Press release

Business Travel Accident Insurance Market 2024 Report By Key Companies, Regional Analysis And Forecast 2033

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2033The Business Research Company presents an extensive market research report on the Business Travel Accident Insurance Global Market Report 2024, furnishing businesses with a competitive edge through a detailed examination of the market structure, encompassing estimates for various segments and sub-segments.

Furthermore, the report highlights on emerging trends, significant drivers, challenges, and opportunities, providing all necessary data for thriving in the industry. This report market research offers a comprehensive perspective, including an in-depth analysis of the present and future scenarios within the industry.

Market Sizing:

The business travel accident insurance market size has grown exponentially in recent years. It will grow from $6.1 billion in 2023 to $7.53 billion in 2024 at a compound annual growth rate (CAGR) of 23.5%. The growth in the historic period can be attributed to rise in awareness of travel-associated risks, increased incidences of natural catastrophes and rise in healthcare costs.

The business travel accident insurance market size is expected to see exponential growth in the next few years. It will grow to $16.58 billion in 2028 at a compound annual growth rate (CAGR) of 21.8%. The growth in the forecast period can be attributed to globalization and increase in business travel and growing volume of corporate conferences and events. Major trends in the forecast period include integration of technology to elevate services, customized coverage for diverse employee groups, business-centric travel insurance solutions, and business-centric travel insurance solutions.

Request for free sample report -

https://www.thebusinessresearchcompany.com/sample.aspx?id=8114&type=smp

Key Market Players:

Major companies operating in the business travel accident insurance market report are MetLife Inc, Allianz SE, American International Group Inc, Zurich Insurance Group, AXA,Assicurazioni Generali S.P.A., Chubb Corporation, The Hartford, Starr International Company, Tata AIG General Insurance Company Limited, Corporate Risks India Insurance Brokers Pvt Ltd, New India Assurance - General Insurance Brokers, Oriental Insurance Company, ICICI Lombard General Insurance Company, United India Insurance, HDFC ERGO Non-Life Insurance Company, Fanhua Holdings, Insubuy LLC, China Life Insurance Company Limited, SafetyWing, Genki, Insured Nomads, Sompo Japan Nipponkoa Insurance Inc, Mitsui Sumitomo Insurance Co. Ltd, Marsh & McLennan Companies UK Limited, Aon UK Limited, Arthur J Gallagher & Co, Willis Towers Watson plc, Lloyd's of London Limited, Funk Gruppe GmbH, Ecclesia Holding GmbH, Hannover Re, Crédit Agricole Assurances, Société Générale, Sogaz Insurance Group, Ingosstrakh Insurance Co, UNIQA, Ceská Pojištovna, Groupama, RSHB Insurance, Soglasie Insurance Company, Sberbank Insurance Company LLC, Travel Insurance Center, Global Underwriters Agency Inc., International Citizens Insurance, AIG Seguros Brasil SA, Mapfre Argentina Holding S.A., Sancor Seguros Argentina, Nación Seguros, Arabia Insurance Cooperative Company, Abu Dhabi National Insurance, Dubai Insurance Co, Al-Etihad Co-operative Insurance Co, Saudi Arabian Cooperative Insurance Co., Care Line Group, De Wet De Villiers, Travelinsure, Lensure Insurance Brokers Cc, Oojah Travel Protection, Takaful Insurance of Africa, Bryte Insurance Company Limited

Market Drivers:

The surge in business travel is expected to propel the growth of the business travel accident insurance market. Business travel refers to traveling from one place to another for business purposes only. As the pandemic is getting better, business travel is booming. Business travel accident insurance aids in traveling, as it insures the travelers against any losses occurring at the time of travel. For instance, according to a US-based business travel and meetings trade organization Global Business Travel Association (GBTA) on Business Travel Recovery report, in August 2022, the percentage of business travel has climbed to 86%, up from 73% in the GBTA's February report. Therefore, the rise in business travel will drive the business travel accident insurance market.

Learn More About The Market Report -

https://www.thebusinessresearchcompany.com/report/business-travel-accident-insurance-global-market-report

The business travel accident insurance market covered in this report is segmented -

1) By Type: Single Trip Coverage, Annual Multi-Trip Coverage, Other Types

2) By Distribution Channel: Insurance Company, Insurance Broker, Banks, Insurance Aggregators, Other Distribution Channels

3) By End-User: Corporations, Government, International Travelers, Employees

The report answers the following questions:

What are the primary factors propelling the market during the projected period?

In which region is the most substantial growth expected?

Which trend will take center stage in the upcoming period?

