Press release

Refinance Market to Attain $44.6 Billion By 2032, at 8.7% CAGR | Top Impacting Factors and Business Strategies

Allied Market Research published a report, titled, "Refinance Market by Type (Mortgage Refinancing, Auto Loan Refinancing, Student Loan Refinancing, Personal Loan Refinancing, and Business Loan Refinancing), Lender (Banks, NBFCs, and Others), and End User (Individual, and Business): Global Opportunity Analysis and Industry Forecast, 2023-2032". According to the report, the global refinance market was valued at $19,876.34 million in 2022 and is estimated to reach $44,628.02 million by 2032, exhibiting a CAGR of 8.7% from 2023 to 2032.📚 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐑𝐞𝐩𝐨𝐫𝐭:

https://www.alliedmarketresearch.com/request-sample/221558

The process of revising the terms of an existing loan, such as interest rates, payment schedules, or other terms is referred to as refinance. The refinancing activity among high-income borrowers increased during the outbreak of the COVID-19 pandemic.

Prime determinants of growth

Rising government initiatives and programs and an increase in the adoption of digital technologies for refinancing are boosting the growth of the global refinance market. in addition, the emergence of online refinance applications the positively impacts growth of the refinance market. However, a lack of awareness and accessibility about refinancing services security issues, and privacy concerns is hampering the refinance market growth. On the contrary, the enactment of technologies in existing product lines and the untapped potential of emerging economies is expected to offer remunerative opportunities for the expansion of the refinance market during the forecast period.

Based on the type, the mortgage loan refinancing segment held the highest market share in 2022, accounting for nearly two-fifths of the global refinance market revenue, owing to Increase in technical improvements in mortgage lending for underwriting automation and the use of machine learning in lending markets. However, the auto loan refinancing segment is projected to manifest the highest CAGR of 12.6% from 2023 to 2032, owing to the rising number of auto loans, including refinancing.

𝐈𝐟 𝐲𝐨𝐮 𝐡𝐚𝐯𝐞 𝐚𝐧𝐲 𝐬𝐩𝐞𝐜𝐢𝐚𝐥 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭𝐬, 𝐫𝐞𝐪𝐮𝐞𝐬𝐭 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧@ https://www.alliedmarketresearch.com/request-for-customization/221558

The banks segment to maintain its leadership status throughout the forecast period

Based on lenders, the banks segment held the highest market share in 2022, accounting for around three-fifths of the global refinance market revenue, as it enables lenders to efficiently consolidate the data of borrowers, such as previous loans, current outstanding debts, credit scoring, and others. This helps lenders to speed up their decision process and offer customized loan solutions based on client needs. However, the NBFCs segment is projected to manifest the highest CAGR of 11.3% from 2023 to 2032, owing to increase in demand for personalization and self-service and products.

The individual's segment to maintain its lead position during the forecast period

Based on end user, the individuals segment accounted for the largest share in 2022, contributing to more than two-thirds of the global refinance market revenue, owing to the rising popularity of the lower interest rates in student loans offered by the refinancing solution providers. However, the businesses segment is expected to portray the largest CAGR of 10.7% from 2023 to 2032 and is projected to maintain its lead position during the forecast period, due to an increase in the adoption of refinance in small businesses to improve cash flow, pay off debt, or fund growth and expansion.

North America maintains its dominance by 2032

Based on region, North America held the highest market share in terms of revenue in 2022, accounting for nearly two-fifths of the global refinance market revenue, owing to the increase in the number of government-sponsored mortgage investors. However, the Asia-Pacific region is expected to witness the fastest CAGR of 11.9% from 2023 to 2032, owing to increasing government initiatives in the banking industry and an increasing number of users in developing nations such as India and China are responsible for the development of private and rural banking.

Leading Market Players: -

Wells Fargo & Company,

Bank of America Corp.,

Ally Financial Inc

JPMorgan Chase & Co,

Rocket Companies, Inc.,

Citigroup Inc.,

RefiJet,

Better Holdco, Inc,

loanDepot, Inc,

Caliber Home Loans, Inc.,

The report provides a detailed analysis of these key players in the global refinance market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠:

https://www.alliedmarketresearch.com/purchase-enquiry/221558

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Refinance market analysis from 2023 to 2032 to identify the prevailing refinance market forecast.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the Refinance market segmentation assists to determine the prevailing refinance market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global refinance market outlook.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global refinance market trends, key players, market segments, application areas, and refinance market growth strategies.

Refinance Market Report Highlights

By Type

Mortgage Refinancing

Auto Loan Refinancing

Student Loan Refinancing

Personal Loan Refinancing

Business Loan Refinancing

By Lenders

Banks

NBFC's

Others

By End User

Individuals

Businesses

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐌𝐨𝐫𝐞 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Buy Now Pay Later Market https://www.alliedmarketresearch.com/buy-now-pay-later-market-A12528

B2B Payments Market https://www.alliedmarketresearch.com/b2b-payments-market-A08183

Marine Insurance Market https://www.alliedmarketresearch.com/marine-insurance-market-A11321

Travel Insurance Market https://www.alliedmarketresearch.com/travel-insurance-market

Insurance Third Party Administrator Market https://www.alliedmarketresearch.com/insurance-third-party-administrator-market-A12542

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://steemit.com/@poojabfsi

https://www.quora.com/profile/Pooja-BFSI

https://medium.com/@psaraf568

https://www.scoop.it/topic/banking-finance-insurance

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Refinance Market to Attain $44.6 Billion By 2032, at 8.7% CAGR | Top Impacting Factors and Business Strategies here

