Press release

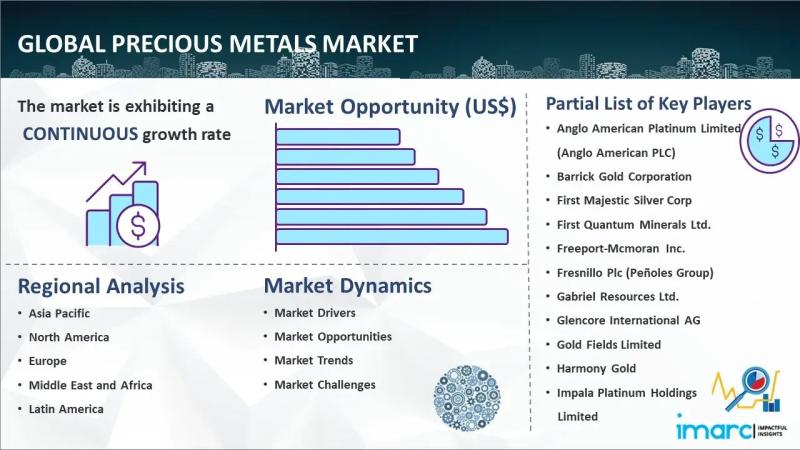

Precious Metals Market 2024: Latest Updates, Industry Size, Share, Growth and Research Report Till 2032

According to IMARC Group, the global precious metals market size reached US$ 209.4 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 323.2 Billion by 2032, exhibiting a growth rate (CAGR) of 4.8% during 2024-2032.Global Precious Metals Market Trends:

The global precious metals market is characterized by several evolving trends, influenced by economic, technological, and societal factors. Economic instability and inflation fears continue to drive investments in gold and silver as safe-haven assets, reinforcing their value during times of financial uncertainty. Technological advancements are expanding the use of precious metals in various industries, from electronics and automotive to renewable energy, particularly in the development of solar panels and electric vehicles, which require silver, platinum, and palladium.

Environmental concerns and the push towards sustainability are further boosting demand for these metals, as they play a crucial role in green technologies. Geopolitically, supply chain disruptions and trade tensions contribute to market volatility, affecting prices and availability. Moreover, the increasing interest in ethical sourcing and recycling of precious metals reflects a growing awareness of environmental and social governance (ESG) issues among consumers and investors, shaping market dynamics and preferences.

Get Sample Copy of Report at -

https://www.imarcgroup.com/precious-metals-market/requestsample

Factors Affecting the Growth of the Precious Metals Industry:

• Economic Uncertainty and Inflation:

Economic instability and the fear of inflation significantly influence the growth of the precious metals market. During times of financial uncertainty, investors often turn to precious metals like gold and silver as a hedge against inflation and currency devaluation. These metals are perceived as a safe store of value when traditional investments may seem risky. As a result, increased demand during such periods can drive up prices and stimulate market growth. This trend is a testament to the enduring appeal of precious metals as a protective investment in diverse economic landscapes.

• Technological Advancements:

Technological advancements are significantly reshaping the precious metals market by enhancing extraction methods, expanding applications, and improving recycling processes. Innovations in mining technology, such as bioleaching and more efficient ore processing techniques, have made it possible to extract precious metals from previously uneconomical or difficult-to-access deposits. In terms of applications, advancements in electronics, automotive, and renewable energy sectors have increased the demand for metals like silver, platinum, and palladium. For instance, silver's exceptional conductivity makes it indispensable in solar panels and electronic devices, while platinum and palladium are essential for catalytic converters in vehicles. Additionally, advancements in recycling technologies have improved the recovery of precious metals from electronic waste, contributing to a more sustainable and environmentally friendly approach to metal supply.

• Geopolitical Factors:

Geopolitical factors significantly impact the precious metals market by influencing supply, demand, and pricing. Political instability, trade policies, and international conflicts can disrupt mining operations and supply chains, leading to fluctuations in metal availability and prices. For instance, sanctions or trade disputes between major producing and consuming countries can restrict the flow of metals, creating supply shortages and driving up prices. Additionally, geopolitical tensions can increase demand for precious metals as safe-haven assets, as investors seek stability in uncertain times. The strategic importance of countries rich in these resources further complicates the market dynamics, making geopolitics a critical factor in the precious metals landscape.

