Press release

Retail Banking Market Sector Poised for 8.1% CAGR Growth, Targeting USD 4 Trillion by 2032 with Barclays, BNP Paribas, and Citigroup Leading

The retail banking market is undergoing a transformative phase marked by rapid integration of technology, which continues to reshape the market landscape, with a strong emphasis on digitalization. Mobile banking apps, online platforms, and AI-driven services are becoming universal, revolutionizing customer interactions and enhancing operational efficiency. In addition, there is rise in focus on personalization and customer-centric experiences. Banks are investing heavily in user-friendly interfaces and adopting omnichannel strategies to meet the evolving expectations of customers who seek seamless and tailored services.Allied Market Research published a report, titled, "Retail Banking Market by Type (Commercial Banks, Rural Banks, and Others), Function (Bank Account Opening, Deposits and Withdrawals, Debit and Credit Card Issuance, Investment and Insurance, and Others), and End User (Individuals and Businesses): Global Opportunity Analysis and Industry Forecast, 2023-2032". According to the report, the global retail banking industry generated $ 1.9 trillion in 2022 and is anticipated to generate $ 4030.3 billion by 2032, witnessing a CAGR of 8.1% from 2023 to 2032.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐓𝐡𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐎𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭 : https://www.alliedmarketresearch.com/request-sample/6037

Retail banking refers to the segment of banking that provides financial services directly to individual consumers and small businesses. It includes a wide range of services, including basic transactions like depositing and withdrawing money, as well as offering loans, mortgages, credit cards, and various investment products. Retail banks operate through a network of physical branches, ATMs, online platforms, and mobile applications. They focus on meeting the everyday financial needs of individuals, such as managing savings and checking accounts, obtaining loans for homes or cars, and providing access to payment and transfer services. Retail banking plays a vital role in the economy by serving as a conduit for individuals to manage their finances and access credit for personal and business needs.

Prime Determinants of Growth

The retail banking market is expected to witness notable growth owing to technological advancements and digital transformation, changing customer expectations and preferences and regulatory shifts and compliance focus. Moreover, personalized financial services and data-driven insights are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, intense competition from fintech startups and economic uncertainty and low interest rates limit the growth of the retail banking market.

COVID-19 Scenario

The impact of COVID-19 on the retail banking market was mixed, with both positive and negative consequences. Initially, the pandemic presented significant challenges, leading to economic uncertainty, job losses, and financial strain for many individuals and businesses. This resulted in increased demand for loan restraint and relief programs, putting pressure on banks' asset quality.

However, as the crisis advanced, retail banks played a crucial role in stabilizing the economy by swiftly implementing government-backed stimulus programs and providing financial support to affected customers and businesses. Furthermore, the pandemic accelerated the adoption of digital banking solutions, as customers sought contactless and online options, ultimately propelling technological advancements in the industry.

Thus, while COVID-19 initially posed challenges, it also emphasized the resilience and adaptability of the retail banking sector, driving innovation and digital transformation.

𝐆𝐫𝐚𝐛 𝐭𝐡𝐞 𝐨𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐲 !!! 𝐋𝐈𝐌𝐈𝐓𝐄𝐃-𝐓𝐈𝐌𝐄 𝐎𝐅𝐅𝐄𝐑 - 𝐁𝐮𝐲 𝐍𝐨𝐰 & 𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝟏𝟓 % 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐨𝐧 𝐭𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭 :- https://bit.ly/3Qr2PcD

The commercial banks segment to maintain its leadership status throughout the forecast period

Based on type, the commercial banks segment held the highest market share in 2022, accounting for more than half of the global retail banking market revenue and is estimated to maintain its leadership status throughout the forecast period. This is primarily attributed to its extensive range of services and established presence. Commercial banks typically offer a comprehensive suite of financial products and services, including checking and savings accounts, loans, credit cards, and wealth management. However, the rural banks segment is projected to attain the highest CAGR of 10.4% from 2023 to 2032. This is attributed to its strategic focus on underserved areas and specialized services tailored to the unique needs of rural communities. Rural banks are adept at understanding the specific challenges and financial requirements of rural populations, which can differ significantly from urban areas.

The bank account opening segment to maintain its leadership status throughout the forecast period

Based on function, the bank account opening segment held the highest market share in 2022, accounting for more than one-third of the global retail banking market revenue. This is attributed to the fact that there has been a concerted effort by banks to streamline and simplify the account opening process, making it more accessible and convenient for customers. This includes the integration of digital platforms and mobile applications, allowing individuals to open accounts remotely without the need for physical visits to a branch. However, the investment and insurance segment is projected to attain the highest CAGR of 11.7% from 2022 to 2032. This is due to a shifting focus towards wealth management and financial planning. There is an increased interest in investment products and insurance policiesas individuals become more familiar of the importance of long-term financial security.

Get Customized Reports with your Requirements: https://www.alliedmarketresearch.com/request-for-customization/6037

The individuals segment to maintain its leadership status throughout the forecast period

Based on end user, the individuals segment held the highest market share in 2022, accounting for two-thirds of the global retail banking market revenue. This is primarily due to the sheer volume of individual consumers who rely on retail banking services for their day-to-day financial needs. This includes activities like managing personal accounts, obtaining mortgages, and accessing various payment services. In addition, individuals are likely to engage with retail banks for services like savings accounts and credit cards, further solidifying their dominant market presence. However, the businesses segment is projected to manifest the highest CAGR of 10.2% from 2022 to 2032. This is because of the increase in recognition of the unique financial needs and complexities faced by businesses. There is a growing demand for specialized banking services tailored to business operations with the expansion of entrepreneurship and small to medium-sized enterprises (SMEs), . This includes services like business loans, commercial lines of credit, and cash management solutions. The business segment in retail banking is expected to experience substantial growth as businesses continue to evolve and seek more sophisticated financial products.

