Press release

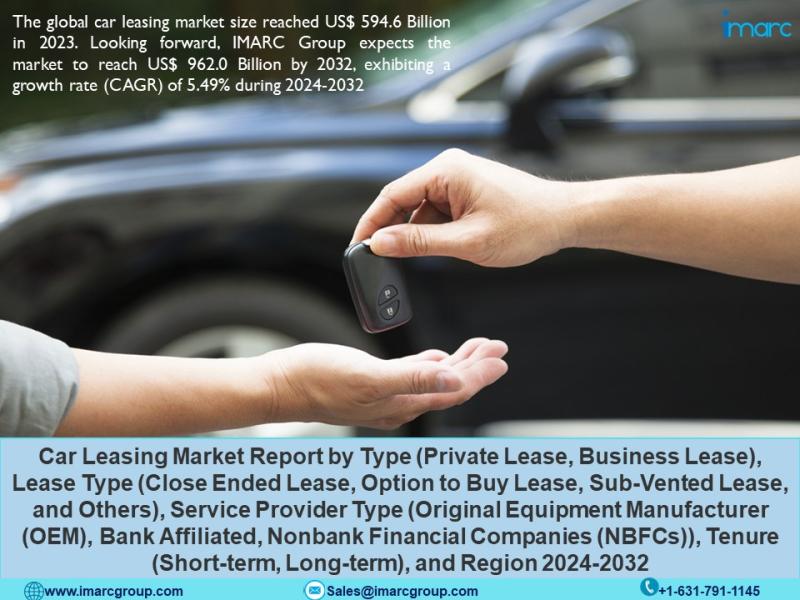

Car Leasing Market Size, Share, Trends, Companies, Segmentation and Forecast 2024-2032

The global car leasing market size reached US$ 594.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 962.0 Billion by 2032, exhibiting a growth rate (CAGR) of 5.49% during 2024-2032.Global Car Leasing Market Trends:

The growing awareness and adoption of environmentally friendly practices spurring the demand for electric and hybrid vehicles on lease is aiding in market expansion as consumers increasingly prioritize sustainability. In line with this, the surge in on-demand and shared mobility services, with consumers opting for short-term, hassle-free vehicle access, is acting as another significant growth-inducing factor. Moreover, the rise of subscription-based models is aiding in market expansion as consumers are drawn to the simplicity of bundled services, encompassing maintenance, insurance, and roadside assistance, eliminating the complexities associated with vehicle ownership.

Request to Get the Sample Report: https://www.imarcgroup.com/car-leasing-market/requestsample

FACTORS Affecting the Growth of the Car Leasing Industry:

Financial flexibility and affordability: Car leasing is fueled by the appeal of financial flexibility and affordability for consumers. With leasing, individuals can drive a new vehicle without the burden of a substantial upfront payment or the long-term commitment associated with purchasing. Monthly lease payments are typically lower than loan payments, enabling consumers to access higher-end models and advanced features at a more manageable cost. This factor is particularly attractive to those who prioritize driving the latest models while maintaining budgetary control. The flexibility to return or upgrade the vehicle at the end of the lease term adds to the allure, making car leasing an attractive option for those seeking cost-effective and adaptable mobility solutions.

Technological advancements and rapid depreciation: The constant evolution of automotive technology plays a pivotal role in the car leasing market. Rapid technological advancements result in vehicles becoming outdated quickly, leading to accelerated depreciation. Leasing allows consumers to embrace cutting-edge features and safety innovations without the long-term commitment that comes with ownership. This factor is especially relevant in today's fast-paced technological landscape, where consumers desire the latest connectivity, safety, and efficiency features. Leasing provides an avenue for staying ahead of the technological curve, enticing customers who seek to enjoy the benefits of modern automotive advancements without the burden of long-term ownership.

Changing consumer preferences and urban lifestyles: Shifting consumer preferences, influenced by urbanization and changing lifestyles, contribute significantly to the growth of the car leasing market. Increasingly, consumers value access over ownership, especially in urban areas where space constraints and environmental concerns are prevalent. Car leasing aligns with this trend, offering a convenient and cost-effective solution for individuals who prioritize access to a vehicle without the responsibilities associated with ownership. The flexibility to adapt to changing lifestyle needs, whether it be downsizing for city living or transitioning to a different vehicle type, positions car leasing as a tailored and adaptable mobility solution in response to the evolving demands of contemporary consumers, bolstering the market growth.

Explore Full Report Description At: https://www.imarcgroup.com/car-leasing-market

Competitive Landscape:

The competitive landscape of the market has been studied in the report with the detailed profiles of the key players operating in the market.

• ALD Automotive (Société Générale Group)

• Arval BNP Paribas Group (BNP Paribas)

• Avis Budget Group

• Caldwell Leasing

• Ewald Automotive Group

• LeasePlan Corporation N.V.

• Lex Autolease Limited

• ORIX Corporation

• Sixt SE

• Wheels Inc.

Car Leasing Market Report Segmentation:

By Type:

• Private Lease

• Business Lease

Business leases lead the market due to the cost-effectiveness and strategic advantages they offer to companies, providing access to a fleet of vehicles without the financial burden of ownership.

