Press release

Top Insurtech Companies Worldwide (2024) | IMARC Group

Top Insurtech companies are increasingly focusing on customer needs and preferences. This shift towards customer-centricity involves using data analytics and artificial intelligence (AI) to understand customer behavior and preferences better. Key market players are also deploying chatbots and AI-driven platforms to provide personalized advice and streamline the claims process, making it more user-friendly. They are introducing novel insurance products that are flexible and tailored to individual needs. Moreover, pay-as-you-go insurance models and micro-insurance products are gaining traction. These models offer more affordable and accessible insurance solutions, especially beneficial for those who may not require or afford traditional insurance plans. Insurtech companies are harnessing the power of big data and AI to improve risk assessment and pricing strategies. By analyzing large datasets, these companies can more accurately predict risks and tailor premiums accordingly. This data-driven approach not only improves the efficiency of underwriting processes but also helps in fraud detection and risk management. Insurtech firms are partnering with established insurance companies. These partnerships enable traditional insurers to access advanced technologies and innovative business models, while Insurtech startups benefit from the established customer base and brand trust of these larger companies.According to the latest report by IMARC Group, The global insurtech market size reached US$ 3.1 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 12.1 Billion by 2032, exhibiting a growth rate (CAGR) of 16.53% during 2024-2032.

Request for a sample copy of this research report: https://www.imarcgroup.com/insurtech-market/requestsample

Insurtech Market Trends and Growth:

Insurtech companies are also leveraging online platforms, mobile apps, and social media to reach a broader audience and offer a more seamless insurance buying experience. This approach not only reduces operational costs but also caters to the preferences of a tech-savvy customer base. Top Insurtech companies are actively engaging with regulatory bodies to ensure compliance with existing laws and to shape new regulatory frameworks. By working collaboratively with regulators, they are helping to create an environment that is conducive to innovation while ensuring customer protection and market stability. Many leading Insurtech companies are expanding their operations globally. This expansion is not just in terms of geographical reach but also in diversifying their product offerings to cater to different markets. Insurtech firms are at the forefront of implementing telematics in insurance products, particularly in auto insurance. By using data from in-car devices or smartphones, they can assess driver behavior and vehicle usage, enabling more personalized and usage-based insurance premiums. This not only encourages safer driving habits but also allows customers to potentially reduce their insurance costs based on their driving patterns. Top companies are exploring the use of blockchain technology to improve transparency and efficiency. Blockchain can be used for smart contracts, secure and transparent record-keeping, and reducing fraud. This technology also enables peer-to-peer insurance models, where individuals can pool their risks without needing a traditional insurance carrier.

Top Leading Insurtech Companies in the World:

Damco Group

DXC Technology Company

Insurance Technology Services

Majesco (Aurum PropTech Limited)

Oscar Insurance Corporation

Quantemplate

Shift Technology

Travelers Companies, Inc.

Wipro

ZhongAn Online P&C Insurance Co. Ltd.

Explore Complete Blog by IMARC Group: https://www.imarcgroup.com/top-insurtech-companies

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top Insurtech Companies Worldwide (2024) | IMARC Group here

News-ID: 3373584 • Views: …

More Releases from IMARC Group

United States AI Governance Market Size, Growth, Latest Insights and Forecast 20 …

IMARC Group's Latest Research Reveals a CAGR of 28.10% from 2026-2034, Supported by Expanding Certification, Auditing, and Impact Assessment Processes

NEW YORK, USA - The United States artificial intelligence (AI) governance industry is witnessing rapid expansion as organizations intensify efforts to implement responsible AI practices. According to the latest market intelligence report by IMARC Group, the United States AI Governance Market, valued at USD 81.6 Million in 2025, is projected to…

