Press release

Investor ESG Software Market Comprehensive Statistics, Growth Rate, and Future Trends 2030

This research report provides insights into the "Global Investor ESG Software Market." This report summarizes the results of the assessment carried out by The Insight Partners in the field of the Investor ESG Software Market for the global perspective. The report provides an analysis of the Investor ESG Software Market by deployment, application, and geography.The Investor ESG Software Market report provides the current market size for the Investor ESG Software Market, defines trends, and presents growth forecasts to 2028. All the market numbers for revenue are provided in US dollars. The Investor ESG Software Market is analyzed by the supply side, considering the market penetration of Investor ESG Software for all the regions globally. The study also provides market insights and analysis of the Investor ESG Software Market, highlighting the technological market trends, adoption rate, industry dynamics, and competitive analysis of major players in the Investor ESG Software industry.

Get a PDF Sample Brochure at - https://www.theinsightpartners.com/sample/TIPRE00017547/?utm_source=OpenPR&utm_medium=10779

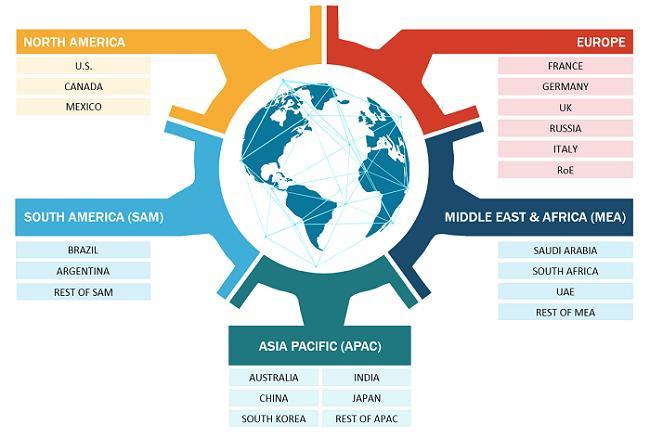

This research report on the "Investor ESG Software Market" provides a holistic view of the global market size across major regions- North America, Europe, APAC, MEA, and SAM. The report further elucidates the key driving factors, restraints, growth opportunities, and future trends about the market growth. The Investor ESG Software Market is segmented into Component, Enterprise Size.

Market Drivers

Market Restraints

Future Trends

Market Opportunities

The Insight Partners Investor ESG Software Market Research Report Scenario includes:

Chapter 1 The report provides qualitative and quantitative trends of the global Investor ESG Software Market.

The report provides qualitative and quantitative trends of the global Investor ESG Software Market segmented by Component, Enterprise Size.

Chapter 2The report starts with the key takeaways, highlighting the key trends and outlook of the global Investor ESG Software Market.

Chapter 3 provides the research methodology of the study.

Chapter 4 provides a brief overview of the Investor ESG Software Market landscape. It further provides the segmentation of the market with PEST analysis on global scenarios along with ecosystem analysis and expert opinions.

Chapter 5 highlights the Investor ESG Software Market trends and outlook and the prevailing factors that are driving the market, as well as are deterrents to market growth, along with their impact analysis.

Chapter 6 discusses the market revenue and forecast, in the global Investor ESG Software Market.

Chapter 7, 8, and 9 discuss the Investor ESG Software Market segmented by Component, Enterprise Size across the regions of North America, Europe, Asia-Pacific, the Middle East and Africa, and South America.

Chapter 10 provides the impact of COVID 19 across the regions of North America, Europe, Asia-Pacific, the Middle East and Africa, and South America, and respective countries.

Chapter 11 provides the industry landscape and highlights the major market events, as well as major Investor ESG Software Market vendors in the ecosystem.

Chapter 12 provides the detailed profiles of the key companies operating within the Investor ESG Software Market. The companies have been profiled based on their key facts, business descriptions, financial overview, SWOT analysis, and key developments.

Chapter 13 the appendix is inclusive of a brief overview of the company, glossary of terms, contact information, and the disclaimer section.

This research provides detailed information regarding the major factors influencing the growth of the Investor ESG Software Market at the Global and Regional Level (drivers, restraints, opportunities, and challenges), forecast of the market size, in terms of value, market share by region and segment; regional market positions; segment and country opportunities for growth; New product developments, strengths, and weaknesses, brand portfolio; Marketing and distribution strategies; challenges and threats from current competition and prospects; Key company profiles, SWOT, product portfolio and growth strategies.

For More Info - https://www.theinsightpartners.com/reports/investor-esg-software-market/

Primary Research:

"The Insight Partners" conducts hundreds of primary interviews a year with industry participants and commentators to validate its data and analysis. A typical research interview fulfills the following functions:

Provides First-Hand Information on the Market Size, Market Trends, Growth Trends, Competitive Landscape, and Future Outlook

Validates and Strengthens Secondary Research Findings

Further Develops the Analysis Team's Expertise and Market Understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

Industry Participants: VPs, Business Development Managers, Market Intelligence Managers and National Sales Managers

Outside Experts: Valuation Experts, Research Analysts and Key Opinion Leaders Specializing in the Industry

Immediate delivery of our off-the-shelf reports and prebooking of upcoming studies, through flexible and convenient payment methods - https://www.theinsightpartners.com/buy/TIPRE00017547/?utm_source=OpenPR&utm_medium=10779

Key Players -

Conservice, LLC

Greenstone+ Ltd

Refinitiv Ltd

WeSustain GmbH

COLLIBRA (OWN ANALYTICS)

ARABESQUE GROUP

DATAMARAN

PLANA.EARTH GMBH (PLAN A)

CLARITY AI

S&P Global Inc

Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation and industry verticals.