Precious Metals Market Report Segmentation:

By Metal Type:

• Gold:

o Jewelry

o Investment

o Technology

o Others

• Platinum:

o Auto-catalyst

o Jewelry

o Chemical

o Petroleum

o Medical

o Others

• Silver:

o Industrial Application

o Jewelry

o Coins and Bars

o Silverware

o Others

• Palladium:

o Auto-catalyst

o Electrical

o Dental

o Chemical

o Jewelry

o Others

Gold is the largest metal type segment in the market due to its widespread recognition as a safe-haven investment and its cultural significance in various societies, which is driving demand for both investment and ornamental purposes.

By Application:

• Jewelry

• Investment

• Electricals

• Automotive

• Chemicals

• Others

Jewelry is the largest application segment in the market because of the high aesthetic value and status symbol associated with precious metals, especially in cultures where jewelry holds significant traditional and emotional value.

By Region:

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• North America (United States, Canada)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

By region, Asia Pacific is the largest market owing to the substantial consumer demand in countries like China and India, where precious metals are deeply integrated into cultural practices, alongside the region's growing economic stature and investment appetite.

Ask Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=2351&flag=C

Competitive Landscape With Key Players:

The competitive landscape of the global precious metals market has been studied in the report with the detailed profiles of the key players operating in the market.

Some of these key players include:

• Anglo American Platinum Limited (Anglo American PLC)

• Barrick Gold Corporation

• First Majestic Silver Corp

• First Quantum Minerals Ltd.

• Freeport-Mcmoran Inc.

• Fresnillo Plc (Peñoles Group)

• Gabriel Resources Ltd.

• Glencore International AG

• Gold Fields Limited

• Harmony Gold

• Impala Platinum Holdings Limited

• Lundin Mining Corporation

• Pan American Silver Corporation

Key Highlights of the Report:

• Market Performance (2018-2023)

• Market Outlook (2024-2032)

• Market Trends

• Market Drivers and Success Factors

• Impact of COVID-19

• Value Chain Analysis

• Comprehensive mapping of the competitive landscape

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Precious Metals Market 2024: Latest Updates, Industry Size, Share, Growth and Research Report Till 2032 here

News-ID: 3384416 • Views: …

More Releases from IMARC Group

Charcoal Production Plant DPR & Unit Setup 2026: Demand Analysis and Project Cos …

Setting up a charcoal production plant involves strategic planning, substantial capital investment, and comprehensive understanding of production technologies. This essential biomass fuel serves cooking, heating, metallurgical, and industrial applications. Success requires careful site selection, efficient carbonization processes, proper kiln systems, reliable wood and biomass sourcing, and compliance with environmental and forestry regulations to ensure profitable and sustainable operations.

IMARC Group's report, "Charcoal Production Plant Project Report 2026: Industry Trends, Plant Setup,…

Grease Manufacturing Plant DPR 2026: CapEx/OpEx Analysis with Profitability Fore …

Setting up a grease manufacturing plant involves strategic planning, substantial capital investment, and comprehensive understanding of production technologies. This essential lubricant serves automotive, industrial machinery, and heavy equipment applications. Success requires careful site selection, efficient blending and mixing processes, quality control systems, reliable raw material sourcing from base oil and thickener suppliers, and compliance with environmental and safety regulations to ensure profitable and sustainable operations.

