Press release

Supply Chain Finance Global Market Set to Skyrocket to $9.68 Billion By 2028 with an Impressive CAGR 9.0% | Allianz Trade, Alibaba, Bank of America Corporation, Citigroup Inc., HSBC Holdings Plc., BNP Paribas

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2033The Business Research Company presents an extensive market research report on the Supply Chain Finance Global Market Report 2024, furnishing businesses with a competitive edge through a detailed examination of the market structure, encompassing estimates for various segments and sub-segments.

Furthermore, the report highlights on emerging trends, significant drivers, challenges, and opportunities, providing all necessary data for thriving in the industry. This report market research offers a comprehensive perspective, including an in-depth analysis of the present and future scenarios within the industry.

Market Sizing:

The supply chain finance market size has grown strongly in recent years. It will grow from $6.23 billion in 2023 to $6.85 billion in 2024 at a compound annual growth rate (CAGR) of 9.9%. The growth in the historic period can be attributed to globalization, regulatory changes, risk mitigation needs, collaboration trends, market competition, working capital optimization.

The supply chain finance market size is expected to see strong growth in the next few years. It will grow to $9.68 billion in 2028 at a compound annual growth rate (CAGR) of 9.0%. The growth in the forecast period can be attributed to sustainable finance, economic recovery, enhanced data analytics, regulatory adaptation, strategic partnerships. Major trends in the forecast period include technological integration, technology advancements, data analytics for risk management, digitization and technology integration, dynamic ecosystem collaboration.

Request for free sample report -

https://www.thebusinessresearchcompany.com/sample.aspx?id=10841&type=smp

Key Market Players:

Major companies operating in the supply chain finance market report are JPMorgan Chase & Co, Allianz Trade, Alibaba, Bank of America Corporation, Citigroup Inc., HSBC Holdings Plc., Mitsubishi UFJ Financial Group Inc., BNP Paribas, Oracle Corporation, SAP SE, Deutsche Bank, Royal Bank of Scotland Plc., DBS Bank, Standard Chartered Plc., Asian Development Bank, Finastra, Euler Hermes, Greensill Capital, C2FO, Tradeshift, Taulia, Demica, Vayana Network, Incomlend, PrimeRevenue

Market Drivers:

Rise in investment in small and medium-sized enterprises (SMEs) for supply chain finance is expected to propel the growth of the supply chain finance market going forward. Small and medium-sized companies (SMEs) are businesses with sales, assets, or a specific number of employees that are less than a given size. Supply chain finance allows small and medium-sized enterprises (SMEs) to access larger volumes of bank credit based on the strength and volume of their trade transactions, where these credits are accessible at significantly lower interest rates to navigate working capital challenges and improve their overall financial health to ensures an uninterrupted flow of materials and services from their smallest suppliers to timely delivery of finished goods to their clients. For instance, in June 2021, European Investment Bank (EIB), a Luxembourg-based investment bank, partnered with Intesa Sanpaolo, an Italy-based leading bank. It allocated $19.39 billion (18 billion euros) fund for small and medium-sized Italian businesses to address and support the industrial supply chains and this scheme would support over 50,000 SMEs, 150 large corporates and mid-caps over the three years. Therefore, rise in investment in SMEs for supply chain finance drives the growth of the supply chain finance market.

Learn More About The Market Report -

https://www.thebusinessresearchcompany.com/report/supply-chain-finance-global-market-report

The supply chain finance market covered in this report is segmented -

1) By Offering: Export And Import Bills, Letter of Credit, Performance Bonds, Shipping Guarantees, Other Offerings

2) By Provider: Banks, Trade Finance House, Other Providers

3) By Application: Domestic, International

4) By End User: Large Enterprises, Small and Medium-sized Enterprises

The report answers the following questions:

What are the primary factors propelling the market during the projected period?

In which region is the most substantial growth expected?

Which trend will take center stage in the upcoming period?

Want To Know More About The Business Research Company?

