Press release

Check Cashing Services Market Forecast From 2022 To 2032 To Identify The Prevailing Market Opportunities | at a CAGR of 9.4%

Allied Market Research published a report, titled, "Check Cashing Services Market by Service Provider (Banks, Credit Unions, and Others), Type (Pre-Printed Checks, Payroll Checks, Government Checks, Tax Checks, and Others), and End User (Commercial, and Personal): Global Opportunity Analysis and Industry Forecast, 2022-2032". According to the report, the global check cashing services industry generated $ 27.5 billion in 2022 and is anticipated to generate $ 65.8 billion by 2032, witnessing a CAGR of 9.4 % from 2023 to 2032.𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 𝐍𝐨𝐰:

https://www.alliedmarketresearch.com/request-sample/10896

(We are providing report as per your research requirement, including the Latest Industry Insight's Evolution, Potential and COVID-19 Impact Analysis)

• 123 - Tables

• 62 - Charts

• 377 - Pages

Prime determinants of growth

Surge in the use of alternative financial services and growth in the shift of the population from banks to the non-bank sector are becoming the major factors driving the growth of the market. However, the increase in the adoption of digital payment systems and electronic transactions has reduced paper check usage and, consequently, the demand for check cashing services, which hampers the market growth. Contrarily, the launch of new and advanced software for cashing systems is estimated to provide huge opportunities in the market over the forecast period.

Report coverage & details:

Report Coverage

Details

Forecast Period

2023-2032

Base Year

2022

Market Size in 2022

$ 27.5 billion

Market Size in 2032

$ 65.8 billion

CAGR

9.4 %

No. of Pages in Report

377

Segments covered

Service Provider, Type, End User, and Region.

Drivers

Surge in adoption of digital technologies

Increase in focus on regulatory compliance

High speed of transactions

Opportunities

Continuous improvements in KYC policy

Increased collaboration of key players with banks

Restraints

High cost of fees and fraud concerns

Procure Complete Report (377 Pages PDF with Insights, Charts, Tables, and Figures) @ https://bit.ly/4aitC3R

The banks segment to maintain its leadership status throughout the forecast period

Based on service provider, the banks segment held the highest market share in 2022, accounting for nearly two-thirds of the global check cashing services market revenue. This is because banks are increasingly incorporating community engagement and social responsibility into their check cashing services. This involves actively participating in community outreach programs, supporting local initiatives, and demonstrating a commitment to addressing the financial needs of underserved communities. However, the others segment is projected to manifest the highest CAGR of 11.8% from 2023 to 2032. This is because financial institutions are exploring partnerships with FinTech companies to enhance the efficiency and security of their check cashing services.

The commercial segment to maintain its leadership status throughout the forecast period

Based on end user, the commercial segment held the highest market share in 2022, accounting for more than two-thirds of the global check cashing services market revenue, and is estimated to maintain its leadership status throughout the forecast period. This is owing to check cashing services providing businesses with flexibility in handling different types of checks, including payroll checks, business checks, and customer payments. This flexibility allows businesses to choose a convenient and efficient method for converting checks into cash. However, the personal segment is projected to manifest the highest CAGR of 11.3% from 2023 to 2032. This is because check cashing services are integrated with prepaid card services. This trend allows personal end users to load funds onto prepaid cards, providing them with an additional financial tool for managing their money securely.

𝐈𝐟 𝐲𝐨𝐮 𝐡𝐚𝐯𝐞 𝐚𝐧𝐲 𝐬𝐩𝐞𝐜𝐢𝐚𝐥 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭𝐬, 𝐫𝐞𝐪𝐮𝐞𝐬𝐭 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧@

https://www.alliedmarketresearch.com/request-for-customization/10896

North America to maintain its dominance by 2032

Based on region, North America held the highest market share in terms of revenue in 2022, accounting for more than one-third of the check cashing services market revenue, owing to the presence of leading market players and increase in the adoption of alternative financial services. However, the Asia-Pacific region is expected to witness the fastest CAGR of 12.3% from 2023 to 2032, and is expected to dominate the market during the forecast period. This is due to the economic growth and urbanization in many Asia-Pacific countries contributing to the expansion of the check cashing services industry.

𝐏𝐫𝐨𝐦𝐢𝐧𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐏𝐥𝐚𝐲𝐞𝐫𝐬:

Anfield Cheque Cashing Centre

Encore Capital Group

PHH Mortgage Corporation

Oaktree Capital Group, LLC

Ocwen Financial Corporation

QCHI

Currency Exchange International Corp

Navient Corporation

Secure Check Cashing, Inc

National Money Mart Company

The report provides a detailed analysis of these key players of the global check cashing services market. These players have adopted different strategies such as partnership, product launch, and expansion to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Inquiry before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/10896

𝐊𝐞𝐲 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐅𝐨𝐫 𝐒𝐭𝐚𝐤𝐞𝐡𝐨𝐥𝐝𝐞𝐫𝐬:

◉ This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the check cashing services market forecast from 2022 to 2032 to identify the prevailing market opportunities.

