Press release

Impact Investing Market Analysis and Future Prospects for 2033

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2587The Business Research Company presents an extensive market research report on the Impact Investing Global Market Report 2024 , furnishing businesses with a competitive edge through a detailed examination of the market structure, encompassing estimates for various segments and sub-segments.

Furthermore, the report highlights on emerging trends, significant drivers, challenges, and opportunities, providing all necessary data for thriving in the industry. This report market research offers a comprehensive perspective, including an in-depth analysis of the present and future scenarios within the industry.

Market Sizing:

The impact investing market size has grown rapidly in recent years. It will grow from $478.15 billion in 2023 to $550.52 billion in 2024 at a compound annual growth rate (CAGR) of 15.1%. The growth in the historic period can be attributed to social and environmental awareness, shift in investor values, emergence of impact metrics, rise of social enterprises, millennial and gen z preferences, institutional commitment.

The impact investing market size is expected to see rapid growth in the next few years. It will grow to $1061.14 billion in 2028 at a compound annual growth rate (CAGR) of 17.8%. The growth in the forecast period can be attributed to renewable energy transition, racial and gender equity, global resilience planning, circular economy initiatives, education and skill development. Major trends in the forecast period include technology and innovation, outcome measurement and reporting, social bonds and green bonds, collaboration and partnerships, nature-based solutions.

Request for free sample report -

https://www.thebusinessresearchcompany.com/sample.aspx?id=7688&type=smp

Key Market Players:

Major companies operating in the impact investing market report are LeapFrog Investments Ltd., Sustainalytics, The Rise Fund, Revolution Foods Inc., Root Capital Inc., Triodos Bank N.V., MicroVest Capital Management LLC, New Ventures LLC, Acumen Fund Inc., Omidyar Network Fund Inc., responsAbility Investments AG, Calvert Impact Capital Inc., Capricorn Investment Group LLC, Toniic Network Inc., Bridges Fund Management Ltd., Veris Wealth Partners LLC, RSF Social Finance Inc., Sarona Asset Management Inc., ClearlySo Ltd., Elevar Equity LLC, Open Road Alliance, Shared Interest, SJF Ventures Management LLC, Big Path Capital LLC, Blue Haven Initiative LLC, Core Innovation Capital Management LLC, BlueOrchard Finance S.A., Lok Capital LLC, RENEW Strategies LLC, Capria Ventures LLC

Market Drivers:

The increase in millennial investors is expected to propel the growth of the impact investing market going forward. Millennial investors refer to a type of investor who is less likely to invest in stocks. These millennial investors are adopting sustainable investing to aim for positive change in addressing social and environmental issues and to generate wealth constantly. Millennial investors believe impact investing is the best way to increase their share of social change and good as compared to the traditional forms of philanthropy to create long-term positive change in society. For instance, in April 2022, according to a survey conducted by Fidelity Charitable, a US-based independent public charity with a donor-advised fund program, that included more than 1,200 investors to understand their approach to investing in social change, stated that approximately 61% of millennial investors participated in impact investing and 40% of non-participating investors are expected to make their impact investment in the future in the US. Therefore, increasing the number of millennial investors is driving the growth of the impact investing market.

Learn More About The Market Report -

https://www.thebusinessresearchcompany.com/report/impact-investing-global-market-report

The impact investing market covered in this report is segmented -

1) By Illustrative Sector: Education, HealthCare, Housing, Agriculture, Environment, Clean Energy Access, Climate Change, Other Illustrative Sectors

2) By Enterprise Size: Large Enterprises, Medium and Small Enterprises

The report answers the following questions:

What are the primary factors propelling the market during the projected period?

In which region is the most substantial growth expected?

Which trend will take center stage in the upcoming period?

Want To Know More About The Business Research Company?

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Impact Investing Market Analysis and Future Prospects for 2033 here

News-ID: 3371756 • Views: …

More Releases from The Business research company

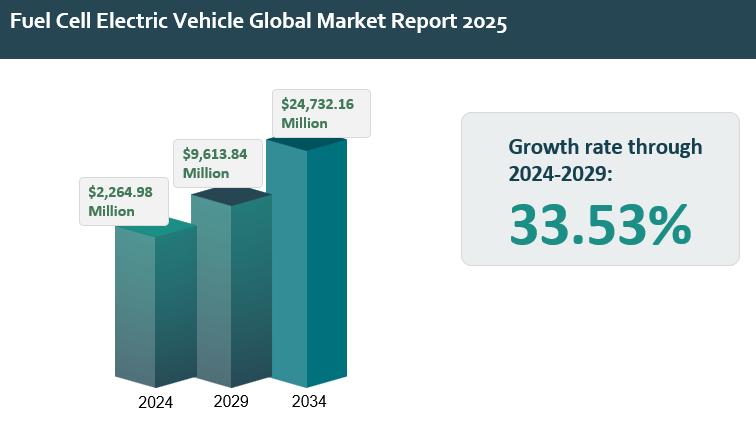

Global Fuel Cell Electric Vehicle Market Outlook 2025-2034: Growth Acceleration, …

The fuel cell electric vehicle report outlines and analyzes the fuel cell electric vehicle market, covering the historic period 2019-2024 and the forecast periods 2024-2029 and 2034F. The report assesses the market across regions and the major economies within each region.