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Supply Chain Finance Global Market Set to Skyrocket to $9.68 Billion By 2028 with an Impressive CAGR 9.0% | Allianz Trade, Alibaba, Bank of America Corporation, Citigroup Inc., HSBC Holdings Plc., BNP Paribas here

News-ID: 3375722 • Views: …

More Releases from The Business research company

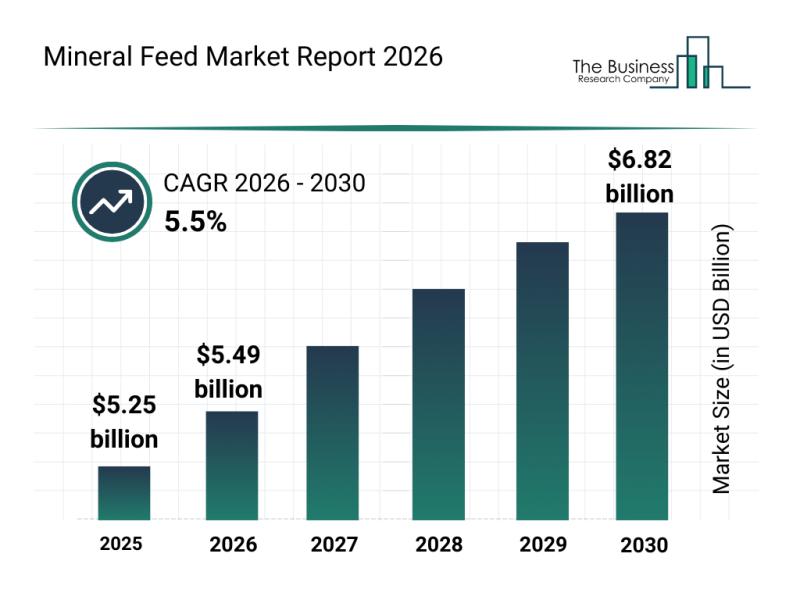

Emerging Growth Patterns Driving Expansion in the Mineral Feed Market

The mineral feed sector is poised for notable expansion as the demand for optimized animal nutrition continues to grow. With increasing emphasis on sustainability and precision in feeding practices, this market is set to experience substantial development in the coming years. Below is a detailed overview covering projected market size, key players, emerging trends, and segment analysis.

Projected Growth Trajectory of the Mineral Feed Market through 2030

The mineral feed…

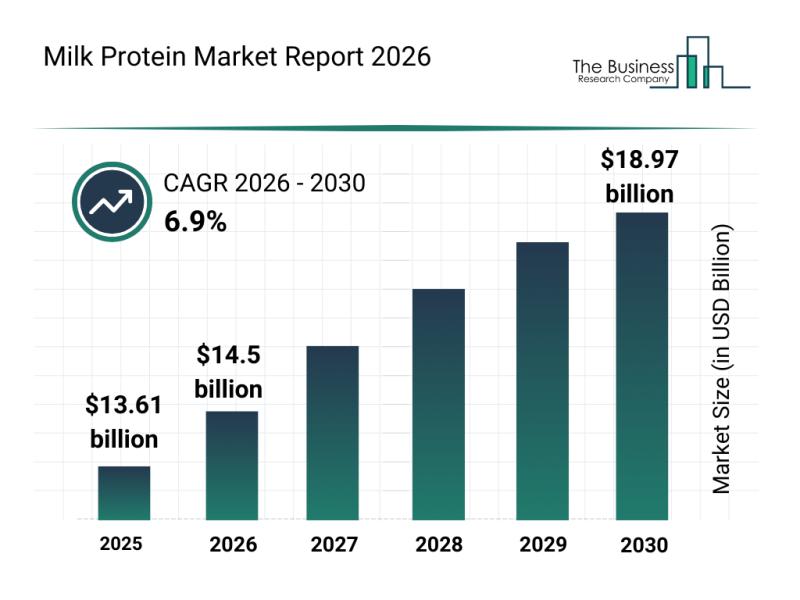

Overview of Segmentation, Market Dynamics, and Competitive Landscape in the Milk …

The milk protein sector is poised for substantial expansion over the coming years as consumer interest in health and nutrition continues to rise. Advances in product innovation and evolving eating habits are driving this market forward, creating promising opportunities for manufacturers and suppliers alike. Let's explore the current market size, major players, prevailing trends, and key segments shaping the future of milk proteins.

