Press release

Private 5G-as-a-Service Market By Component (Hardware, Software, Service), By Frequency Band (Sub-6 GHz, mmWave), By Deployment Model (Standalone (SA), Non-standalone (NSA)), By Spectrum (Licensed, Unlicensed/Shared), By Industry Vertical (Manufacturing,

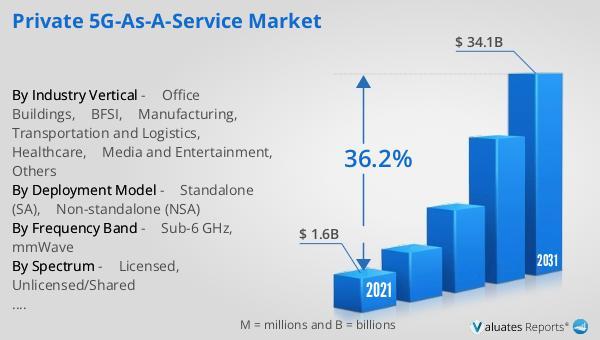

Private 5G-as-a-Service Market SizeAccording to a new report published by , titled, "Private 5G-as-a-Service Market," The private 5g-as-a-service market was valued at $1.6 billion in 2021, and is estimated to reach $34.1 billion by 2031, growing at a CAGR of 36.2% from 2022 to 2031.

Purchase Regional Report: https://reports.valuates.com/request/regional/ALLI-Auto-1T952/Private_5G_as_a_Service_Market_By_Component_Hardware_Software_Service_By_Frequency_Band_Sub_6_GHz_mmWave_By_Deployment_Model_Standalone_SA_Non_standalone_NSA_By_Spectrum_Licensed_Unlicensed_Shared_By_Industry_Vertical_Manufacturing_Transportation_and_Logistics_Office_Buildings_BFSI_Healthcare_Media_and_Entertainment_Others_Global_Opportunity_Analysis_and_Industry_Forecast_2022_2031

Private 5G-as-a-Service Market

Private 5G as a service refers to a telecommunication service that provides organizations with their own private 5G network infrastructure, which is managed and operated by a third-party provider. This type of service is designed to offer the benefits of 5G technology, such as high-speed connectivity, low latency, and the ability to connect a large number of devices, while providing organizations with greater control and security over their network. By providing private 5G as a service, organizations can avoid the capital expenses and complexities associated with building and maintaining their own private network infrastructure, while also benefiting from the flexibility and scalability of a cloud-based service model. Private 5G as a service can be customized to meet the specific needs and requirements of different organizations, making it a highly versatile and adaptable solution.

Key factors driving the growth of the cyber security in energy market include rise in number of IoT devices & adoption of edge computing, surge in demand for content streaming services, and increase in demand for low latency connectivity in industrial automation. 5G technologies are expected to help deliver unmatched data speeds while improving the overall user experience and dramatically improving real-time data processing capabilities in IoT devices. Edge computing can help streaming services improve network performance by caching popular content closer to end users in edge data centers. Moreover, advent of 5G technologies is expected to boost data speeds while improving the overall user experience. 5G technologies provide the essential network characteristics such as high reliability and low latency, which are required to support critical application in manufacturing facilities. 5G is one of the major technologies that is projected to facilitate industrial automation to Industry 4.0. Increase in investments in smart cities and surge in demand for connected cars are expected to provide growth opportunities for the market. In addition, increase in investments toward smart city infrastructure is expected to provide significant opportunity for implementation of 5G technologies within smart cities.

The market also offers growth opportunities to the key players in the market. With ultra-reliable, accessible, low-latency networks, 5G is anticipated to enable new services that can revolutionize sectors, such as remote control of crucial infrastructure, automobiles, and medical operations. Depending on the sector, certain firms can fully utilize 5G's advantages, particularly those that require the high speed, low latency, and network capacity that 5G is intended to offer. To boost operational productivity and precision, for instance, smart factories may leverage 5G to operate industrial Ethernet.

The private 5G as a service market is segmented into component, frequency band, deployment model, spectrum, industry vertical, and region. By component, it is classified into hardware, software, and service. Depending on frequency band, it is segregated into sub-6 GHz and mmWave. On the basis of deployment model, it is segregated into standalone (SA) and non-standalone (NSA). Depending on spectrum, it is divided into licensed and unlicensed/shared. As per industry vertical, the market is divided into BFSI, transportation & logistics, IT, manufacturing, healthcare, media & entertainment, and others. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, Russia, Portugal and rest of Europe), Asia-Pacific (China, India, Japan, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, South Africa, and rest of LAMEA).

The key players profiled in the study include Amazon Web Services, Inc., Mavenir, Ericsson, Cisco Systems, Inc., Anterix, Infosys Limited, Verizon, AT&T Intellectual Property, Nokia, and Kyndryl Inc. The players in the market have been actively engaged in the adoption various strategies such as acquisition, product launch and expansion to remain competitive and gain advantage over the competitors in the market. For instance, in February 2023, Kyndryl and Nokia announced the expansion of their global network and edge partnership, with a focus on developing and delivering industry-leading LTE and 5G private wireless services and Industry 4.0 solutions to customers worldwide. Furthermore, a collaboration between Telecommunications Consultants India Ltd. (TCIL) and Bharat Sanchar Nigam Limited (BSNL) was established in March 2023 to offer enterprises 5G-driven captive network services. Demand for private networks is anticipated to rise as 5G is implemented since businesses will require them to enable a wide range of new use cases. Mid-sized to large-sized organisations are the ones most able to afford private networks. Businesses that operate in a number of industries, such as manufacturing, retail, mining, and healthcare, would benefit greatly from private 5G networks.