News-ID: 3381017 • Views: …

More Releases from Allied Market Research

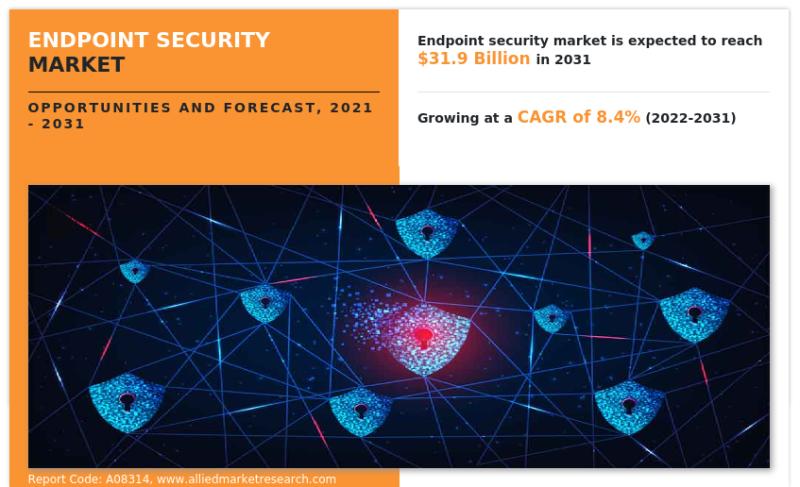

Endpoint Security Market Size Growing at 8.4% CAGR Reach USD 31.9 Billion by 203 …

Allied Market Research published a new report, titled, "Endpoint Security Market Size Growing at 8.4% CAGR Reach USD 31.9 Billion by 2031." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

Smart Manufacturing Market Size Growing at 13.7% CAGR Reach USD 860 Billion by 2 …

Allied Market Research published a new report, titled, "Smart Manufacturing Market Size Growing at 13.7% CAGR Reach USD 860 Billion by 2031." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

Data Virtualization Market Sizze Growing at 21.7% CAGR Reach USD 22.2 Billion by …

According to the report published by Allied Market Research, Data Virtualization Market Sizze Growing at 21.7% CAGR Reach USD 22.2 Billion by 2031. The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers valuable able guidance to leading players, investors, shareholders, and startups in devising strategies for sustainable growth and gaining a competitive edge in the market.

Driving Factors…

Europe IoT Market Growing at 19.0% CAGR Reach USD 12.30 Billion by 2031

According to the report published by Allied Market Research, Europe IoT Market Growing at 19.0% CAGR Reach USD 12.30 Billion by 2031. The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers valuable able guidance to leading players, investors, shareholders, and startups in devising strategies for sustainable growth and gaining a competitive edge in the market.

The Europe IoT…

More Releases for Refinancing

Refinancing Market Insights by Growth, Emerging Trends and Forecast by 2030

Refinancing Market is valued at USD 18.09 million in 2022 and is projected to reach a value of USD 32.26 million in 2030 expanding at a CAGR of 7.5% over the forecast period of 2022-2030

The borrowers in this refinance their current loans in order to enjoy lower monthly payments. This will aid borrowers in making speedier payments, modifying their loan terms, and cashing out their home equity, which are the…

Refinancing Market Overview, Cost Structure Analysis, Growth Opportunities And F …

The Refinancing report presents information related to restraints, key drivers, and opportunities, along with a detailed global market share analysis. The current market is quantitatively analyzed from 2022 to 2029 to highlight the global market growth scenario. The competitive landscape comprises key players, strategies, and new developments in the upcoming years.

Download FREE Sample Report @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=6429486

Key Companies & Market Share Insights

In this section, the readers will gain an understanding of…

Refinancing Market Competitive Environment and Forecast - 2031

Refinancing Market: Snapshot

The global refinancing market is anticipated to show exponential growth during the forecast period of 2021-2031 owing to the aggressive investments made by banks and financial institutions to improve their offerings. The rising demand for loans and refinance options has created multiple growth avenues for the refinancing market. The lucrative finance options available in the market for various purposes such as lower interest rates, fixed rate mortgage, and…

Bond Refinancing Saves St. Louis Lambert International Airport $35 Million

(ST. LOUIS) Comptroller Darlene Green announced that the City of St. Louis saved more than $35 million by refinancing $242 million of outstanding St. Louis Lambert International Airport bonds.

“With favorable market conditions, the City of St. Louis was able to deliver a $35 million present value savings for St. Louis Lambert International Airport that will reduce future debt payments and increase financial flexibility for airport operations and planning,” said…

Municipal Finance Agency 2012 reveals new refinancing possibilities

Kandler Gruppe GmbH (the "Kandler Group") announces new concept for municipal fund-raising

Straubing / Germany, July 3, 2012 – German municipalities manage funding on their own. But taking out bank loans faces increasing difficulties: Stricter requirements for banks' equity capital and the withdrawal of several banks from the municipal finance sector suggest a meltdown of favourable credit terms for municipalities.

In this situation, only the private capital markets can meet the…

Free Mortgage Refinancing Leads Gives Mortgage Brokers R.O.I. Boost In Refinanci …

How can mortgage brokers and loan offers re-capture those glory days? A 7 year old online Ad Agency, Low Cost Traffic shows how they still can.

The company gives Mortgage brokers and loan officers who want telemarketing campaigns a Free telemarketing live transfers control panel which now includes free mortgage refinancing leads of prospects who have previously filled out mortgage refinancing forms uploaded into the system.

Typically mortgage lead brokers sell these…