Projected Market Size and Growth Expectations for the…

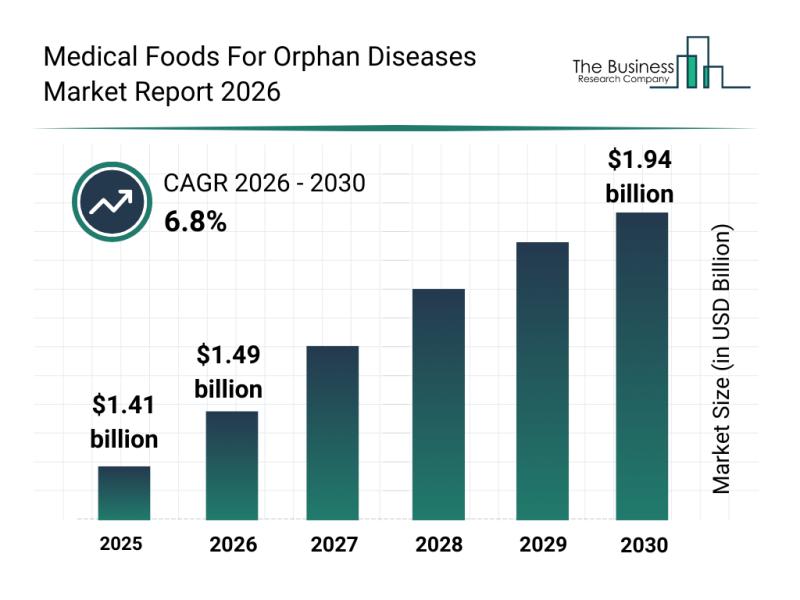

Segment Evaluation and Major Growth Areas in the Medical Foods for Orphan Diseas …

The medical foods sector for orphan diseases is gaining significant attention as demand for specialized nutritional therapies grows. With advancements in precision nutrition and a surge in investments aimed at rare conditions, this niche market is set to experience considerable expansion. Below, we explore the market's size, key players, emerging trends, and detailed segment insights shaping its future.

Expected Market Size and Growth Path of Medical Foods for Orphan Diseases …

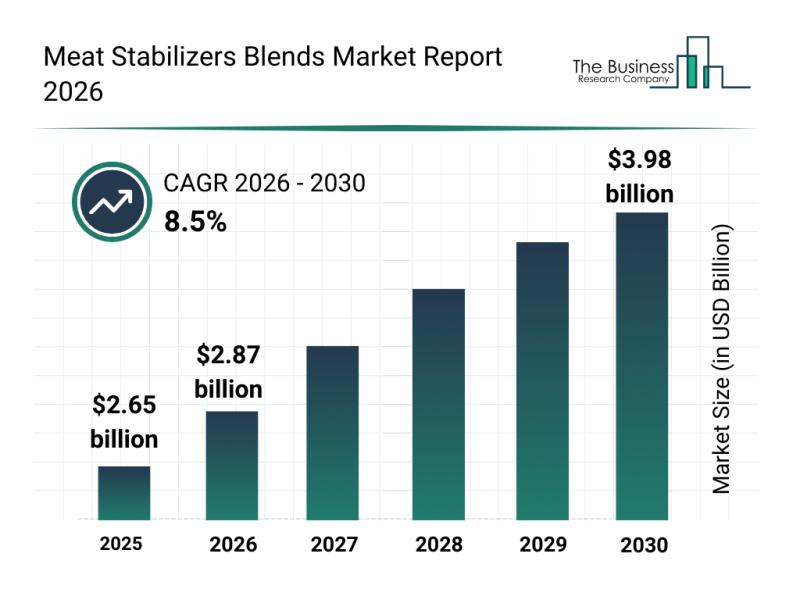

Emerging Growth Patterns Driving the Expansion of the Meat Stabilizers Blends Ma …

The meat stabilizers blends market is on track for significant expansion as consumer preferences and food industry innovations continue to evolve. Driven by a growing demand for healthier and more functional meat products, this sector is set to witness remarkable growth through 2030. Below, we explore the market size, leading players, emerging trends, and key segments that define this dynamic landscape.

Market Size and Growth Outlook for the Meat Stabilizers Blends…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…