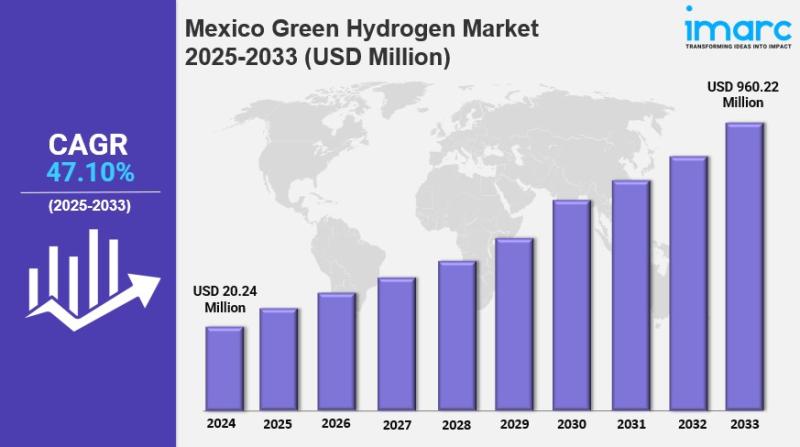

Mexico Green Hydrogen Market Size, Share, Demand, Trends & Forecast to 2033

IMARC Group's Latest Research Reveals a CAGR of 47.10% from 2025-2033, with Renewable-Powered Electrolysis and Export-Oriented Projects Accelerating Market Expansion

NEW YORK, USA - The Mexico green hydrogen industry is entering a high-growth phase, supported by national decarbonization initiatives and rising global demand for clean fuels. According to the latest report by IMARC Group, the Mexico Green Hydrogen Market reached a value of USD 20.24 Million in 2024 and is projected…

U.S. Pet Insurance Market Growth, Outlook & Key Players Analysis 2033

IMARC Group's Latest Research Reveals a CAGR of 10.8% from 2025-2033, with Customized Coverage Plans and Digital Platforms Accelerating Market Expansion

NEW YORK, USA - The U.S. pet insurance industry is witnessing rapid and sustained growth. According to a new market intelligence report by IMARC Group, the U.S. Pet Insurance Market, valued at USD 2.0 Billion in 2024, is projected to reach USD 5.1 Billion by 2033, registering a compound annual…

United States Home Healthcare Market Set to Reach USD 186.5 Billion by 2034, Dri …

PRESS RELEASE

FOR IMMEDIATE RELEASE

Date: February 24, 2026

Contact: sales@imarcgroup.com | +1-201-971-6302 | www.imarcgroup.com

IMARC-Style Industry Analysis Reveals a CAGR of 6.70% During 2026-2034, Supported by Expansion of Telehealth and Remote Patient Monitoring

The United States Home Healthcare Market reached a value of USD 103.7 Billion in 2025 and is projected to grow to USD 186.5 Billion by 2034, exhibiting a steady CAGR of 6.70% during 2026-2034.

Market growth is primarily driven by the rapidly…

More Releases for Insurtech

Insurtech Accelerators Market Hits New High | Major Giants Plug and Play, Startu …

HTF MI just released the Global Insurtech Accelerators Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Insurtech Accelerators Market are: Plug and Play,…

Insurtech Market: A Comprehensive Overview

The global insurtech market was valued at approximately USD 10.3 billion in 2024 and is projected to reach around USD 152.9 billion by 2033, growing at a compound annual growth rate (CAGR) of about 31.5% from 2025 to 2033.

Insurtech Market Overview

The global Insurtech market is undergoing explosive growth, fueled by the insurance industry's rapid digitization and rising customer demand for seamless, personalized digital experiences. Advanced technologies like artificial intelligence (AI),…

Top Trends Transforming the InsurTech (Insurance Technology) Market Landscape in …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the InsurTech (Insurance Technology) Industry Market Size Be by 2025?

The volume of the insurtech (insurance technology) market has expanded significantly in the past few years. The market, currently valued at $19.23 billion in 2024, is projected to reach $25.95 billion in 2025, demonstrating a compound annual…

Emerging Trends Influencing The Growth Of The Insurtech Market: Innovative AI-Po …

The Insurtech Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Insurtech Market Size Expected to Be by 2034?

In recent times, the insurtech market has seen substantial expansion. The projected growth indicates an increase from $17.08 billion in 2024 to $22.08 billion…

Top Factor Driving Insurtech Market Growth in 2025: Rising Tide Of Insurance Cla …

How Are the key drivers contributing to the expansion of the insurtech market?

The expected surge in insurance claims is projected to directly contribute to the expanded growth of the insurtech market. Insurtech plays a critical role in claim management, risk assessment, contract processing, and policy underwriting. The increase in hospitalizations during the COVID-19 pandemic has resulted in a steep rise in insurance claims. An illustrative example of this could be…

Insurtech, Market Dynamics, Global Opportunities, Forecast 2024

The Business Research Company recently released a comprehensive report on the Global Insurtech Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…