IMARC Group's report, "Grease Production Plant…

Tequila Manufacturing Plant Cost 2026: CapEx, OpEx & ROI Analysis

Setting up a Tequila Manufacturing Plant positions investors in one of the most stable and essential segments of the premium spirits and alcoholic beverages value chain, backed by sustained global growth driven by rising international demand for authentic agave-based spirits, increasing consumer preference for premium and super-premium heritage-driven beverages, expanding consumption across hospitality, retail, and export channels, and the dual-benefit advantages of strong brand loyalty combined with high-margin product differentiation.…

Prefabricated Building and Structural Steel Manufacturing Plant Cost Analysis Re …

Setting up a prefabricated building and structural steel manufacturing plant positions investors within one of the most dynamic and infrastructure-driven segments of the global construction and industrial manufacturing sector, supported by accelerating urbanization, expanding industrial corridors, and rising demand for fast-track, cost-efficient building solutions across residential, commercial, and industrial projects.

Prefabricated structures and structural steel components play a critical role in modern construction by enabling reduced project timelines, improved quality…

More Releases for Metal

Metal Roofing Companies Revolutionizing the Industry: Classic Metal Roofs Leads …

Classic Metal Roofs has established itself as a leading provider of durable and energy-efficient roofing systems in Southern New England. With over 20 years of experience, the company is known for high-quality installations, customer satisfaction, and sustainable metal roofing solutions.

As homeowners increasingly seek durable and energy-efficient solutions, metal roofing companies continue to provide top-tier roofing systems. Among the industry leaders, Classic Metal Roofs [http://business.bigspringherald.com/bigspringherald/markets/article/abnewswire-2025-2-15-classic-metal-roofs-expert-aluminum-shingle-metal-roof-installation-and-services/] stands out for its commitment to…

Rare Metal Raw Materials - Boron(B) Metal

Boron Powder [https://www.urbanmines.com/boron-powder-product/]

Short Description:

Boron [,%20a%20chemical%20element%20with%20the%20symbol%20B%20and%20atomic%20number%205,%20is%20a%20black/brown%20hard%20solid%20amorphous%20powder.%20It%20], a chemical element with the symbol B and atomic number 5, is a black/brown hard solid amorphous powder. It is highly reactiveand soluble in concentrated nitric and sulfuric acids but insoluble in water, alcohol and ether. It has a high neutro absorption capacity. UrbanMines specializes in producing high purity Boron Powder with the smallest possible average grain sizes. Our standard powderparticle sizes average in the…

Metal Polishing Services Market Trends and Leading Players 2023-2030 | Metal Pol …

With a CAGR of 6.1%, the Metal Polishing Services Market is expected to grow from USD 1.5 billion in 2023 to USD 2.3 billion by 2030, offering a gleaming finish to metal surfaces for aesthetic and functional purposes.

Market Overview:

The Metal Polishing Services market is poised for rapid growth, driven by several pivotal drivers. There is a continuous demand for metal finishing and polishing services that improve the appearance and…

Metal-to-metal Seal Market 2021 | Detailed Report

Metal-to-metal Seal Market Forecasts report provided to identify significant trends, drivers, influence factors in global and regions, agreements, new product launches and acquisitions, Analysis, market drivers, opportunities and challenges, risks in the market, cost and forecasts to 2027.

Get Free Sample PDF (including full TOC, Tables and Figures) of Metal-to-metal Seal Market @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=5089735

The report provides a comprehensive analysis of company profiles listed below:

- Parker

- CPI

- HTMS

- American Seal &…

Metal Polishing Services Market Research Report 2020 Analysis: Enhanced Growth a …

Metal Polishing Services Market

Global Metal Polishing Services Market is providing the summarized study of several factors encouraging the growth of the market such as manufacturers, market size, type, regions and numerous applications. By using the report consumer can recognize the several dynamics that impact and govern the market. For any product, there are several companies playing their role in the market, some new, some established and some are planning to…

Worldwide Recycled Metal Market By Metal 2024 | Nucor, Steel Dynamics, Schnitzer …

The 2018-2024 report on global Recycled Metal market explores the essential factors of Recycled Metal industry covering current scenario, market demand information, coverage of active companies and segmentation forecasts.

North America recycled metal market was estimated close to USD 8.5 billion in 2017. This is mainly attributed to strong presence of transportation, electrical & electronics and defense industry which majorly constitute to the overall product demand. Moreover, strict laws formulated…