Press release

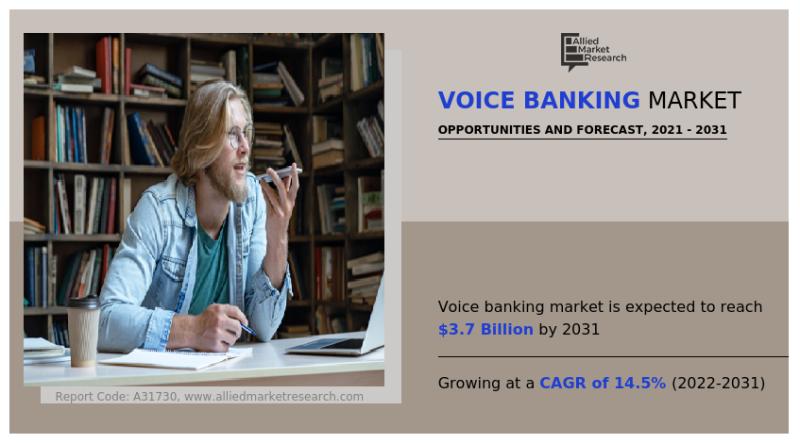

Voice Banking Market Is Expected to Generate $3.7 Billion by 2031 | Growth in Digital Banking Services

Voice Banking Market Size, Share, Competitive Landscape and Trend Analysis Report by Component (Solution, Services), by Deployment Mode (On-Premise, Cloud), by Technology (Machine Learning, Deep Learning, Natural Language Processing, Others), by Application (Banks, NBFCs, Credit Unions, Others): Global Opportunity Analysis and Industry Forecast, 2022-2031𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 :

https://www.alliedmarketresearch.com/request-sample/A31730

According to the report published by Allied Market Research, the global voice banking market garnered $984.6 million in 2021 and is estimated to generate $3.7 billion by 2031, manifesting a CAGR of 14.5% from 2022 to 2031.

The report provides an extensive analysis of changing market dynamics, major segments, value chains, competitive scenarios, and regional landscapes. This research offers valuable guidance to leading players, investors, shareholders, and startups in devising strategies for sustainable growth and gaining a competitive edge in the market.

Covid-19 Scenario:

The outbreak of the COVID-19 pandemic had a positive impact on the growth of the global voice banking market, owing to the implementation of global lockdown and social distancing norms which resulted in the temporary closure of banks.

The rapid adoption of digitalization in the banking sector during the pandemic helped to grow the voice banking market. Moreover, to improve the security features in the banking platform, many banks adopted machine learning to predict fraud even before it happened.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧:

https://www.alliedmarketresearch.com/request-for-customization/A31730

The research provides a detailed segmentation of the global voice banking market based on component, deployment mode, application, and region. The report discusses segments and their sub-segments in detail with the help of tables and figures. Market players and investors can strategize according to the highest revenue-generating and fastest-growing segments mentioned in the report.

Based on application, the bank's segment held the highest share in 2021, accounting for more than half of the global voice banking market, and is expected to continue its leadership status during the forecast period. However, the NBFC segment is expected to register the highest CAGR of 18.6% from 2022 to 2031.

Based on deployment mode, the on-premise segment accounted for the highest share in 2021, holding around three-fifths of the global voice banking market, and is expected to continue its leadership status during the forecast period. However, the cloud-based segment is estimated to grow at the highest CAGR of 16.4% during the forecast period.

Based on components, the solution segment accounted for the highest share in 2021, contributing to nearly three-fourths of the global voice banking market, and is expected to maintain its lead in terms of revenue during the forecast period. However, the services segment is expected to manifest the highest CAGR of 17.6% from 2022 to 2031.

Based on region, North America held the largest share in 2021, contributing to nearly two-fifths of the global voice banking market share. On the other hand, the Asia-Pacific region is projected to maintain its dominant share in terms of revenue in 2031 and is expected to manifest the fastest CAGR of 19.7% during the forecast period.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/A31730

Leading market players of the global voice banking market analyzed in the research include U.S. Bank, Axis Bank, HSBC, Emirates NBD Bank, IndusInd Bank, NatWest Group, BankBuddy, Central 1 Credit Union, DBS Bank, Acapela Group.

The report provides a detailed analysis of these key players in the global voice banking market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Key findings of the study

• By component, the solution segment led the voice banking market in terms of revenue in 2021.

• By deployment mode, the on-premise segment accounted for the highest voice banking market share in 2021.

• By region, the North America segment accounted for the highest voice banking market share in 2021

• By technology, the natural language processing segment accounted for the highest voice banking market share in 2021.