Asia-Pacific to maintain its dominance by 2032

Based on region, Asia-Pacific held the highest market share for more than one-fourth in terms of revenue in 2022 and it is expected to witness the fastest CAGR of 10.3% from 2023 to 2032 and is likely to dominate the market during the forecast period. Asia-Pacific's estimated rapid growth in the retail banking market is due to the region's increasing middle class, rapid urbanization, and the increasing penetration of smartphones and internet connectivity. There is a growing demand for convenient and accessible banking services as more individuals gain access to digital platforms. Moreover, many countries in Asia-Pacific have traditionally been savings-oriented, providing a strong foundation for retail banking services.

Leading Market Players: -

Barclays

BNP Paribas

Citigroup, Inc.

Deutsche Bank

Goldman Sachs

Industrial and Commercial Bank of China ( Asia ) Limited.

JP Morgan Chase & Co.

Mitsubishi UFJ Financial Group, Inc.

The Hongkong and Shanghai Banking Corporation Limited

Wells Fargo

𝐈𝐧𝐪𝐮𝐢𝐫𝐲 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/6037

Trending Reports in BFSI Industry

Banking as a Service Market https://www.alliedmarketresearch.com/banking-as-a-service-market-A14258

Extended Warranty Market https://www.alliedmarketresearch.com/extended-warranty-market

AI in BFSI Market https://www.alliedmarketresearch.com/artificial-intelligence-in-BFSI-market

Business Insurance Market https://www.alliedmarketresearch.com/business-insurance-market

Retail E-commerce Market https://www.alliedmarketresearch.com/retail-e-commerce-market-A06000

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://steemit.com/@poojabfsi

https://www.quora.com/profile/Pooja-BFSI

https://medium.com/@psaraf568

https://www.scoop.it/topic/banking-finance-insurance

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Retail Banking Market Sector Poised for 8.1% CAGR Growth, Targeting USD 4 Trillion by 2032 with Barclays, BNP Paribas, and Citigroup Leading here

News-ID: 3369772 • Views: …

More Releases from Allied Market Research

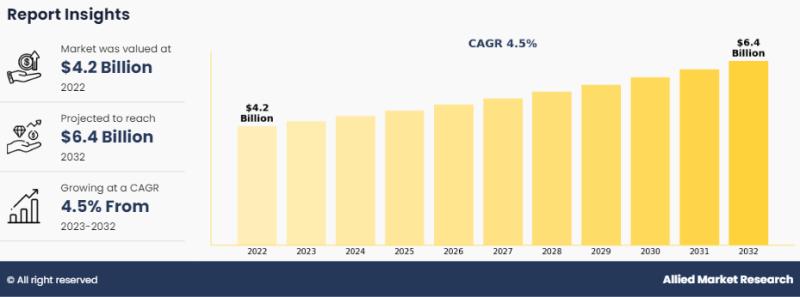

Aircraft Paint Market Trend 2026 to 2032, Growing at a CAGR of 4.5%

Allied Market Research has recently published a report, titled, "Aircraft Paint Market Size, Share, Competitive Landscape and Trend Analysis Report by Application, by Type, by Aircraft Type, by End-User: Global Opportunity Analysis and Industry Forecast, 2023-2032." According to the report, the global aircraft paint market generated $4.2 billion in 2022, and is anticipated to generate $6.4 billion by 2032, rising at a CAGR of 4.5% from 2023 to 2032. …

Grease Additives Industry: Exploring Market Trends and Innovations, Forecast, 20 …

Allied Market Research published a report, titled, "Grease Additives Market by Type (Antiwear Agents, Corrosion Inhibitors, Pressure Additives, Oxidation Inhibitors, Metal Deactivators, and Others) by End-Use Industry (Automotive, Marine, Aerospace, Mining, Industrial Machinery, and Others): Global Opportunity Analysis and Industry Forecast, 2022-2032". According to the report, the global grease additives market was valued at $380.7 million in 2022 and is projected to reach $642.9 million by 2032, growing at a…

Expert View: High Performance Plastics Market Shows Outstanding Growth at a CAGR …

Allied Market Research published a report, titled, "High Performance Plastics Market by Type (Fluoropolymers, High-Performance Polyamides, Polyphenylene Sulfide, Liquid Crystal Polymers, and Polyimides) by End-Use Industry (Transportation, Medical, Industrial, Electrical and Electronics, Defense, Building and Construction and Others): Global Opportunity Analysis and Industry Forecast, 2022-2032". According to the report, the global high performance plastics market was valued at $23.6 billion in 2022 and is projected to reach $58.0 billion by…

![[2026] Blow Molded Plastics Market Growing at a CAGR of 4.2% to 2032, Says AMR](https://cdn.open-pr.com/L/2/L206833859_g.jpg)

[2026] Blow Molded Plastics Market Growing at a CAGR of 4.2% to 2032, Says AMR

Allied Market Research published a report, titled, "Blow Molded Plastics Market by Type (Injection Blow Molding, Extrusion Blow Molding, Others), by Material (Polyethylene, Polyethylene Terephthalate, Polypropylene, Polyamide, Polycarbonate, Polyvinyl chloride, Others), by End-use industry (Medical, Packaging, Building and Construction, Automotive and transportation, Electrical and electronics, Others): Global Opportunity Analysis and Industry Forecast, 2023-2032". According to the report, the blow molded plastics market was valued at $72.6 billion in 2022 and…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…