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Want To Know More About The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Business Travel Accident Insurance Market 2024 Report By Key Companies, Regional Analysis And Forecast 2033 here

News-ID: 3377307 • Views: …

More Releases from The Business research company

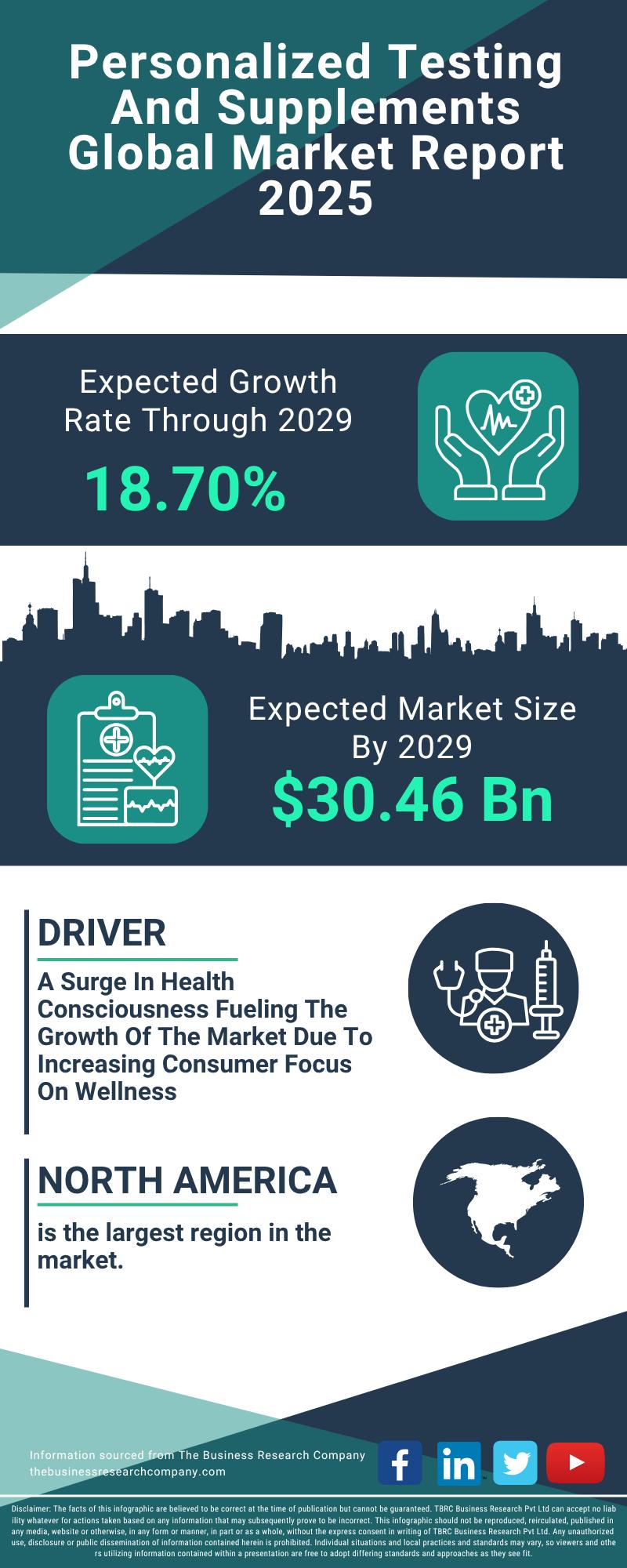

Segment Evaluation and Major Growth Areas in the Personalized Testing and Supple …

The personalized testing and supplements sector is gaining remarkable traction, driven by advancements in technology and a rising consumer focus on tailored health solutions. As more individuals seek customized wellness options, this market is set to experience substantial expansion in the coming years. Here's an in-depth look at its current valuation, key players, significant trends, and the main market segments shaping its future.

Market Valuation and Expansion Forecast for Personalized Testing…

Top Players and Market Competition in the Skin Microbiome Industry

The skin microbiome market is emerging as a significant area of interest due to growing awareness about the critical role of skin health and innovative skincare technologies. As research advances and consumer preferences shift towards more natural and science-backed products, this market is set to undergo substantial growth. Let's explore the current market size, key players, driving factors, and upcoming trends shaping the skin microbiome industry.

Projected Expansion in the Skin…

Key Strategic Developments and Emerging Changes Shaping the Upadacitinib Market …

The upadacitinib market is poised for significant expansion over the coming years, driven by advances in treatment options and increasing awareness of autoimmune diseases. This report delves into the market's current size, key drivers, major players, and the emerging trends shaping its future trajectory.

Steady Growth Expected in Upadacitinib Market Size Through 2029

The market for upadacitinib is projected to reach $2.54 billion by 2029, growing at a robust compound annual…

Analysis of Key Market Segments Driving the Alzheimer's Disease Diagnostic Marke …

The Alzheimer's disease diagnostic sector is rapidly evolving as advancements in technology and healthcare infrastructure open new possibilities for early detection and personalized treatment. With rising awareness and innovative approaches, this market is poised for significant growth in the coming years. Let's explore the current market size, key drivers, leading companies, and emerging trends that are shaping this critical healthcare field.

Projected Market Size and Growth Trends in Alzheimer's Disease Diagnostics…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…