◉ Market research is offered along with information related to key drivers, restraints, and opportunities of check cashing services market outlook.

◉ Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

◉ In-depth analysis of the check cashing services market segmentation assists in determining the prevailing check cashing services market opportunity.

◉ Major countries in each region are mapped according to their revenue contribution to the global check cashing services market.

◉ Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the check cashing services market players.

◉ The report includes an analysis of the regional as well as global check cashing services market trends, key players, market segments, application areas, and market growth strategies.

Check Cashing Services Market Report Highlights

By Service Provider

Banks

Credit Unions

Others

By Type

Pre-printed Checks

Payroll Checks

Government Checks

Tax Checks

Others

By End User

Commercial

Personal

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

𝐓𝐡𝐚𝐧𝐤𝐬 𝐟𝐨𝐫 𝐫𝐞𝐚𝐝𝐢𝐧𝐠 𝐭𝐡𝐢𝐬 𝐚𝐫𝐭𝐢𝐜𝐥𝐞; 𝐲𝐨𝐮 𝐜𝐚𝐧 𝐚𝐥𝐬𝐨 𝐠𝐞𝐭 𝐢𝐧𝐝𝐢𝐯𝐢𝐝𝐮𝐚𝐥 𝐜𝐡𝐚𝐩𝐭𝐞𝐫-𝐰𝐢𝐬𝐞 𝐬𝐞𝐜𝐭𝐢𝐨𝐧𝐬 𝐨𝐫 𝐫𝐞𝐠𝐢𝐨𝐧-𝐰𝐢𝐬𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 𝐯𝐞𝐫𝐬𝐢𝐨𝐧𝐬 𝐥𝐢𝐤𝐞 𝐍𝐨𝐫𝐭𝐡 𝐀𝐦𝐞𝐫𝐢𝐜𝐚, 𝐋𝐀𝐌𝐄𝐀, 𝐄𝐮𝐫𝐨𝐩𝐞, 𝐨𝐫 𝐀𝐬𝐢𝐚-𝐏𝐚𝐜𝐢𝐟𝐢𝐜.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐌𝐨𝐫𝐞 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Consumer Credit Market https://www.alliedmarketresearch.com/consumer-credit-market-A68827

Generative AI in Insurance Market https://www.alliedmarketresearch.com/generative-ai-in-insurance-market-A283347

Smart Contracts Market https://www.alliedmarketresearch.com/smart-contracts-market-A144098

Flood Insurance Market https://www.alliedmarketresearch.com/flood-insurance-market-A113192

Refinance Market https://www.alliedmarketresearch.com/refinance-market-A221074

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://steemit.com/@poojabfsi

https://www.quora.com/profile/Pooja-BFSI

https://medium.com/@psaraf568

https://www.scoop.it/topic/banking-finance-insurance

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Check Cashing Services Market Forecast From 2022 To 2032 To Identify The Prevailing Market Opportunities | at a CAGR of 9.4% here

News-ID: 3380811 • Views: …

More Releases from Allied Market Research

Growing at 21.6% CAGR AI Training Dataset Market Reach USD 9.3 Billion by 2031

According to the report published by Allied Market Research, Growing at 21.6% CAGR AI Training Dataset Market Reach USD 9.3 Billion by 2031. The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers valuable able guidance to leading players, investors, shareholders, and startups in devising strategies for sustainable growth and gaining a competitive edge in the market.

AI Training…

Luxury Footwear Market CAGR to be at 4.7% | $40 Billion Industry Revenue by 2030

Allied market research offers a latest published report on "Global Luxury Footwear Market, 2021-2030". In addition, the report on the global Luxury Footwear Market sizing & forecasting, Y-o-Y growth analysis, and market dynamics, including growth drivers, restraining factors, opportunities, and trends covering the overall prospect of the market.

A detailed analysis into the market position of Luxury Footwear market competitiveness, benefits and downside of enterprise stock, industry growth patterns in the…

Sustainable Athleisure Market is Projected to Grow Expeditiously: to Reach USD 5 …

According to a new report published by Allied Market Research, titled, "Sustainable Athleisure Market Analysis by Type, Demographic, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2021-2030". The global sustainable athleisure market size was valued at $17,641.2 million in 2020, and is projected to reach $53,431.5 million by 2030, registering a CAGR of 11.6% from 2021 to 2030.