Private 5G-as-a-Service Market By Component (Hardware, Software, Service), By Frequency Band (Sub-6 GHz, mmWave), By Deployment Model (Standalone (SA), Non-standalone (NSA)), By Spectrum (Licensed, Unlicensed/Shared), By Industry Vertical (Manufacturing, Transportation and Logistics, Office Buildings, BFSI, Healthcare, Media and Entertainment, Others): Global Opportunity Analysis and Industry Forecast, 2022-2031

Get Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-1T952/Private_5G_as_a_Service_Market_By_Component_Hardware_Software_Service_By_Frequency_Band_Sub_6_GHz_mmWave_By_Deployment_Model_Standalone_SA_Non_standalone_NSA_By_Spectrum_Licensed_Unlicensed_Shared_By_Industry_Vertical_Manufacturing_Transportation_and_Logistics_Office_Buildings_BFSI_Healthcare_Media_and_Entertainment_Others_Global_Opportunity_Analysis_and_Industry_Forecast_2022_2031

Key Market Insights

By component, the hardware segment led the private 5G as a service industry trends in terms of revenue in 2021.

By end use, the manufacturing segment accounted for the highest private 5G as a service market share in 2021.

By region, North America generated the highest revenue for the private 5G as a service market size in 2021.

View Full Report: https://reports.valuates.com/market-reports/ALLI-Auto-1T952/private-5g-as-a-service

Phone:

U.S. (TOLL FREE) : +1 (315) 215-3225

India: +91 8040957137

Email Id:

Please reach us at sales@valuates.com

Valuates offers an extensive collection of market research reports that helps companies to take intelligent strategical decisions based on current and forecasted Market trends.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Private 5G-as-a-Service Market By Component (Hardware, Software, Service), By Frequency Band (Sub-6 GHz, mmWave), By Deployment Model (Standalone (SA), Non-standalone (NSA)), By Spectrum (Licensed, Unlicensed/Shared), By Industry Vertical (Manufacturing, here

News-ID: 3363641 • Views: …

More Releases from Valuates Reports

High Purity Quartz Crucible Market Accelerates as Solar Wafer and Semiconductor …

High Purity Quartz Crucible Market

The global market for High Purity Quartz Crucible was valued at US$ million in the year 2024 and is projected to reach a revised size of US$ million by 2031, growing at a CAGR of %during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-14K7095/Global_High_Purity_Quartz_Crucible_Market_Insights_Forecast_to_2028

By Type

• 18 Inch

• 20 Inch

• 22 Inch

• 24 Inch

• 26 Inch

• 28 Inch

• 32 Inch

By Application

• Photovoltaic Industry

• Semiconductor Industry

Key Companies

Ferrotec Holdings Corporation, Ojing Quartz, Pacific Quartz, Zhejiang JSG, Conyutech, Shin-Etsu Quartz, Jinzhou…

99.9% or Above Silica Sand Market Size, Share & Forecast 2031 | Valuates Reports

99.9% or Above Silica Sand Market Size

The global market for 99.9% or Above Silica Sand was valued at US$ million in the year 2024 and is projected to reach a revised size of US$ million by 2031, growing at a CAGR of %during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-29F13340/Global_99_9_or_Above_Silica_Sand_Market_Research_Report_2023

Key Highlights

Ultra-high purity silica demand rising due to semiconductor manufacturing expansion.

Solar energy growth driving sustained adoption of high-purity silica materials.

Optical and…

Spherical Quartz Powder Market Expands with Rising Demand from Advanced Electron …

Spherical Quartz Powder Market

The global market for Spherical Quartz Powder was valued at US$ million in the year 2024 and is projected to reach a revised size of US$ million by 2031, growing at a CAGR of %during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-29Y14877/Global_Spherical_Quartz_Powder_Market_Research_Report_2023

By Type

• 0.99

• 0.98

By Application

• Electronics Industry

• Chemical Industry

• Construction Industry

Major Trends

• Increasing use of high-purity spherical fillers in electronic packaging

• Growing preference for low thermal expansion materials in semiconductors

• Expansion of advanced epoxy molding…

High Purity Silica Sand Market Market Size, Share & Forecast 2029 | Valuates Rep …

High Purity Silica Sand Market Size

The global High Purity Silica Sand revenue was US$ 450.1 million in 2022 and is forecast to a readjusted size of US$ 777.7 million by 2029 with a CAGR of 7.9% during the forecast period (2023-2029).

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-18Q15964/Global_and_India_High_Purity_Silica_Sand_Market_Report_Forecast_2023_2029

High Purity Silica Sand Market Share

Global key players of high purity silica sand include Sibelco, The Quartz Corp, Jiangsu Pacific Quartz, etc. The top three players hold…

More Releases for Private

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private asset management,private wealth management firms,middle market private e …

Private asset management is the management of assets on behalf of private individuals, families, or institutions. It involves the creation of a customized investment strategy to achieve specific financial goals, such as wealth preservation, growth, income generation, or a combination of these objectives. The assets managed can include cash and cash equivalents, stocks, bonds, real estate, private equity, and alternative investments.

https://tendawholesale.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private asset management is typically provided by…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Financing Consulting, China Private Equity Investment Corpo …

Pandacu China is a venture capital firm that focuses on early-stage investments in technology companies based in China. The firm was founded in 2015 by a group of experienced venture capitalists and entrepreneurs who have a deep understanding of the Chinese market and a strong network of contacts in the tech industry.

http://pandacuads.com/

China Private Equity Financing Consulting

Email:nolan@pandacuads.com

Pandacu China's mission is to help innovative and ambitious entrepreneurs turn their ideas into successful…