enterprise, Consumer Electronics and Industrial Machines, Travel), Deployment Type (On-Premises and Cloud), Organization Size (Large Enterprises, Small and Medium-Sized Enterprises)

Intended Audience:

Companies within the Digital Insurance Platform industry

Investors and analysts keen on the Digital Insurance Platform market

Individuals seeking insights into the dynamics of the Digital Insurance Platform market

Get ahead of the competition with unparalleled market intelligence @---> https://www.databridgemarketresearch.com/reports/global-digital-insurance-platform-market

Discover More Insightful Reports:

https://dbmrnews2210.blogspot.com/2024/02/3d-printing-construction-marketgrowth.html

https://dbmrnews2210.blogspot.com/2024/02/medical-scrubs-market-regional-analysis.html

https://dbmrnews2210.blogspot.com/2024/02/ophthalmology-market-latest-trend-share.html

Contact Us

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email - corporatesales@databridgemarketresearch.com

About Data Bridge Market Research, Private Ltd

Data Bridge Market Research operates as a multinational management-consulting firm, boasting offices situated in both India and Canada. Renowned for our innovative and cutting-edge market analysis methodologies, we pride ourselves on our unparalleled durability and forward-thinking approaches. Our commitment lies in unravelling optimal consumer prospects and nurturing invaluable insights to empower your company's success within the market.

With a team comprising over 500 analysts specializing in various industries, we have been instrumental in serving over 40% of Fortune 500 companies on a global scale. Our extensive network boasts a clientele exceeding 5000+, spanning across the globe. At Data Bridge Market Research, our goal remains steadfast: to provide comprehensive market intelligence and strategic guidance to propel your business toward success.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Insurance Platform Market Poised for Impressive Growth with a Projected CAGR of 13.7% from 2022 to 2029, as per Data Bridge Market Research here

News-ID: 3385130 • Views: …

More Releases from Data Bridge Market Research

Fire Resistant Glass Market Advances with Intumescent Coatings, Hybrid Laminates …

Fire resistant glass market is growing at a high CAGR during the forecast period 2024-2031.

Fire Resistant Glass Market is positioned for robust growth, and shifting market dynamics reshaping the competitive landscape. DataM Intelligence's new report provides data-driven insights, SWOT analysis, and marketing-ready intelligence for businesses seeking to improve market penetration and campaign ROI.

Get your exclusive sample report today: (corporate email gets priority access): https://datamintelligence.com/download-sample/fire-resistant-glass-market?vs

Fire Resistant Glass Market Overview &…

Rising Demand for Advanced Treatments to Propel Obliterative Bronchiolitis Marke …

The Obliterative Bronchiolitis Market is undergoing a significant transformation, with industry forecasts predicting rapid expansion and cutting-edge technological innovations by 2032. As businesses continue to embrace digital advancements and strategic shifts, the sector is set to experience unprecedented growth, driven by rising demand, market expansion, and evolving industry trends.

A recent in-depth market analysis sheds light on key factors propelling the Obliterative Bronchiolitis market forward, including increasing market share, dynamic segmentation,…

Medical-Social Working Services Market Industry Trends and Forecast to 2030

This Medical-Social Working Services Market report has been prepared by considering several fragments of the present and upcoming market scenario. The market insights gained through this market research analysis report facilitates more clear understanding of the market landscape, issues that may interrupt in the future, and ways to position definite brand excellently. It consists of most-detailed market segmentation, thorough analysis of major market players, trends in consumer and…

Global Marine Insurance Market to Grow at 4.50% CAGR, Reaching USD 39.87 Billion …

The Marine Insurance Market is undergoing a significant transformation, with industry forecasts predicting rapid expansion and cutting-edge technological innovations by 2032. As businesses continue to embrace digital advancements and strategic shifts, the sector is set to experience unprecedented growth, driven by rising demand, market expansion, and evolving industry trends.

A recent in-depth market analysis sheds light on key factors propelling the Marine Insurance market forward, including increasing market share, dynamic segmentation,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…