Request Sample Copy of Report: https://www.alliedmarketresearch.com/request-sample/14247

The report provides a detailed analysis of…

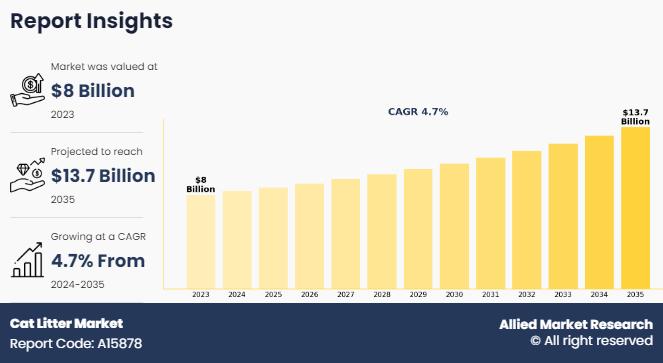

Cat Litter Market 2026 : is Predicted to Develop at a CAGR of 4.7% from 2024 to …

Allied Market Research published a report, titled, "Cat Litter Market by Product Type (Clumping and Non-Clumping), Raw Material (Clay, Silica, and Others), and Distribution Channel (Hypermarkets/Supermarkets, Specialty Pet Stores, and Online Channels): Global Opportunity Analysis and Industry Forecast, 2024-2035". According to the report, the "cat litter market" was valued at $8.0 billion in 2023, and is estimated to reach $13.7 billion by 2035, growing at a CAGR of 4.7% from…

More Releases for Cashing

ZeroPayBank Revolutionizes Mobile Payments: Exploring Micropayment Cashing Metho …

Image: https://lh7-rt.googleusercontent.com/docsz/AD_4nXcowgMZZhhw8VvwaWHOCkRY0bhUbNOx64Gel68_zW3YVQWkwDZlCulVyFnHqW2YafZp3-SHswMIMNhMrlmR5rp6SPWrfsm3MG_vRcQyGu3GEJ1XbRMVyKZrYEBg_SpL7aE?key=53P-TjcyKi1BT7Myu-zzDoQ6

The Era of Mobile Payment: Flat Money in Micropayment! Methods

Realist review: a systematic rapid evidence synthesis Roundtable discussions with international nephrology society members

Key Considerations

- Understanding reasons for variation Withdrawal Safety factors

- Practical aspects

- Prospective vs. Retrospective Optimal timing

- Agreement amongst key stakeholders Migration?

If you are seeing above reading, then the great question that will come to your mind is: at a time when mobile payment method have made big…

Increasing Use of Business Checks Fuels Expansion Of Check Cashing Services Mark …

How Are the key drivers contributing to the expansion of the check cashing services market?

The upwards trend in demand for checks in business transactions is projected to fuel the expansion of the check cashing services market. Checks employed in business transactions are concrete financial tools utilized by firms to execute payments or shift money between entities, ensuring a definitive document and mode of payment. The popularity of checks in business…

Check Cashing Services Market Revenue Expected to Exceed $65.8 Billion by 2032, …

Allied Market Research published a report, titled, "Check Cashing Services Market by Service Provider (Banks, Credit Unions, and Others), Type (Pre-Printed Checks, Payroll Checks, Government Checks, Tax Checks, and Others), and End User (Commercial, and Personal): Global Opportunity Analysis and Industry Forecast, 2022-2032". According to the report, the global check cashing services industry generated $ 27.5 billion in 2022 and is anticipated to generate $ 65.8 billion by 2032, witnessing…

Cashing in on Convenience: Automotive USB PD Market Charges Towards $1 Billion

Data Bridge Market Research recently undertook a comprehensive market intelligence investigation into the Automotive USB Power Delivery System Market. Their freshly released report adopts an attractive format, effectively presenting crucial data through visually captivating tables, graphs, charts, and figures.

Crafting sustainable and lucrative business strategies demands continuous access to valuable and actionable market insights. Addressing this need, the Automotive USB Power Delivery System market research report thoroughly dissects the market landscape,…

Bridge Capital Solutions Corp. Deploys Check Cashing Compliance Training from Ba …

Bridge Capital Solutions Corporation has deployed custom Check Cashing Business Compliance training from Edcomm Banker’s Academy.

New York, NY, April 18, 2011 -- Bridge Capital Solutions Corporation has recently deployed custom Check Cashing Business Compliance training from Edcomm Banker’s Academy. Focus on Compliance for Check Cashing Businesses will be hosted and maintained by Edcomm Banker’s Academy’s Learning Management System (LMS), Learning Link®.

Focus on Compliance for Check Cashing Businesses, from Edcomm Banker’s…

HEADLINE: TEENS CASHING IN ONLINE WITH ECOMMERCE

: The Online Space Continues To Grow Exponentially Year On Year And More Teen Entrepreneurs Are Cashing In On The Opportunity

The days of kids selling lemonade outside the house are not gone but the days on savvy teens cutting the neighbour’s grass are almost dead as more teens turn online to earn their pocket money or in some cases substantially more.

Teens are now looking towards money making schemes online. The…