By Lease Type:

• Close Ended Lease

• Option to Buy Lease

• Sub-Vented Lease

• Others

Close-ended leases dominate as they provide consumers with fixed costs, minimizing financial uncertainties, and offering the option to return the vehicle at the end of the lease without residual value concerns.

By Service Provider Type:

• Original Equipment Manufacturer (OEM)

• Bank Affiliated

• Nonbank Financial Companies (NBFCs)

Based on the service provider type, the global car leasing market is segmented into original equipment manufacturers (OEM), bank-affiliated, and nonbank financial companies (NBFCs).

By Tenure:

• Short-term

• Long-term

On the basis of tenure, the global car leasing market is bifurcated into short-term and long-term.

Regional Insights:

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East and Africa

North America stands as the largest market due to a strong culture of car leasing, driven by consumer preferences for flexible mobility solutions and a robust business leasing sector, especially in economically developed regions like the United States and Canada.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=12636&flag=C

Key Highlights of the Report:

• Market Performance (2018-2023)

• Market Outlook (2024-2032)

• Market Trends

• Market Drivers and Success Factors

• Impact of COVID-19

• Value Chain Analysis

• Comprehensive mapping of the competitive landscape

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Car Leasing Market Size, Share, Trends, Companies, Segmentation and Forecast 2024-2032 here

News-ID: 3379270 • Views: …

More Releases from IMARC Group

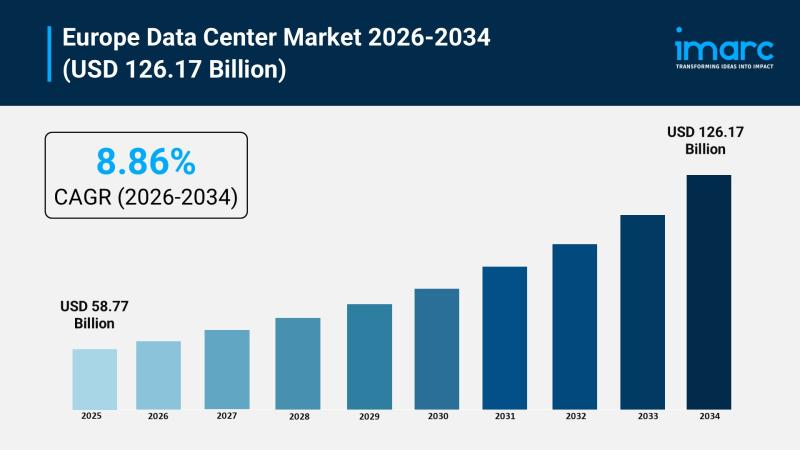

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

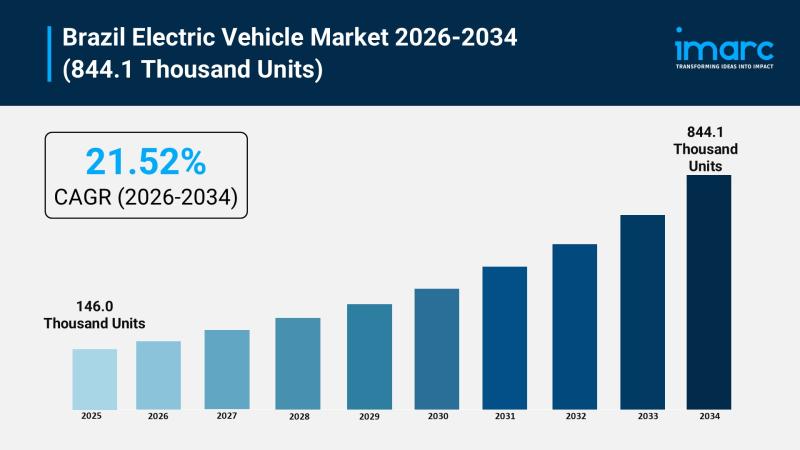

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for Leasing

Financial Leasing Market: A Compelling Long-Term Growth Story | Minsheng Financi …

The latest 94+ page survey report on Financial Leasing Market is released by HTF MI covering various players of the industry selected from global geographies like North America, US, Canada, Mexico, Europe, Germany, France, U.K., Italy, Russia, Nordic Countries, Benelux, Rest of Europe, Asia, China, Japan, South Korea, Southeast Asia, India, Rest of Asia, South America, Brazil, Argentina, Rest of South America, Middle East & Africa, Turkey, Israel, Saudi Arabia,…

Financial Leasing Market 2019 Global Major Players: CDB Leasing, ICBC Financial …

The Global Financial Leasing Industry, 2019-2024 Market Research Report is a professional and in-depth study on the current state of the Global Financial Leasing industry with a focus on the Global market. The report provides key statistics on the market status of the Financial Leasing manufacturers and is a valuable source of guidance and direction for companies and individuals interested in the industry.

The report displays significant strategies which are…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report: https://www.researchreportsinc.com/sample-request?id=177516

Over the next five years, RRI…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

Oct 2018, New York USA (News) - A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report:…

Financial Leasing Market by Top Key Participant CDB Leasing, ICBC Financial Leas …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Get Sample Copy of this Report @ https://www.researchbeam.com/global-financial-leasing-by-manufacturers-countries-type-and-application-forecast-to-2023-market/request-sample?utm_source=Anil

Scope of the Report:

This report studies the Financial Leasing market…