The global fuel cell electric vehicle market was valued at $2.26498 billion in 2024, increasing at a CAGR of 6.88% since 2019. The market is projected to rise from $2.26498…

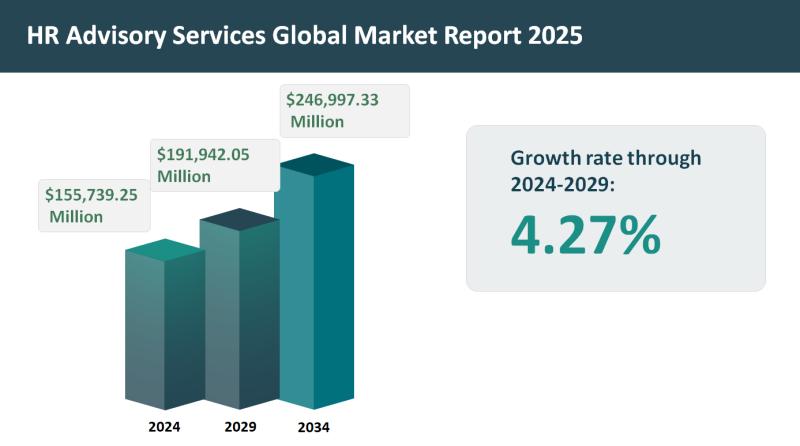

Global HR Advisory Services Market Set for 4.27% Growth, Projected to Reach $191 …

The HR advisory services report outlines and analyzes the HR advisory services market across 2019-2024 (historic period) and 2024-2029, 2034F (forecast period). It examines market performance across global regions and key economies.

The global HR advisory services market was valued at approximately $155.73925 billion in 2024, increasing at a CAGR of 4.22% since 2019. The market is anticipated to rise from $155.73925 billion in 2024 to $191.94205 billion in 2029, reflecting…

Evolving Market Trends In The Integrated Geophysical Services Industry: Enhancin …

The Integrated Geophysical Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Integrated Geophysical Services Market Size During the Forecast Period?

The integrated geophysical services market has experienced consistent growth in recent years, expected to rise from $2.35 billion in 2024 to…

Global HR Advisory Services Market: Key Trends, Market Share, Growth Drivers, An …

The HR advisory services market report describes and explains the HR advisory services market and covers 2019-2024, termed the historic period, and 2024-2029, 2034F termed the forecast period. The report evaluates the market across each region and for the major economies within each region.

The global HR advisory services market reached a value of nearly $155.74 billion in 2024, having grown at a compound annual growth rate (CAGR) of 4.22% since…

More Releases for Capital

Venture Capital Investment Market Is Booming Worldwide | Accel, Benchmark Cap …

Venture Capital Investment Market: The extensive research on Venture Capital Investment Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Venture Capital Investment Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Venture Capital & Private Equity Firms Market is Going to Boom | TPG Capital, GG …

The latest independent research document on Venture Capital & Private Equity Firms examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Venture Capital & Private Equity Firms study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth,…

Venture Capital Investment Market 2021 Is Booming Worldwide | Accel, Benchmark C …

Venture Capital Investment Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Venture Capital Investment market across the globe, including valuable facts and figures. Venture Capital Investment Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…

Risk Capital Investment Market Business Development Strategies 2020-2026 by Majo …

Risk Capital Investment Market - Global Analysis is an expert compiled study which provides a holistic view of the market covering current trends and future scope with respect to product/service, the report also covers competitive analysis to understand the presence of key vendors in the companies by analyzing their product/services, key financial facts, details SWOT analysis and key development in last three years. Further chapter such as industry landscape and…

Global Venture Capital Investment Market, Top key players are Accel, Benchmark C …

Global Venture Capital Investment Market Report 2019 - History, Present and Future

The global market size of Venture Capital Investment is $XX million in 2018 with XX CAGR from 2014 to 2018, and it is expected to reach $XX million by the end of 2024 with a CAGR of XX% from 2019 to 2024.

Global Venture Capital Investment Market Report 2019 - Market Size, Share, Price, Trend and Forecast is a professional…

Venture Capital Investment Market 2019 Trending Technologies, Developments, Key …

Fintech solutions provide alternative finance firms with a platform for investors to directly come across companies and individuals looking for equity financing and debt. The technology has enabled new players to take faster decisions, engage with customers more precisely, and run operations at low cost-to-income ratios compared with traditional banks

This report studies the Venture Capital Investment market status and outlook of Global and major regions, from angles of players,…