"𝑻𝒉𝒆 𝒗𝒐𝒊𝒄𝒆 𝒃𝒂𝒏𝒌𝒊𝒏𝒈 𝒎𝒂𝒓𝒌𝒆𝒕 𝒊𝒔 𝒇𝒐𝒓𝒆𝒄𝒂𝒔𝒕𝒆𝒅 𝒕𝒐 𝒈𝒓𝒐𝒘 𝒓𝒂𝒑𝒊𝒅𝒍𝒚 𝒘𝒊𝒕𝒉 𝒕𝒉𝒆 𝒊𝒏𝒕𝒆𝒈𝒓𝒂𝒕𝒊𝒐𝒏 𝒐𝒇 𝒕𝒆𝒄𝒉𝒏𝒐𝒍𝒐𝒈𝒚. 𝑻𝒉𝒆 𝒂𝒅𝒐𝒑𝒕𝒊𝒐𝒏 𝒐𝒇 𝒊𝒏𝒏𝒐𝒗𝒂𝒕𝒊𝒗𝒆 𝒕𝒆𝒄𝒉𝒏𝒐𝒍𝒐𝒈𝒚 𝒊𝒔 𝒈𝒂𝒊𝒏𝒊𝒏𝒈 𝒔𝒊𝒈𝒏𝒊𝒇𝒊𝒄𝒂𝒏𝒕 𝒕𝒓𝒂𝒄𝒕𝒊𝒐𝒏 𝒘𝒊𝒍𝒍 𝒃𝒆 𝒉𝒆𝒍𝒑𝒇𝒖𝒍 𝒇𝒐𝒓 𝒗𝒐𝒊𝒄𝒆 𝒃𝒂𝒏𝒌𝒊𝒏𝒈 𝒎𝒂𝒓𝒌𝒆𝒕 𝒈𝒓𝒐𝒘𝒕𝒉. 𝑭𝒖𝒓𝒕𝒉𝒆𝒓𝒎𝒐𝒓𝒆, 𝒎𝒂𝒄𝒉𝒊𝒏𝒆 𝒍𝒆𝒂𝒓𝒏𝒊𝒏𝒈 𝒂𝒏𝒅 𝒂𝒓𝒕𝒊𝒇𝒊𝒄𝒊𝒂𝒍 𝒊𝒏𝒕𝒆𝒍𝒍𝒊𝒈𝒆𝒏𝒄𝒆 𝒄𝒂𝒑𝒂𝒃𝒊𝒍𝒊𝒕𝒊𝒆𝒔 𝒂𝒓𝒆 𝒑𝒂𝒓𝒕𝒊𝒄𝒖𝒍𝒂𝒓𝒍𝒚 𝒉𝒆𝒍𝒑𝒊𝒏𝒈 𝒗𝒐𝒊𝒄𝒆 𝒃𝒂𝒏𝒌𝒊𝒏𝒈 𝒑𝒓𝒐𝒗𝒊𝒅𝒆𝒓𝒔 𝒕𝒐 𝒓𝒆𝒅𝒖𝒄𝒆 𝒂𝒄𝒄𝒐𝒖𝒏𝒕 𝒐𝒑𝒆𝒏𝒊𝒏𝒈 𝒕𝒊𝒎𝒆 𝒂𝒏𝒅 𝒐𝒑𝒆𝒓𝒂𝒕𝒊𝒐𝒏𝒂𝒍 𝒄𝒐𝒔𝒕𝒔."

𝐁𝐫𝐨𝐰𝐬𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 :

https://www.alliedmarketresearch.com/voice-banking-market-A31730

𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Online Insurance Market https://www.alliedmarketresearch.com/online-insurance-market-A31675

Exchange Traded Fund Market https://www.alliedmarketresearch.com/exchange-traded-fund-market-A31686

Blockchain In Retail Banking Market https://www.alliedmarketresearch.com/blockchain-in-retail-banking-market-A31695

RPA and Hyperautomation in Banking Market https://www.alliedmarketresearch.com/rpa-and-hyperautomation-in-banking-market-A31697

Canada Extended Warranty Market https://www.alliedmarketresearch.com/canada-extended-warranty-market-A24713

WealthTech Solutions Market https://www.alliedmarketresearch.com/wealthtech-solutions-market-A31614

Property Insurance Market https://www.alliedmarketresearch.com/property-insurance-market-A05998

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://steemit.com/@monikak

https://www.quora.com/profile/Monika-Kawade-2

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Voice Banking Market Is Expected to Generate $3.7 Billion by 2031 | Growth in Digital Banking Services here

News-ID: 3380785 • Views: …

More Releases from www.alliedmarketresearch.com

Pet Insurance Market Soars: Projected to Hit $38.3 Billion by 2033 as Demand for …

According to a new report published by Allied Market Research, titled, "Pet Insurance Market, By Policy Coverage (Accident Only, Accident and Illness, and Others), By Animal Type (Dogs, Cats, and Others), and By Sales Channel (Agency, Broker, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". The pet insurance market was valued at $10.10 billion in 2023, and is estimated to reach $38.3 billion by 2033, growing at a CAGR…

Manual Spray Guns Market to Hit $2.6 Billion by 2032 | Key Growth Drivers & Oppo …

Prime determinants of growth

The demand for manual spray guns, which are mostly used for painting consumer durables, has increased because of this need, particularly in developing nations like India, China, and Vietnam. Additionally, there is a greater need for manual spray guns from car manufacturers due to the rising demand for automobiles around the world, particularly in industrialized nations like Europe and North America.

Download PDF Sample Report: www.alliedmarketresearch.com/request…ple/111362

Due to…

Hygienic Cladding Market Poised for Growth: Global Trends & Opportunities 2023-2 …

According to the report, the global hygienic cladding market generated $2.8 billion in 2022, and is anticipated to generate $6 billion by 2032, rising at a CAGR of 8.3% from 2023 to 2032.

Prime Determinants of Growth

The increased awareness & demand for health-related products, the increasing need for safe & healthy environments in healthcare facilities, and hygienic wall cladding's affordability & durability than traditional tiling methods are the factors expected to…

AI in Insurance Market Poised to Reach $45.74 Bn Globally by 2031, Soaring at a …

Global Opportunity Analysis and Industry Forecast, 2021-2031". According to the report, the global AI in insurance industry generated $2.74 billion in 2021, and is anticipated to generate $45.74 billion by 2031, witnessing a CAGR of 32.5% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A11615

Higher deployment cost of AI, advanced machine learning, and lack of skilled labor hamper the market growth. On the contrary, surge in government initiatives…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…