Contact Us:

Contact Person : Ankit Mathur

Phone : +1-646-491-9876

E-mail : sales@theinsightpartners.com

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Food and Beverages, Consumers and Goods, Chemicals and Materials.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Investor ESG Software Market Comprehensive Statistics, Growth Rate, and Future Trends 2030 here

News-ID: 3364958 • Views: …

More Releases from The Insight Partners

Green Building Materials Market Forecast 2031: Valued at US$ 791.93 Billion, Gro …

The Green Building Materials Market size is expected to reach US$ 791.93 billion by 2031. The market is anticipated to register a CAGR of 10.4% during 2025-2031.

Global Green Building Materials Market 2031 Report give our customers an exhaustive and top to bottom examination of Green Building Materials Market alongside its key factors, for example, market diagram and rundown, pieces of the pie, restrictions, drivers, local examination, players, serious elements, division,…

Text Analytics Market Growth Forecast: Valued at US$ 29.53 Billion by 2031

The Text Analytics Market is evolving rapidly, fueled by breakthroughs in artificial intelligence, natural language processing, and the exploding volume of unstructured data from social media, customer feedback, and enterprise communications. Businesses worldwide are turning to text analytics solutions to unlock hidden insights, enhance customer experiences, and drive data-informed strategies. As organizations navigate complex data landscapes, text analytics stands out as a critical tool for competitive advantage.

Download PDF: -https://www.theinsightpartners.com/sample/TIPTE100000198?utm_source=Openpr&utm_medium=10413

In today's…

Genome Editing Market: Trends, Opportunities, and Future Outlook

The genome editing market has emerged as one of the most dynamic and transformative sectors in biotechnology, driven by advancements in genetic engineering technologies and increasing applications across various fields. As of 2024, the market is witnessing significant growth, fueled by the rising demand for personalized medicine, agricultural innovations, and therapeutic solutions. This article explores the current trends, opportunities, and future outlook of the genome editing market.

Get the sample request…

Transdermal Drug Delivery System Market to Reach US$ 51,949.74 Million by 2030

The Transdermal Drug Delivery System Market is entering a new era of growth, driven by rising demand for non-invasive drug administration, patient-friendly therapies, and technological innovation. According to industry analysis, the market size is expected to grow from US$ 37,230.28 million in 2022 to US$ 51,949.74 million by 2030, recording a CAGR of 4.3% during 2022-2030. This trajectory highlights the increasing adoption of transdermal patches, gels, sprays, and other advanced…

More Releases for Investor

VestaScan Launches Investor Ready Startup Program to Standardize Investor Access …

Delaware, US - VestaScan [https://www.vestascan.com/] today announced the launch of its Investor Ready Startup Program, a low budget growth initiative designed to help startups become investor ready by improving how they package, control, and share information during investor review. The program positions VestaScan as investor access infrastructure, focused on readiness and due diligence workflows rather than fundraising services.

Image: https://www.abnewswire.com/upload/2026/01/4bee80940683169157dd9113bcd877be.jpg

The program is delivered through a small group of trusted startup ecosystem…

Las Vegas Investor Conference 2024

Connecting Visionary Investors with Next-Gen Opportunities In-Person & Virtual Webinar

Today through Friday, December 15th, join 500+ investors and investment attendees in person and online for an exclusive, one-day gathering showcasing cutting-edge investment opportunities across sectors like AI, Blockchain, Consumer Products, Longevity, Medtech, Psychedelics, Real Estate, Sports and Tech for the 2nd annual Las Vegas Investor Conference 2024. This is a hybrid in-person and Zoom webinar so event participants and marketing…

Securing Legacies: Global Investor Connections

For every business owner, there comes a time when the future of their company becomes as important as its past. It's not just about handing over the keys, but ensuring that the vision, values, and hard-earned legacy continue to thrive. In response to this, IndiaBizForSale is quietly playing a vital role by connecting business owners with a network of over 40,000 investors worldwide, people who understand the importance of legacy…

Peruvian Stock Exchange and BRON Investor Network Join Forces to Create Unique I …

Peruvian Stock Exchange and BRON Investor Network Join Forces to Create Unique Investor Education Platform: Lima, Peru - The Bolsa de Valores de Lima (BVL) and the BRON Investor Network announced today that they have entered into an agreement to offer investors in Peru a unique investment network that offers extensive investor relations aggregation with the latest social networking technology. The partnership will bring together BVL's years of experience in…

INVESTOR LOAN FINANCING PRODUCTS NATIONWIDE

We at KIS Lending believe in the art of word of mouth recommendations. Please see below with a variety of programs clients can take advantage of. We can assist in a variety of ways to finance the next home purchase or investment property NATIONWIDE for you or your clients. DSCR is the latest best option for investors.

• RESIDENTIAL FIX & FLIP + BRRRR LOANS: 90% of purchase, 100% of…

DeSpace Protocol Investor Announcement

DeSpace Protocol has partnered with a new team of strategic investors

LONDON, September 7, 2021 – Today we’re extremely proud to introduce some of the strategic investors that are backing DeSpace. We’re honored to have Lead Wallet ( https://www.leadwallet.io/ ), OMNI ( https://omni.ai/ ), Almora Capital ( https://www.almora.capital/ ), Criterion ( https://criterionvc.com/ ), Dach Capital ( https://dach.capital/ ) , and BTA Ventures ( https://bta.ventures/ ) partnering with DeSpace to help…